The Bank of Namibia Monetary Policy Committee (MPC) is set to make its third announcement for 2022 on the interest rate decision on Wednesday the 15th June 2022. The MPC increased the repo rate by 25 basis points from 4.0% to 4.25% in their last meeting. The MPC was of the view that the rate is appropriate to safeguard the one-to-one link between the Namibia Dollar and the South African Rand while meeting the country’s international financial obligations. The South Africa Reserve Bank increased its repo rate by 50 basis points in its last meeting held in May 2022 bringing the repo rate to 4.75%. The South Africa Reserve Bank increased its repo rate to safeguard its inflation targeting policy.

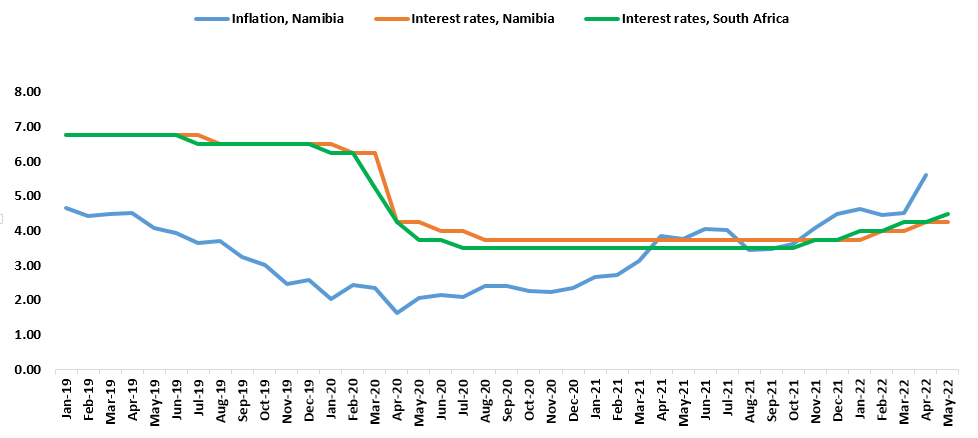

Namibia has been experiencing negative real interest rates since October 2021. This is due to the annual inflation rate outstripping the repo rate. Inflation has been hovering above 4% and reached 5.6% in April 2022 (See figure 1 below). Our outlook is that the MPC could follow the South African Reserve Bank’s footsteps and increase the repo rate by 50 basis points to protect the currency peg. We are in an interest hike cycle in the short to medium term. This is augmented by high inflation rates that are expected to remain elevated as a result of the continuous external cost-push factors.

Figure 1: Repo Rates, Namibia vs. South Africa, and Namibia’s Inflation rate (January 2019- May 2022)

Source: BON, SA Reserve Bank, NSA & HEI RESEARCH