The Bank of Namibia Monetary Policy Committee (MPC) is scheduled to make its last announcement for 2022 on the interest rate decision tomorrow, the 30th of November 2022.

The committee increased the repo rate by 75 basis points to 6.25% in their last meeting held in October 2022. The MPC was of the view that the rate will continue safeguarding the peg arrangement and thus anchoring inflation expectations while meeting the country’s international financial obligations. South Africa’s reserve bank increased its repo rate by 75 basis points in their last meeting held last week, on the 24th of November 2022.

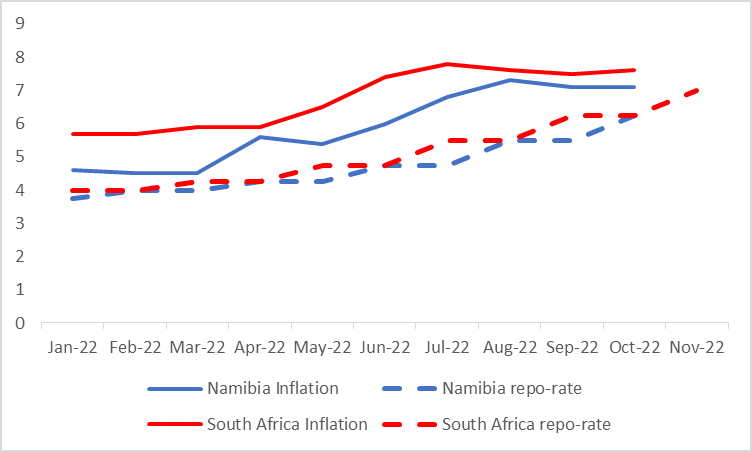

The Bank of Namibia MPC increased the repo rate by 250 basis points year to date while the South African Reserve Bank increased by 300 basis points

The repo rate currently stands at 6.25%. The Bank of Namibia’s MPC indicated that the repo rate remained supportive of credit demand in the near term, and they were of the view that hiking the rate will be more consistent with the current view of inflation risks.

Although inflation has shown signs of slowing down over the past 3 months ever since peaking at 7.3% in August 2022, the current inflation levels still remain significantly too high, with average annual inflation for 2022(January to October) standing at 5.9% compared to 3.6% recorded during the period in 2021.

Our outlook is that the MPC could increase the repo rate by 75 basis points following South Africa’s path. The decision will continue to contain the elevated global and domestic inflationary pressures, and the fragile economic recovery and maintain the need to safeguard the currency peg while meeting the country’s international financial obligations.

Figure 1: Repo Rates and Inflation Rates, Namibia vs. South Africa (January – November 2022)