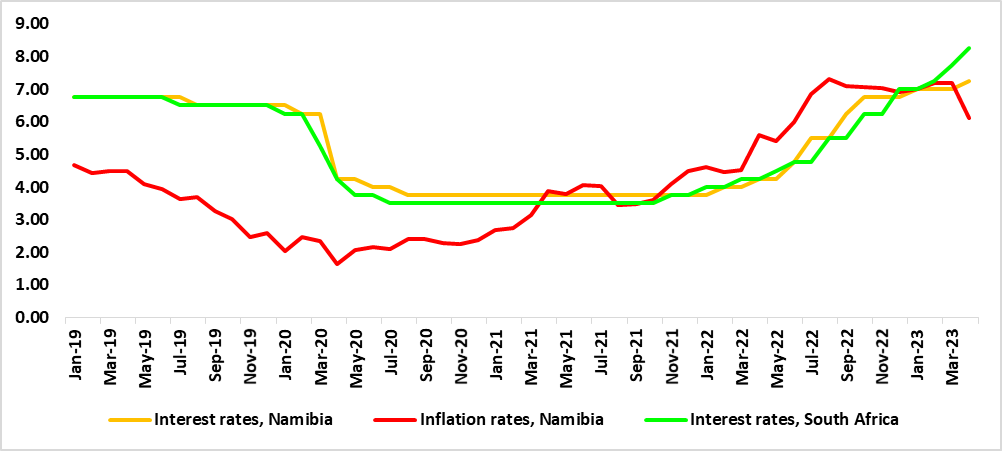

The Bank of Namibia Monetary Policy Committee (MPC) is set to make its third announcement for 2023 on the interest rate decision today the 14th of June 2023. The MPC increased the repo rate by 25 basis points during their second meeting on the 13th of April 2023, bringing the repo rate to 7.25%. Additionally, the South Africa Reserve Bank increased its repo rate by 50 basis points in its last meeting held in March 2023 bringing the repo rate to 8.25%. This translated into a spread of 100 basis points between Namibia and South Africa’s repo rates. (Figure 1)

Our outlook is that the Bank of Namibia’s MPC could increase the repo rate by 25 basis points to continue protecting the currency peg and to control inflation for price stability. We expect the interest rate hike cycle to persist in the short term. This is augmented by the lingering upside inflation risks in South Africa as food price inflation continues to be elevated, as the risk of drier weather conditions in coming months has increased. Load-shedding may additionally have broader price effects on the cost of doing business and the cost of living. Non-performing loans at the banks will rise as a result of the ongoing increase in interest rates. As such banks will start to take the variation in the rise in non-performing loans and the returns on interest rates into account.

Figure 1: Repo and Interest Rates, Namibia vs. South Africa (January 2019- April 2023)

Source: BoN & HEI Research