Background

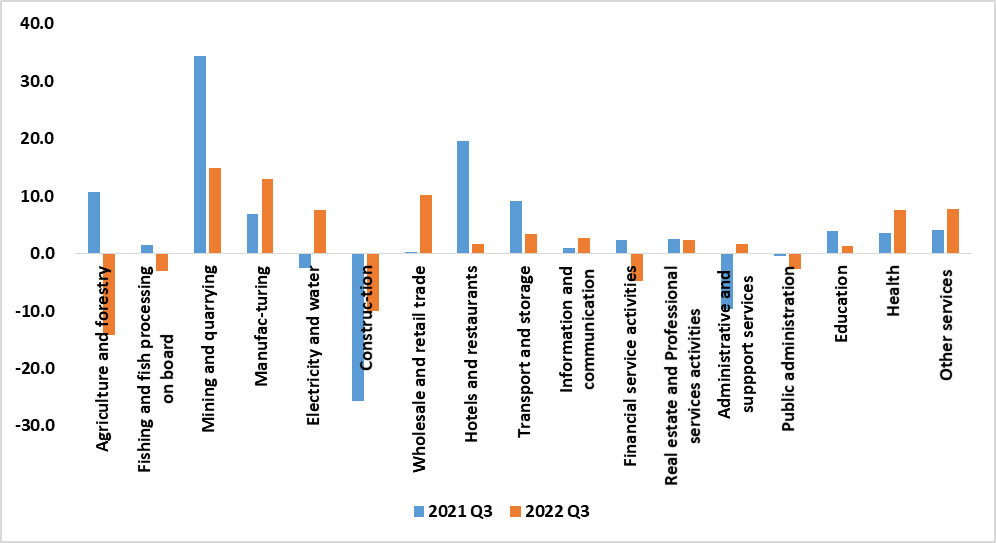

The domestic economy recorded a slowdown in economic activity for the third quarter of 2022. Economic activity declined by 1.7% in relation to Quarter 2 of 2022 and by 1.3% when compared to the corresponding quarter of 2021. Slow growth was recorded for major segments of the economy, with the agriculture and forestry, fishing and processing on board, construction, financial activities, and public administration sectors recording no growth during quarter 3 of 2022. However, the mining and quarrying, manufacturing and wholesale, and retail trade sectors posted double-digit growth during the period under review.

Analysis

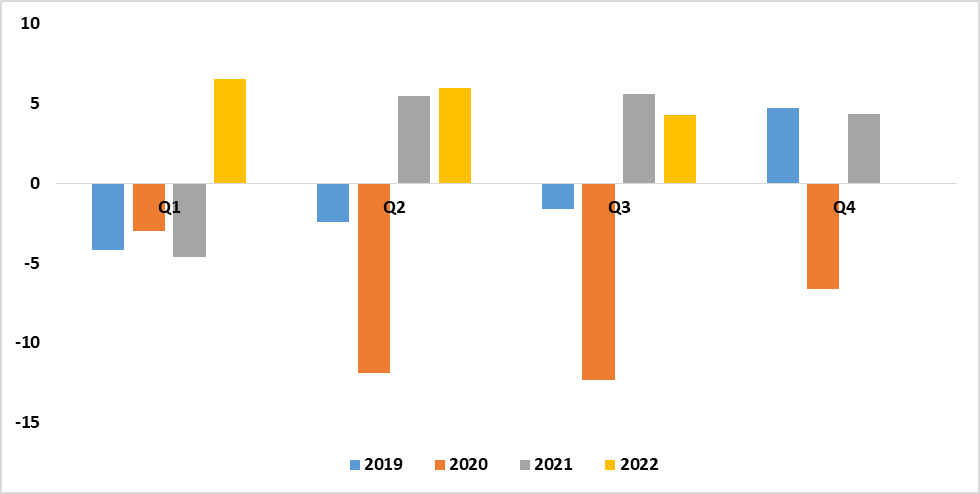

The domestic economy expanded by 4.3% during the third quarter of 2022, slow growth when compared to 5.6% recorded during the corresponding quarter of 2021. (See figure 1). The agriculture and forestry sectors declined to 14.2% from 10.8% in relation to quarter 3 of 2022. Poor performance for the sector emanated from the livestock farming subsector which contracted by 18.9% as a result of the low number of livestock marketed for exports due to the restrictive measures that were imposed by South Africa to curtail the spread of food and mouth disease within their borders. The fishing and fish processing on board sector registered a decline of 3.1% during the period under review when compared to a growth of 1.6% in the corresponding quarter of 2021. Poor performance in the sector was observed in the fish landings due to the reduction in Total Allowable Catches (TAC).

The construction and public administration sectors continue to remain under pressure contracting for the fifth consecutive quarter by 10% and 2.7% respectively. The financial services activities sector also declined by 4.7% when compared to a growth of 2.4% recorded in quarter 3 of 2021.

Figure 1: Quarterly Gross Domestic Product (GDP) % Change

Figure 2: Sectors percentage growth (GDP) Q1 2021 vs. Q1 2022

Outlook

Growth in advanced economies is anticipated to slow from 2.5% in 2022 to 0.5% in January 2023. Slowdowns of this scale can foreshadow a global recession and this has a spillover effect on the domestic economy. Growth in emerging markets and developing economies including Namibia are also projected to fall from 3.8% in 2022 to 2.7% in 2023, reflecting significantly weaker external demand compounded by high inflation, currency depreciation, tighter financing conditions, and other domestic headwinds that will result in subdued economic activities.

Given the uncertainty of the anticipated “global recession,” the Namibian economic performance remains volatile.