Executive Summary

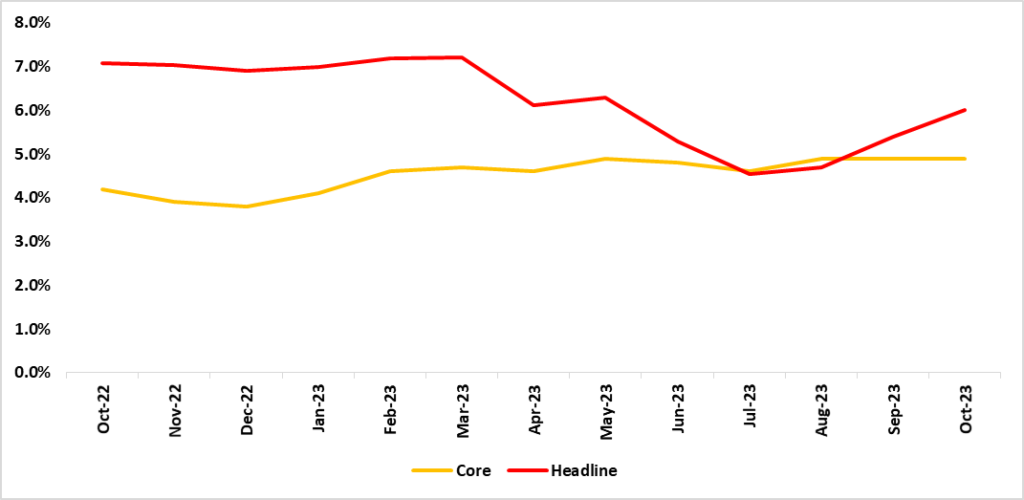

- In October 2023, the annual inflation rate stood at 6.0%, marking an increase compared to the 5.4 % recorded the previous month but a slowdown compared to the 7.1% of October 2022 (Figure 1)

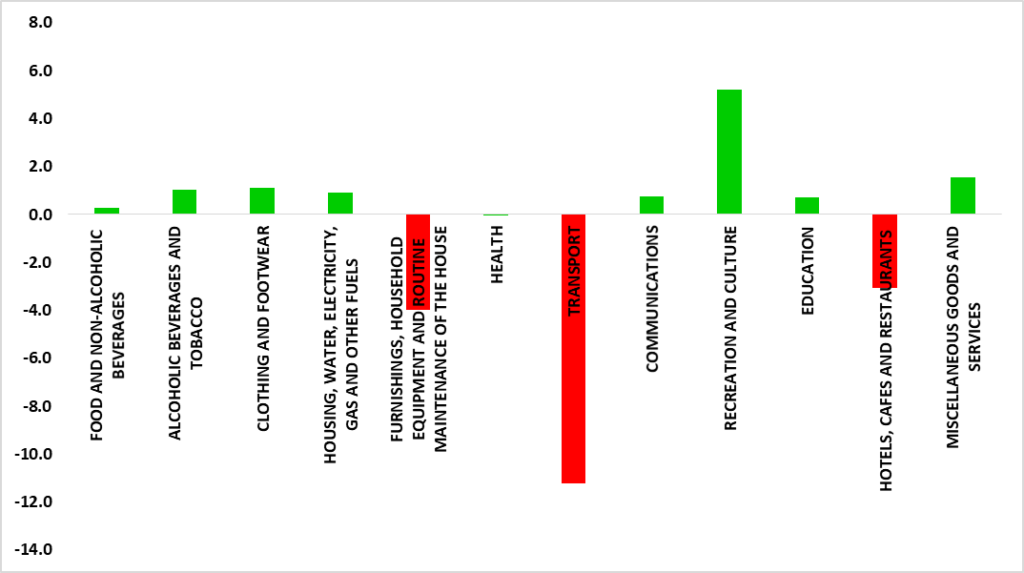

- The main contributors to a decline in the annual inflation were: transport, furnishings, household equipment, and routine maintenance of the houses and hotels, cafes, and restaurants, (Figure 2)

- On a monthly basis, the inflation rate remained the same as that of the previous month at 0.8%. The 0.8% emanated from the categories of transport (from 2.9% to 3.5%), furnishings, household equipment, and routine maintenance of the houses and hotels (from 0.3% to 0.6%), and health (from 0.0% to 0.2%)

Analysis

- The transport category which accounts for 14.3% of the consumer basket registered a decline in the annual inflation rate of 6.6% in October 2023 compared to 17.8% recorded in October 2022. The decline in the annual inflation rate for this component was mainly attributed to decline in petrol and diesel prices which declined to 9.0% from 45.8% recorded in October 2022. However, on a monthly basis, petrol and diesel prices increased significantly from -3.3% to 9.0%

- The annual inflation rate for furnishings, household equipment, and routine maintenance of the house which accounts for 5.5% of the consumer basket registered a decline in the annual inflation rate of 5.6% in October 2023 compared to 9.6% recorded in October 2022. This was attributed to a decline in the price levels of goods and services for routine household maintenance which declined to 4.2% compared to 24.8% recorded in October 2022

- Hotels, cafes, and restaurants account for 1.4% of the consumer basket recorded a decline in the annual inflation rate of 7.5% in October 2023 compared to 10.6% recorded in October 2022. This was driven by a decline in demand for accommodation services which declined to 9.5% compared to 18.8% recorded in October 2022

- Core inflation stood at 4.9% while headline inflation increased to 6.0% from the previous month’s 5.4%, translating into a 1.1% difference between core and headline inflation. The disparity between core and headline inflation continues to raise concerns about long-term inflation trends and a widening gap might signal a necessity for more proactive measures to combat inflation. (See Figure 1)

Figure 1: Annual Inflation Rate, Namibia (October 2022 – October 2023)

Source: NSA & HEI Research

Figure 2: Sub-Categorical analysis (%) change Year on Year (October 2022 – October 2023)

Source: NSA & HEI Research

Outlook

Following a declining trend observed since June 2023, headline inflation has now begun to increase on a monthly basis, though it still remains lower compared to the previous year. We expect inflation to decrease in November 2023, both monthly and annually, due to unchanged fuel prices for November 2023.