Analysis

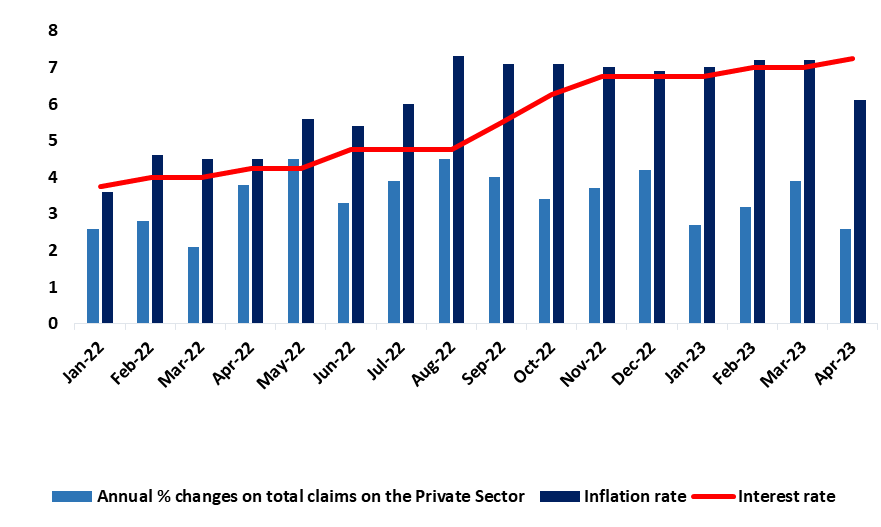

Credit provision to individuals and businesses in the private sector increased by N$ 323, 000 between April 2023 and March 2023. This translated into a monthly increment of 0.27 percent. In actual figures total credit extended to the private sector increased to N$ 119,104 million for April 2023 compared to N$ 118.781 million that was recorded in March 2023. The monthly slight increase was mainly driven by overdrafts and the installment and leasing for the business category. (figure 1).

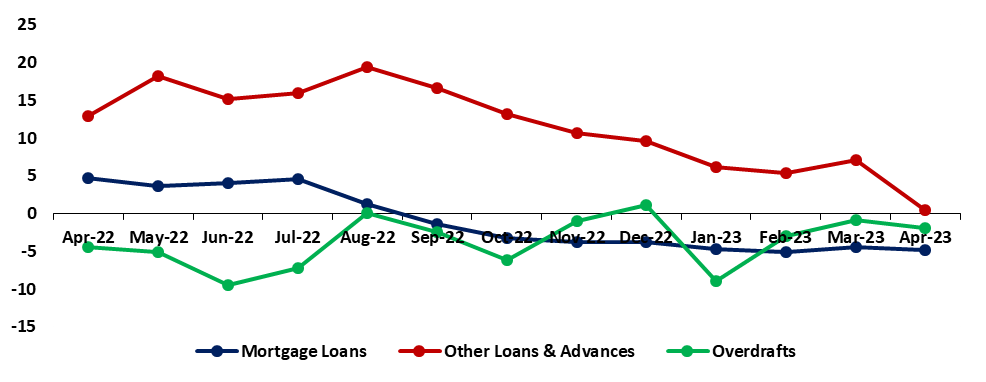

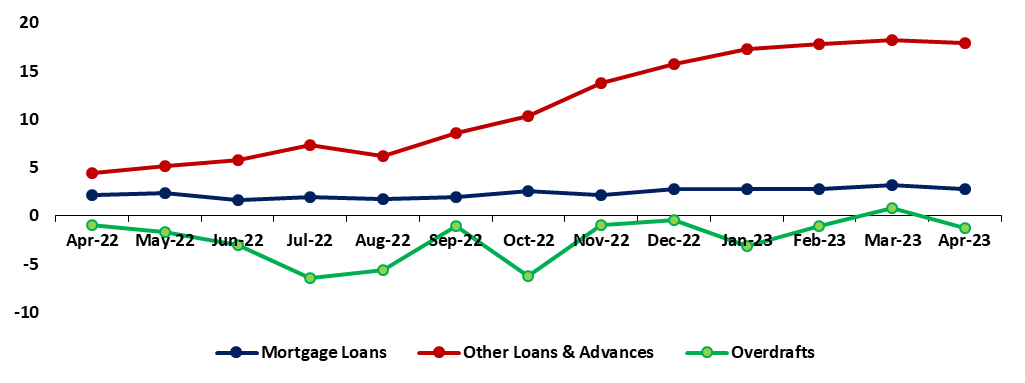

On an annual basis, the Private Sector Credit Extension (PSCE) recorded a decline of 2.6%, a decline from the 3.8% recorded at the end of April 2022. The decline in PSCE growth is explained by a decrease in demand by both the household and corporate sectors coupled with higher net repayments resulting in the decline in other loans and advances for both the business and household categories and overdrafts by the households. (figures 2 and 3). Between April 2022 and April 2023, households borrowed a cumulative amount of about N$830,424 million and businesses took credit worth about N$ 598,256 million. This reflects that household credit continues to dominate Namibia’s private sector credit extension.

Figure 1: Annual % ∆ growth rates on Total Credit Extended to the Private Sector vs. Repo Rate & Interest Rate, (January 2022- April 2023)

Source: BON, NSA & HEI RESEARCH

Figure 2: The % ∆ in Credit Extended to Businesses per category Year on Year (April 2022-April 2023)

Source: BON & HEI RESEARCH

Figure 3: The % ∆ in Credit Extended to Individuals per category Year on Year, (April 2022-April 2023)

Source: BON & HEI RESEARCH

Outlook During the period under review, households credit uptake especially for the category of other loans and advances continued to outpace corporate credit uptake. This implies that corporates are more hesitant to borrow in the current economic climate, in which the overall economic conditions, inflation rates, and the availability of alternative financing options, and interest rates are unfavorable for stimulating the demand for credit for businesses. We anticipate modest growth in the Private Sector Credit Extension (PSCE) in the short to medium term.