Executive summary

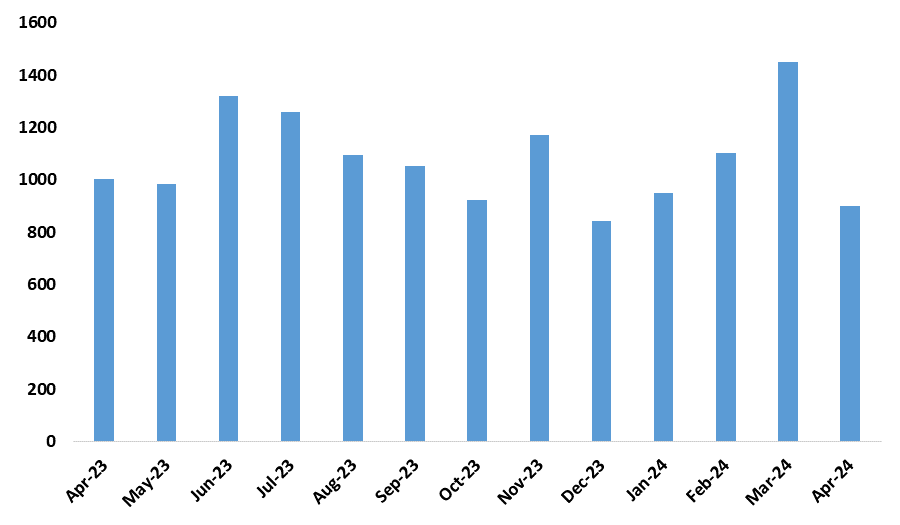

- In April 2024, new vehicle sales in Namibia experienced a significant decline, with only 899 vehicles sold compared to 1451 vehicles in March 2024, representing a monthly decrease of 38%. Figure 1

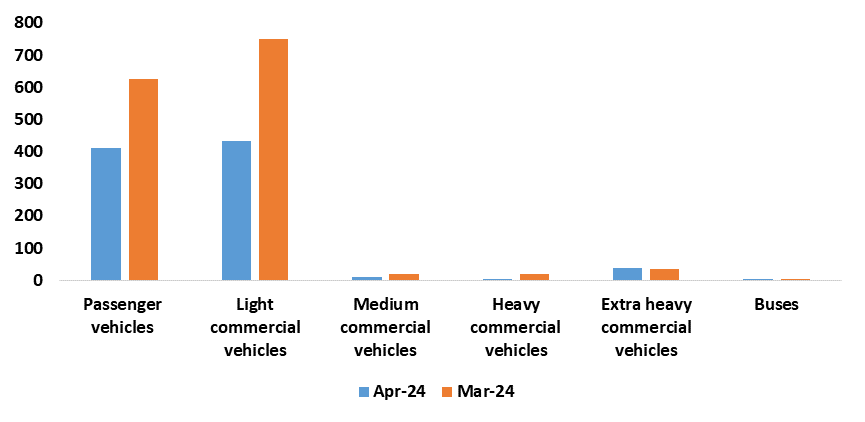

- Extra heavy vehicles and buses were the only segments that saw an increase in sales, with growth rates of 11% and 100% respectively.

- Conversely, sales of passenger, light commercial, medium commercial, heavy commercial, and buses all recorded declines of -34%, -42%, -50%, and -79% respectively. Figure 2.

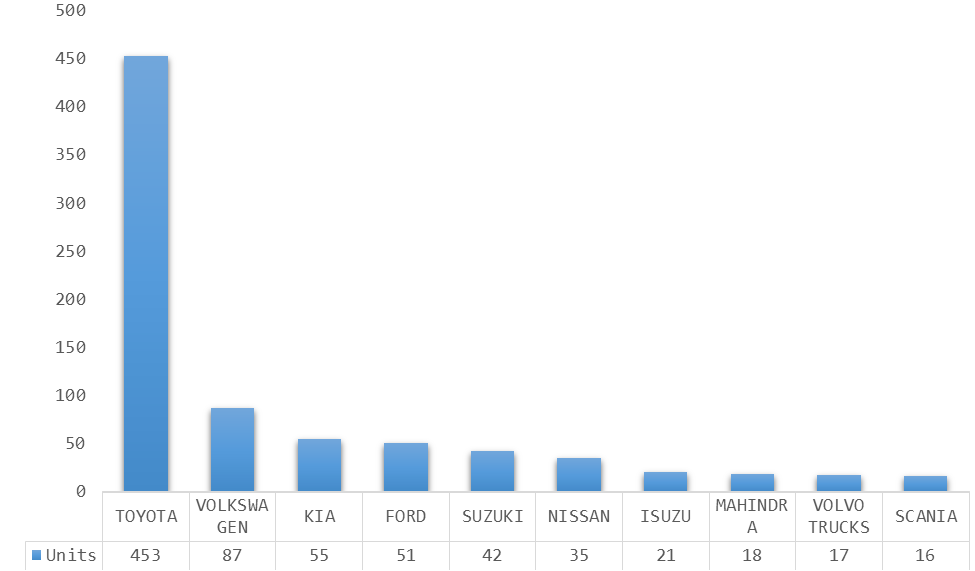

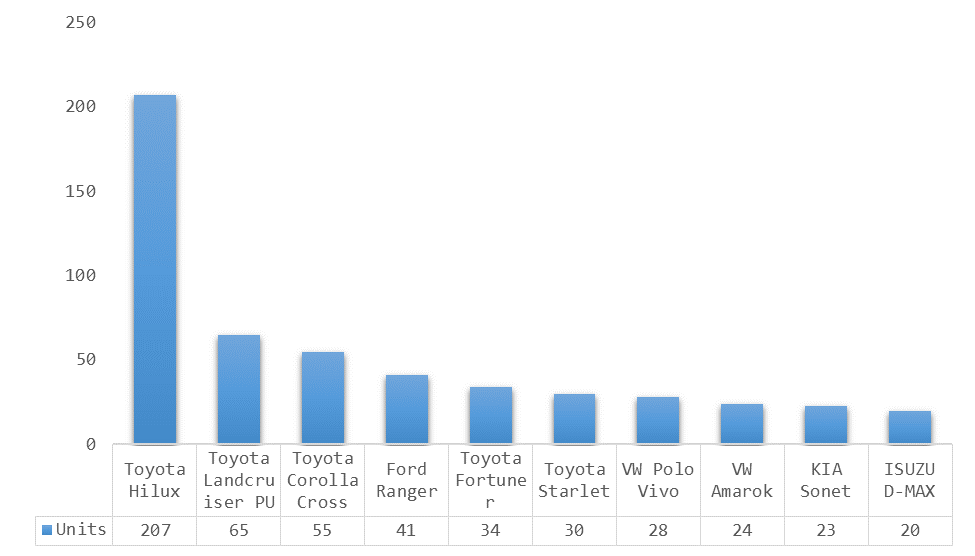

- During the month under review, Toyota emerged as the best-selling vehicle make, with the Hilux being the top seller, recording 207 units sold in April 2024. Figure 3 and 4.

- On an annual basis, the first third of 2024 saw an improvement in new vehicle sales, with 4402 vehicles sold compared to 4131 vehicles sold in the same period in the previous year, indicating a 6.6% increase.

- Out of the 4402 vehicles sold in 2024, 1973 were passenger vehicles, 2200 were light commercial vehicles, 63 were medium commercial vehicles, 43 were heavy commercial vehicles, 116 were extra heavy vehicles, and 5 were buses.

Analysis

- The 899 vehicles sold in April 2024 represent the lowest number of vehicles sold in a single month in 2024.

- Passenger vehicles experienced a decrease of 214 units compared to March 2024 and a 12% decline compared to April 2023. The best-selling passenger vehicle for April 2024 was the Toyota Corolla Cross, which sold 47 units less than the previous month’s leader, the Toyota Fortuner, with 102 units sold in March 2024.

- Light commercial vehicles decreased by 318 units compared to March 2024 and 8% less compared to April 2023.

- Medium commercial vehicles decreased by 10 units compared to March 2024 and 41% less compared to April 2023,

- Heavy commercial vehicles decreased by 15 units compared to March 2024 and 33% less compared to April 2023.

- Extra heavy commercial vehicle sales increased by 4 units compared to March 2024 but remained unchanged compared to April 2023.

- Overall, commercial vehicle sales increased to 825 from the 478 recorded in March 2024. The commercial vehicle segment was dominated by Volvo and Scania, with 17 and 16 units sold for the month respectively, possibly influenced by the increasing performance of the commercial sector.

- Bus sales increased by 1 unit compared to March 2024 and grew 100% compared to April 2023.

- The monthly decrease in vehicle sales in April 2024 from March 2024 was mainly driven by decreases in 67% of all the vehicle segments. This decline could be attributed to the end of the festive season of vehicle promotions, leading to a decrease in demand.

- On an annual basis, new vehicle sales fell by 10.5%, translating into 899 vehicles sold in April 2024 compared to 1004 sold in March 2023, indicating weak consumer confidence.

Table 1: Monthly vehicle sales by type

| Market | April 20204 | March 2024 | Monthly unit change | Monthly % change |

| Passenger vehicles | 411 | 625 | -214 | -34 |

| Light commercial vehicles | 433 | 751 | -318 | -42 |

| Medium commercial vehicles sales | 10 | 20 | -10 | -50 |

| Heavy commercial vehicle sales | 4 | 19 | -15 | -79 |

| Extra heavy commercial vehicle sales | 39 | 35 | 4 | 11 |

| Bus | 2 | 1 | 1 | 100 |

Figure 1: Monthly Vehicle Sales (April 2023 – April 2024)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: Month on month, Vehicle Sales Growth March 2024 vs April 2024)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Figure 3: Top 10 bestselling vehicles by make (March 2024-April 2024)

Figure 4: Top 10 bestselling cars by type (March 2024-April 2024)

Outlook

Although interest rates have remained high, the demand for new vehicles is starting to slow down. Warning signs of falling consumer confidence. As inflation tricks down it is expected for interest rates to be lowered which will boost vehicle sales in the short to medium term.