The Bank of Namibia Monetary Policy Committee (MPC) is set to make its fifth announcement for 2023 regarding the interest rate decision tomorrow the 25th of October 2023. The MPC decided to keep rates unchanged at their last meeting in August 2023. That was their second unchanged MPC meeting. The repo rate currently stands at 7.75%, the highest it’s ever been in the past 14 years.

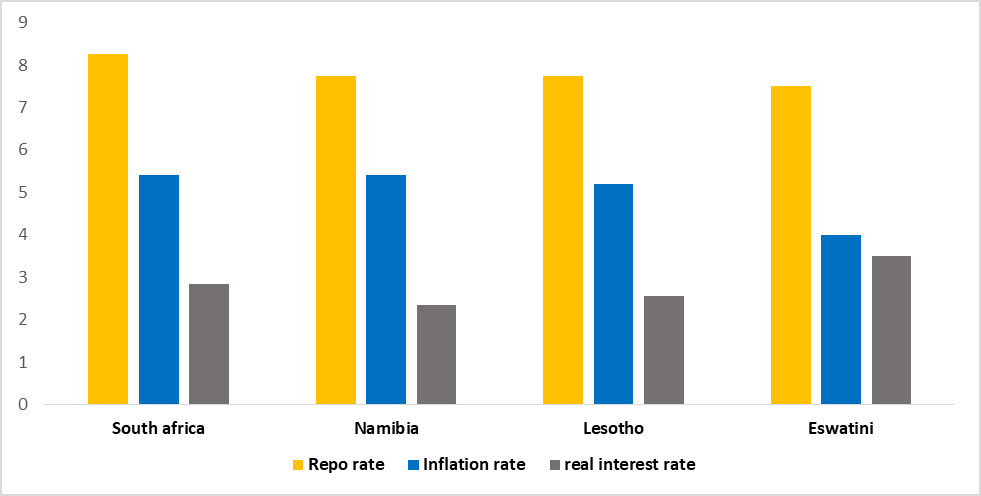

Additionally, inflation in Namibian currently stands at 5.4% from 4.7% recorded in August 2023. Inflation pressures remain elevated, driven by food and non-alcoholic beverages, and transport. Other countries in the CMA continue to lag behind South Africa’s repo rate of 8.25% and a real interest rate of 2.85%. The South Africa Reserve Bank kept its repo rate unchanged at 8.25% in its last meeting held in September 2023. This results in a spread of 50 basis points between Namibia and South Africa’s repo rates (Figure 1).

Core inflation in South Africa fell to 4.5% from 4.8% and Namibia remains unchanged at 4.9%, after months of raising prices in core components. This indicates subdued overall price pressures, providing a rationale for central banks to keep interest rates unchanged as a measure to stimulate spending and investment, supporting economic growth.

Figure 1: Repo and Interest Rates, CMA countries October 2023, (Eswatini inflation rate August 2023)

Source: Respective Central Banks, Respective Statistics Agencies & HEI Research

Our outlook is that the Bank of Namibia’s MPC will keep the repo rate unchanged at 7.75% to continue protecting the currency peg and to control inflation for price stability. We expect the interest rate pause to persist in the short term with possible cuts in the late first half of 2024.