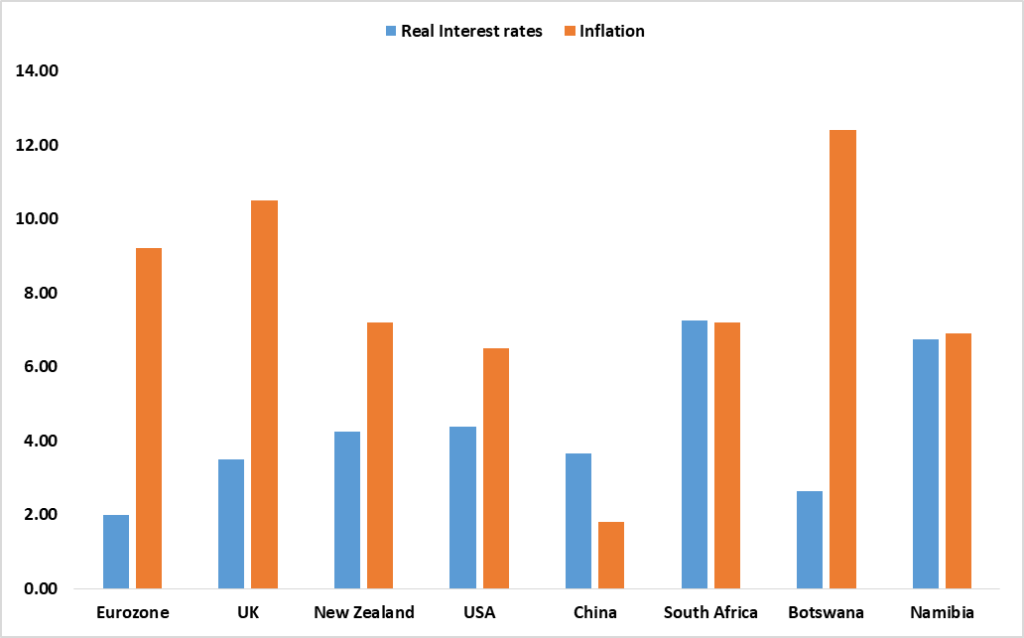

The South African bank’s monetary policy committee opted to increasing the repurchase rate by 0.25% to 7.25%. This decision was strongly motivated by finding the balance between inflation risks and the potential economic slowdown climate. The revised repurchase rate remains supportive of credit demand in the near term while raising rates to levels more consistent with the current view of inflation and its risks to it. The SARB’s MPC aims to anchor inflation expectations more firmly around the midpoint of the target band (3% -6%) which currently stands at 7.2%. The Governor of the Reserve Bank is of the view that this decision is aimed at maintaining the inflation target sustainably over time. Guiding inflation back towards the mid-point of the target band can reduce the economic costs of high inflation and enable lower interest rates in the future according to SARB. Economic and financial conditions are expected to remain more on the upside of risk for the foreseeable future.

Figure 1: Global real interest rates vs. Inflation as at 27 January 2023

Source: COUNTRY’S STATISTICS AGENCY, CENTRAL BANKS & HEI RESEARCH