The Bank of Namibia Monetary Policy Committee (MPC) is set to make its fifth announcement for 2022 on the interest rate decision today the 26th of October 2022. The Bank of Namibia MPC increased the repo rate by 150 basis points since the beginning of the year 2022 while the South African Reserve Bank increased by 250 basis points. The committee increased the repo rate to 5.50% in their last meeting held in August 2022. The MPC was of the view that the rate will continue safeguarding the peg arrangement and thus anchoring inflation expectations while meeting the country’s international financial obligations. South Africa’s reserve bank increased its repo rate by 75 basis points in their last meeting held in September 2022. The repo rate currently stands at 6.25%. The MPC indicated that the repo rate remained supportive of credit demand in the near term, and they were of the view that hiking the rate will be more consistent with the current view of inflation risks.

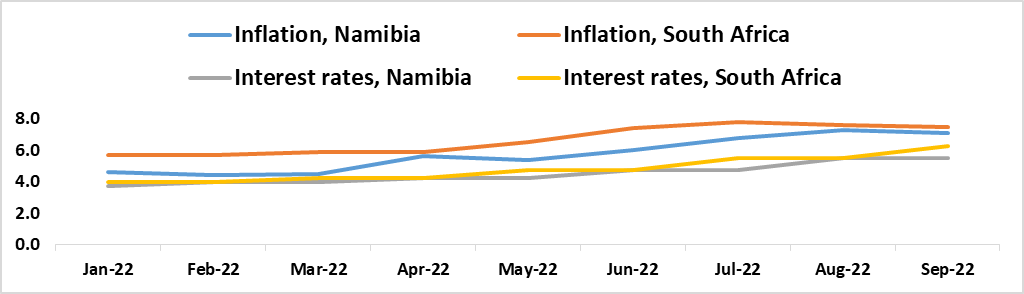

Although the Namibian economy showed signs of improvement during the first two quarters of 2022 by recording an average growth of 5.4%, the country’s interest rates have been on an upward trajectory since the beginning of the year (See figure 1 below). Higher-than-expected inflation has pushed major central banks including the Bank of Namibia to accelerate the normalization of monetary policy rates, tightening global financial conditions and soaring risk profiles of economies needing foreign capital. There remains an upside inflationary outlook risk, augmented by global commodities prices which could surprise again on the upside given the high uncertainty about the impact of the war in Ukraine, the continuous decline in OPEC+ countries’ production output, and the global recession concerns.

Our outlook is that the MPC could increase the repo rate by 75 basis points following South Africa’s path. The decision will continue to contain the elevated global and domestic inflationary pressures, and the fragile economic recovery and maintain the need to safeguard the currency peg while meeting the country’s international financial obligations.

Figure 1: Repo Rates and Inflation Rates, Namibia vs. South Africa (January- September 2022)