The Namibian uranium industry is distinctive because it operates in a region with a variety of uranium deposits and high levels of biodiversity and geomorphology cultural preservation value. Almost all Namibian uranium activities occur in the central western Erongo Region of the country, a region that is characterised by its aridity, vast desert landscapes, scenic beauty, high biodiversity and endemism, and heritage resources. The region makes important contributions to Namibia’s economy, and mining plays a major role in making this contribution. Namibia is one of the world’s top producers of uranium ranking second only to Kazakhstan, (2022). The country produces around 10% of the world’s global uranium production mainly from its large uranium mines with Rossing Uranium and Swakop Uranium. Notwithstanding this, there are also a number of small uranium exploration projections currently ongoing.

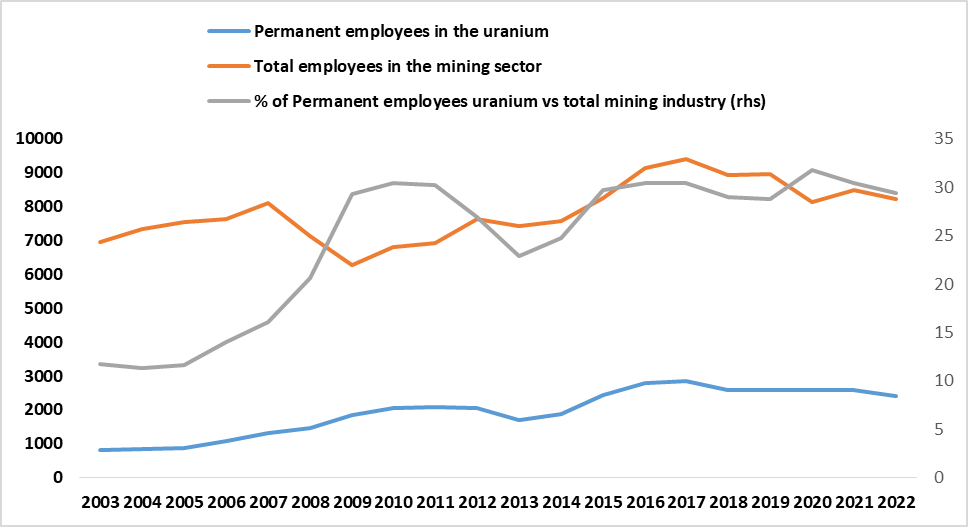

The mining and export of uranium contribute significantly to GDP export earnings and employment. The sector contributed around 2% to GDP in 2022. Data from the NSA indicate that a notable increase in uranium export earnings was observed over the past 5 years. Uranium export earnings surged to N$3.5 billion for quarter 1 of 2023 from N$1.0 billion recorded in the same period in 2022. This could be attributed to a stronger uranium export volume and the depreciation of the domestic currency. The higher export volumes were triggered by a low base effect, as shipping vessels were unavailable during the corresponding quarter of 2022. On a quarterly basis, however, uranium export receipts declined by 28.4% to N$3.5 billion from N$ 4.9 billion recorded in quarter 4 of 2022, explained by the lower volumes exported. Additionally, the data from the Chamber of Mines Namibia indicates that the uranium sector employed about 5772 people in 2022 with only 42 % of permanent employees and the rest are contract-based or temporary casual workers. (Figure 1)

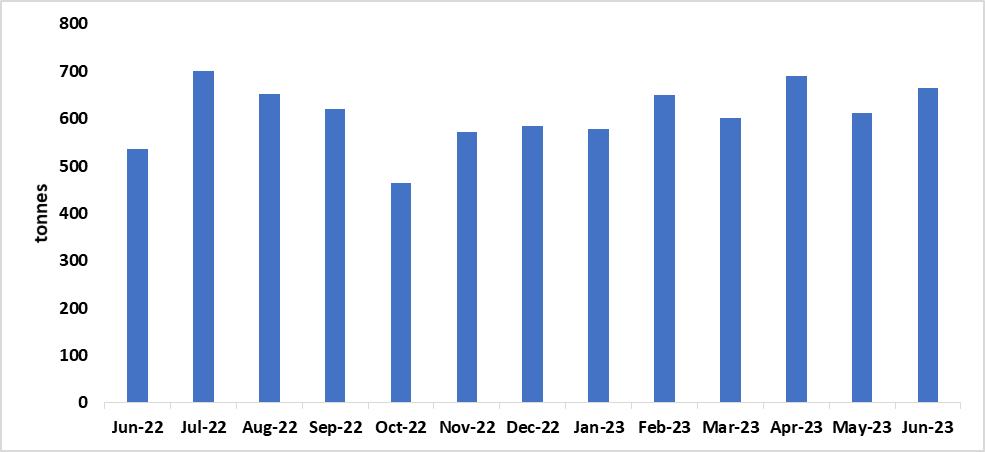

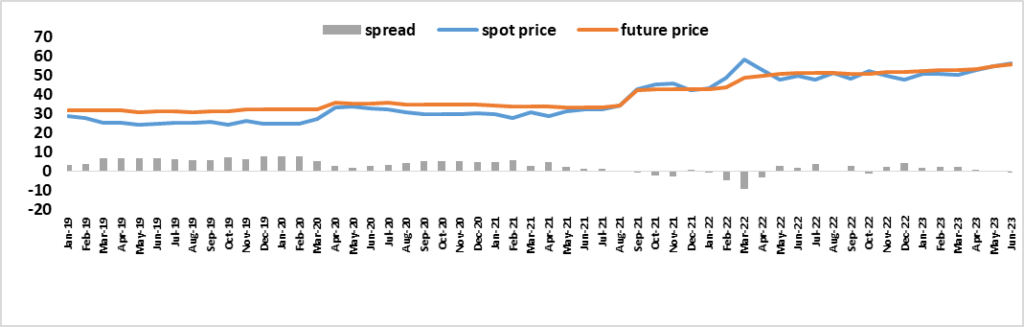

Furthermore, Production of uranium rose both year-on-year (between June 2022 and June 2023 and month-on-month (between May 2023 and June 2023). (Figure 2). This could be due to a recovery from water supply challenges experienced during the previous year. Uranium production rose both on a yearly and monthly basis by 24.2% and 9%, respectively. The international average spot price for uranium stood at U$50.00 per pound during the first quarter of 2023, similar to the level registered during the corresponding quarter in 2022. This suggests that the market conditions for uranium have not experienced any significant shifts that would impact its price and this could indicate the balance between the global supply and demand for uranium. (Figure 3)

Figure 1: Employment in the uranium and overall mining sector, (2003- 2023)

Source: Chamber of Mines Namibia and HEI Research

Figure 2: Uranium Production in tonnes, (June 2022-June 2023)

Source: NSA and HEI Research

Figure 2: Price of Uranium, (January 2019-June 2023)

Source: Cameco and HEI Research