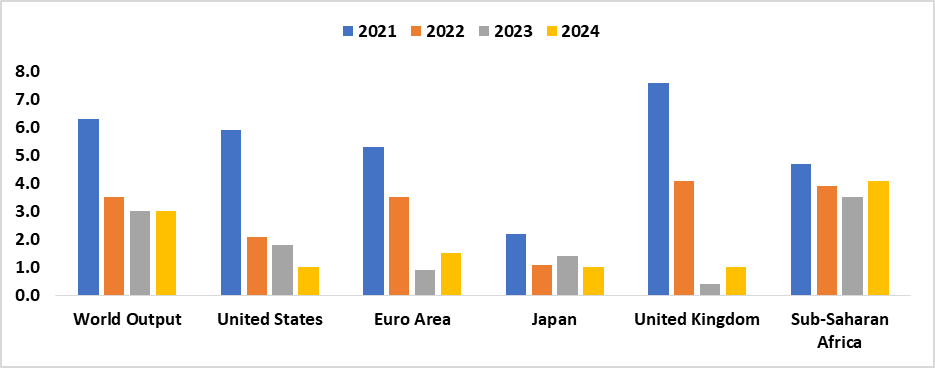

Global growth remains weak by historical standards. According to the recent World Economic Outlook published today, global growth is expected to slow from 3.5% in 2022 to 3.0% both in 2023 and 2024. The forecast for 2023 is slightly higher than predicted in the World Economic Outlook (WEO) for April 2023. The rise in central bank policy rates in order to combat inflation continues to have an impact on economic activity.

Growth in Sub-Saharan Africa is projected to decline to 3.5% in 2023 before picking up to 4.1% in 2024. Growth in Nigeria in 2023 and 2024 is projected to gradually decline, in line with April projections, reflecting security issues in the oil sector. In South Africa, growth is expected to decline to 0.3% in 2023, with the decline reflecting power shortages, although the forecast has been revised upward by 0.2% since the April 2023 WEO, on account of resilience in services activity in the first quarter. (Figure 1)

Additionally, global headline inflation is expected to fall from 8.7% in 2022 to 6.8% in 2023 and 5.2% in 2024. In 2023, roughly three-quarters of the world’s economies are expected to have lower annual average headline inflation. Monetary policy tightening is expected to gradually dampen inflation, but falling international commodity prices are a key driver of the disinflation forecast for 2023. Differences in the rate of disinflation across countries reflect factors such as different exposures to commodity price and currency movements, as well as varying degrees of economic overheating.

Main forces shaping the Global Outlook:

- The fight against inflation continues. Inflation is easing in most countries but remains high, with divergences across economies and inflation measures

- Acute stress in the banking sector has receded, but credit availability is tight. Thanks to the authorities’ swift reaction, the March 2023 banking scare remained contained and limited to problematic regional banks in the United States and Credit Suisse in Switzerland

- Following a reopening boost, China’s recovery is losing steam. Manufacturing activity and consumption of services in China rebounded at the beginning of the year when Chinese authorities abandoned their strict lockdown policies; net exports contributed strongly to sequential growth in February and March as supply chains normalized and firms swiftly put backlogs of orders into production

Figure 1: Overview of the World Economic Outlook Projections (percentage change)

Source: IMF|July 2023