Analysis

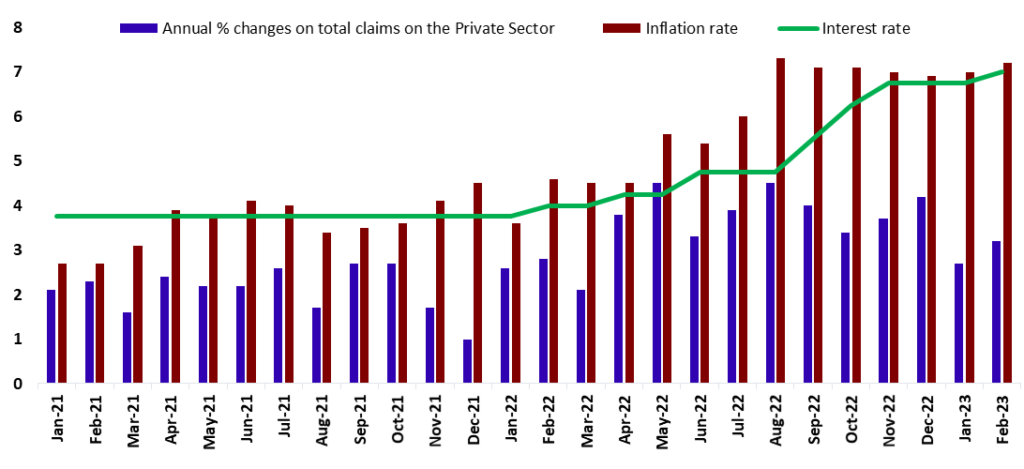

Credit provision to individuals and businesses in the private sector increased by N$ 693, 000 between February 2023 and January 2023. This translated into a monthly increment of 0.59 percent. In actual figures total credit extended to the private sector increased to N$ 118.878 million for February 2023 compared to N$ 118.186 million that was recorded in January 2023. The monthly slight increase was mainly driven by overdrafts and the installment and leasing for the business category. (figure 1).

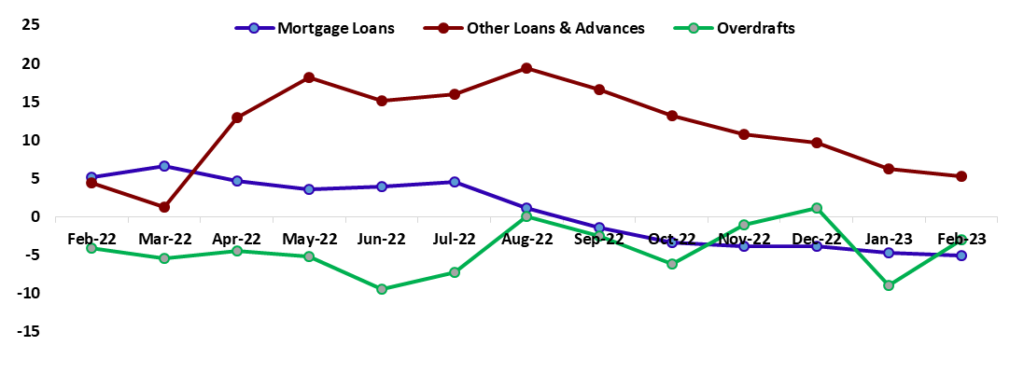

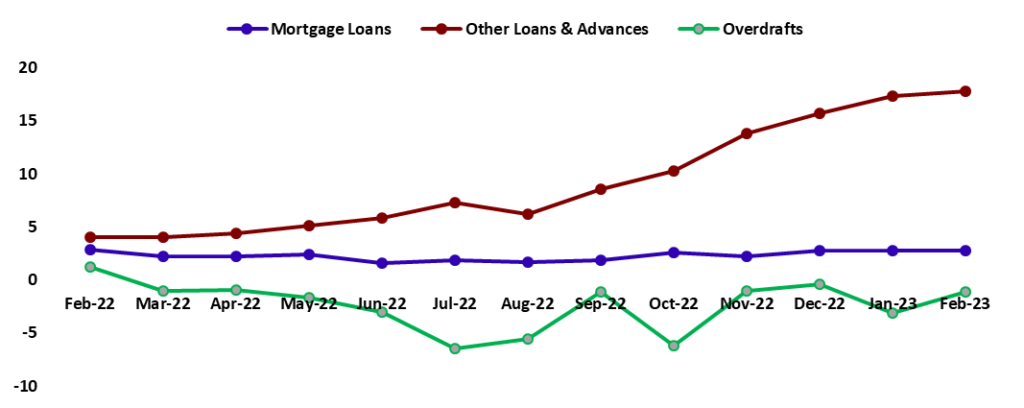

On an annual basis, the Private Sector Credit Extension (PSCE) recorded a growth of 3.2% an increase from 2.7% recorded at the end of February 2022. This was mainly driven by an increase in other loans and advances for both the business and household categories and overdrafts by the households. (figures 2 and 3). During the period under review, households borrowed a cumulative amount of about N$ 823,707.77 and businesses took credit worth about N$ 597,180.20 between February 2022 and February 2023. This reflects that household credit dominates Namibia’s private sector credit extension.

Figure 1: Annual % ∆ growth rates on Total Credit Extended to the Private Sector vs. Repo Rate & Interest Rate, (January 2021- January 2023)

Source: BON, NSA & HEI RESEARCH

Figure 2: The % ∆ in Credit Extended to Businesses per category Year on Year (February 2022-February 2023)

Source: BON & HEI RESEARCH

Figure 3: The % ∆ in Credit Extended to Individuals per category Year on Year (February 2022-February 2023)

Source: BON & HEI RESEARCH

Outlook

Despite a recovery in domestic economic growth, credit demand is still on a slow recovery path. Inflationary pressures, coupled with rising interest rates continue to put households in an unfavorable position. With the continuous monetary policy heightening cycle. The recent increase in the prime lending rate has a direct implication on the households’ debt-servicing cost and the performance of the entire private sector extension. This puts additional strain on already vulnerable households, as such their ability to service both interest and capital repayments has weakened, which is substantiated by the growth in household debt in Namibia. However, there are some encouraging signs for the credit demand horizon, particularly for businesses in the diamond mining industry, as well as those involved in oil discoveries and green hydrogen projects. We anticipate moderate growth in credit extension to the private sector over the short to medium term.