The Bank of Namibia Monetary Policy Committee (MPC) is set to make its last announcement for 2023 regarding the interest rate decision on the 6th of December 2023. The MPC decided to keep rates unchanged at their last meeting in October 2023. That was their second unchanged MPC meeting. The repo rate currently stands at 7.75%, the highest it has ever been in the past 14 years.

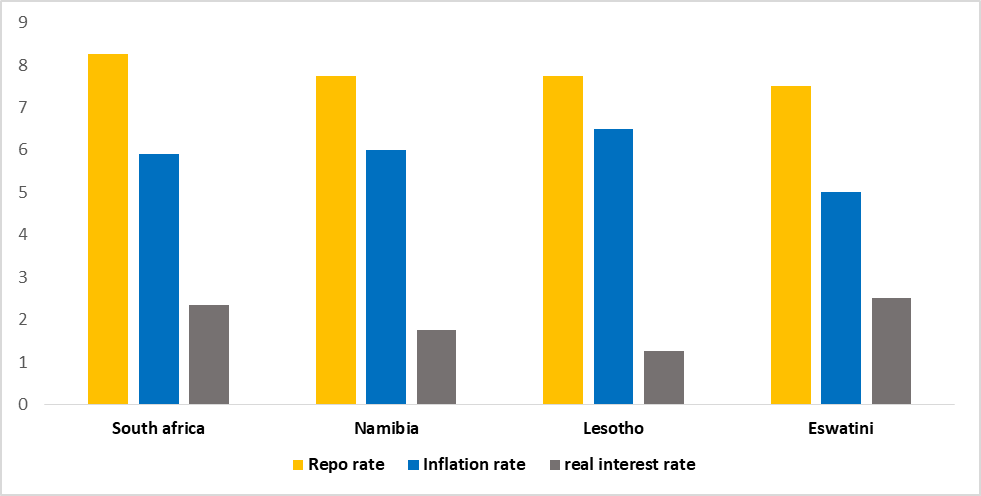

Additionally, inflation in Namibia currently stands at 6.0%, up from 5.4% recorded in August 2023. Inflation pressures remain elevated, driven by food and non-alcoholic beverages, and transport. Other countries in the CMA continue to lag behind South Africa’s repo rate of 8.25% and a real interest rate of 2.35%. The South Africa Reserve Bank kept its repo rate unchanged at 8.25% in its last meeting held in November 2023. This results in a spread of 50 basis points between Namibia and South Africa’s repo rates (Figure 1).

Core inflation in South Africa fell to 4.4% from 4.5%, and Namibia’s core inflation remains unchanged at 4.9%, after months of raising prices in core components. This indicates subdued overall price pressures, providing a rationale for central banks to keep interest rates unchanged as a measure to stimulate spending and investment, supporting economic growth.

Our outlook is that the Bank of Namibia’s MPC will keep the repo rate unchanged at 7.75% to continue protecting the currency peg and to control inflation for price stability. We expect the interest rate pause to persist in the short term with possible cuts in the late first half of 2024

Figure 1: Repo and Interest Rates, CMA countries October 2023

Source: Respective Central Banks, Respective Statistics Agencies & HEI Research