Analysis

Between August and September 2023, credit extended to households and businesses in the private sector decreased by N$345.1 million. In real terms, total credit extended to the private sector decreased from N$119,288.8 million in August 2023 to N$118,943.7 million in September 2023. This decline was observed across all credit categories except for installment sales and leasing credit, which exhibited a modest increase of 11.6% during the period under review.

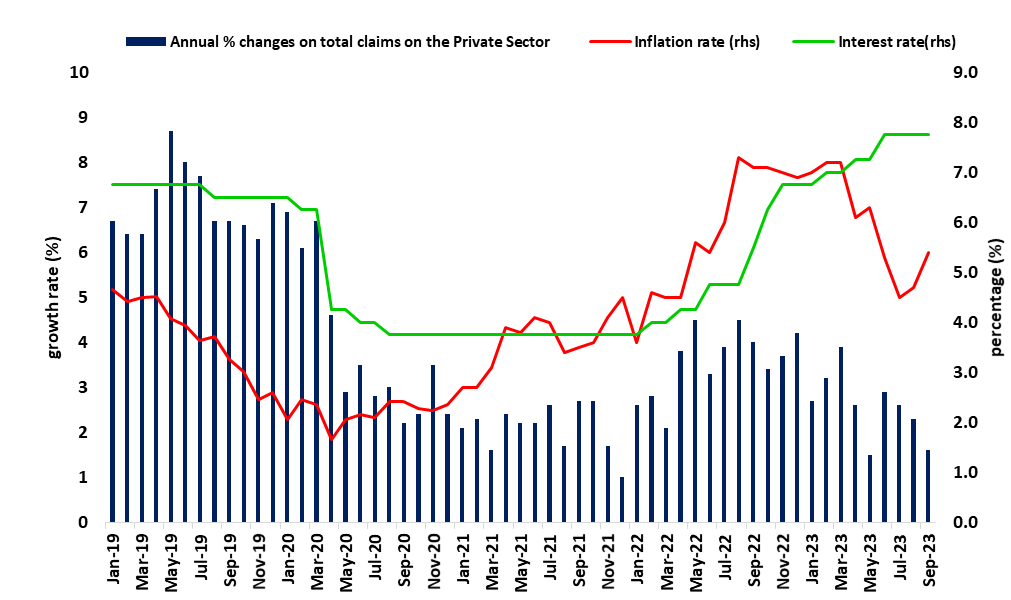

On an annual basis, the Private Sector Credit Extension (PSCE) recorded a growth rate of 1.6% a decline from the 2.2% growth rate recorded at the end of August 2023. This decline could be attributed to low demand for credit and the net repayment of credit by businesses, particularly in the services, wholesale, retail trade, commercial real estate, mining, manufacturing, and fishing sectors, as reported by the Bank of Namibia (see Figure 1). Moreover, business credit contracted by 2.1% year-on-year, while household credit experienced a decline of 4.3% year-on-year.

Figure 1: Annual % PSCE vs. Repo Rate & Interest Rate, (January 2019- September 2023)

Source: BON, NSA & HEI RESEARCH

Credit to Households

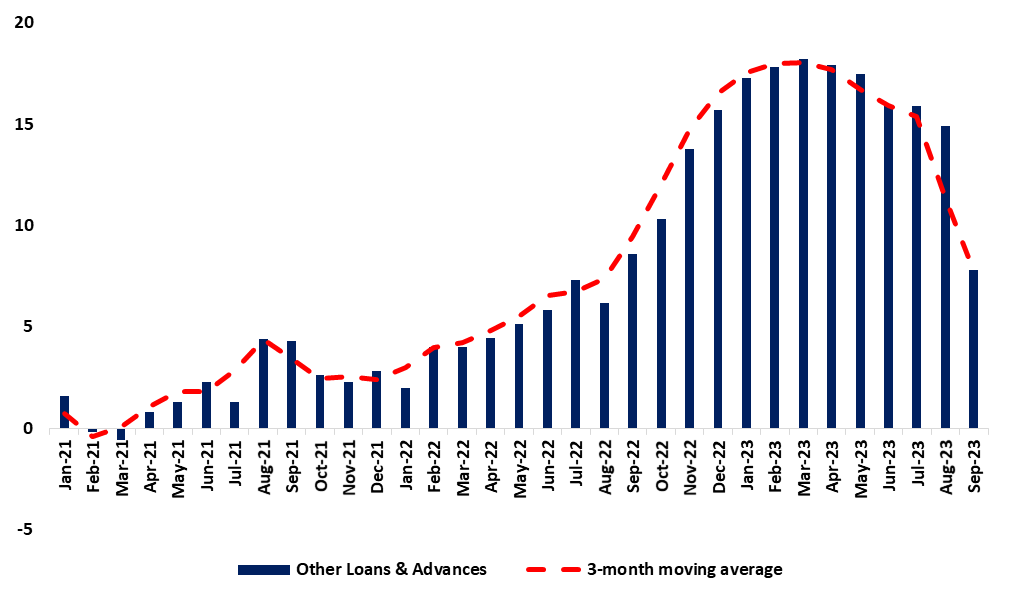

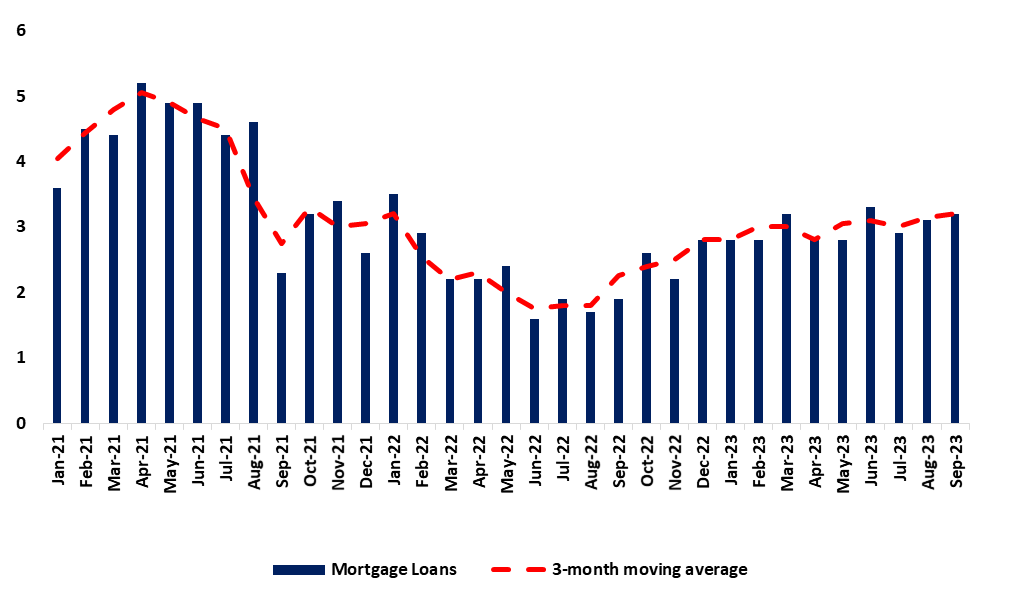

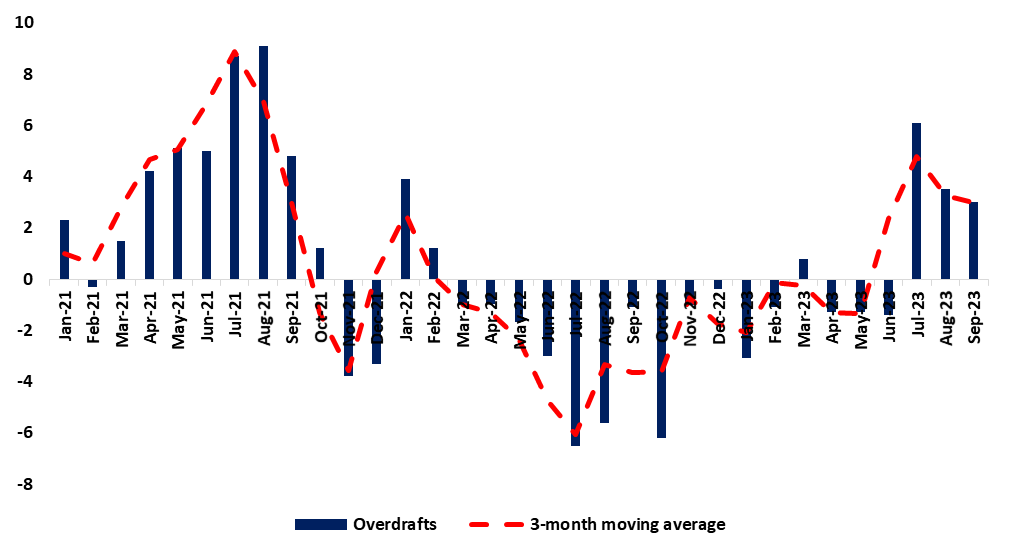

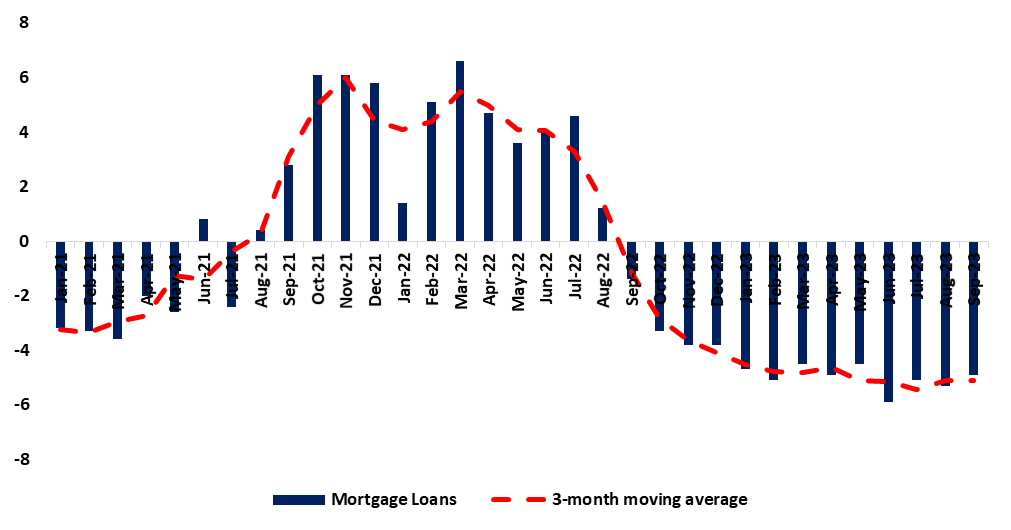

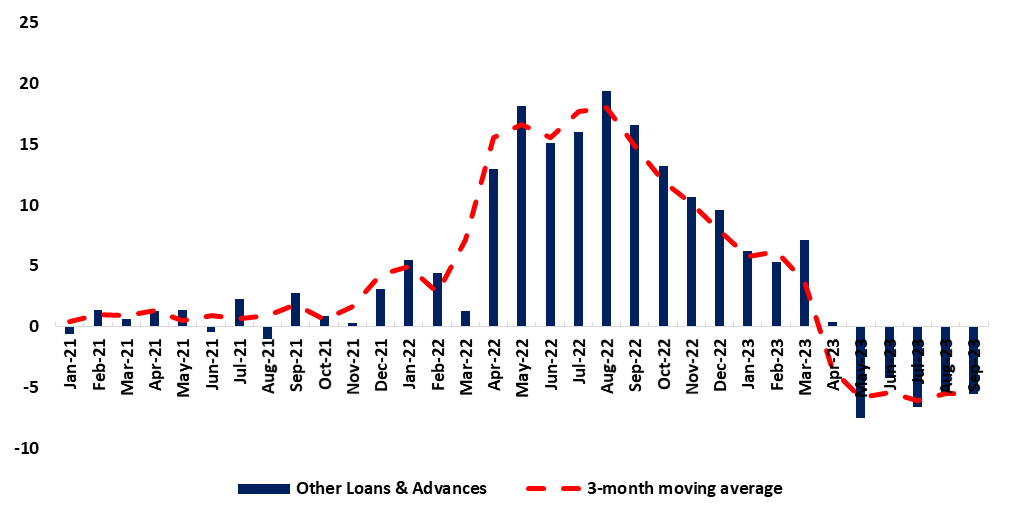

The credit extended to households stood at N$65,967.9 million in September 2023 from N$66,433 million in August 2023. This signified a weakening trend, primarily driven by sub-categories such as other loans and advances, which decreased from 14.9% to 7.8% month-on-month. In comparison, mortgage credit remained subdued at 3.2% month-on-month (refer to Figures 2 and 3). Consequently, most credit facilities available to households experienced declines, including overdraft credit, which decreased from 3.5% to 3.0%. However, there was a slight increase in installments and leasing credit, albeit modest, rising from 6.1% to 6.4% during the specified period (refer to Figures 4 and 5).

Figure 2: Other loans and advances, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Figure 3: Mortgage, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

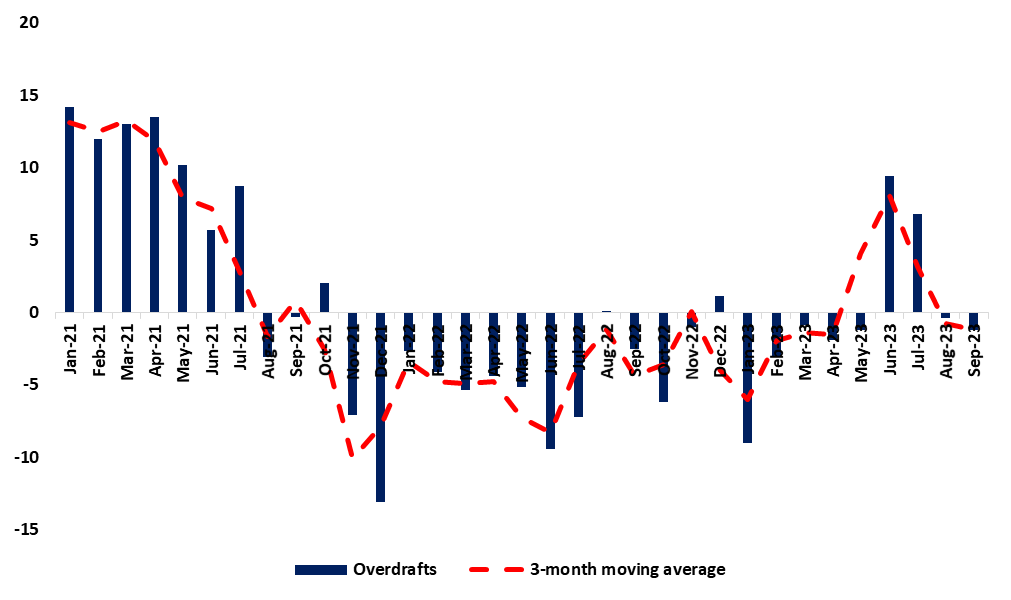

Figure 4: Overdrafts (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

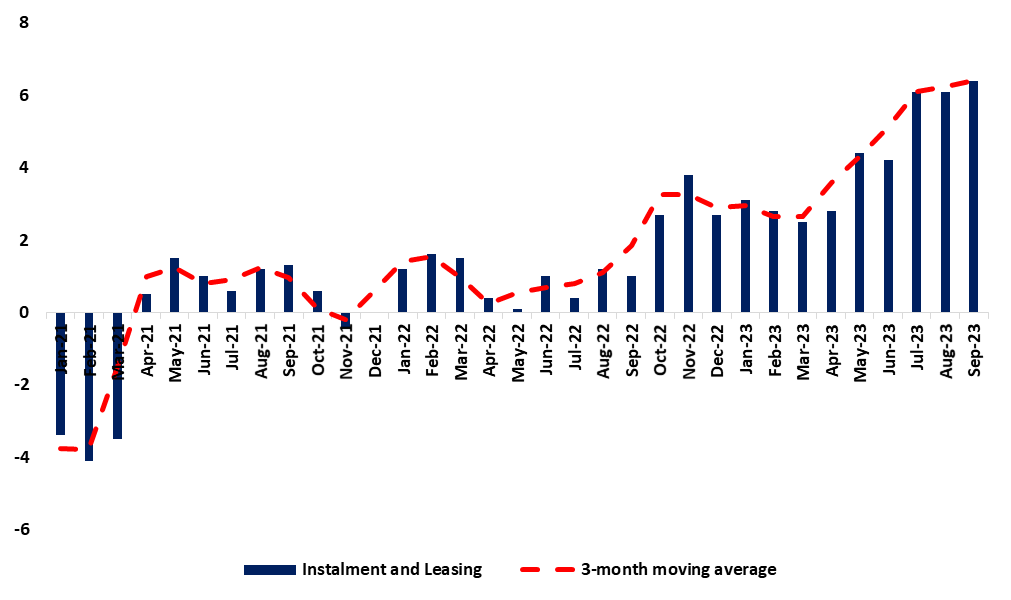

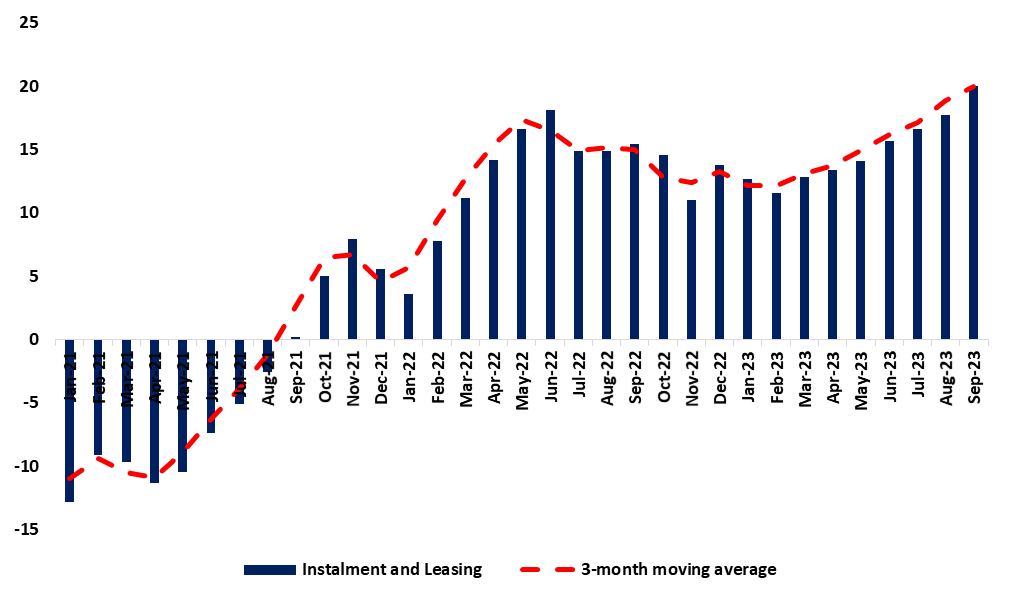

Figure 5: Instalments and Leasing, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Credit to Businesses

During the month under review (September 2023), total credit extended to businesses amounted to N$ 45,281 million, reflecting a marginal improvement from the August figure of N$ 45,188 million. This slight uptick was primarily driven by a surge in demand for installment and leasing credit, which increased from 17.8% to 20.0% month-on-month. This growth was spurred by heightened demand in the car rental industry, supported by activities within the tourism sector. On the other hand, overdraft credit experienced a decline, decreasing from 0.4% to -1.2% month-on-month, along with a contraction in mortgage loans, dropping from 5.3% to -4.9% month-on-month. Meanwhile, other loans and advances remained stable at -5.5%, as illustrated in Figures 6, 7, and 8 (refer to Figure 9).

Figure 6: Overdrafts, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Figure 7: Mortgage, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Figure 8: Other loans and advances, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Figure 9: Instalments and Leasing, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Commercial Bank Liquidity Position

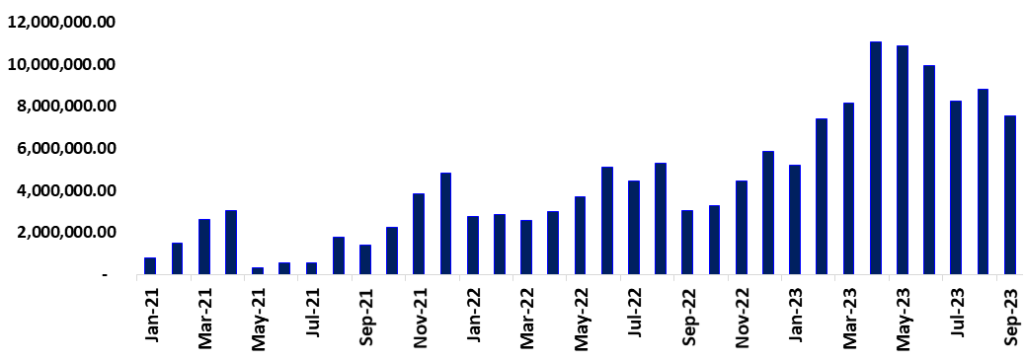

The aggregate liquidity status of the banking industry saw a decline to N$7.3 billion in September 2023, in comparison to the N$8.8 billion reported in August 2023, marking a month-on-month reduction of N$1.5 billion (see Figure 10). The Bank of Namibia (BoN) attributed this decline to factors such as reduced government expenditure, decreased diamond sales, and an increase in funds placed in the BoN Bill.

Figure 10: Banking Liquidity (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Foreign Reserves & Money Supply

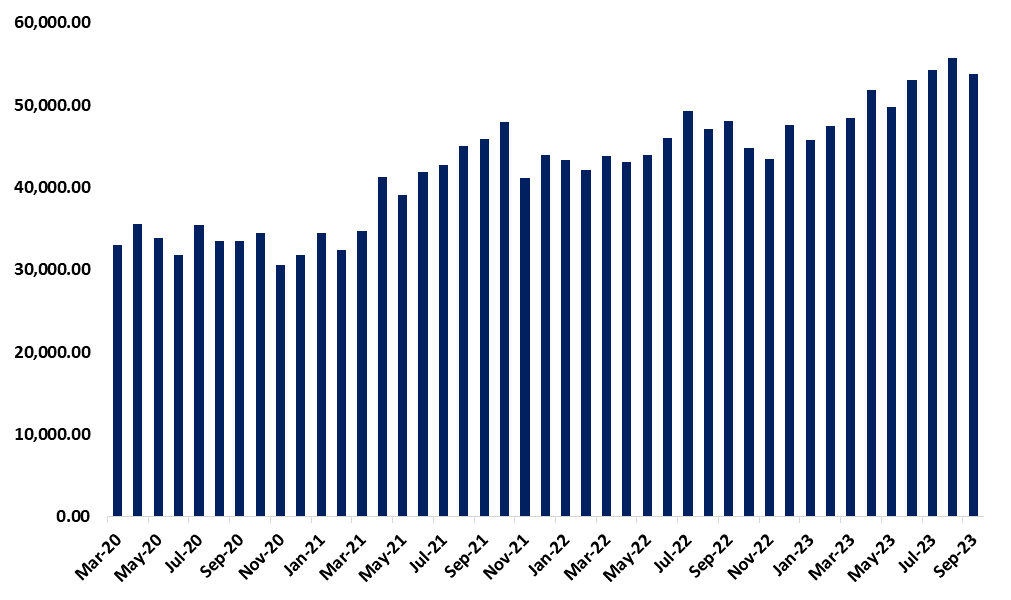

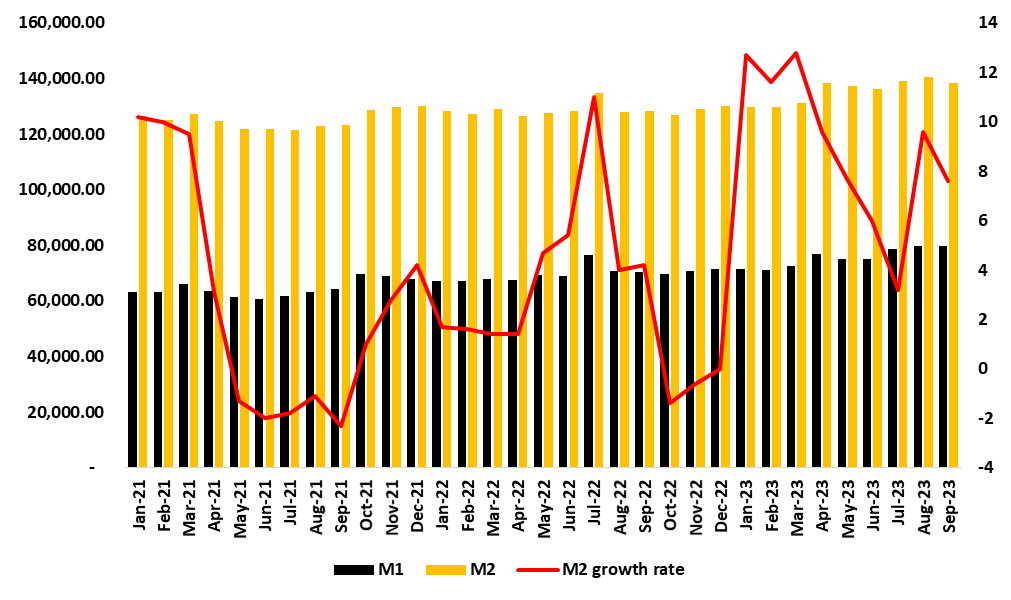

The Bank of Namibia saw a reduction in its stock of international reserves, which decreased from N$55.6 billion in August 2023 to N$53.8 billion in September 2023. This decline could be attributed to outflows from commercial banks and government payments, as illustrated in Figure 11. Due to these developments, the growth rate in broad money supply experienced a notable decrease, falling from 9.6% in August 2023 to 7.9% in September 2023, as shown in Figure 12.

Figure 11: Foreign Reserves (March 2020- September 2023)

Source: BON, NSA & HEI RESEARCH

Figure 12: Broad Money Supply Growth % (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Outlook

The prevalence of homeownership facilitated by mortgages among households, along with the adoption of Installment and Leasing credit options by both households and businesses, often serves as an indicator of economic confidence and individual financial stability. Within Namibia’s credit landscape, a subdued trend is distinct, evident in the restrained growth of various credit options such as overdrafts and other loans and advances available to households and businesses, coupled with constraints in liquidity.

Our analysis suggests that the trajectory of credit allocation to households and businesses is likely to face continued limitations in the near-to-intermediate future. Additionally, there is evidence of evolving preferences among households and businesses regarding the types of credit facilities they prefer, with a growing inclination towards installment and leasing options. It’s worth noting that, with the central bank keeping the interest rates unchanged, consumers might experience some relief, particularly as they adjust to the effects of previous interest rate hikes.