Executive Summary

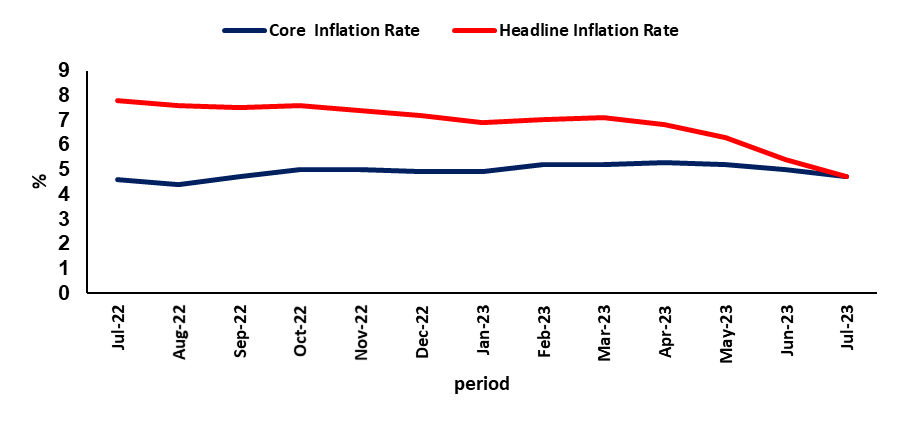

- In July 2023, the annual inflation rate slowed to 4.7%, the lowest since April 2021, from the 5.4% recorded in July 2022 and 6.3% recorded the prior month. (Figure 1)

- Core inflation, which excludes prices of food, non-alcoholic beverages, fuel and energy, reached a 10-month low of 4.7% in July 2023, from 5% recorded in June 2023. On a monthly basis, core consumer prices went up by 0.5%, from a 0.4% rise in June mainly attributed to housing and utilities. (Figure 1)

- On a monthly basis, inflation in South Africa increased by 0.9% from 0.2% recorded in June 2023. The increase emanated from the categories of food and non-alcoholic beverages categories (1.7%), followed by alcoholic beverages and tobacco (0.4%). The transport category contributed the least (-0.4%) to monthly inflation

- Analysis

- The annual rate for food and non-alcoholic beverages was 9,9% in July, down from 11,0% recorded in July 2022. The bread and cereals annual inflation slowed to 13,1% from 15,5% recorded in July 2022. Maize meal was cheaper in July compared with June, with prices falling on average by 0,7% month on month. The annual inflation for meat declined for a fifth consecutive month, easing to 5,1%

- The decline in fuel prices led to a decrease in transport inflation. The annual rate for fuel was negative 16,8% in July 2023. This dragged the transport category down into negative territory for the first time since January 2021

- The housing and utilities inflation increased by 2,8% between June and July. On average, households are paying 14,5% more for electricity through the NERSA determination. Water tariffs increased by 9,6% and property rates by 2,9%

Figure 1: Headline and Core Inflation for South Africa (July 2022 – July 2023)

Source: STATSSA & HEI Research

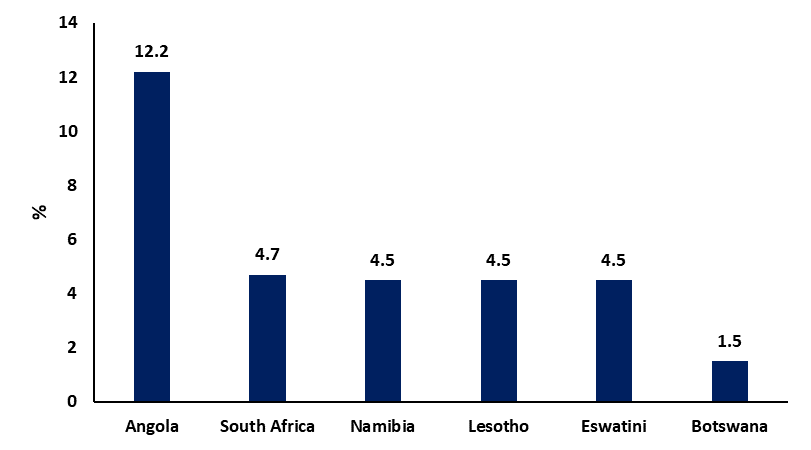

Figure 2: Selected SADC countries Headline Inflation Rates (July 2023)

Source: STATSSA & HEI Research

Outlook

Going forward we expect inflation to continue easing mainly due to manufacturing companies finding alternative energy sources for production. However, there could be a second-round effect in the short to medium term through the household utilities as seen in core inflation which appears to be more ‘sticky’ than headline inflation.