Executive summary

Namibia’s economic performance in the second quarter of 2023 exhibited a mixed picture, with notable declines in construction, agriculture, and the public administration sector. However, the mining and electricity sectors contributed positively to overall growth, although at a slower pace compared to the previous year’s performance. South Africa’s economic landscape in the second quarter of 2023 displayed signs of recovery, with notable growth in key sectors such as agriculture, manufacturing, mining, finance, and personal services. However, certain sectors, including transport, electricity, and trade, faced challenges resulting in declines, albeit with varying impacts on overall GDP growth.

Analysis

Namibia

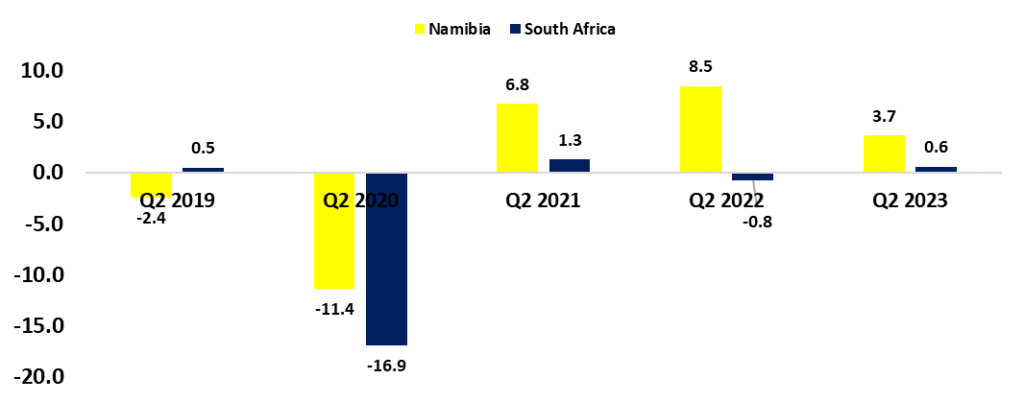

During the second quarter of 2023, the Namibian economy recorded a growth rate of 3.7%, which, while positive, marked a deceleration compared to the robust 8.5% growth recorded in the corresponding quarter of 2022 (Figure 1). This quarter-on-quarter decline in economic performance was primarily driven by contractions in the following sectors.

- Construction Activities: The ‘Construction’ sector experienced a substantial decline, with real value-added contracting by 35.9%. This poor performance was particularly evident in government expenditure on construction, which saw a significant decline of 54.5%. The decrease in government investment in construction projects, especially those related to engineering works, contributed to the poor performance of the sector.

- Agriculture and Forestry: The ‘Agriculture and Forestry’ sector posted a decline of 31.9%. The significant downturn in this sector was largely attributed to a contraction of 55.0% in the crop farming subsector. This decline was a consequence of a drought experienced during the period under review.

- Financial Services: The ‘Financial Services’ activities sector experienced a decline of 2.6% in real value-added, in contrast to a growth of 11.4 % witnessed during the same period in 2022. The poor performance emanates from the banking subsector which registered a decline of 5.2% in real value added compared to 6.5% growth recorded in the same quarter of 2022. This was attributed to a deceleration in total deposits from all sectors of the economy (household, government, and private sector)

- Public Administration and Defense: The ‘Public Administration and Defense’ sectors decelerated, posting growth rates of 2.2%. This deceleration was driven by a reduction in compensation for employees due to a decrease in the number of employees, notably in the health sector.

On a more positive note, certain sectors recorded growth:

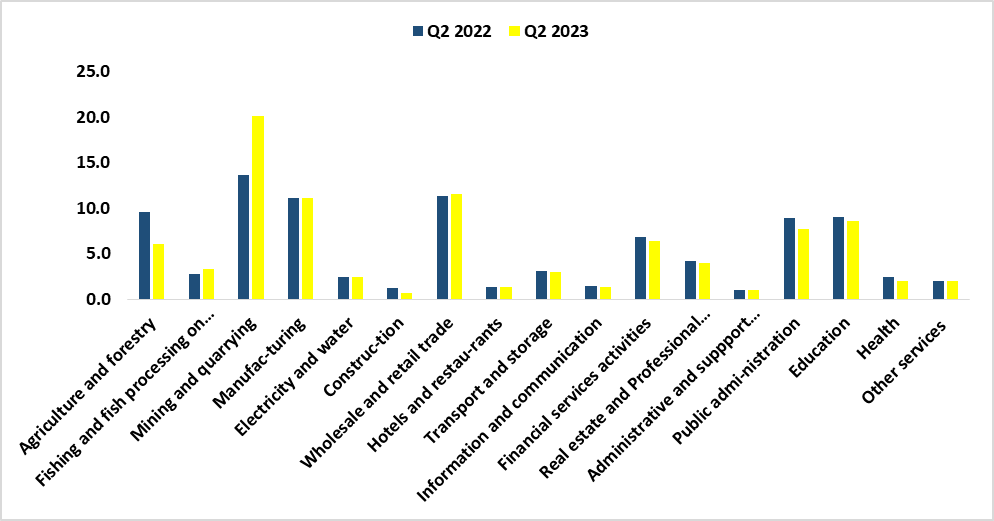

- Mining and Quarrying: The ‘Mining and Quarrying’ sectors exhibited significant growth of 32.0%, although it represented a decline from the impressive 64.4% growth recorded in the corresponding quarter of 2022. This performance was influenced by the subsector of diamond mining, which saw a reduced growth rate of 9.4%. This slowdown can be attributed to a high base effect compared to the same quarter in 2022.

- Electricity and Water: The ‘Electricity and Water’ sectors posted growth rates of 14.4%. This growth was primarily attributed to the electricity sub-sector, which saw a 15% increase in value-added. This increase was driven by higher quantities of electricity sold and increased domestic power production (Figure 2).

South Africa

During the second quarter of 2023, South Africa’s real GDP exhibited a positive growth of 0.6%, marking a notable improvement compared to the previous year’s corresponding quarter, which had seen a decline of 0.8% (Figure 1). This resurgence in economic activity was attributed to the following sectors that demonstrated substantial growth:

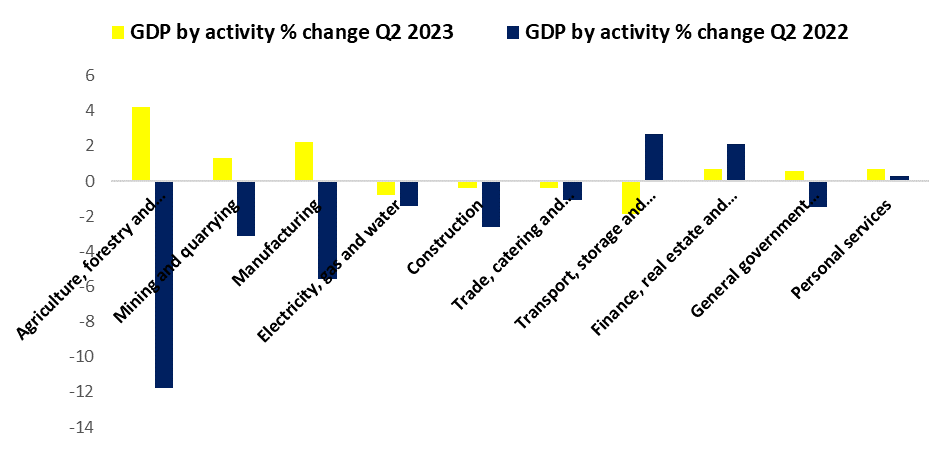

- Agriculture: The agriculture sector experienced robust growth of 4.2%, rebounding from a significant 11.8% decline observed in the same quarter of 2022. This sector’s resurgence contributed 0.1 % to overall GDP growth and was primarily driven by increased economic activities in field crops and horticulture products.

- Manufacturing: The manufacturing sector exhibited a notable 2.2% growth, which marked a significant turnaround from the 5.6% decline recorded in the second quarter of 2022. This sector contributed 0.3 % to the overall GDP growth, with the petroleum, chemical products, rubber, and plastic products division making the most substantial contribution.

- Mining and Quarrying: The mining and quarrying sector also registered growth, with a 1.3% increase compared to a 3.1% decline in the same period of 2022. This growth was attributed to increased economic activities related to platinum group metals (PGMs), gold, other metallic minerals, and coal.

- Finance: The finance industry recorded a 0.7% increase, contributing 0.2 % to GDP growth. This growth was underpinned by increased economic activities in financial intermediation, insurance, and real estate.

- Personal Services: The personal services sector grew by 0.7%, primarily due to improved economic activities in the education and health sector. This sector contributed 0.1 % to overall GDP growth.

However, the following sectors experienced declines during the period under review:

- Transport, Storage, and Communication: The sector recorded a decline of 1.9%, negatively impacting GDP growth by -0.2 %. The decline was primarily a result of poor performance in land transport and transport support services sub-sectors.

- Electricity, Gas, and Water: The electricity, gas, and water sector saw a decline of 0.8%, mainly due to decreased electricity production and consumption.

- Trade, Catering, and Accommodation: During the second quarter of 2023, this industry recorded a decline of 0.4%, contributing -0.1 %age point to GDP growth due to reduced economic activities in the wholesale trade and retail trade (Figure 3).

Figure 1: Namibia vs. South Africa GDP Growth rates (Q2 2019-Q2 2023)

Source: NSA, STATSSA & HEI RESEARCH

Figure 2: Namibia GDP by activity % change Quarter 2 2022 vs Quarter 2 2023

Source: NSA & HEI Research

Figure 3: South Africa GDP by activity % change Quarter 2 2022 vs Quarter 2 2023

Source: STATS SA & HEI Research

Outlook

Namibia

Namibia’s GDP growth trajectory is anticipated to experience a deceleration throughout 2023 and 2024 (Bank of Namibia, August 2023 Economic Outlook), primarily attributed to sluggish global demand and constrained growth within the agricultural sector. The domestic economy is predicted to moderate downwards to 3.3% in 2023 from the 4.6% registered in 2022, which is expected to moderate to 3.0% in 2024. The envisaged moderation in growth for 2023 primarily stems from subdued demand both internationally and domestically. Prevailing high levels of inflation and elevated interest rates are projected to dampen expenditure. This dampening effect has been further exacerbated by the diminished global demand, which has negatively impacted commodity prices, including key minerals that Namibia relies on for export.

South Africa

Economic conditions appear to have improved; the longer-term outlook mirrors the uncertainty of the global environment. Prices for commodity exports continue to weaken. In addition, energy supply remains unreliable and stronger El Nino conditions threaten the agricultural outlook. For 2023, the SA Reserve Bank’s forecast for South Africa’s GDP growth is slightly higher than in May, at 0.4% (from 0.3%). Energy and logistical constraints remain binding on the growth outlook, limiting economic activity and increasing costs.