Executive summary

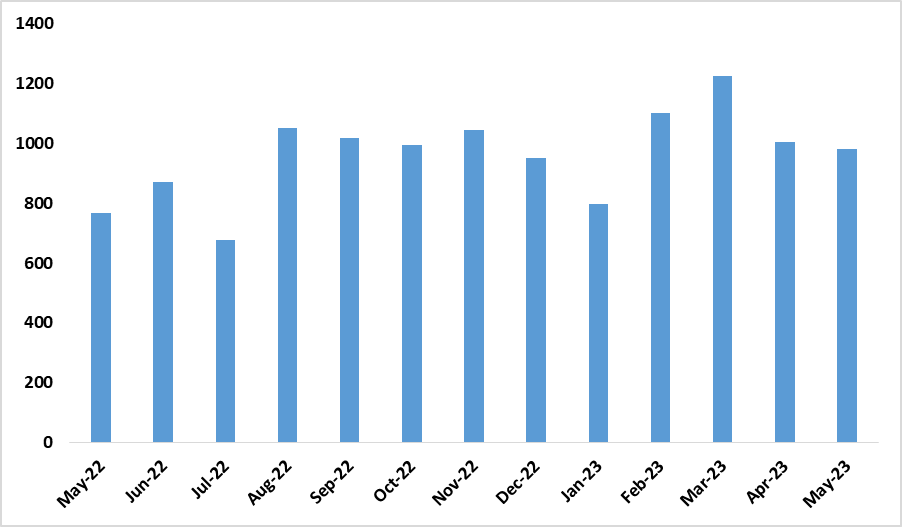

- New vehicle sales declined to 982 vehicles for May 2023, down from 1004 vehicles sold in April 2023. This represented a monthly decline of 2%. (figure 1)

- Sales of passenger, medium commercial, and heavy vehicles increased by 7.9%, 29.4%, and 16.7%, month on month respectively.

- Light commercial vehicle and bus vehicle sales decreased by 13.5% and -100%, respectively, in May 2023 compared to April 2023

- Out of 5113 vehicles sold for 2023, 2070 were passenger vehicles, 1833 were Light commercial vehicles, 123 were extra heavy vehicles, 77 were medium commercial vehicles, 21 were heavy commercial vehicles and 7 were buses.

Analysis

- The monthly decline in vehicle sales between May and April 2023 was mainly driven by the low sales of light commercial vehicle sales. This could be ascribed to low credit demand as a consequence of an increase in the interest rates in April, additionally, low sales of commercial vehicles could be attributed to subdued commercial activities hence a low demand for commercial transportation services

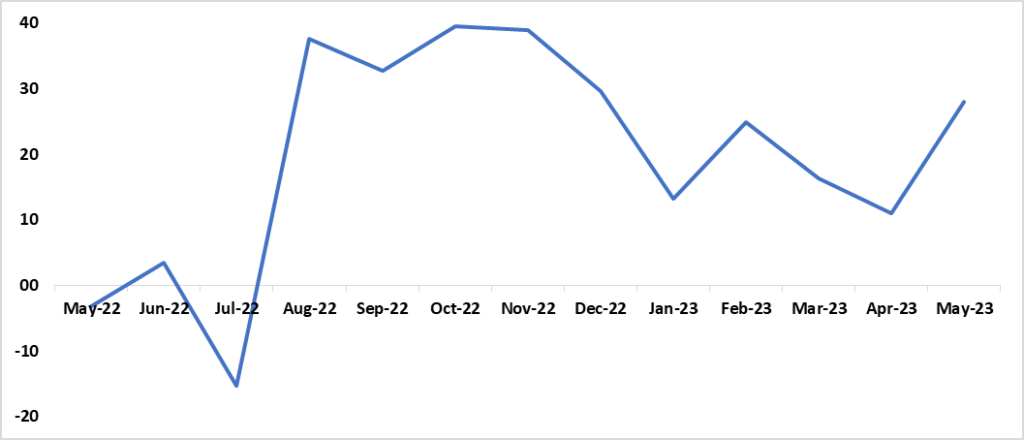

- On an annual basis, new vehicle sales in the first 5 months of the year increased by 18.5%. This implies an improvement in consumer confidence

- Passenger vehicle sales increased from 468 vehicles sold in April 2023 to 505 in May 2023. This could be attributed to the no increase in interest rates for the month of May.

- Light commercial vehicle sales declined to 409 for May 2023 from 473 which was recorded in April 2023. This could have been influenced by subdued commercial sector performance

- Heavy commercial vehicle sales decreased by one vehicle between May and April 2023

Table 1: Monthly vehicle sales by type

| Market | Apr-23 | May-23 | Monthly unit change | Monthly % change |

| Passenger vehicles | 468 | 505 | 37 | 7.9 |

| Light commercial vehicles | 473 | 409 | -64 | -13.5 |

| Medium commercial vehicles sales | 17 | 22 | 5 | 29.4 |

| Heavy commercial vehicle sales | 6 | 7 | 1 | 16.7 |

| Extra heavy commercial vehicle sales | 39 | 39 | 0 | 0% |

| Bus | 1 | 0 | -1 | -100 |

Figure 1: Monthly Vehicle Sales (May 2022 – May 2023)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: Year on Year, Vehicle Sales Growth (May 2022- May 2023)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Outlook

The high-interest rates and inflation have to the erosion of purchasing power for businesses and households, however, the demand for new vehicles has been resilient. The magnitude of interest rate hikes, the level of inflation, and the state of the economy will all have an impact on new vehicle sales in the short to medium term.