Background

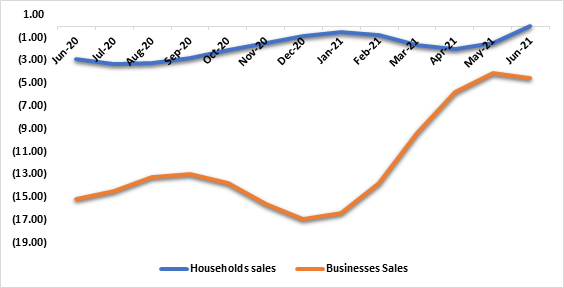

Namibia’s total outstanding private sector credit currently stands at N$105,3 billion. Total credit extended to the businesses sector stands at N$ 43,455.0 million and total credit extended to the households sector stands at N$ 61,279.7 million(June 2021). The current largest uptake for credit in the country is households for mortgage loans (See figure 2 below). Additionally, instalment and leasing credit for both households and businesses sector remain under pressure due to the general sluggish growth in the wholesale and retail trade sector and the overall domestic economy (See figure 3). Overall, the Private Sector Credit Extension (PSCE) remains at historically low levels due to the persistent sluggish domestic economic activity, reinforced by the Covid-19 pandemic.

Analysis

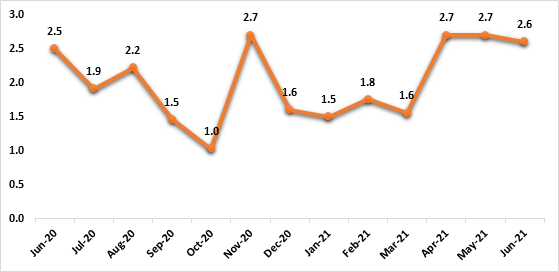

The annual credit extended to Namibia’s private sector increased to 2.6% for June 2021 from 2.5% recorded for June 2020 (See figure 1 below). On a monthly basis credit extended to the private sector between May and June 2021 recorded a growth of 0.3%, that came from for mortgage loans. Despite the small uptick for mortgage loans for June 2021, overall credit remains subdued due to low levels of economic activity, which translate into low earnings for individuals and businesses. The slow growth of credit is observed in all credit categories largely due to slower economic activity coupled with income uncertainties as a consequence of the impact of the Covid-19 pandemic. Meanwhile, instalment and leasing credit for businesses declined by 7.4% and for the households grew by 1.0% between June 2020 and June 2021.

Figure 1 : Annual % changes for the Private Sector Credit Extension

Figure 2: Annual % changes for the Private Sector Credit Extension

Figure 3: Households and Businesses Instalment sales Index YoY%

Outlook

There are no green shots on the horizon as the domestic economic activity remains subdued and there are no catalysts for economic growth at present. Households and businesses remain uncertain about future income and thus there is no confidence to take up credit, as a result we do not expect to see a recovery in credit extension in the short to medium term.