Executive Summary

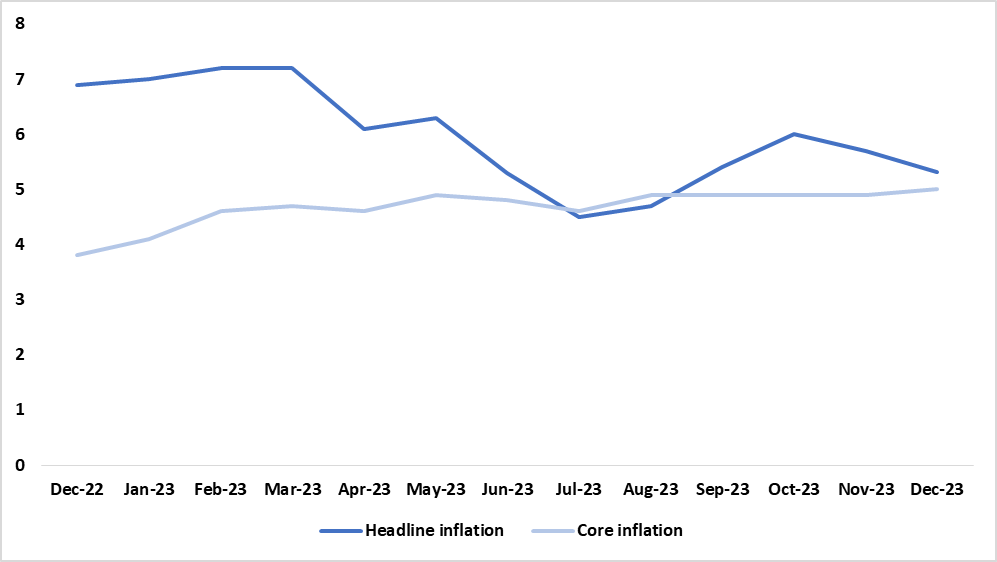

- In December 2023, the annual inflation rate slowed to 5.3%, compared to the 6.9% recorded in December 2022 and the 5.7% recorded in November 2023 (Figure 1)

- The average annual inflation rate from January to December 2023 was estimated at 5.9%

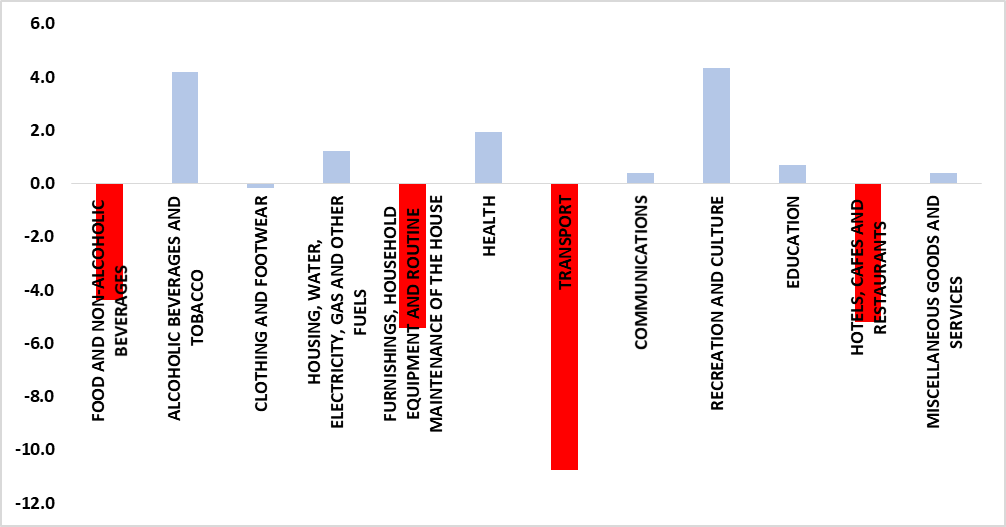

- The main contributors to the decline in annual inflation were transport, furnishings, household equipment, and routine maintenance of houses, hotels, cafes, and restaurants as well as food and non-alcoholic beverages (Figure 2)

- On a monthly basis, the inflation rate slowed to 0.1%, compared to the 0.3% recorded in November 2023 while core inflation increased to 5.0%

Analysis

- The largest changes in annual prices in December 2023 were recreation and culture at 10.0%, and alcoholic beverages and tobacco at 8.4%

- The transport category, which accounts for 14.3% of the inflation basket, recorded an annual change of 4.0% during December 2023, compared to the 14.8% recorded in December 2022. The slow increase in the annual inflation rate for this component was reflected mainly in the lower prices for fuel

- The annual inflation rate for furnishings, household equipment, and routine maintenance of the house which accounts for 5.5% of the consumer basket registered a decline in the annual inflation rate of 5.1% in December 2023 compared to 10.6% recorded in December 2022. This was attributed to a decline in the price levels of goods and services for routine household maintenance which declined to 3.9% compared to 25.8% recorded in December 2022

- Hotels, cafes, and restaurants account for 1.4% of the consumer basket recorded a decline in the annual inflation rate of 6.5% in December 2023 compared to 11.7% recorded in December 2022. This was driven by a decline in demand for accommodation services which declined to 9.4% compared to 20.4% recorded in December 2022

- Core inflation stood at 5.0%, while headline inflation slowed to 5.3% from November’s 5.7%, translating into a 0.3% difference between core and headline inflation.

The gap between core and headline inflation is a concern for long-term inflation trends. A growing difference may indicate the need for proactive measures to control inflation. (See Figure 1)

Figure 1: Annual Inflation Rate, Namibia (December 2022 – December 2023)

Source: NSA & HEI Research

Figure 2: Sub-Categorical analysis (%) change Year on Year (December 2022 – December 2023)

Source: NSA & HEI Research

Outlook

The rate of headline inflation slowed down, decreasing from 9.2% in 2022 to 5.9% in 2023. We expect the ongoing pattern of decreasing inflation to persist into 2024.