Executive Summary

| Export | Export | Import | Import | Trade Deficit | Trade Deficit |

| July 2021 N$ 3.6 billion | July 2022 N$ 7.2 billion | July 2021 N$ 7.2 billion | July 2022 N$ 11.5 billion | July 2021 N$ 3.5 billion | July 2022 N$ 4.2 billion |

| Top 5 export products | Top 5 import products |

| Precious stones(diamonds) Fish Uranium Non-monetary gold Petroleum oils | Petroleum oils Copper ores and concentrates Ores and concentrates of precious metals Pearls and precious or semiprecious stones Civil engineering and contractors |

| Export destination | % share of export |

| Botswana South Africa China Zambia Netherlands | 20.5 19.8 10.0 8.8 6.6 |

| Main source import for Namibia | % share of import |

| South Africa Peru Bulgaria Imported from various countries India | 36.2 12.0 6.3 6.1 5.6 |

| Import mode of transport | % share |

| Sea Air Road Rail Multimodal | 35.0 33.5 31.4 0.0 0.0 |

Analysis

- Total export earnings declined by 14.8% for July 2022 when compared to June 2022. This was influenced by a decrease in uranium, fish, precious stones (diamonds), ores and concentrates of base metals, and printed matter

- On an annual basis, total export earnings increased by 99.6 % year on year on the back of the base effect of the Covid-19 pandemic. This resulted from an increase in the export earnings recorded for commodities such as precious stones (diamonds), uranium, petroleum oils, inorganic chemical elements, and copper ores and concentrates. This is an indication that the mining sector outperforms other sectors in exports earnings

- Import bills increased by 4.5% for July 2022 when compared to June 2022. This resulted from an increase in copper ores and concentrates, ores and concentrates of precious metals, precious stones (diamonds), motor vehicles for the transportation of goods, and alcoholic beverages

- On an annual basis, the total import bill increased by 60.1% year on year. This was influenced by an increase in the importation of petroleum oils, copper ores and concentrates, ores and concentrates of precious metals, pearls, and precious or semiprecious stones, civil engineering, and contractors' equipment (See figure 1 below)

- The trade balance increased by 73.4% for July 2022 in relation to the same period last year (See figure 2)

Figure 1: Export and Import value N$ million, (July 2021 – July 2022)

Figure 2: Trade Balance (July 2021 – July 2022)

Outlook

Namibia’s trade activities continue to improve in relation to the Covid-19-induced 2021. However, the country’s trade balance remains constrained when compared to the previous month. The country’s substantial reliance on imports poses a risk to Namibia’s trade given the uncertain current economic environment and the anticipated global economic recession. Boosting local productive capacity remains crucial to improving the overall trade balance for Namibia, this will trigger investment in value addition for the exported commodities.

Executive summary

The Namibian economy showed signs of improvement in 2021 after the severe contraction recorded in 2020 due to the negative impact of the Covid-19 pandemic. The domestic economy recorded a recovery of 2.7% in 2021 from a contraction of 8.5% in 2020 (See figure 1 below). The domestic economy revision of 2.7% is an increase from the 2.4% that was recorded in the preliminary national accounts of 2021. The positive performance could be attributed to the relaxation of the restrictive measures that were imposed during the pandemic and a bounce in domestic economic activities. In monetary terms, Real Gross Domestic Product (RGDP) increased to N$ 136.7 billion from N$ 133.2 billion recorded for 2020. The primary and tertiary industries recorded a growth of 6.2% and 1.9% respectively while the secondary industries recorded a decline of 3.3%. The major sectors that attributed to the economy’s rebound were mining, and quarrying, hotels and restaurants, and transport (See figure 2). Namibian economic recovery continues to be driven by the tertiary sector followed by the secondary and primary sectors respectively. (See figure 3).

Analysis

- The mining and quarrying sector registered a growth of 10% in 2021. The surge in the sector was mainly observed in uranium and other mining and quarrying subsectors. During the period under review, the growth recorded for the uranium subsector could be ascribed to an increase in uranium production that emanated from the high global demand for uranium ores. Additionally, growth in the other mining and quarrying subsectors was mainly due to the increase in the production of salt and marble

- The hotels and restaurants sector registered a growth of 8.8% during the period under review, this was due to the relaxation of the Covid-19 travel and gathering restrictions, resulting in high demand for leisure, conferencing, and accommodation services

- The wholesale and retail trade sector registered a growth of 6.1% as a result of an increase in the demand for vehicles, supermarkets, furniture, and wholesale outlets, the sector recorded the first ever growth since 2016

- The health sector registered a growth of 4.3%. The positive performance emanated from an increase in the number of personnel and increased health expenditures

- The professional, scientific, and technical services sectors registered a growth of 2.3%. The first positive performance since 2015. The recovery in the sector came as a result of the relaxation of strict pandemic measures coupled with improved tax compliance regulatory measures (taxpayers paying tax timely and accurately) that have propelled a resurgence in economic activities for the sector

- The transport sector registered a growth of 2.2%. The main subsectors that contributed to the growth were air transport, airport services, port services, and freight transport by road which recorded positive growths of 14.8%, 30.0%, 5.7%, and 3.2%, respectively. This was influenced by an increase in aircraft movement, passenger arrivals, and cargo handled as a result of the easing of the Covid-19 travel restrictions and improved logistical chains

Figure 1: Annual GDP growth rates (2010 – 2021)

Figure 2: GDP Growth per sector (2020 & 2021)

Figure 3: Industries' contribution to GDP (2019 - 2021)

Outlook

The growth of the Namibian economy is intertwined with the performance of the South African economy. South Africa’s GDP declined by 0.7% in quarter 2 of 2022 due to devastating floods in KwaZulu-Natal and continuous load shedding which had a negative impact on a number of industries, most notably manufacturing. As such Namibia’s GDP could be negatively affected as the country obtains most of its imports from South Africa. Hence, Namibia should strive and enhance its manufacturing industries to create more local enterprises. We anticipate a moderate recovery for the remaining of 2022 on the back of the anticipated recession in the advanced economies.

| NSX Trades | Traded Volume (No. Shares) | Monetary Amount (N$) | Trading Contribution (%) |

| Overall | 550,859.00 | 9,705,444.80 | 100.00% |

| ETFs | - | - | 0.00% |

| Total | 550,859.00 | 9,705,444.80 | 100.00% |

Table 1: NSX Trades

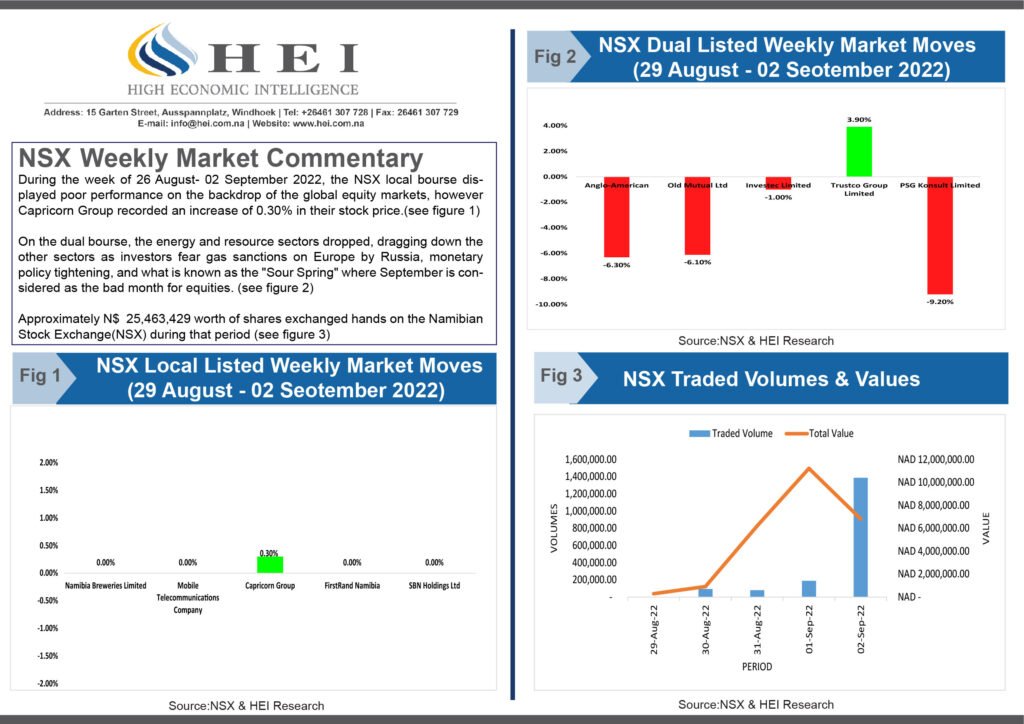

NSX Activities

A total of N$ 9,705,444.80 worth of shares was traded on the NSX on Thursday with about N$ 922,621 worth of Anglo-American plc and N$ 156,094 worth of Oryx Properties Limited on the home front. No ETFs were traded on Thursday

HEI Market Commentary

From the trading activity that took place:

- Anglo-American shares increase at closing as indexes performed well aimed the ECB hawkish interest rates

- Shares belonging to Oryx Properties Limited were traded with no change in share price

| Name | NSX Local Ticker | Price Previous Close 'N$ | Price End of Day 'N$ | Daily Change % |

| Namibian Breweries | NBS | 42.50 | 42.50 | 0.00% |

| Nictus Holdings | NHL | 1.75 | 1.75 | 0.00% |

| Capricorn | CGP | 10.75 | 12.00 | 11.63% |

| First Rand Namibia | FNB | 30.20 | 30.21 | 0.03% |

| Standard Bank Namibia | SNO | 4.40 | 4.41 | 0.23% |

| Oryx Limited | ORY | 10.27 | 10.27 | 0.00% |

| Letshego | LHN | 2.65 | 2.66 | 0.38% |

| Namibia Asset Management | NAM | 0.70 | 0.68 | -2.86% |

| Stimulus | SILP | 127.90 | 127.90 | 0.00% |

| Paratus Namibia Holdings Ltd | PNH | 13.00 | 12.99 | -0.08% |

| Mobile Telecommunication Company | MOC | 7.52 | 7.50 | -0.27% |

| Alpha Namibia Industries Renewable Power Limited | ANE | 9.00 | 9.00 | 0.00% |

Table 2: Primary listed Trades

| Name | South African Dual Listed Ticker | Price Previous Close 'N$ | Price End of Day 'N$ | Daily Change % |

| Anglo-American plc | ANM | 548.00 | 554.85 | 1.25% |

| B2Gold Corporation | B2G | 53.80 | 57.55 | 6.97% |

| Oceana Group Limited | OCG | 54.29 | 53.50 | -1.46% |

| Mediclinic International Plc | MEP | 98.03 | 99.12 | 1.11% |

| Truworths | TRW | 57.59 | 59.06 | 2.55% |

| Nedbank Group Limited | NBK | 203.94 | 207.76 | 1.87% |

| Standard Bank Group | SNB | 150.88 | 151.56 | 0.45% |

| Shoprite Holdings | SRH | 225.00 | 225.61 | 0.27% |

| FirstRand Limited | FST | 63.45 | 63.56 | 0.17% |

| Momentum Metropolitan Holdings | MMT | 16.22 | 16.64 | 2.59% |

| Old Mutual Ltd | OMM | 10.40 | 10.67 | 2.60% |

| Sanlam Limited | SLA | 53.76 | 54.66 | 1.67% |

| Santam Limited | SNM | 240.17 | 241.80 | 0.68% |

| Vukile Property Fund Limited | VKN | 13.24 | 13.10 | -1.06% |

| Investec Limited | IVD | 81.11 | 76.93 | -5.15% |

| PSG Konsult Limited | KFS | 11.63 | 10.60 | -8.86% |

Table 3: Dual Listed Trades

| Name | ETFs | Price Previous Close 'N$ | Price End of Day 'N$ | Daily Change % |

| New Gold Issuer Ltd NM | NGNGLD | 276.96 | 278.21 | 0.45% |

| New Gold Palladium ETF | NGNPLD | 338.49 | 362.45 | 7.08% |

| New Gold Platinum ETF N | NGNPLT | 144.59 | 147.61 | 2.09% |

| New Funds S&P NAM Bond | NFNAMA | 17.15 | 17.27 | 0.70% |

Table 4: ETFs

| Exchange Rates @ 08:00 | |

| USD/NAD | 17.40 |

| EUR/NAD | 17.52 |

| GBP/NAD | 20.16 |

| EUR/GBP | 0.86 |

| EUR/USD | 0.99 |

| GBP/USD | 1.15 |

| AUD/USD | 0.68 |

| USD/JPY | 142.95 |

| Commodities @ 08:00 | |

| Gold | 1,729.25 |

| Silver | 18.70 |

| Platinum | 850.60 |

| Palladium | 2,106.77 |

| WTI | 83.72 |

| Brent | 89.49 |

Table 5: Exchange Rates and Commodities

Local News

The well-known Okapuka Game Ranch, situated just outside Windhoek on the road to Okahandja, recently entered into an exciting joint venture with Gondwana Collection Namibia (Namibian Sun)

The Agricultural Bank of Namibia has encouraged farmers to prepare for a better rainfall season, and at the same time urged them to continue building adaptive capacity to climate change through various strategies. (New Era Newspaper)

The Bank of Namibia this week borrowed N$1.7 billion on the behalf of the state through bonds and treasury bills. (The Namibian)

Sub-Sahara News

Mineral Resources and Energy Minister Gwede Mantashe said it would cost the government R49 billion to rehabilitate all 6 100 of the derelict mines in its database, but that the Department of Mineral Resources only has a budget of R140 million for this purpose. (News24)

The European Central Bank on Thursday announced a 75-basis point interest rate rise, taking its benchmark deposit rate to 0.75%. (CNBC Africa)

Climate catastrophe, war, and political turmoil took a back seat on Thursday night to the news that the ailing Queen Elizabeth II, Britain's longest-ever reigning monarch, had died. (All Africa News)

International News

The crowning achievement of Britain's Queen Elizabeth, who died on Thursday after 70 years on the throne, was to maintain the popularity of the monarchy across decades of seismic political, social and cultural change that threatened to make it an anachronism. (Reuters)

European stocks rebounded on Friday despite mounting concerns over Europe's energy crisis and slowing growth momentum in the global economy. Traders remained focused on a key U.S. monthly jobs report (RTT News)

China is facing a steeper climb to overtake the United States and its allies in semiconductors as Washington ramps up measures to restrict Beijing’s ability to produce advanced chips and secure dominance over the strategic technology. (Aljazeera News)

Executive summary

- New vehicle sales declined to 677 vehicles for July 2022 from 872 vehicles sold in June 2022. See figure 1.

- A decline in new vehicle sales for July 2022 was mainly driven by low sales of extra heavy vehicles, heavy commercial vehicles, and light commercial vehicles

- Extra heavy vehicle sales declined by 76% when compared to June 2022

- Heavy commercial vehicle sales declined by 50% in relation to June 2022

- New light commercial vehicle sales declined by 29% when compared to June 2022

- A total 10394 of vehicles were sold between July 2021 and July 2022

Analysis

- On an annual basis, new vehicle sales declined by 15.4%, (See figure 2). This is could be influenced an increase in interest rates which resulted in low demand for credit to buy new vehicles

- Extra heavy vehicle sales declined to 9 from 37 vehicles sold in June 2022

- Heavy commercial vehicle sales declined to 6 from 12 vehicles sold in June 2022

- Light commercial vehicle sales declined to 266 from 376 vehicles sold in June 2022. This could have resulted from poor performance in commercial operations.

Figure 1: Monthly Vehicle Sales (July 2021 – July 2022), Namibia

Figure 2: Year on Year, Vehicle sales growth (July 2021- July 2022), Namibia

Outlook

- The current interest rate hike cycle influences the demand for credit for both households and businesses. This speaks to the overall affordability of credit to purchase new vehicles and the tightening of overall general spending in the market. We project new vehicle sales momentum for August 2022 to decline further.

Executive summary

- New vehicle sales increased to 872 vehicles for June 2022 from 767 vehicles sold in May 2022. See figure 1.

- An increase in new vehicle sales for June 2022 was mainly driven by high sales of medium commercial vehicles and light commercial vehicles

- Medium commercial vehicle sales increased by 44% in relation to May 2022

- New light commercial vehicle sales increased by 22% when compared to May 2022

- Passenger vehicle sales declined by 5% in relation to May 2022

- A total of 5186 vehicles were sold during the first half of the year 2022.

Analysis

- On an annual basis, new vehicle sales increased by 3.4%, (See figure 2). This is could be influenced by improvements in consumer confidence albeit at a slow pace

- Light commercial vehicle sales increased by 376 from 309 recorded in May 2022

- Medium commercial vehicle sales increased to 13 vehicles from 9 vehicles that were sold in May 2022. This could be attributed to an upturn in commercial operations

- Extra heavy vehicle sales increased to 37 from 34 vehicles sold in May 2022. This could be influenced by an increase in demand for heavy goods and transportation services. This reflects the continuous dependence of the Namibian economy on road freight.

Figure 1: Monthly Vehicle Sales (June 2021 – June 2022), Namibia

Figure 2: Year on Year, Vehicle sales growth (June 2021- June 2022), Namibia

Outlook

- We project that new vehicle sales for July 2022 will continue on a modest upward trend.

| NSX Trades | Traded Volume (No. Shares) | Monetary Amount (N$) | Trading Contribution (%) |

| Overall | 234,384.00 | 11,325,139.74 | 100.00% |

| ETFs | - | - | 0.00% |

| Total | 234,384.00 | 11,325,139.74 | 100.00% |

Table 1: NSX Trades

NSX Activities

A total of N$ 11,325,139.74 worth of shares was traded on the NSX on Wednesday with about N$ 1,886,648 worth of Anglo-American plc and N$ 24,851 worth of Mobile Telecommunications Limited on the home front. No ETFs were traded on Wednesday.

HEI Market Commentary

From the trading activity that took place:

- Anglo-American shares slumped as markets closed as RMB/BER confidence index declined from 42 index points to 39

- Shares belonging to Mobile Telecommunications Limited were traded resulting in a decline in share price at closing

| Name | NSX Local Ticker | Price Previous Close 'N$ | Price End of Day 'N$ | Daily Change % |

| Namibian Breweries | NBS | 42.50 | 42.50 | 0.00% |

| Nictus Holdings | NHL | 1.75 | 1.75 | 0.00% |

| Capricorn | CGP | 10.75 | 10.75 | 0.00% |

| First Rand Namibia | FNB | 30.20 | 30.20 | 0.00% |

| Standard Bank Namibia | SNO | 4.40 | 4.40 | 0.00% |

| Oryx Limited | ORY | 10.27 | 10.27 | 0.00% |

| Letshego | LHN | 2.65 | 2.65 | 0.00% |

| Namibia Asset Management | NAM | 0.70 | 0.68 | -2.86% |

| Stimulus | SILP | 127.90 | 127.90 | 0.00% |

| Paratus Namibia Holdings Ltd | PNH | 13.00 | 13.00 | 0.00% |

| Mobile Telecommunication Company | MOC | 7.52 | 7.51 | -0.13% |

| Alpha Namibia Industries Renewable Power Limited | ANE | 9.00 | 9.00 | 0.00% |

Table 2: Primary listed Trades

| Name | South African Dual Listed Ticker | Price Previous Close 'N$ | Price End of Day 'N$ | Daily Change % |

| Anglo-American plc | ANM | 557.50 | 548.00 | -1.70% |

| B2Gold Corporation | B2G | 53.52 | 53.80 | 0.52% |

| Oceana Group Limited | OCG | 54.03 | 54.29 | 0.48% |

| Mediclinic International Plc | MEP | 98.35 | 98.03 | -0.33% |

| Truworths | TRW | 57.02 | 57.59 | 1.00% |

| Nedbank Group Limited | NBK | 207.84 | 203.94 | -1.88% |

| Standard Bank Group | SNB | 154.97 | 150.88 | -2.64% |

| Shoprite Holdings | SRH | 217.63 | 225.00 | 3.39% |

| FirstRand Limited | FST | 65.53 | 63.45 | -3.17% |

| Momentum Metropolitan Holdings | MMT | 16.55 | 16.22 | -1.99% |

| Old Mutual Ltd | OMM | 10.51 | 10.40 | -1.05% |

| Sanlam Limited | SLA | 54.82 | 53.76 | -1.93% |

| Santam Limited | SNM | 245.30 | 240.17 | -2.09% |

| Vukile Property Fund Limited | VKN | 13.34 | 13.24 | -0.75% |

| Investec Limited | IVD | 81.11 | 76.93 | -5.15% |

| PSG Konsult Limited | KFS | 11.63 | 10.60 | -8.86% |

Table 3: Dual Listed Trades

| Name | ETFs | Price Previous Close 'N$ | Price End of Day 'N$ | Daily Change % |

| New Gold Issuer Ltd NM | NGNGLD | 275.10 | 276.96 | 0.68% |

| New Gold Palladium ETF | NGNPLD | 336.98 | 338.49 | 0.45% |

| New Gold Platinum ETF N | NGNPLT | 143.05 | 144.59 | 1.08% |

| New Funds S&P NAM Bond | NFNAMA | 17.12 | 17.15 | 0.18% |

Table 4: ETFs

| Exchange Rates @ 08:00 | |

| USD/NAD | 17.36 |

| EUR/NAD | 17.29 |

| GBP/NAD | 19.90 |

| EUR/GBP | 0.86 |

| EUR/USD | 0.99 |

| GBP/USD | 1.15 |

| AUD/USD | 0.67 |

| USD/JPY | 143.76 |

| Commodities @ 08:00 | |

| Gold | 1,727.50 |

| Silver | 18.42 |

| Platinum | 850.60 |

| Palladium | 2,027.50 |

| WTI | 82.69 |

| Brent | 88.69 |

Table 5: Exchange Rates and Commodities

Local News

The country’s second-largest university is ushering in a new regime, which will see students who do not meet the pass mark receiving compensatory marks to assist them to reach 50%. (Namibian Sun)

The GIPF CEO David Nuyoma said there is a special need to be on guard to thwart any attempts by those who are tempted to satisfy their greed by dipping their hands in the cookie jar (New Era Newspaper)

The Namibia Investment Promotion and Development Board has launched a market access initiative for young entrepreneurs between the ages of 18 and 35, set to take place in mid-November at Tsumeb. (The Namibian)

Sub-Sahara News

Eskom's pension fund has said that the power utility's former CEO, Brian Molefe, has not yet paid back the R10 million he owes it. (News24)

South Africa’s business confidence slipped in the third quarter as sentiment among building contractors deteriorated due to shortages of some materials, load-shedding, and planning delays, a survey showed on Wednesday. (CNBC Africa)

United Nations Population Fund (UNFPA) has disclosed that over 20,000 adolescent girls have been retained in schools and safe places, while over 5,500 women and girls are living with obstetrics fistula in Nigeria. (All Africa News)

International News

Britain's new Prime Minister Liz Truss on Wednesday readied the final details of a plan to tackle soaring energy bills, which looks likely to cool inflation but add more than 100 billion pounds ($115 billion) to the country's borrowing. (Reuters)

China's manufacturing sector unexpectedly contracted in August as power cuts and temporary factory closures due to the heatwave dampened production and sales, survey results from S&P Global showed on Thursday (RTT News)

The United Nations said there are credible accusations that Russian forces have sent Ukrainian children to Russia for adoption as part of a larger-scale forced relocation and deportation programme. (Aljazeera News)

Analysis

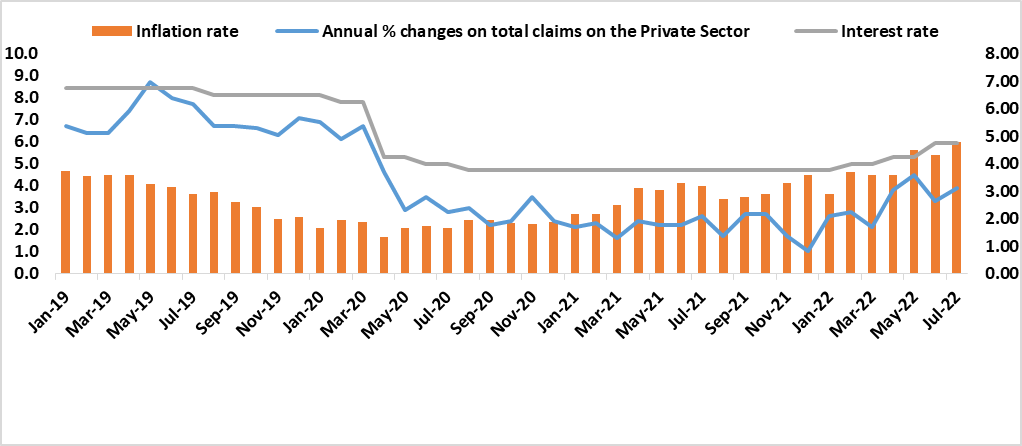

Total credit extended to the private sector (individuals and businesses) amounted to N$ 109,323 million for July 2022 from N$ 108,963 million recorded in June 2022. This translated into a slight increase of 0.3%. The increase was against the backdrop of an upturn in demand for credit by businesses for the category of other loans and advances and the mortgages category for households augmented an increase in the standard of living. See figure 1 below.

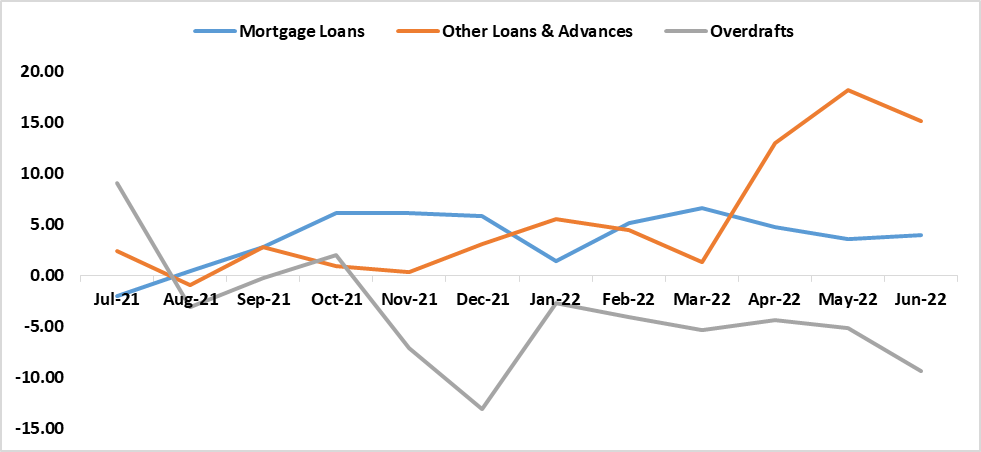

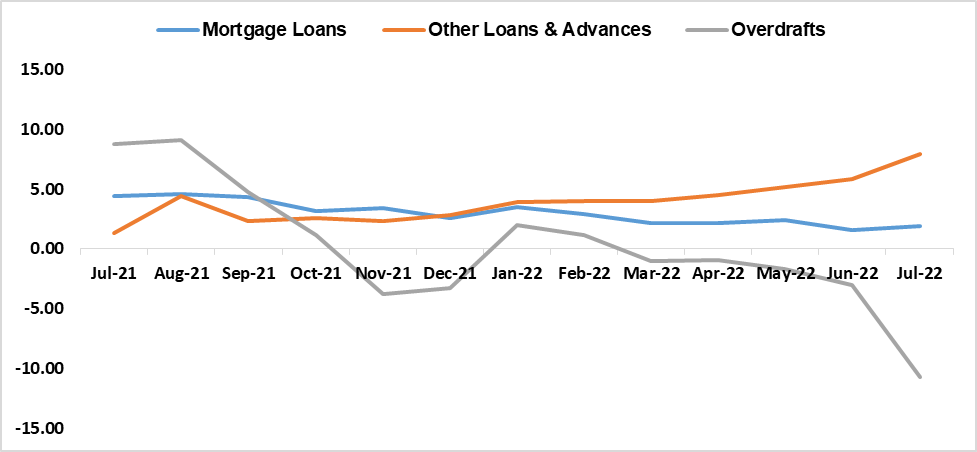

On an annual basis, total credit extended to the private sector increased by 3.9% up from 3.4% recorded in July 2021. An increase in the annual growth rate was mainly derived from growth recorded for other loans and advances for businesses and the uptake for mortgage credit for both households and businesses by 15.7% and 7.9%, respectively. This is an indication that confidence is returning albeit at a slow pace. According to the Bank of Namibia, businesses in the transport, mining, health, and service sectors have become the main contributors to businesses’ credit growth due to the high demand for other loans and advances and it has been on an upward trajectory since the beginning of the year. However, the demand for overdrafts for both households and businesses recorded no growth since January 2022. This speaks to the overall affordability of credit and tightening of overall general spending. See Figures 2 & 3.

Figure 1: Annual % growth rates on Total Credit Extended to the Private Sector vs. Repo Rate & Interest Rate, (January 2019- July 2022)

Figure 2: Annual % changes for Credit Extended to Businesses per category, (July 2021-July 2022)

Figure 3: Annual % changes for Credit Extended to Individuals per category, (July 2021-July 2022)

Outlook

Looking forward we expect credit growth to continue on a slow upward trend for the rest of the year 2022. This could be driven by improved credit scores for households especially mortgages as a result of an increase in housing benefits by 11% for government employees. However, the current interest rate hike cycle further possess a risk to the demand for credit as this further constrains consumers and business spending patterns.

| NSX Trades | Traded Volume (No. Shares) | Monetary Amount (N$) | Trading Contribution (%) |

| Overall | 405,588.00 | 13,952,923.37 | 100.00% |

| ETFs | - | - | 0.00% |

| Total | 405,588.00 | 13,952,923.37 | 100.00% |

Table 1: NSX Trades

NSX Activities

A total of N$ 13,952,923.37 worth of shares was traded on the NSX on Monday with about N$ 1,732,775 worth of Anglo-American plc and N$ 783,732 worth of Namibia Breweries on the home front. No ETFs were traded on Monday

HEI Market Commentary

From the trading activity that took place:

- Anglo-American shares continue to be allotted by participants as the markets bounce back.

- Shares belonging to Namibia Breweries were traded causing the share price to spike by 6.25%

| Name | NSX Local Ticker | Price Previous Close 'N$ | Price End of Day 'N$ | Daily Change % |

| Namibian Breweries | NBS | 40.00 | 42.50 | 6.25% |

| Nictus Holdings | NHL | 1.75 | 1.75 | 0.00% |

| Capricorn | CGP | 10.75 | 10.75 | 0.00% |

| First Rand Namibia | FNB | 30.03 | 30.20 | 0.57% |

| Standard Bank Namibia | SNO | 4.40 | 4.40 | 0.00% |

| Oryx Limited | ORY | 10.26 | 10.27 | 0.10% |

| Letshego | LHN | 2.65 | 2.65 | 0.00% |

| Namibia Asset Management | NAM | 0.70 | 0.70 | 0.00% |

| Stimulus | SILP | 127.90 | 127.90 | 0.00% |

| Paratus Namibia Holdings Ltd | PNH | 13.00 | 13.00 | 0.00% |

| Mobile Telecommunication Company | MOC | 7.52 | 7.52 | 0.00% |

| Alpha Namibia Industries Renewable Power Limited | ANE | 9.00 | 9.00 | 0.00% |

Table 2: Primary listed Trades

| Name | South African Dual Listed Ticker | Price Previous Close 'N$ | Price End of Day 'N$ | Daily Change % |

| Anglo-American plc | ANM | 548.34 | 550.19 | 0.34% |

| B2Gold Corporation | B2G | 50.84 | 50.84 | 0.00% |

| Oceana Group Limited | OCG | 54.51 | 54.10 | -0.75% |

| Mediclinic International Plc | MEP | 99.17 | 97.86 | -1.32% |

| Truworths | TRW | 59.40 | 57.59 | -3.05% |

| Nedbank Group Limited | NBK | 205.90 | 208.13 | 1.08% |

| Standard Bank Group | SNB | 155.02 | 156.21 | 0.77% |

| Shoprite Holdings | SRH | 232.03 | 235.25 | 1.39% |

| FirstRand Limited | FST | 64.97 | 65.78 | 1.25% |

| Momentum Metropolitan Holdings | MMT | 16.86 | 16.86 | 0.00% |

| Old Mutual Ltd | OMM | 10.74 | 10.69 | -0.47% |

| Sanlam Limited | SLA | 54.11 | 54.33 | 0.41% |

| Santam Limited | SNM | 239.50 | 238.00 | -0.63% |

| Vukile Property Fund Limited | VKN | 13.34 | 13.42 | 0.60% |

| Investec Limited | IVD | 81.82 | 81.81 | -0.01% |

| PSG Konsult Limited | KFS | 10.50 | 11.06 | 5.33% |

Table 3: Dual Listed Trades

| Name | ETFs | Price Previous Close 'N$ | Price End of Day 'N$ | Daily Change % |

| New Gold Issuer Ltd NM | NGNGLD | 275.55 | 274.79 | -0.28% |

| New Gold Palladium ETF | NGNPLD | 336.81 | 335.57 | -0.37% |

| New Gold Platinum ETF N | NGNPLT | 140.27 | 141.50 | 0.88% |

| New Funds S&P NAM Bond | NFNAMA | 17.21 | 17.24 | 0.17% |

Table 4: ETFs

| Exchange Rates @ 08:00 | |

| USD/NAD | 17.12 |

| EUR/NAD | 17.04 |

| GBP/NAD | 19.83 |

| EUR/GBP | 0.86 |

| EUR/USD | 0.99 |

| GBP/USD | 1.15 |

| AUD/USD | 0.67 |

| USD/JPY | 141.13 |

| Commodities @ 08:00 | |

| Gold | 1,727.35 |

| Silver | 18.17 |

| Platinum | 832.15 |

| Palladium | 2,052.38 |

| WTI | 88.80 |

| Brent | 95.25 |

Table 5: Exchange Rates and Commodities

Local News

As of tomorrow, motorists will pay N$ 1.20 less per litre of petrol while the price of diesel will decrease by N$0.65per liter. (Namibian Sun)

Between 150 and 300 new jobs that would have been created through the Trevali Posh Pinah mine expansion have been deferred on later-dated vessels. (New Era Newspaper)

Namibia is expected to finalize a policy on green hydrogen in November to coincide with the 2022 United Nations Climate Change Conference (Cop27). (The Namibian)

Sub-Sahara News

The price of both 93 and 95 unleaded petrol will be lowered by R2.04 a litre on Wednesday, the Department of Mineral Resources and Energy announced on Monday (News24)

South African petrochemical firm Sasol SOLJ.J on Friday said it was partnering with Japan’s Itochu Corp 8001.T to explore the development of green hydrogen and green ammonia projects for shipping fuel and power generation. (CNBC Africa)

UNICEF says it is "deeply concerned" after Zimbabwe's health ministry confirmed that nearly 700 children have died from the latest outbreak of measles. A vaccine campaign is underway but faces resistance from anti-vaccine religious groups. (All Africa News)

International News

The U.N. nuclear watchdog is due to issue a report on the Zaporizhzhia nuclear power station in Ukraine on Tuesday, a day after shelling cut its electricity supplies for the second time in two weeks and raised fears of a catastrophe. (Reuters)

Asian stocks ended broadly higher on Tuesday despite a weak lead from Wall Street overnight (RTT News)

Singapore’s LGBTQ community worries a government move to “safeguard” the institution of marriage could perpetuate discrimination in the conservative city-state, even as a colonial-era law criminalizing sex between men is finally repealed. (Aljazeera News)