Executive summary

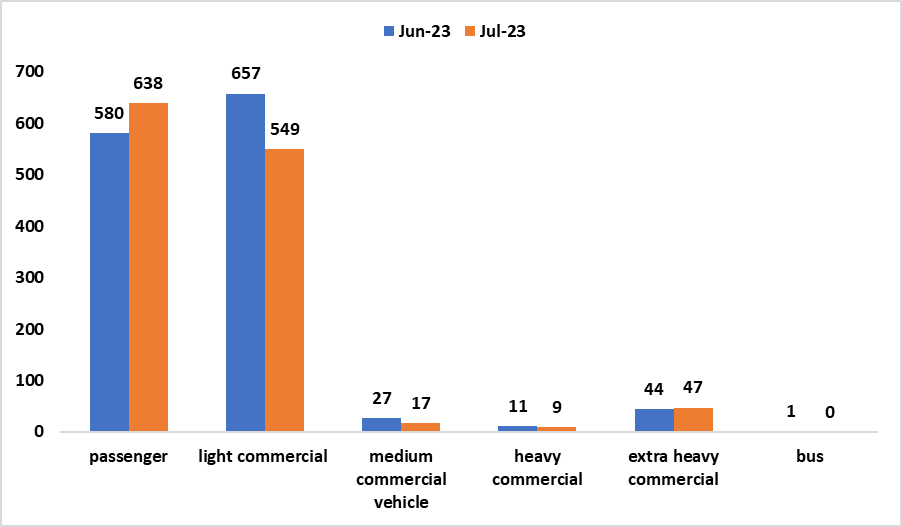

- Vehicle sales experienced a slowdown, with only 1260 vehicles sold in July 2023, down from the 1320 vehicles sold in June 2023. This marked a monthly decline of 60 vehicles, equivalent to a 5% decrease (Figure 1)

- Interestingly, specific segments within the market showed varying trends. Sales of passenger vehicles surged by 10% month on month, indicating a positive consumer sentiment. Additionally, extra-heavy commercial vehicles also demonstrated growth, albeit at a more moderate rate of 6.82%. In contrast, light commercial vehicles saw a notable drop of -16.4% on a monthly basis.

- Breaking down the figures for the seventh month of 2023, a total of 6373 vehicles were sold. Among these, passenger vehicles constituted the majority with 3288 units, followed closely by light commercial vehicles at 3039 units. Medium-sized vehicles accounted for 167 sales, while heavy commercial vehicles contributed 97 units. Furthermore, 112 extra heavy commercial vehicles were sold, and a smaller segment consisted of 8 buses. These insights provide a comprehensive overview of the vehicle sales landscape during this period, showcasing the varying dynamics across different vehicle categories

Analysis

- The decline in monthly vehicle sales between July and June 2023 can be primarily attributed to the notable decrease in light commercial vehicle sales. This decline could be linked to decreased credit demand, likely influenced by an interest rate increase in April. Furthermore, the sluggish sales of commercial vehicles might be a consequence of subdued commercial activities, resulting in diminished demand for commercial transportation services

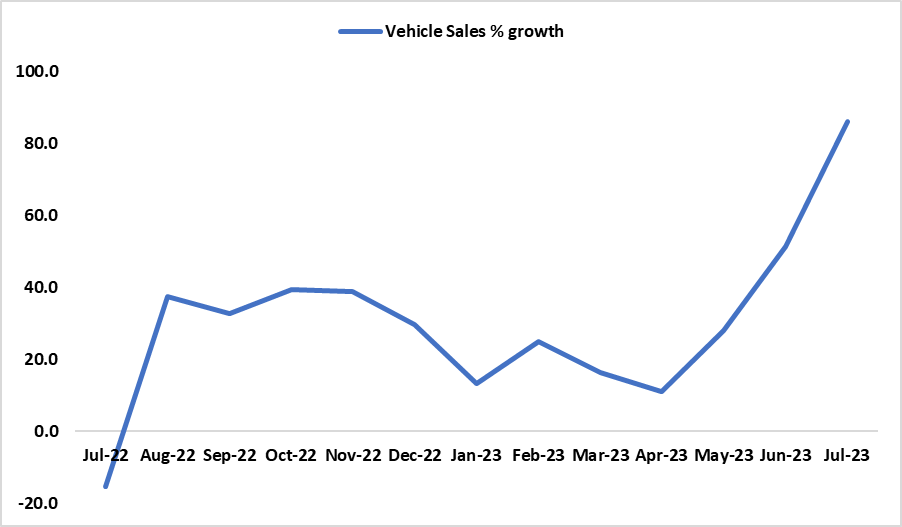

- Looking at the broader picture, on an annual basis, new vehicle sales witnessed a substantial increase of 31%. This positive trend could potentially be attributed to a bolstering of consumer confidence, which in turn has stimulated higher purchasing activity within the market

- During July 2023, the sales of passenger vehicles experienced a noteworthy surge, reaching 638 units, a clear upswing from the 580 units sold in June 2023. This notable increase can be attributed to the absence of interest rate hikes throughout the entire month of July, potentially allowing consumers more favorable conditions for vehicle acquisition

- In contrast, light commercial vehicle sales declined to 549 units in July 2023, a significant drop from the 657 units recorded in June 2023. This decline serves as an indicator of the underperformance of the commercial sector during this period, potentially reflecting the broader economic challenges faced within the commercial landscape

Table 1: Monthly vehicle sales by Market

| market | Jun-23 | Jul-23 | monthly unit change | monthly % change | |

| passenger vehicles | 580 | 638 | 58 | 10 | |

| light commercial vehicles | 657 | 549 | -108 | -16.4 | |

| medium commercial vehicles sales | 27 | 17 | -10 | -37 | |

| heavy commercial vehicle sales | 11 | 9 | -2 | -18.2 | |

| extra heavy commercial vehicle sales | 44 | 47 | 3 | 6.82 | |

| bus | 1 | 0 | -1 | -100 | |

Figure 1: Monthly Vehicle Sales (July 2023 vs June 2023)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: Year on Year, Vehicle Sales Growth (July 2022- July 2023)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Outlook

The demand for new vehicles has demonstrated impressive resilience during the initial seven months of 2023. With the recent determination of the Bank of Namibia’s Monetary Policy Committee (MPC) to uphold the repo rate in their August session, our projections indicate a continuation of the positive momentum in vehicle sales for the foreseeable short to medium term. This decision by the MPC is expected to provide ongoing stability and favorable conditions, which should further support the resilience of the vehicle market.