Executive Summary

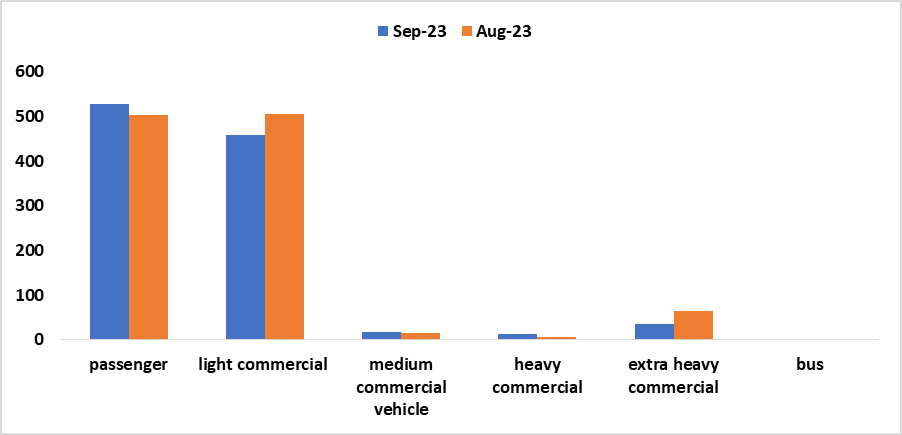

- During September 2023, new vehicle sales experienced a month-on-month decline of 3.7%, marking the third consecutive monthly decrease. A total of 1054 vehicles were sold in September 2023, compared to the 1094 vehicles sold in August 2023, reflecting a reduction of 40 vehicles. (Figure 1)

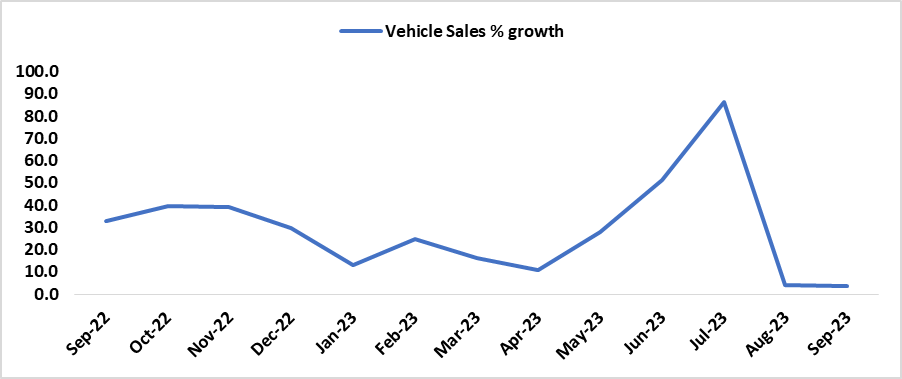

- On an annual basis, vehicle sales increased by 3.5% when compared to September 2022. (Figure 1)

- Month-on-month sales of passenger, medium commercial, and heavy commercial vehicles increased by 5%, 21%, and 86% while light commercial and extra heavy vehicles declined by 9% and 44% respectively.

- During the first 9 months of 2023, 9842 vehicles were sold, comprising 4318 passenger vehicles, 4002 light commercial vehicles, 198 medium vehicles, 117 heavy commercial vehicles, 212 extra heavy commercial vehicles, and 12 buses. This resulted in a 20% annual growth compared to the corresponding period in the first nine months of 2022

Analysis

- A 20% annual growth in new vehicles sold is an indication of overall improvement in consumer confidence

- The continuous decline in monthly vehicle sales since June 2023 could be primarily attributed to diminished credit demand due to high interest rates and eroded disposable income

- The rise in passenger vehicles could be due to no interest rate hike at the last Bank of Namibia’s MPC meeting. Consumers perceived this decision favorably, encouraging them to continue obtaining credit to purchase new cars

- Sales of light commercial vehicles could be attributed to subdued commercial activities hence a low demand for commercial transportation services

- Medium, heavy, and extra-heavy commercial vehicles continued on an upward trajectory. This could be mainly underpinned by the strong mining activity

- The total sales of commercial vehicles experienced an 11% decline in September 2023, compared to the 590 units recorded in August 2023. This downturn underscores the suboptimal performance of the commercial sector

Table 1: Monthly vehicle sales by type

| Market | Aug-23 | Sep-23 | Monthly unit change | Monthly % change |

| Passenger vehicles | 502 | 528 | 26 | 5 |

| Light commercial vehicles | 505 | 458 | -47 | -9 |

| Medium commercial vehicle sales | 14 | 17 | 3 | 21 |

| Heavy commercial vehicle sales | 7 | 13 | 6 | 86 |

| Extra heavy commercial vehicle sales | 64 | 36 | -28 | -44 |

| Bus | 2 | 2 | 0 | 0 |

Figure 1: Monthly Vehicle Sales (September 2023 vs August 2023)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: Year on Year, Vehicle Sales Growth (September 2022- September 2023)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Outlook

The demand for new vehicles has exhibited resilience despite prevailing high-interest rates. Looking ahead, we anticipate a continued month-on-month decline in vehicle sales in the short to medium term. However, the expectation could be influenced otherwise by the upcoming Bank of Namibia’s Monetary Policy Committee’s decision on the 25th of October 2023.