Analysis

Credit provision to individuals and businesses in the private sector declined by N$798,093 between May and April 2023. This equated to a monthly decline of 0.7%. In actual dollars, total credit provided to the private sector fell from N$119,110 million in April 2023 to N$118,312 million, due to low demand for other loans, and advances by the business category. (Figure 1). Nonetheless, the month under review recorded higher net repayments by corporations in the services and manufacturing sectors respectively. This implies that borrowers could either be reducing their overall debt levels or becoming more cautious about taking on new credit which could be a sign of increased financial discipline or a conservative approach to managing debt.

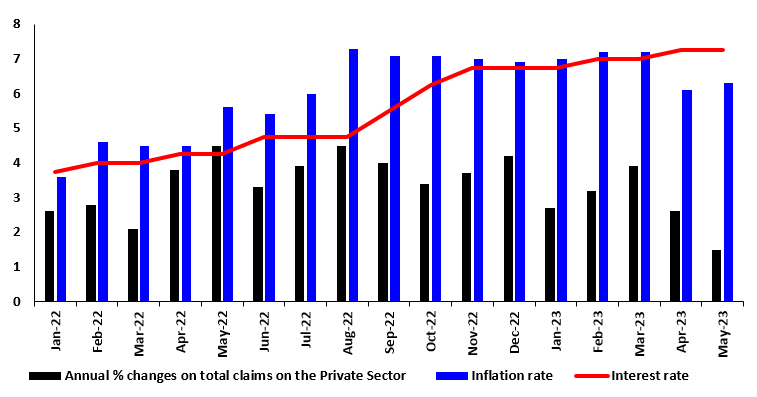

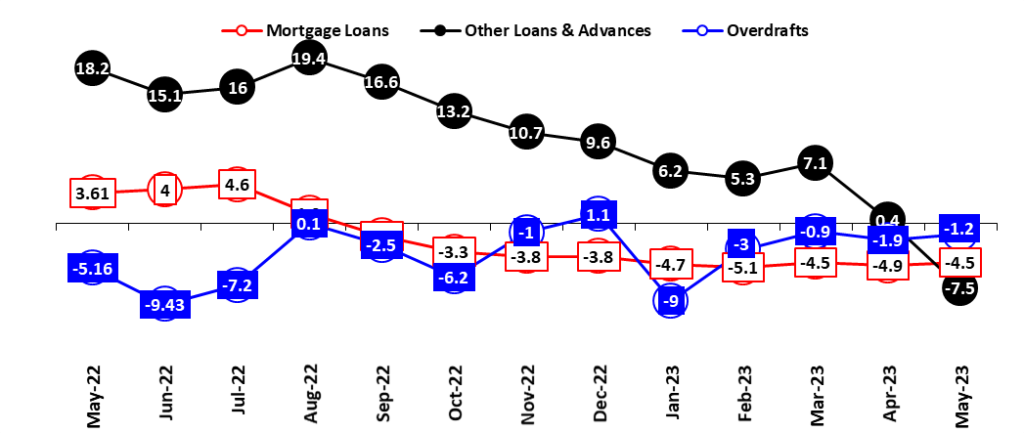

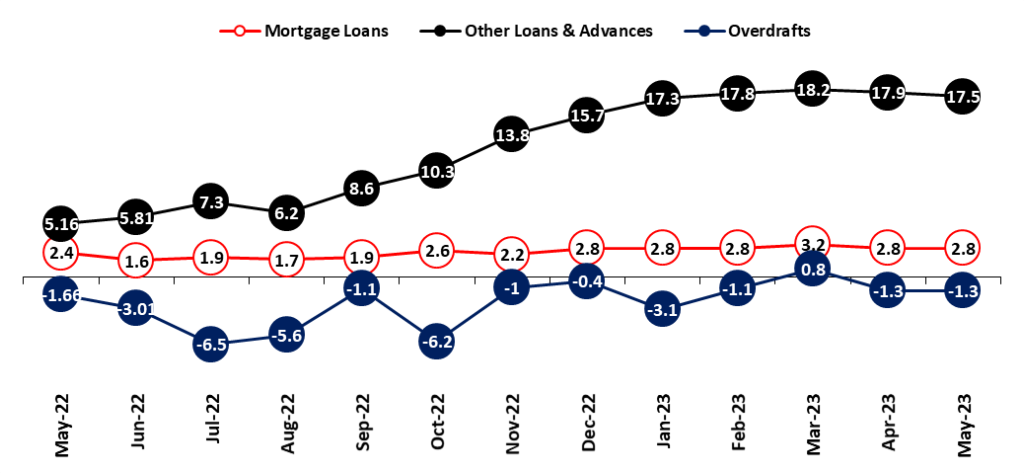

On an annual basis, the Private Sector Credit Extension (PSCE) recorded a decline of 1.5%, from a 4.5% growth rate recorded at the end of May 2022. The yearly subdued growth in the growth of Private Sector Credit Extension (PSCE) was driven by low credit demand by the business category, mainly by the sub-category of other loans and advances declining from 18.2% to -7.5% respectively. Additionally, mortgages and overdrafts by the business category also recorded significant declines during the period under review. Notwithstanding this, the category of other loans and advances for households improved significantly year-on-year recording a growth of 17.5% from 5.2% which was recorded in May 2022. (Figures 2& 3). Additionally, between May 2022 and May 2023, households borrowed a cumulative amount of approximately N$833,854 million, while businesses acquired credit amounting to around N$596,803 million. These continue to highlight the dominance of the demand for credit by households in Namibia’s private sector credit extension environment.

Figure 1: Annual % ∆ growth rates on Total Credit Extended to the Private Sector vs. Repo Rate & Interest Rate, (January 2022- May 2023)

Source: BON, NSA & HEI RESEARCH

Figure 2: The % ∆ in Credit Extended to Businesses per category Year on Year,(May 2022-May 2023)

Source: BON & HEI RESEARCH

Figure 3: The % ∆ of Credit Extended to Individuals per category Year on Year, (May 2022-May 2023)

Source: BON & HEI RESEARCH

Outlook

Looking at the current economic climate, with a tightening monetary policy stance and persistent inflation rates, we believe that businesses will remain hesitant in taking up credit this could be due to the availability of other financing facilities, while household credit demand could continue on a moderate upward trend due to a constraint funding environment. We anticipate modest growth in the Private Sector Credit Extension (PSCE) in the short to medium term.