Analysis

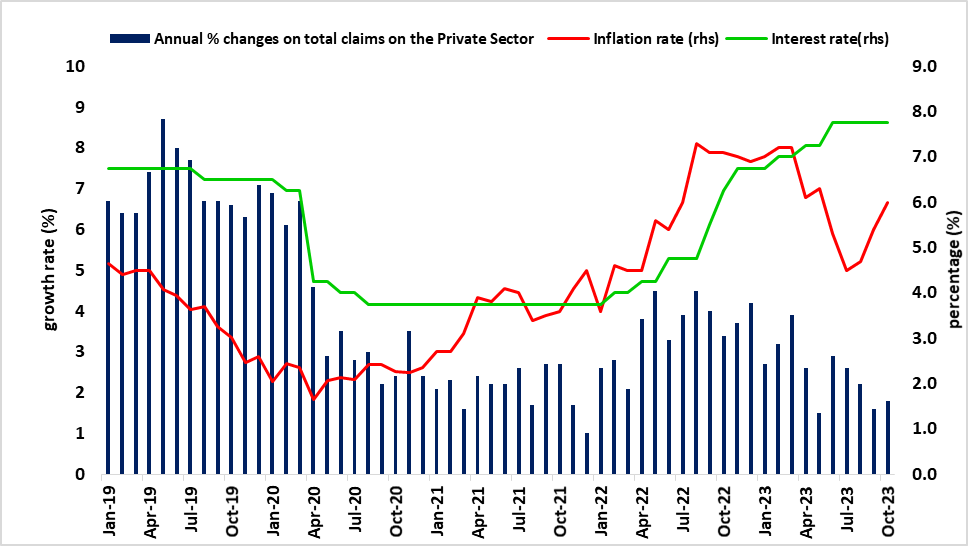

Total credit extended to the private sector (households and businesses) increased to N$ 119,320.3 million for October 2023 from N$118,943.7 million recorded in September 2023. This translated into a 0.3% monthly increase. The monthly increase was influenced by an increase in credit extended to households as a result of an increased demand for loans and loans and advances mainly the overdrafts. However, monthly declines were observed across almost all credit subcategories for the business category except for the other loans and advances installment and leasing credit, which exhibited a monthly increase of 1.0%. Figure 1

On an annual basis, the Private Sector Credit Extension (PSCE) recorded a growth rate of 1.8%, down from the 1.6% growth rate recorded at the end of September 2023. The slight increase in the growth of PSCE emanated from an increase in overdraft credit mainly by the household sector during the review period. In contrast, total credit extended to the business sector continued to decline during the period under review. Figure 2

Figure 1: Annual % PSCE vs. Repo Rate & Interest Rate, (January 2019- October 2023)

Source: BON, NSA & HEI RESEARCH

Credit to Households

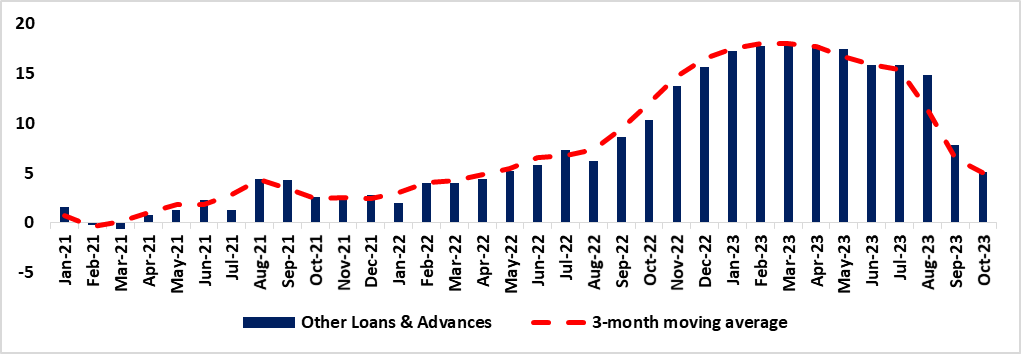

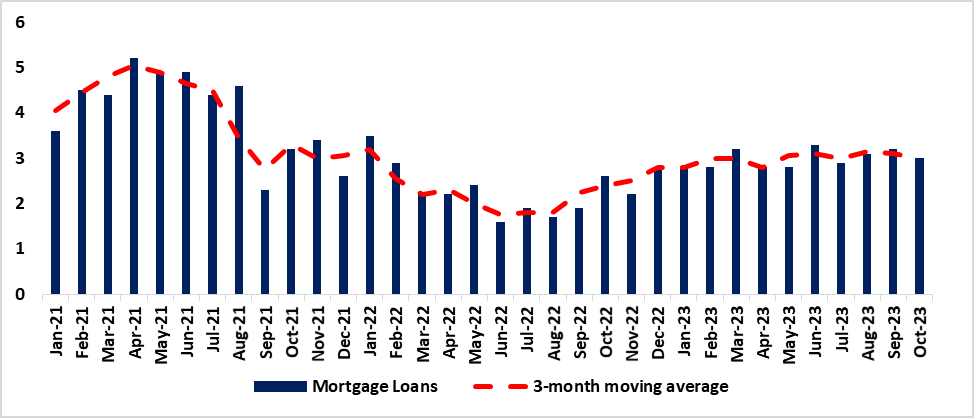

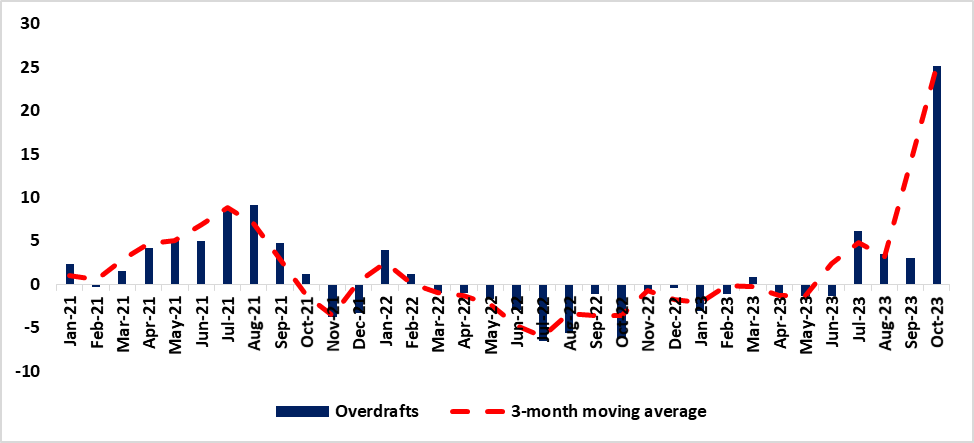

In October 2023, the credit extended to households reached N$ 66,427.1 million, indicating a growth compared to the N$ 65,967.9 million recorded in September 2023, reflecting a monthly increase of 0.7%. The upswing was predominantly propelled by a 1.0% expansion in the loans and advances category. The surge in this category was attributed to notable increases in sub-categories such as overdraft, which escalated from 3.0% to 25.1%, while other loans and advances experienced a decline from 7.8% to 5.1%. Concurrently, mortgage loans observed a decrease from 3.2% to 3.0% (refer to Figures 2, 3, and 4). Furthermore, the installment and leasing category witnessed a decline from 6.4% to 3.4% (Figure 5)

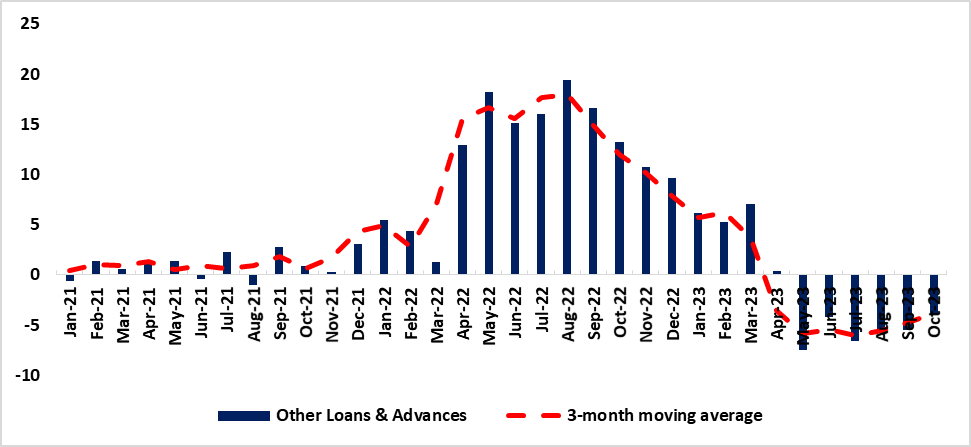

Figure 2: Other loans and advances, (January 2021- October 2023)

Source: BON & HEI RESEARCH

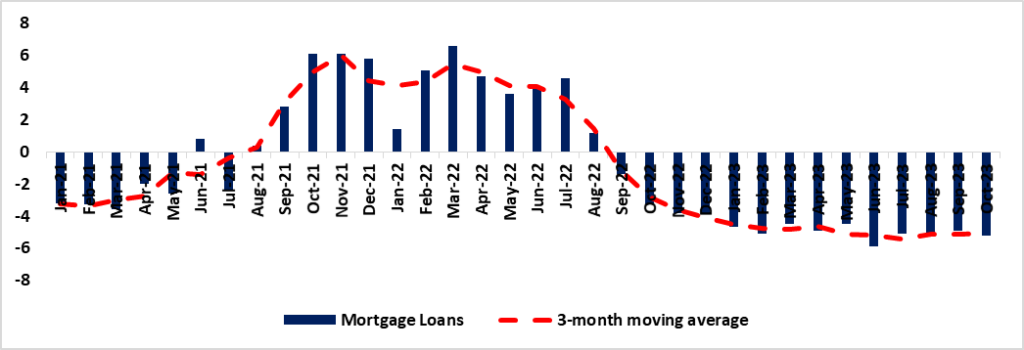

Figure 3: Mortgage, (January 2021- October 2023)

Source: BON & HEI RESEARCH

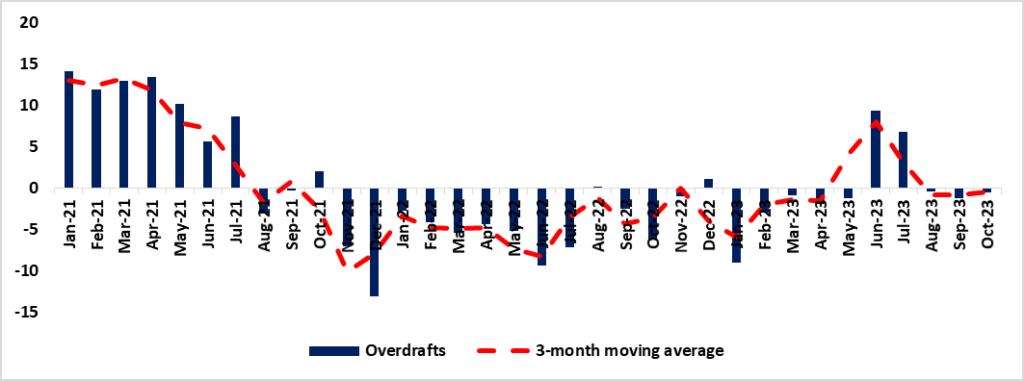

Figure 4: Overdrafts (January 2021- October 2023)

Source: BON & HEI RESEARCH

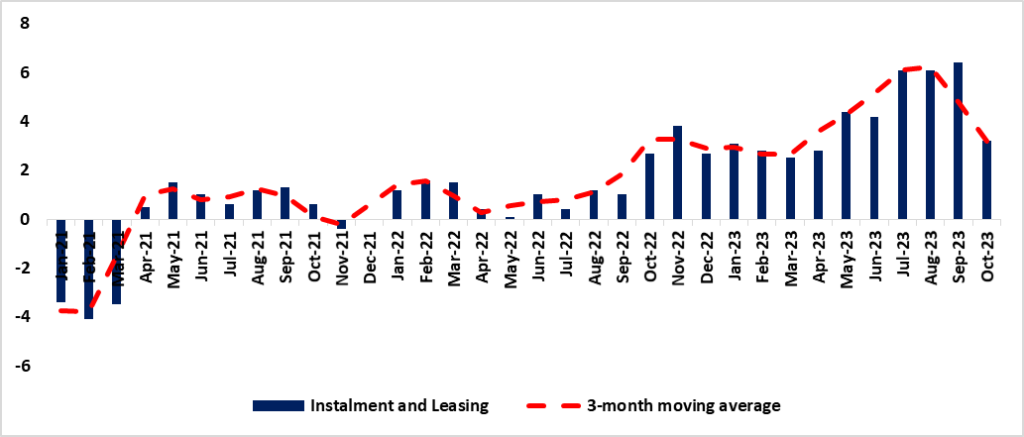

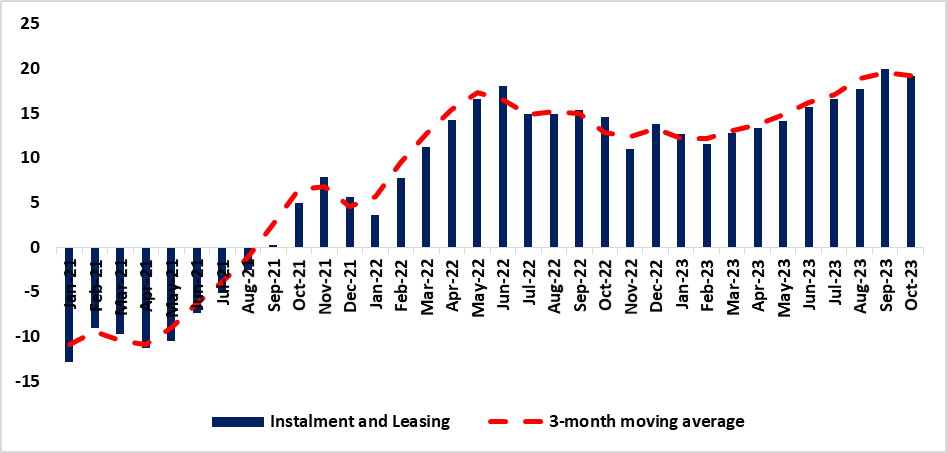

Figure 5: Instalments and Leasing, (January 2021- October 2023)

Source: BON & HEI RESEARCH

Credit to Businesses

During the month of October 2023, a 1.4% contraction in credit extended to businesses, representing a milder decline compared to the 2.1 percent recorded in September 2023. This marks the seventh consecutive month of negative growth in credit to businesses. In actual numbers total credit extended to businesses amounted to N$ 45,182.5 million, reflecting a slight decrease from the previous month’s figure of N$ 45,281.7 million. This reduction primarily stemmed from declines in both the loans and advances category (from 4.9% to 5.2% month-on-month) and the installment and leasing category (from 20.0% to 19.2% month-on-month), primarily influenced by reduced demand for credit in those categories, additionally corporate entities in the financial sector contributed to the negative growth through net repayments in mortgage and overdraft credit

Specifically, within the loans and advances category, there was a notable decrease of 1.7% in other loans and advances, while the sub-category of overdrafts experienced a modest increase of 0.8% month-on-month. (Refer to Figures 5, 6, 7& 8).

Figure 5: Overdrafts, (January 2021- October 2023)

Source: BON & HEI RESEARCH

Figure 6: Mortgage, (January 2021- October 2023)

Source: BON & HEI RESEARCH

Figure 7: Other loans and advances, (January 2021- October 2023)

Source: BON & HEI RESEARCH

Figure 8: Instalments and Leasing, (January 2021- October 2023)

Source: BON & HEI RESEARCH

Banking Liquidity position

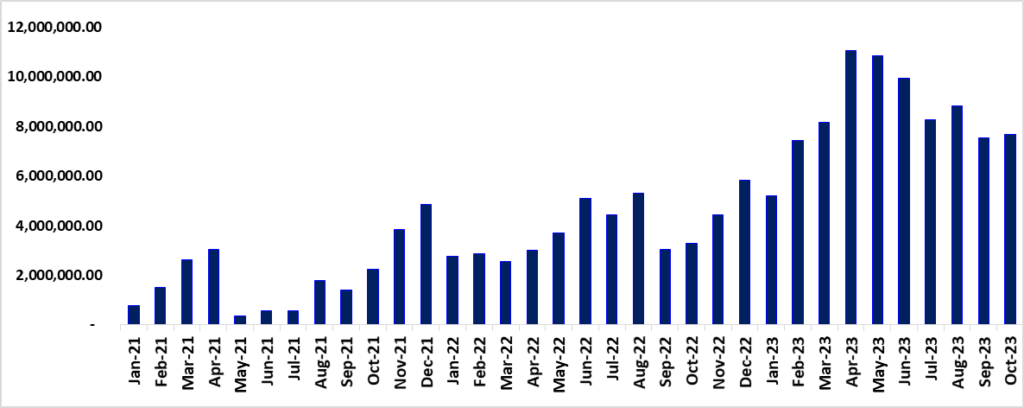

As of October 2023, there was a rise in the overall liquidity of the banking industry. Cash balances within the industry increased from N$7.4 billion in September 2023 to N$7.5 billion by the end of October 2023. This upward trend, reflecting a month-on-month growth of N$174.6 million, can be attributed to government bond payments during the specified period. Figure 9.

Figure 9: Banking Liquidity (January 2021- October 2023)

Source: BON & HEI RESEARCH

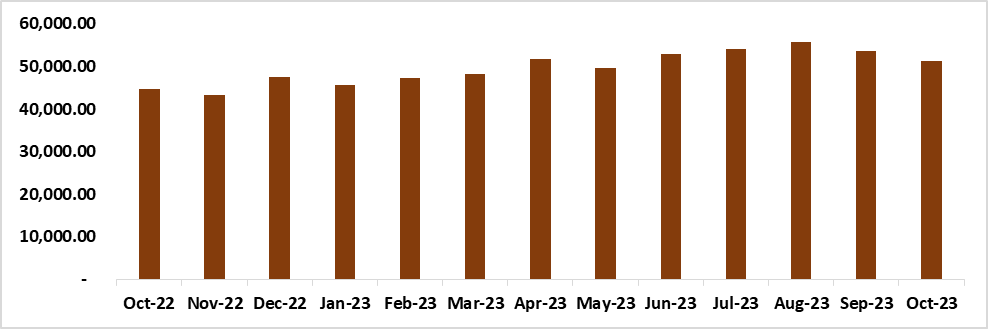

Foreign Reserves & Money Supply

The Bank of Namibia experienced a decrease in its international reserves, witnessing a decline from N$53.7 billion in September 2023 to N$51.3 billion in October 2023. This reduction is primarily linked to heightened outflows from commercial banks, driven by increased import expenses. However, on an annual basis, foreign reserves demonstrated a notable 20% increase, a positive trend attributed to enhanced foreign earnings from exports. Figure 10.

Figure 10: Foreign Reserves (October 2022- October 2023)

Source: BON & HEI RESEARCH

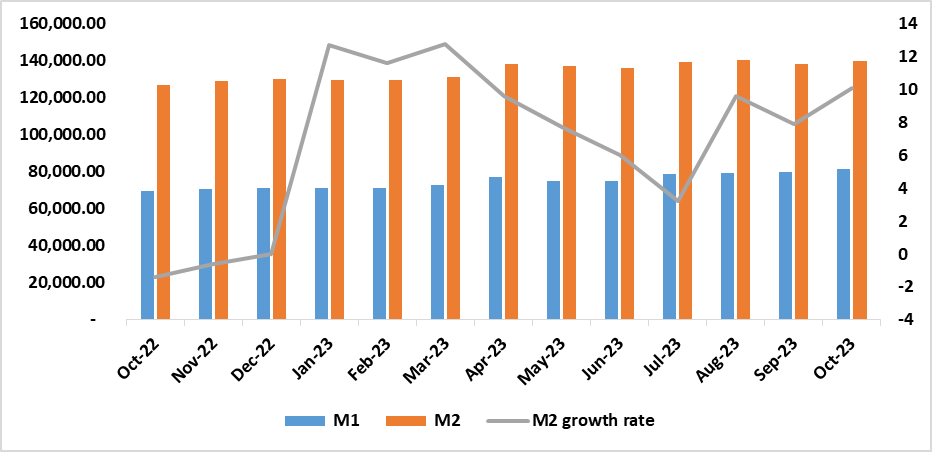

Figure 11: Broad Money Supply Growth % (October 2022- October 2023)

Source: BON, NSA & HEI RESEARCH

Outlook

Namibia experienced subdued growth in Private Sector Credit Extension (PSCE) during the month of October 2023. The annual growth rate persisted at modest levels, reflecting a trend where businesses remained focused and hesitant in taking more loans to reduce their debt burdens. This implies that corporations are showing a reluctance to borrow amid the existing economic conditions characterized by high interest rates and weakened consumer confidence.

Despite the prevailing economic challenges, credit extension to individuals has demonstrated notable resilience. Looking ahead to 2024, we anticipate a gradual and sustained upward trend in credit extension for individuals. This expectation is grounded in the forthcoming improvements in tax brackets in 2024, which are set to enhance credit scores and subsequently stimulate increased demand for credit. As these positive adjustments in tax policies take effect, we foresee a positive impact on individuals’ financial profiles, fostering a climate conducive to higher credit utilization. However, despite these favorable developments, our perspective maintains that the overall growth in Private Sector Credit Extension (PSCE) will persist in a subdued state, primarily influenced by the business category in the short term.