Executive summary

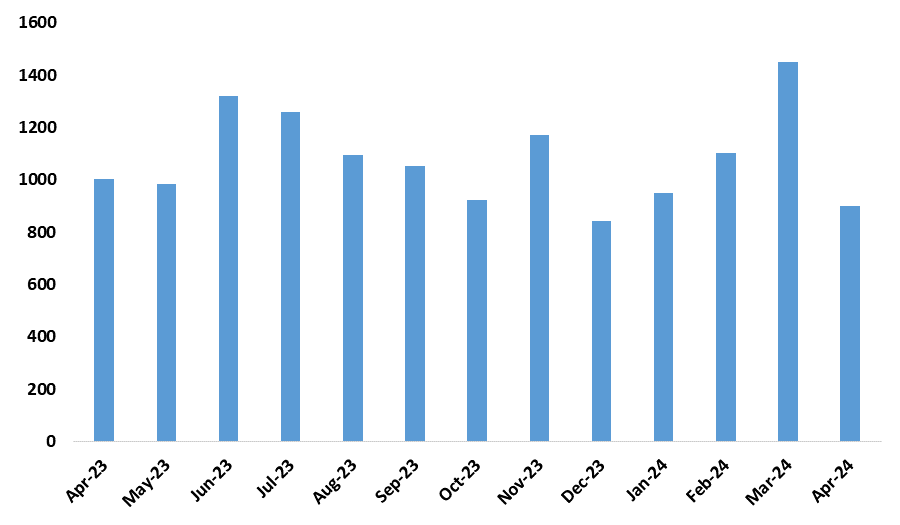

- In April 2024, new vehicle sales in Namibia experienced a significant decline, with only 899 vehicles sold compared to 1451 vehicles in March 2024, representing a monthly decrease of 38%. Figure 1

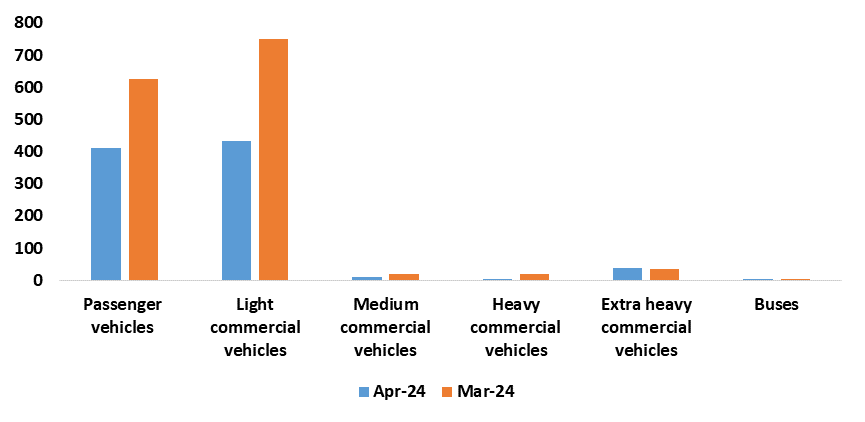

- Extra heavy vehicles and buses were the only segments that saw an increase in sales, with growth rates of 11% and 100% respectively.

- Conversely, sales of passenger, light commercial, medium commercial, heavy commercial, and buses all recorded declines of -34%, -42%, -50%, and -79% respectively. Figure 2.

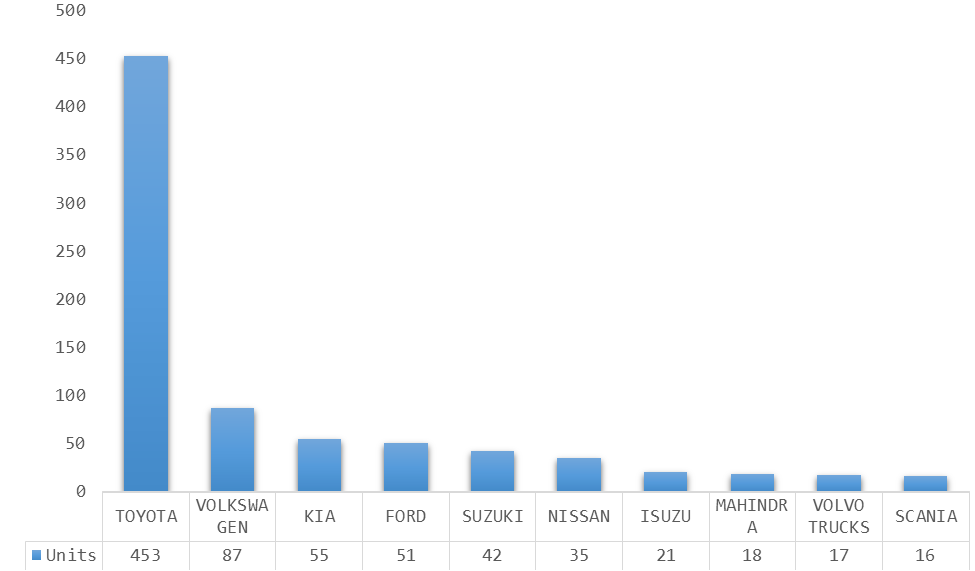

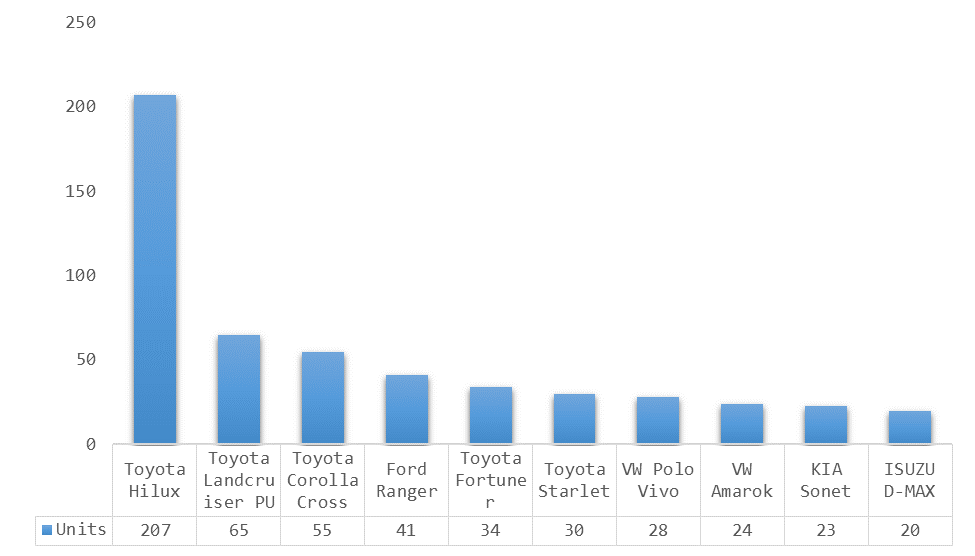

- During the month under review, Toyota emerged as the best-selling vehicle make, with the Hilux being the top seller, recording 207 units sold in April 2024. Figure 3 and 4.

- On an annual basis, the first third of 2024 saw an improvement in new vehicle sales, with 4402 vehicles sold compared to 4131 vehicles sold in the same period in the previous year, indicating a 6.6% increase.

- Out of the 4402 vehicles sold in 2024, 1973 were passenger vehicles, 2200 were light commercial vehicles, 63 were medium commercial vehicles, 43 were heavy commercial vehicles, 116 were extra heavy vehicles, and 5 were buses.

Analysis

- The 899 vehicles sold in April 2024 represent the lowest number of vehicles sold in a single month in 2024.

- Passenger vehicles experienced a decrease of 214 units compared to March 2024 and a 12% decline compared to April 2023. The best-selling passenger vehicle for April 2024 was the Toyota Corolla Cross, which sold 47 units less than the previous month's leader, the Toyota Fortuner, with 102 units sold in March 2024.

- Light commercial vehicles decreased by 318 units compared to March 2024 and 8% less compared to April 2023.

- Medium commercial vehicles decreased by 10 units compared to March 2024 and 41% less compared to April 2023,

- Heavy commercial vehicles decreased by 15 units compared to March 2024 and 33% less compared to April 2023.

- Extra heavy commercial vehicle sales increased by 4 units compared to March 2024 but remained unchanged compared to April 2023.

- Overall, commercial vehicle sales increased to 825 from the 478 recorded in March 2024. The commercial vehicle segment was dominated by Volvo and Scania, with 17 and 16 units sold for the month respectively, possibly influenced by the increasing performance of the commercial sector.

- Bus sales increased by 1 unit compared to March 2024 and grew 100% compared to April 2023.

- The monthly decrease in vehicle sales in April 2024 from March 2024 was mainly driven by decreases in 67% of all the vehicle segments. This decline could be attributed to the end of the festive season of vehicle promotions, leading to a decrease in demand.

- On an annual basis, new vehicle sales fell by 10.5%, translating into 899 vehicles sold in April 2024 compared to 1004 sold in March 2023, indicating weak consumer confidence.

Table 1: Monthly vehicle sales by type

| Market | April 20204 | March 2024 | Monthly unit change | Monthly % change |

| Passenger vehicles | 411 | 625 | -214 | -34 |

| Light commercial vehicles | 433 | 751 | -318 | -42 |

| Medium commercial vehicles sales | 10 | 20 | -10 | -50 |

| Heavy commercial vehicle sales | 4 | 19 | -15 | -79 |

| Extra heavy commercial vehicle sales | 39 | 35 | 4 | 11 |

| Bus | 2 | 1 | 1 | 100 |

Figure 1: Monthly Vehicle Sales (April 2023 – April 2024)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: Month on month, Vehicle Sales Growth March 2024 vs April 2024)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Figure 3: Top 10 bestselling vehicles by make (March 2024-April 2024)

Figure 4: Top 10 bestselling cars by type (March 2024-April 2024)

Outlook

Although interest rates have remained high, the demand for new vehicles is starting to slow down. Warning signs of falling consumer confidence. As inflation tricks down it is expected for interest rates to be lowered which will boost vehicle sales in the short to medium term.

Executive summary

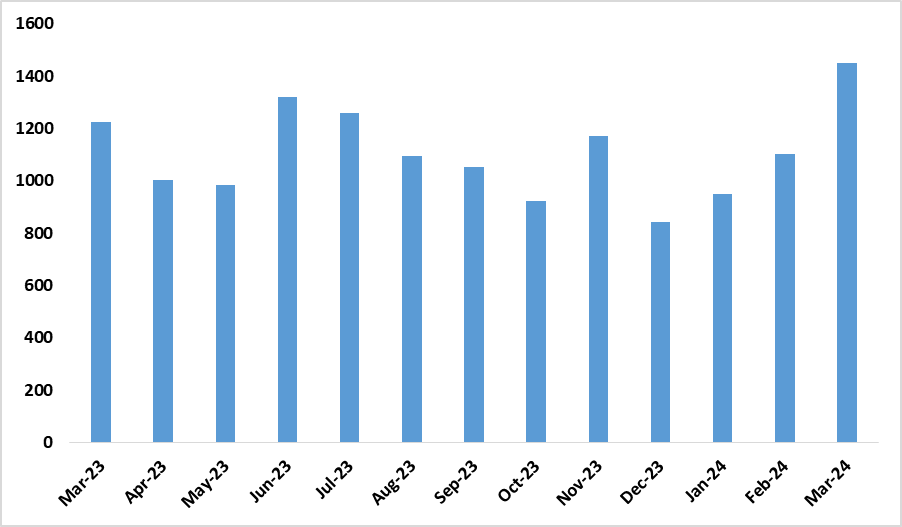

- New vehicle sales increased to 1451 vehicles in March 2024, up from 1102 vehicles sold in February 2024. This represented a monthly increase of 32%. (Figure 1)

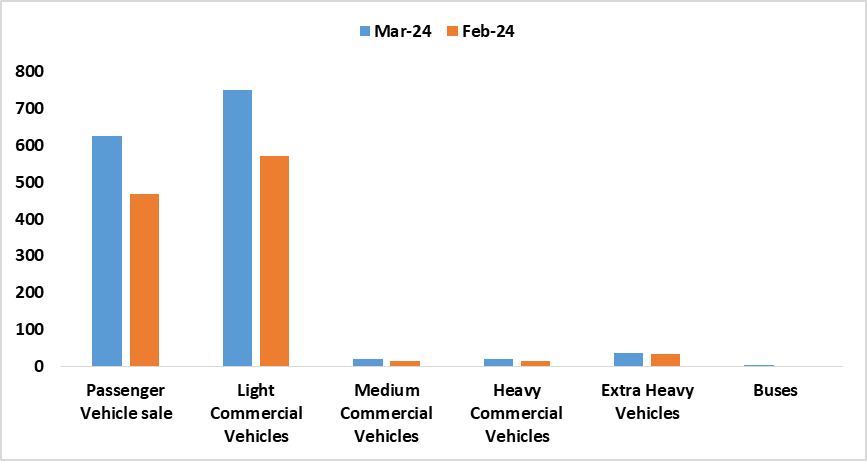

- Sales of Passenger, light commercial, medium commercial, Heavy commercial and extra heavy and busses commercial increased by 34%, 31%, 33%, 27%, 6% and 100% month on month respectively.

- In the first quarter of 2024, 3503 vehicles were sold, compared to 3127 vehicles sold in the same period last year, a 12% improvement.

- Out of the 3053 vehicles sold for 2024 so far, 1562 were passenger vehicles, 1767 were Light commercial vehicles, 55 were medium commercial vehicles, 39 were heavy commercial, 77 were extra heavy vehicles and 3 were buses.

Analysis

- The 1451 vehicles sold in March, is the highest number of vehicles sold in a single month since August 2016

- The monthly increase in vehicle sales in March 2024 from February 2024 was mainly driven by increases in all vehicle segments. This could be ascribed to increased demand because of no changes in the interest rates in the last MPC meetings, additionally, higher sales of commercial vehicles could be attributed to increasing commercial activities hence a growing demand for commercial transportation services.

- On an annual basis, new vehicle sales increased by 18%. 1451 sold in March 2024 vs 1226 sold in March 2023. This implies an improvement in consumer confidence.

- Passenger vehicle sales remain strong with real growth of 155 vehicles from 625 vehicles sold in March, compared to 470 in February 2024, this could be attributed to continued incentives offered by car dealerships at the beginning of the year.

- Commercial vehicle sales increased to 825 from the 478 that was recorded in February 2024. This could have been influenced by increasing commercial sector performance.

Table 1: Monthly vehicle sales by type

| Market | March 2024 | Feb 2024 | Monthly unit change | Monthly % change |

| Passenger vehicles | 625 | 467 | 158 | 34 |

| Light commercial vehicles | 751 | 572 | 179 | 31 |

| Medium commercial vehicles sales | 20 | 15 | 5 | 33 |

| Heavy commercial vehicle sales | 19 | 15 | 4 | 27 |

| Extra heavy commercial vehicle sales | 35 | 33 | 2 | 6 |

| Bus | 1 | 0 | 1 | 100 |

Figure 1: Monthly Vehicle Sales (March 2023 – March 2024)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: month on month, Vehicle Sales Growth (march 2024 vs February 2025)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Outlook

Although interest rates have remained high, the demand for new vehicles has been resilient. As inflation tricks down the outlook for vehicle sales in the short to medium term appears positive, as the expected lowering of interest rates is likely to boost consumer confidence.

Executive summary

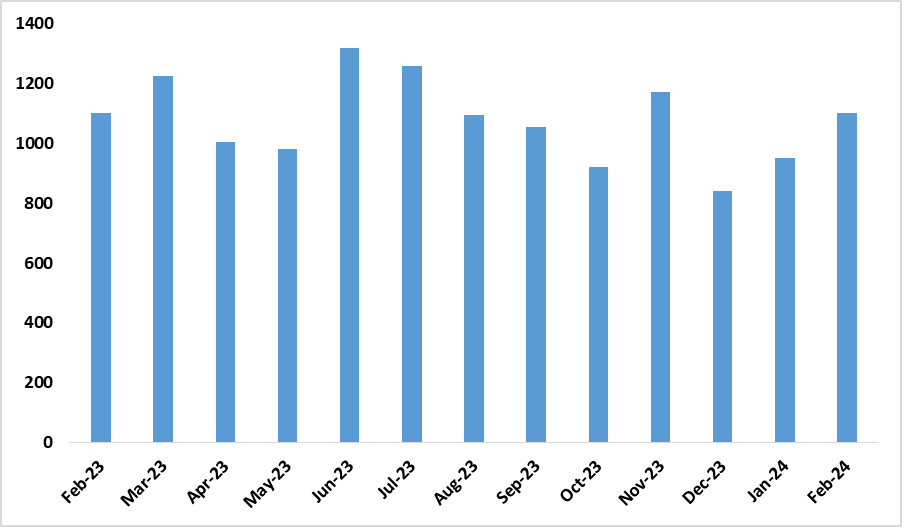

- New vehicle sales increased to 1102 vehicles in February 2024, up from 950 vehicles sold in January2024. This represented a monthly increase of 16%. (Figure 1)

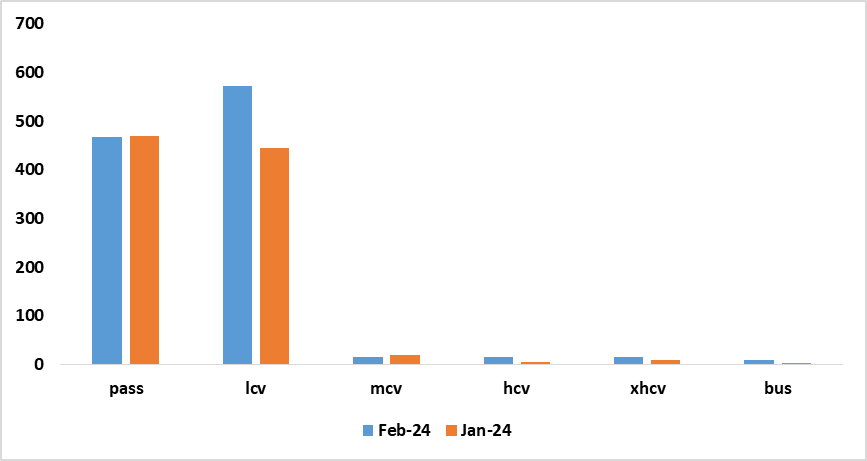

- Sales of light commercial, Heavy commercial and extra heavy commercial increased by 29%, 200%, and 267% month on month respectively.

- Passenger, medium commercial and bus vehicle sales decreased by 1%, 25% and 100% respectively in February 2024 compared to January 2024.

- In the first two months of 2024, 2052 vehicles were sold, compared to 1901 vehicles sold during the same period last year.

- Out of the 2052 vehicles sold for 2024 so far, 937 were passenger vehicles, 1016 were Light commercial vehicles, 35 were medium commercial vehicles, 20 were heavy commercial, 42 were extra heavy vehicles and 2 were buses.

Analysis

- The 1102 vehicles sold in February 2024, sets the year-to-date record of highest number of vehicles

- The monthly increase in vehicle sales in February from January 2024 was mainly driven by the increased sales of light, heavy and extra heavy commercial vehicles. This could be ascribed to increased demand because of no changes in the interest rates in the last MPC meetings, additionally, higher sales of commercial vehicles could be attributed to increasing commercial activities hence a growing demand for commercial transportation services.

- On an annual basis, new vehicle sales remain unchanged%. 1102 sold in February 2024 vs 1103 sold in February 2023. This implies a plateau in consumer confidence.

- Passenger vehicle sales slowed from 470 vehicles sold in january to 467 in February 2024, although its slow down its not alarming as real differences only 3 vehicles. This could be attributed to an a no change in interest rates and the continued incentives offered by car dealerships at the beginning of the year.

- Commercial vehicle sales increased from 635 in January 2024 to 478 that was recorded in February 2024. This could have been influenced by increasing commercial sector performance.

Table 1: Monthly vehicle sales by type

| Market | Feb 2024 | Jan 2024 | Monthly unit change | Monthly % change |

| Passenger vehicles | 467 | 470 | -3 | -1 |

| Light commercial vehicles | 572 | 444 | 128 | 29 |

| Medium commercial vehicles sales | 15 | 20 | -5 | -25 |

| Heavy commercial vehicle sales | 15 | 5 | 10 | 200 |

| Extra heavy commercial vehicle sales | 33 | 9 | 24 | 267 |

| Bus | 0 | 2 | -2 | -100 |

Figure 1: Monthly Vehicle Sales (February 2023 – February 2024)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: month on month, Vehicle Sales Growth (February 2025 vs January 2024)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Outlook

Despite the prevailing high-interest rates, the demand for new vehicles has demonstrated resilience. As inflation gradually subsides, we anticipate that interest rates will be lowered, subsequently resulting into a boost of vehicle sales in the short to medium term. The expectation stems from the understanding that lower interest rates make financing more affordable, thereby incentivizing consumers to make vehicle purchases.

Analysis

Monthly and Annual Sales Performance:

- In December 2023, a total of 841 vehicles were sold, marking a decline from the 1,171 vehicles sold in November 2023, representing a 28% monthly decline

- However, on an annual basis, vehicle sales increased by 11.7% compared to December 2022, with a total of 12,775 vehicles sold in 2023, representing a 16.9% annual increase compared to the same period in 2022.

Specific Vehicle Categories:

- Sales of passenger, light commercial, medium commercial, and extra heavy vehicles declined by 25%, 31%, 41.6%, and 100% month-on-month respectively.

- Notably, sales of heavy commercial vehicles and buses increased by 20% and 125% respectively.

Consumer Confidence and Market Outlook:

- The low vehicle sales for December 2023 are indicative of low consumer confidence, likely influenced by shifting consumer spending patterns during the festive season.

- The subdued sales of light, medium, and extra heavy vehicles could be attributed to reduced construction activities, leading to lower demand for heavy transportation services.

Table 1: Monthly vehicle sales by type

| Market | Dec-2023 | Nov-23 | Monthly unit change | Monthly % change |

| Passenger vehicles | 426 | 568 | (-142) | (-25) |

| Light commercial vehicles | 371 | 542 | (-171) | (-31.5) |

| Medium commercial vehicle sales | 14 | 24 | (-10) | (-41.6) |

| Heavy commercial vehicle sales | 6 | 5 | 1 | 20.00 |

| Extra heavy commercial vehicle sales | 15 | 28 | (-13) | (-46.43) |

| Bus | 9 | 4 | 5 | 125.00 |

Figure 1: Monthly Vehicle Sales (December 2023 vs. November 2023)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: Month on Month, Vehicle Sales Growth (December 2022- December 2023)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Figure 3: Year on Year, Vehicle Sales Growth (December 2022- December 2023)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Outlook

Despite the monthly fluctuations, the demand for new vehicles has remained strong throughout the year 2023. This resilience in demand indicates underlying market stability and potential for recovery in specific vehicle categories. Additionally, the annual increase in vehicle sales signals overall market growth and resilience, providing a positive outlook for vehicle sales in 2024.

Executive summary

- During the month of November 2023, a total of 1,171 vehicles were sold, which represents an increase from the 922 vehicles sold in October 2023. This increase amounts to 249 vehicles, translating to a monthly increase of 27%.

- On an annual basis, vehicle sales increased by 12% compared to November 2022.

- In terms of specific vehicle categories, the sales of passenger, light commercial, medium commercial, extra heavy vehicles, and buses increased by 28%, 28%, 20%, 22%, and 100% respectively, month on month on the other hand, sales of extra heavy commercial vehicles declined by 38% month on month.

- From January until November 2023, a total of 11,934 vehicles were sold, representing a 20% annual increase compared to the same period in 2022.

Analysis

- An upswing in vehicle sales both monthly and annually, spanning from November 2023 to October 2023, may signify a boost in consumer confidence. This positive trend could be attributed to the steady interest rates, which have remained unchanged, creating a favourable environment for individuals looking to buy new vehicles

- Monthly low sales of extra heavy vehicles could be attributed to subdued construction activities which led to a low demand of heavy transportation services

| Market | Nov-23 | Oct-23 | Monthly unit change | Monthly % change |

| Passenger vehicles | 568 | 444 | 124 | 27.9 |

| Light commercial vehicles | 542 | 425 | 117 | 27.5 |

| Medium commercial vehicle sales | 24 | 20 | 4 | 20.0 |

| Heavy commercial vehicle sales | 5 | 8 | -3 | -37.5 |

| Extra heavy commercial vehicle sales | 28 | 23 | 5 | 21.7 |

| Bus | 4 | 2 | 2 | 100.0 |

Figure 1: Monthly Vehicle Sales (November 2023 vs. October 2023)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: Month on Month, Vehicle Sales Growth (November 2022- November 2023)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Figure 3: Year on Year, Vehicle Sales Growth (November 2022- November 2023)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Outlook

The demand for new vehicles has remained strong throughout the year, but we expect a decline in vehicle sales for the month of December 2023. Historical data supports this trend, as December is typically a holiday month when people tend to prioritize spending on other things rather than purchasing new vehicles.

Executive Summary

During October 2023, new vehicle sales experienced a month-on-month decline of 13%, marking the fourth consecutive monthly decline. A total of 922 vehicles were sold in October 2023, compared to the 1054 vehicles sold in September 2023, reflecting a reduction of 132 vehicles. (Figure 1)

On an annual basis, vehicle sales decreased by 7.4% for October 2022 when compared to the same period last year. (Figure 1)

Month-on-month only medium commercial vehicles saw an increase in sales, by 18% whilst passenger, light commercial vehicles, heavy commercial vehicles, and extra heavy vehicles declined by 16%, 7%, 38%, and 36% respectively. Sales for busses remained unchanged.

During the first 10 months of 2023, 10764 vehicles were sold, comprising 4762 passenger vehicles, 4428 light commercial vehicles, 218 medium vehicles, 125 heavy commercial vehicles, 235 extra heavy commercial vehicles, and 14 buses. This resulted in a 21% annual growth compared to the corresponding period in the first 10 months of 2022.

Analysis

Total vehicle sales increased by 21% during the first 10 months of 2023 compared to the same period in 2022. This is an indication of overall improvement in consumer confidence. The continuous decline in monthly vehicle sales since June 2023 could be primarily attributed to diminished credit demand due to high-interest rates and eroded disposable income due to rising inflation.

The total sales of commercial vehicles experienced a 9% decline in October 2023, compared to the 524 units recorded in September 2023. This downturn underscores the suboptimal performance of the commercial sector.

Table 1: Monthly vehicle sales by type

| Market | Oct-23 | Sep-23 | Monthly unit change | Monthly % change |

| Passenger vehicles | 444 | 528 | -84 | -16 |

| Light commercial vehicles | 425 | 458 | -33 | -7 |

| Medium commercial vehicle sales | 20 | 17 | 3 | 18 |

| Heavy commercial vehicle sales | 8 | 13 | -5 | -38 |

| Extra heavy commercial vehicle sales | 23 | 36 | -13 | -36 |

| Bus | 2 | 2 | 0 | 0 |

Figure 1: Monthly Vehicle Sales (October 2023 vs September 2023)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: Year on Year, Vehicle Sales Growth rate (October 2022- October 2023)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Outlook

The demand for new vehicles has exhibited resilience despite prevailing high-interest rates. However, looking ahead, we anticipate a continued month-on-month decline in vehicle sales in the short to medium term. This projection is influenced by the constraints on consumer confidence stemming from the persistent impact of inflation. As inflation erodes purchasing power and increases the overall cost of living, consumers may exhibit hesitancy in making significant financial commitments such as purchasing new vehicles. This, in turn, is expected to contribute to the anticipated decline in vehicle sales over the remaining months of 2023.

Executive Summary

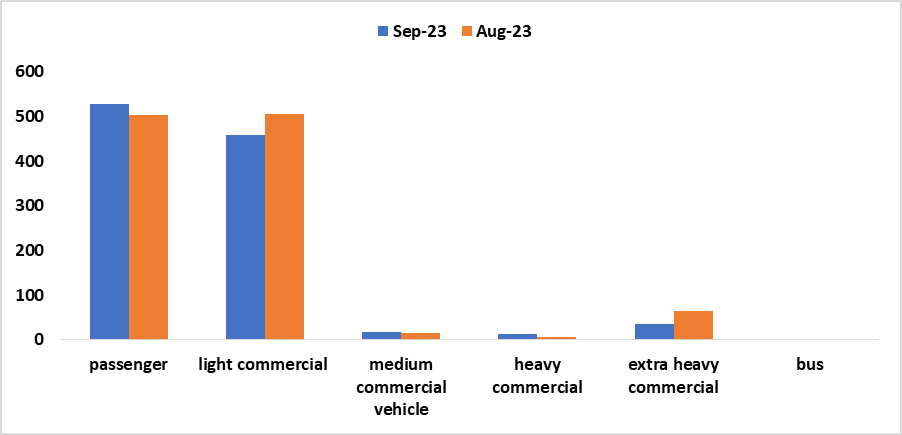

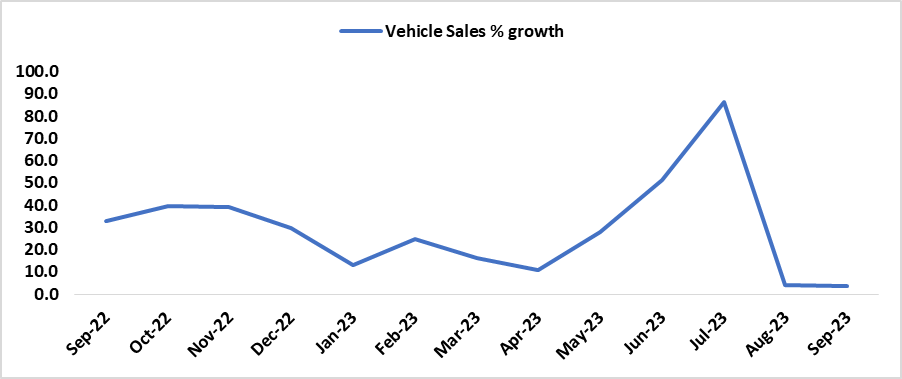

- During September 2023, new vehicle sales experienced a month-on-month decline of 3.7%, marking the third consecutive monthly decrease. A total of 1054 vehicles were sold in September 2023, compared to the 1094 vehicles sold in August 2023, reflecting a reduction of 40 vehicles. (Figure 1)

- On an annual basis, vehicle sales increased by 3.5% when compared to September 2022. (Figure 1)

- Month-on-month sales of passenger, medium commercial, and heavy commercial vehicles increased by 5%, 21%, and 86% while light commercial and extra heavy vehicles declined by 9% and 44% respectively.

- During the first 9 months of 2023, 9842 vehicles were sold, comprising 4318 passenger vehicles, 4002 light commercial vehicles, 198 medium vehicles, 117 heavy commercial vehicles, 212 extra heavy commercial vehicles, and 12 buses. This resulted in a 20% annual growth compared to the corresponding period in the first nine months of 2022

Analysis

- A 20% annual growth in new vehicles sold is an indication of overall improvement in consumer confidence

- The continuous decline in monthly vehicle sales since June 2023 could be primarily attributed to diminished credit demand due to high interest rates and eroded disposable income

- The rise in passenger vehicles could be due to no interest rate hike at the last Bank of Namibia’s MPC meeting. Consumers perceived this decision favorably, encouraging them to continue obtaining credit to purchase new cars

- Sales of light commercial vehicles could be attributed to subdued commercial activities hence a low demand for commercial transportation services

- Medium, heavy, and extra-heavy commercial vehicles continued on an upward trajectory. This could be mainly underpinned by the strong mining activity

- The total sales of commercial vehicles experienced an 11% decline in September 2023, compared to the 590 units recorded in August 2023. This downturn underscores the suboptimal performance of the commercial sector

Table 1: Monthly vehicle sales by type

| Market | Aug-23 | Sep-23 | Monthly unit change | Monthly % change |

| Passenger vehicles | 502 | 528 | 26 | 5 |

| Light commercial vehicles | 505 | 458 | -47 | -9 |

| Medium commercial vehicle sales | 14 | 17 | 3 | 21 |

| Heavy commercial vehicle sales | 7 | 13 | 6 | 86 |

| Extra heavy commercial vehicle sales | 64 | 36 | -28 | -44 |

| Bus | 2 | 2 | 0 | 0 |

Figure 1: Monthly Vehicle Sales (September 2023 vs August 2023)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: Year on Year, Vehicle Sales Growth (September 2022- September 2023)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Outlook

The demand for new vehicles has exhibited resilience despite prevailing high-interest rates. Looking ahead, we anticipate a continued month-on-month decline in vehicle sales in the short to medium term. However, the expectation could be influenced otherwise by the upcoming Bank of Namibia's Monetary Policy Committee's decision on the 25th of October 2023.