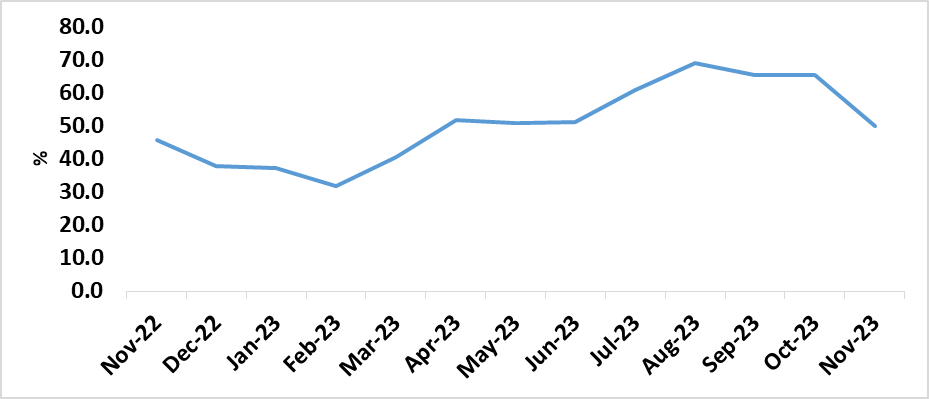

In November 2023, Namibia experienced a decline in national occupancy rates, dropping from 65% in October to 49%. This report provides an analysis of the regional variations in occupancy rates, highlights the year-on-year improvements, and discusses the impact of the COVID-19 pandemic on the tourism industry. Additionally, it explores the primary drivers of tourism activities, the contribution of the domestic market, and the role of international tourists.

Regional Analysis: Northern Region: The northern region recorded the highest occupancy rate in November 2023, reaching 51.4%, Coastal Region: The coastal region closely followed with an occupancy rate of 50.1%, Southern Region: The southern region had the lowest occupancy rate at 41.4%.

Yearly Improvements: The national occupancy rates for the 11 months averaged 52.2%, showcasing significant improvement compared to the average of 40.4% for the same period last year. This improvement can be attributed to the influx of investors visiting Namibia for green hydrogen pilot projects, particularly in coastal towns.

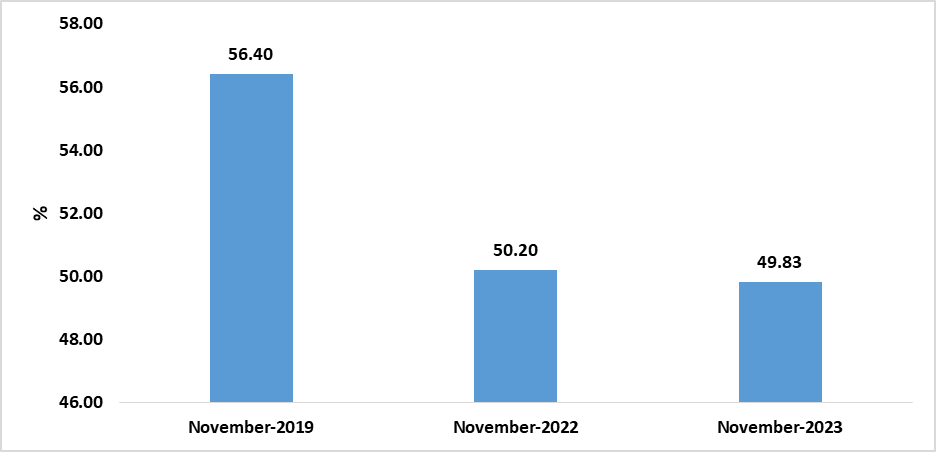

Comparison with Previous Years: November 2023 vs. November 2022: The national occupancy rate experienced a minimal decrease of 1% from 50.2% in November 2022, November 2023 vs. November 2019: The national occupancy rate saw a 7% decline from pre-pandemic levels, standing at 56.4%. This highlights that the tourism industry is still recovering from the impact of the COVID-19 pandemic.

Leisure Tourism vs. Business Travel: Leisure-related occupancy rates constituted a significant 98.9% in November 2023, showcasing a notable increase of 9.3% from October. On the other hand, the business travel segment accounted for only 1.0%, experiencing a decline from 9.9% in October.

Domestic Market Contribution: The domestic market contributed 15.8% to the national occupancy rates in November 2023, indicating a slight increase from October. However, this suggests subdued domestic tourism activities, emphasizing the need for incentives and initiatives to encourage domestic demand. Special travel packages, discounts, and promotional deals could enhance the appeal and affordability of domestic travel for residents.

Role of International Tourists: Key countries such as Germany, Switzerland, and Australia contributed to 48.4% of the total international occupancy demand in November 2023, showing a substantial increase from October. This highlights the growing dependence of Namibia’s tourism sector on international arrivals, with a sustained positive trajectory throughout the year.

Outlook: Looking ahead, Namibia Wildlife Resorts (NWR) plans to kick off its Black Friday Specials from November 24 to November 30, 2023. These exclusive vouchers offer affordable opportunities for avid travelers to explore the country’s diverse attractions. With these enticing specials, NWR aims to extend accessible options. We anticipate that the tourism sector will maintain its favorable trajectory for December 2023 as it is a festive season.

Conclusion: While November 2023 saw a decline in national occupancy rates, the overall trend indicates an improvement compared to the previous year. The report emphasizes the significance of international tourists, the need for domestic market incentives, and the upcoming Black Friday Specials as potential drivers for the tourism sector. As Namibia continues to fully recover from the impact of the COVID-19 pandemic on tourism, strategic measures should be implemented to ensure sustainable growth in tourism activities.

Figure 1: National Occupancy Rates, Namibia (November 2022- November 2023)

Source: H.A.N & HEI RESEARCH

Figure 2: National Occupancy Rates (%), Namibia (November 2019, November 2022 vs November 2023)

Source: H.A.N & HEI RESEARCH