Executive summary

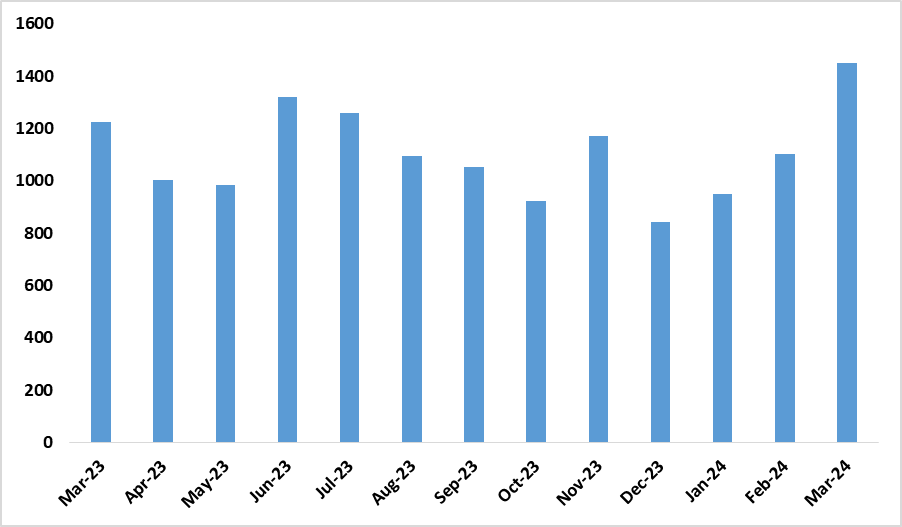

- New vehicle sales increased to 1451 vehicles in March 2024, up from 1102 vehicles sold in February 2024. This represented a monthly increase of 32%. (Figure 1)

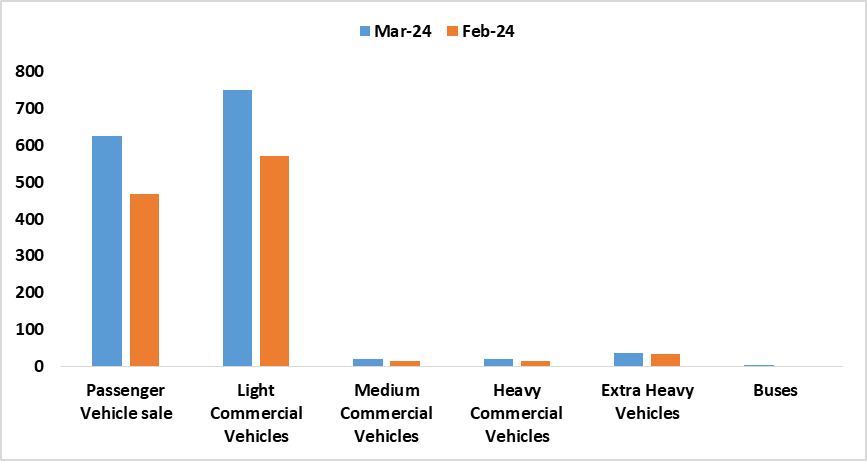

- Sales of Passenger, light commercial, medium commercial, Heavy commercial and extra heavy and busses commercial increased by 34%, 31%, 33%, 27%, 6% and 100% month on month respectively.

- In the first quarter of 2024, 3503 vehicles were sold, compared to 3127 vehicles sold in the same period last year, a 12% improvement.

- Out of the 3053 vehicles sold for 2024 so far, 1562 were passenger vehicles, 1767 were Light commercial vehicles, 55 were medium commercial vehicles, 39 were heavy commercial, 77 were extra heavy vehicles and 3 were buses.

Analysis

- The 1451 vehicles sold in March, is the highest number of vehicles sold in a single month since August 2016

- The monthly increase in vehicle sales in March 2024 from February 2024 was mainly driven by increases in all vehicle segments. This could be ascribed to increased demand because of no changes in the interest rates in the last MPC meetings, additionally, higher sales of commercial vehicles could be attributed to increasing commercial activities hence a growing demand for commercial transportation services.

- On an annual basis, new vehicle sales increased by 18%. 1451 sold in March 2024 vs 1226 sold in March 2023. This implies an improvement in consumer confidence.

- Passenger vehicle sales remain strong with real growth of 155 vehicles from 625 vehicles sold in March, compared to 470 in February 2024, this could be attributed to continued incentives offered by car dealerships at the beginning of the year.

- Commercial vehicle sales increased to 825 from the 478 that was recorded in February 2024. This could have been influenced by increasing commercial sector performance.

Table 1: Monthly vehicle sales by type

| Market | March 2024 | Feb 2024 | Monthly unit change | Monthly % change |

| Passenger vehicles | 625 | 467 | 158 | 34 |

| Light commercial vehicles | 751 | 572 | 179 | 31 |

| Medium commercial vehicles sales | 20 | 15 | 5 | 33 |

| Heavy commercial vehicle sales | 19 | 15 | 4 | 27 |

| Extra heavy commercial vehicle sales | 35 | 33 | 2 | 6 |

| Bus | 1 | 0 | 1 | 100 |

Figure 1: Monthly Vehicle Sales (March 2023 – March 2024)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: month on month, Vehicle Sales Growth (march 2024 vs February 2025)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Outlook

Although interest rates have remained high, the demand for new vehicles has been resilient. As inflation tricks down the outlook for vehicle sales in the short to medium term appears positive, as the expected lowering of interest rates is likely to boost consumer confidence.