Analysis

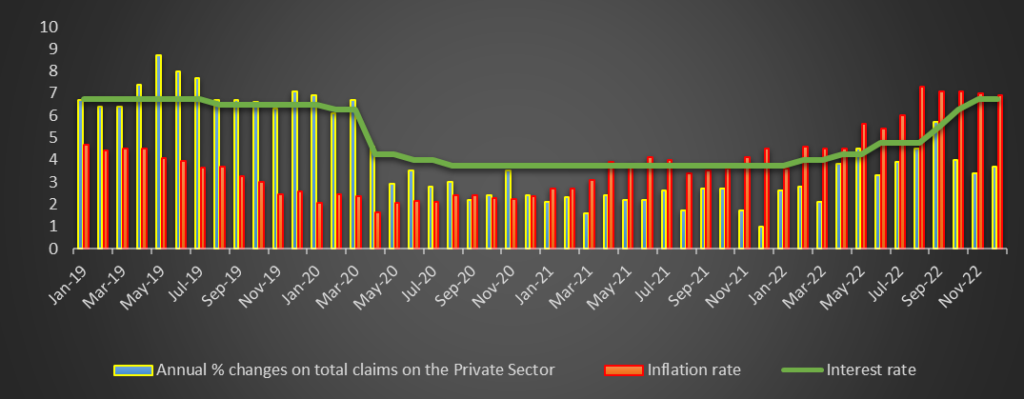

Credit extended to the private sector (individuals and businesses) increased to N$ 117,802 million from N$ 117,219 million recorded in October 2022. This translated into a slight monthly increase of 0.5%. The slight monthly increment was driven by the demand for overdrafts by businesses and other loans and advances by households. The demand for credit by businesses continues to be subdued due to the lower demand and repayments in other loans advances and overdrafts. (Figure 1)

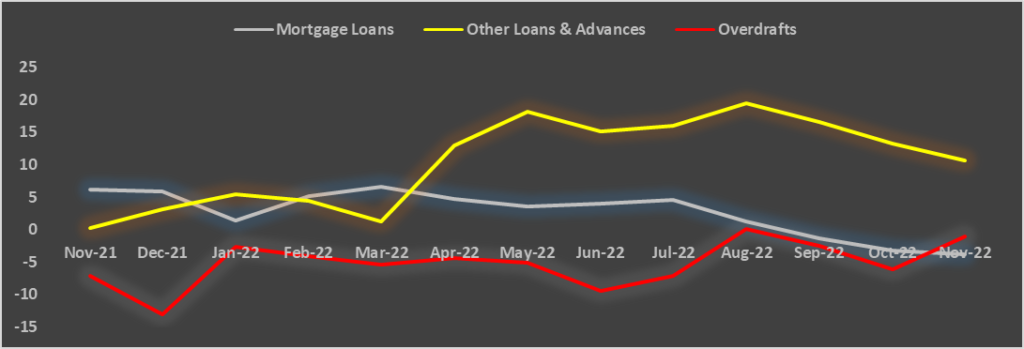

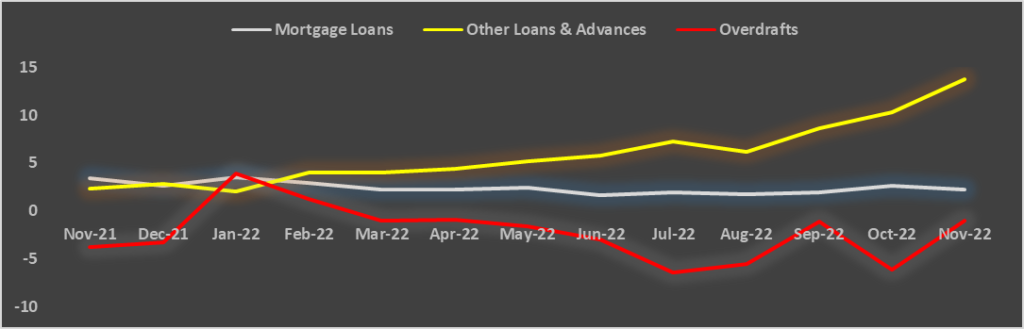

On an annual basis, total credit extended to the private sector increased by 3.7% in November up from 2.1% recorded in November 2021. The annual growth rate was mainly driven by growth recorded for other loans and advances for businesses and households by 10.7% and 13.8%, respectively. This is an indication that businesses and households turned to other loans and advances as a line of credit instead of their usual line of credit. The corporate sector remained anxious about piling more debt amid rising interest rates at the back of the uncertain economic environment. According to the Bank of Namibia, the low demand for credit by the business sector corporate sector compliments the growth in the household sector during the period under review. (Figures 2 & 3).

Figure 1: Annual % growth rates on Total Credit Extended to the Private Sector vs. Repo Rate & Interest Rate, (January 2029- November 2022)

Figure 2: Annual % changes for Credit Extended to Businesses per category, (November 2021-November 2022)

Figure 3: Annual % changes for Credit Extended to Individuals per category, (November 2021-November 2022)

Outlook

We expect slow growth in the Private Sector Credit Extension over the short to medium term. Households and businesses remain uncertain about the cost of borrowing and thus cautious in making credit decisions.