Analysis

Credit provision to individuals and businesses in the private sector increased by N$875,000 between May and June 2023. This equated to a monthly growth of 1.4%. In actual dollars, total credit provided to the private sector grew from N$118,312 million in May 2023 to N$119,187 million in June 2023, due to high growth in mortgage loans and installment credit as well as personal loans and credit cards which sustained the momentum by the household category. (Figure 1). Additionally, the month under review recorded higher demand for overdraft loans spanning from the high demand from corporations in the services and manufacturing sectors.

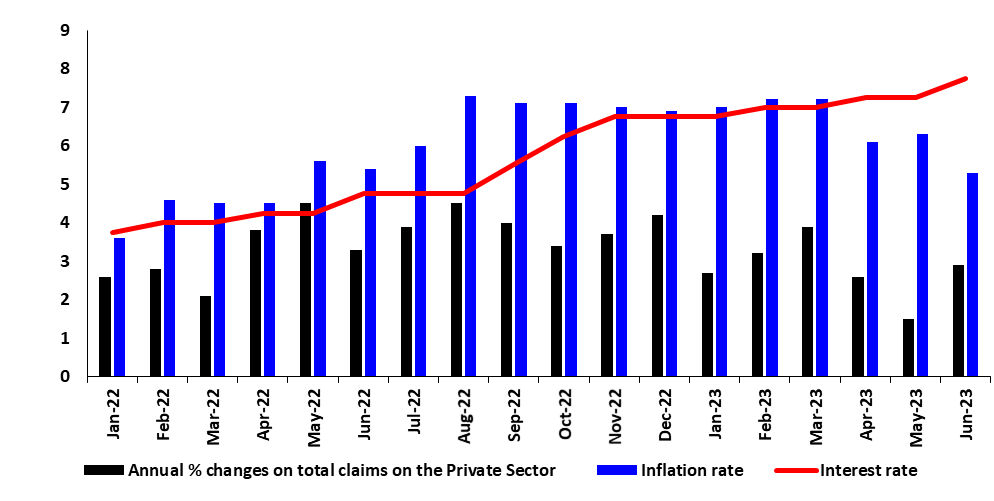

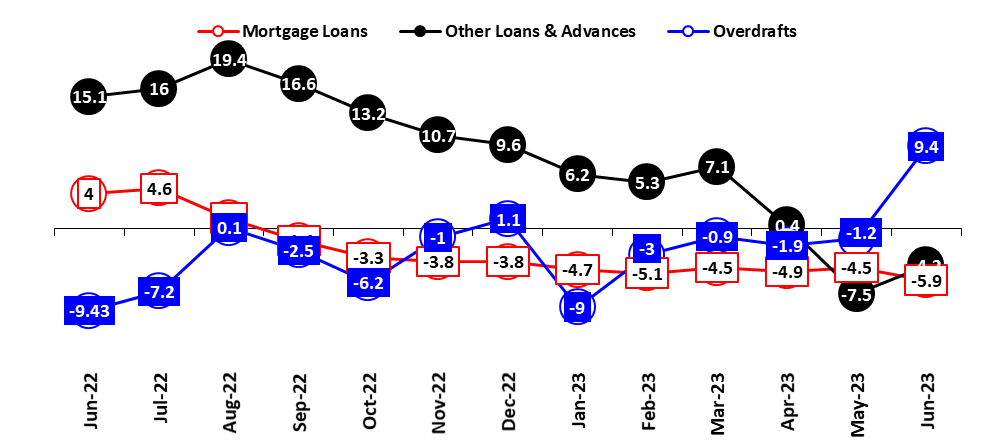

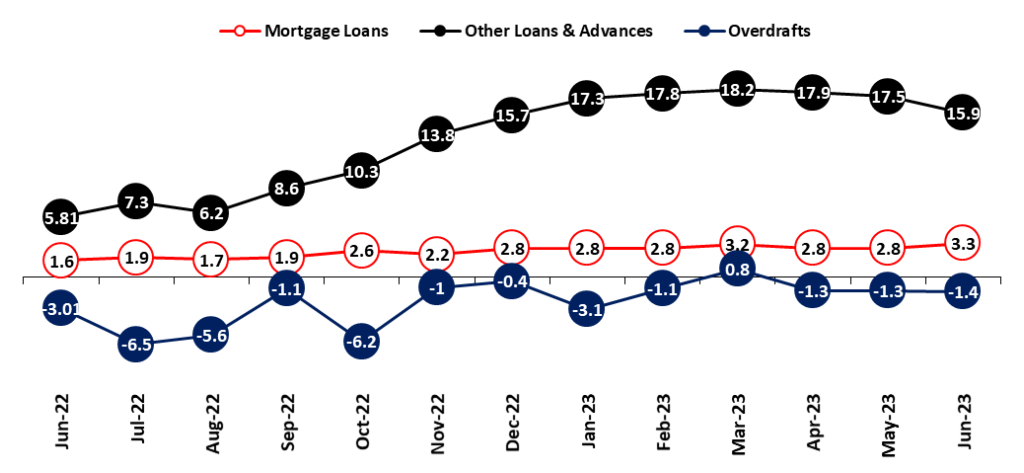

On an annual basis, total credit extended to the private sector increased by 2.9%, for June 2023. The yearly growth for the Private Sector Credit Extension (PSCE) was driven by an increase in credit demand by the business category, mainly by the sub-category of overdrafts increasing from a decline of 9.43% to 9.4% respectively. Furthermore, mortgages and overdrafts by the business category recorded significant declines during the period under review. Notwithstanding this, the category of other loans and advances for households improved significantly year-on-year recording a growth of 15.9% from 5.18% which was recorded in June 2022. (Figures 2& 3). Additionally, between June 2022 and June 2023, households borrowed a cumulative amount of approximately N$837,068 million, while businesses acquired credit amounting to around N$596,092 million. These continue to highlight the dominance of the demand for credit by households in Namibia’s private sector credit extension environment.

Figure 1: Annual % ∆ growth rates on Total Credit Extended to the Private Sector vs. Repo Rate & Interest Rate, (January 2022- June 2023)

Source: BON, NSA & HEI RESEARCH

Figure 2: The % ∆ in Credit Extended to Businesses per category Year on Year

(June 2022- June 2023)

Source: BON & HEI RESEARCH

Figure 3: The % ∆ of Credit Extended to Individuals per category Year on Year,

(June 2022-June 2023)

Source: BON & HEI RESEARCH

Outlook

We anticipate a recovery in credit extension to businesses and households in the short to medium term, primarily driven by the easing of inflation, which is likely to result in a pause in the upward adjustment of interest rates.