Analysis

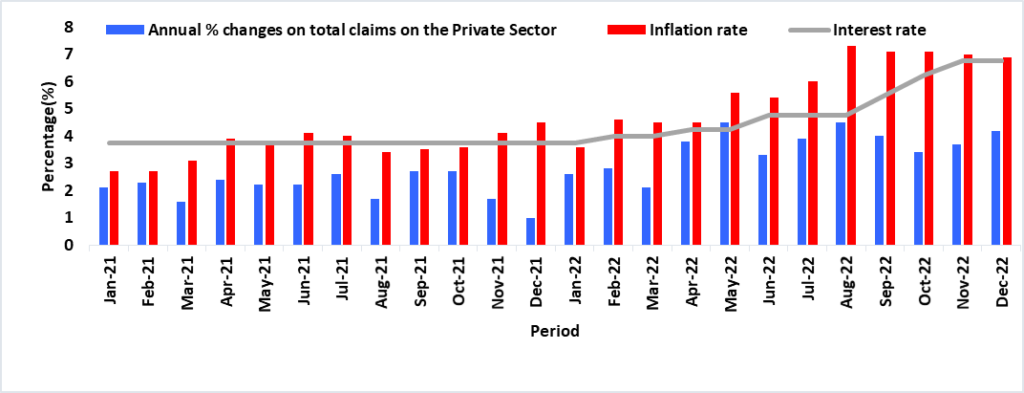

Credit provided to individuals and businesses in the private sector saw a slight monthly increase of 0.3 percent in December 2022, with credit extended rising by N$ 377 million to N$ 118.179 million from the previous month’s figure of N$ 117,802 million. The growth was driven by the demand for installment and leasing options by businesses, as well as other loans and advances by households. However, the demand for credit by businesses remained subdued due to reduced demand and repayments in other loan advances and overdrafts. (See Figure 1)

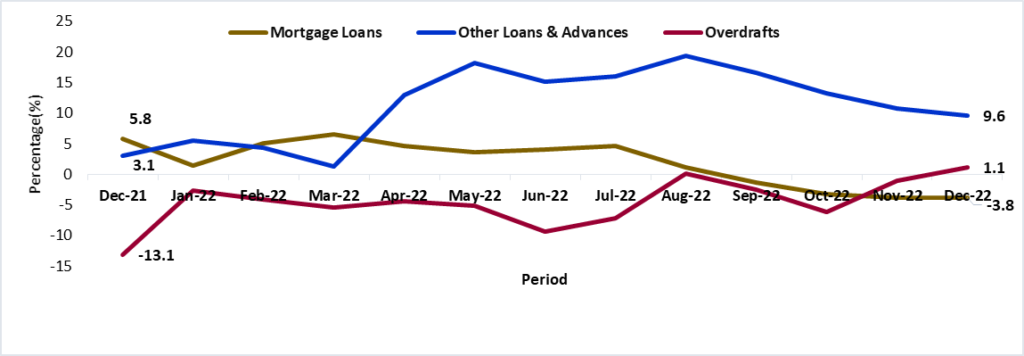

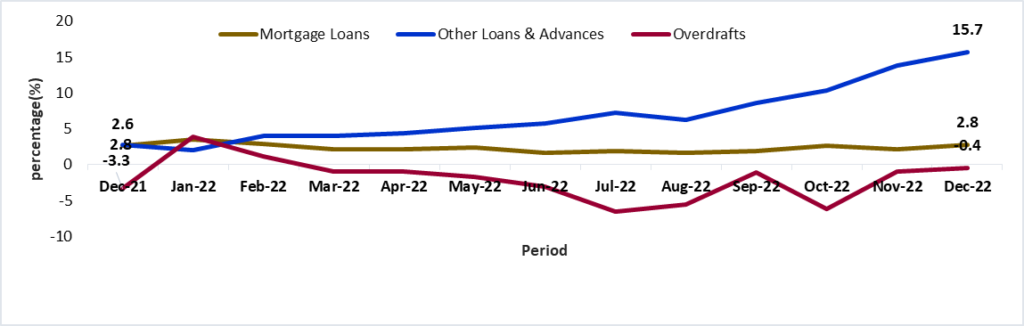

At the end of December 2022, the total credit extended to the private sector showed an annual increase of 4.2 percent, up from 3.7 percent at the end of November 2022. This growth was mainly driven by the significant increase in installment and leasing options for businesses, which saw a growth rate of 13.8 percent, and other loans and advances for households, which recorded a growth rate of 13.15.7 percent. The Bank of Namibia noted that the demand for credit among businesses was due to the tourism sector’s need to increase their fleets, while in households, it was due to the rising cost of living. (See Figures 2 and 3)

Figure 1: Annual % ∆ growth rates on Total Credit Extended to the Private Sector vs. Repo Rate & Interest Rate, (January 2021- December 2022)

Figure 2: The % ∆ in Credit Extended to Businesses per category Year on Year (December 2021-December 2022)

Figure 3: The % ∆ in Credit Extended to Individuals per category Year on Year, (December 2021-December 2022)

Outlook

Our expectation is that the credit extended to the private sector will continue on an upward trend over the short to medium term at the back of an expected boost in the mining and quarrying sector for 2023. This could lead to an increase in demand for credit by businesses in the mining sector. Households remain under pressure as the cost of borrowing continues to rise.