Background

The Namibian Statistics Agency is set to release Namibia’s Q2 GDP figures towards the end of September 2020. This will demonstrate the full impact of the Covid-19 induced lockdowns. The impact will be huge and will result in record contractions. Historically, global recessions have always been accompanied by sharp declines in industrial commodity demand levels. The Namibian tourism and retail sectors face a hefty headwind as local and international travel has been significantly halted under lockdown regulations.

South Africa

South Africa’s GDP set the mark for African countries as the country’s second quarter Gross Domestic Product (GDP) output tanked by 51% on a quarterly basis. This marked the fourth consecutive quarter of decline in GDP. South Africa’s manufacturing industry contracted by 74.9%. The only sector to record growth was the agricultural sector that recorded a 15% increase. We expect this negative trend to mirror Namibia’s GDP figures as both countries were in lockdown between April and June.

Namibia

A large contribution to Namibia’s GDP is derived from the Mining Sector and the Manufacturing Sector. More importantly, the Manufacturing sector is dominated by mining related production. The two sectors contributed a collective 18% of GDP in the first quarter of 2020 according to the Namibian Statistics Agency (2020). Table 1 illustrates the most significant headwinds to global commodity prices, which in turn acts as a headwind to Namibian local mines. The Namibian Retail and Wholesale sectors have been on a downward trajectory since the first quarter of 2017. The private sector credit extension (PSCE) and the latest Vehicles Sales report (July 2020) illustrate a significant retraction on the back of covid-19 induced lockdown measures. This is an indication that businesses and households are under immense pressure.

Outlook

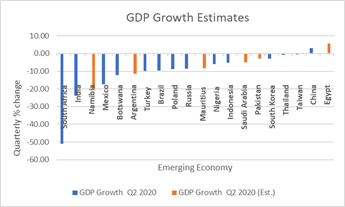

The weak demand for commodities and the abrupt halt to Namibia’s tourism sector paints a gloomy picture. The Namibian consumer is severely under pressure and this will result in poor economic output from the retail sector. We predict a 15- 20% decline in Namibia’s GDP on a quarterly basis. Figure 1 illustrates our GDP growth forecasts for Namibia and other emerging market economies as they are all on a downward trajectory.

| Headwind | Reasoning |

| Reduced demand for travel | The first policy weapon against the Covid-19 pandemic was a world-wide travel ban. This has resulted in a substantial reduction in the demand for fuel. According to the World Bank (2019), this accounts for two thirds of global oil demand. Furthermore, a reduction in crude oil prices has historically resulted in weaker prices for biofuels such as corn. |

| Lower aggregated demand during economic downturns | It is evident that a global recession is a major headwind to commodity demand. This may lead to mines reducing their output in order to mitigate cash burning operations as operational costs exceed future commodity prices. |

Table 1: Headwinds to Commodity Prices

Source: HEI Research, World Bank

Figure 1: GDP Growth Estimates

Source: HEI Research