Background

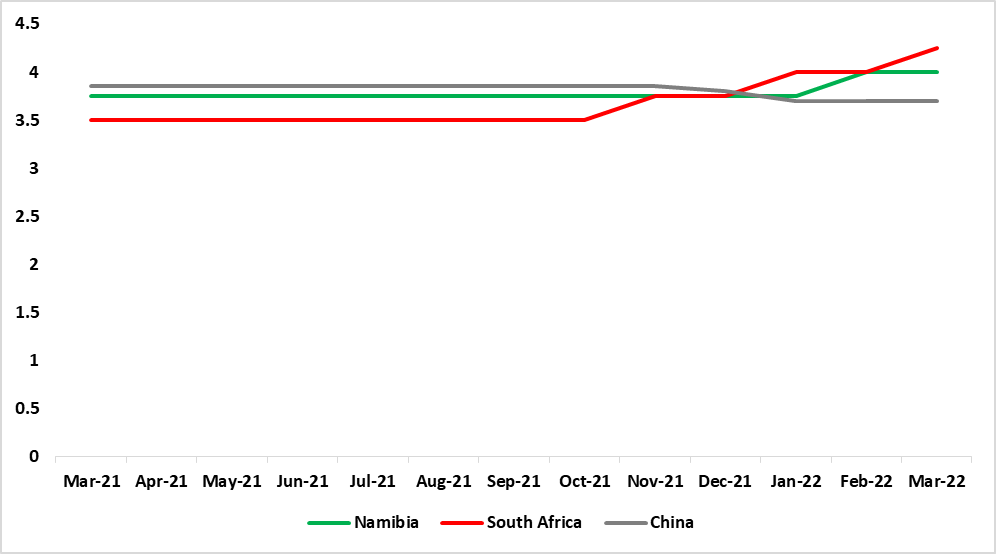

The Bank of Namibia Monetary Policy Committee (MPC) is set to make its second announcement for 2022 on the interest rate decision on Wednesday the 13th of April 2022. The MPC increased the Repo rate by 25 basis points from 3.75% to 4.0% in their first MPC meeting. The MPC was of the view that the rate is appropriate to safeguard the one-to-one link between the Namibia Dollar and the South African Rand while meeting the country’s international financial obligations (See figure 1 below).

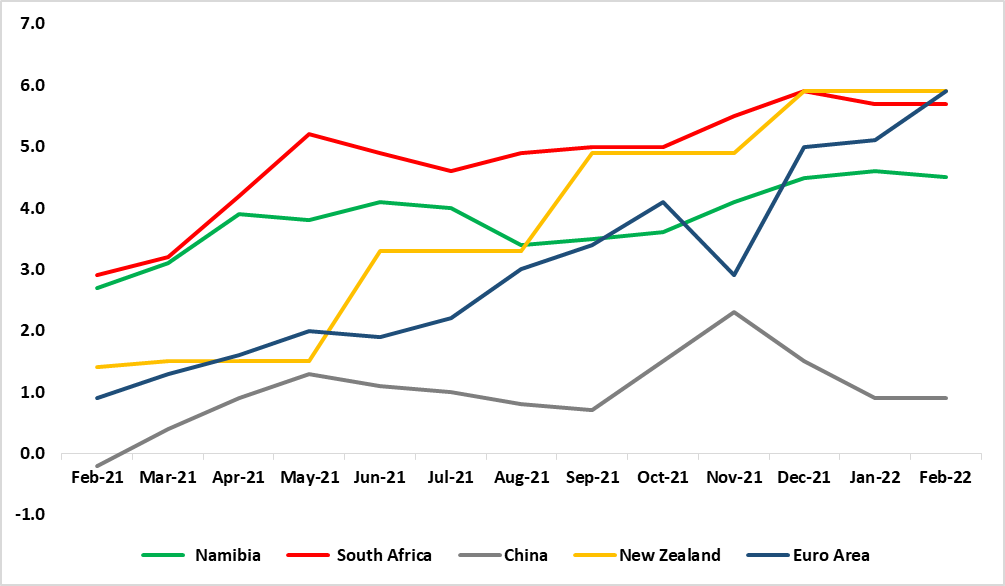

The South Africa Reserve Bank increased its repo rate by 50 basis points since the beginning of the year 2022 to counter inflation. High inflation rates remain a global challenge augmented by surging commodity prices and supply chain bottlenecks reflecting domestic capacity constraints and higher prices for imported goods (See figure 2 below).

Figure 1: Repo Rate, Namibia, South Africa, and China (March 2021-March 2022)

Source: BON, SA Reserve Bank, The People’s Bank of China & HEI Research

Figure 2: Namibia and selected Economies Annual Inflation (February 2021- February 2022)

Source: NSA, Stats SA, Stats China, Stats NZ, Stats Euro Area & HEI Research

Outlook

Given that the South African Reserve Bank indicated a policy path rate of an increase in each quarter for the next three years, we are of the view that the Bank of Namibia may follow the same path to safeguard the one-to-one link between the Namibia Dollar and the South African Rand. However high-interest rates exert pressure on household consumption and as a result, we expect the private sector credit extension for Namibia to remain subdued due to a decline in the demand for credit.