National Occupancy Rates for Namibia, April 2024

Analysis

According to the latest data released by the Hospitality Association of Namibia, and reports, European markets continue to dominate Namibia's tourism industry, with a significant increase in visitors from other European countries as well. (See Figure 2). This trend aligns with the sustained popularity of Namibia as a tourist destination, driven by factors such as its scenic beauty, diverse wildlife, and unique cultural experiences. The coastal region and the central region of Namibia have recorded the highest occupancy rates for April 2024, indicating their appeal to tourists.

In April 2024, the national occupancy rate in Namibia increased to 58.19% from 49.24% recorded in March 2024, representing a notable increase of 8.95%. (See Figure 1). The central region recorded the highest occupancy rate of 66.77%, followed by the coastal region with 62.95%. These figures highlight the attractiveness of these regions to visitors.

Furthermore, the northern region of Namibia recorded the highest occupancy rate for leisure activities at 97.02%, indicating its popularity among tourists seeking leisure experiences. The southern region followed closely with a leisure occupancy rate of 92.1%. In terms of business occupancy rates, the southern region recorded the highest rate at 7.9%, while the northern region had the lowest occupancy rate of 2.79%. The coastal region recorded a leisure occupancy rate of 90.96% and a business occupancy rate of 9.04%. On a national scale, the overall distribution of occupancy rates was 86.38% for leisure, 13.26% for business, and 0.35% for conferences.

Figure 1: National Occupancy Rates, Namibia (April 2023- April 2024)

Source: H.A.N & HEI Research

Figure 2: Number of national occupants by citizenship

Source: H.A.N & HEI Research

Outlook

We anticipate the positive trend for the occupancy to continue in the short to medium term. This could be influenced by Namibia Wildlife Resorts (NWR) recent announcement on the reopening of the Bo Plaas campsite along the Orange River which could attract more tourists, coupled with Namibia preparing to host major events including the Inaugural Global African Hydrogen Summit in the coming months influencing the conference and the business segments.

1. Executive Summary

In February 2024, the national occupancy rates in Namibia were reported at 36.3%, marking a slight decrease from the 36.8% recorded in January 2024. However, this rate signifies an annual increase from the 33.1% observed in February 2023. When compared to pre-pandemic levels, which stood at 40.1%, it's evident that the national occupancy rates have not yet fully recovered, indicating that the tourism sector is still on a recovery path.

2. Detailed Analysis

During the month under review, the central region of Namibia recorded the highest occupancy rate at 53.5%. This was followed by the coastal region at 40.5%, while the northern region reported the lowest rate of 31.0%. The high occupancy rates in the central region were primarily driven by an increase in rooms sold for business purposes, suggesting a strong demand for business activities in the country. This could be a positive economic indicator, as it implies that businesses are thriving and attracting customers.

According to the Hospitality Association of Namibia, German-speaking guests accounted for a significant 40.9% of occupancy in establishments in February 2024. This figure surpasses the 40% level and is notably higher than the levels recorded in 2019. This trend underscores the positive impact of direct flights between Windhoek and Frankfurt on the tourism market.

However, the demand for accommodation services by the domestic market slightly declined to 23.1% in February 2024, from 24.9% in January 2024. The demand for accommodation was primarily driven by leisure activities, accounting for 89.9% of the total demand. Business and conference activities accounted for 4.9% and 5.2% respectively.

3. Outlook

In celebration of Independence Day, Namibia Wildlife Resorts (NWR) announced a 60% discount on accommodations at all its locations across the country for March 2024. With these enticing offers, we foresee a boost in domestic tourism activities, which we believe will help maintain the positive momentum of the overall tourism sector in March 2024.

Figure 1: National Occupancy Rates, Namibia (February 2023-February 2024)

Source: H.A.N & HEI RESEARCH

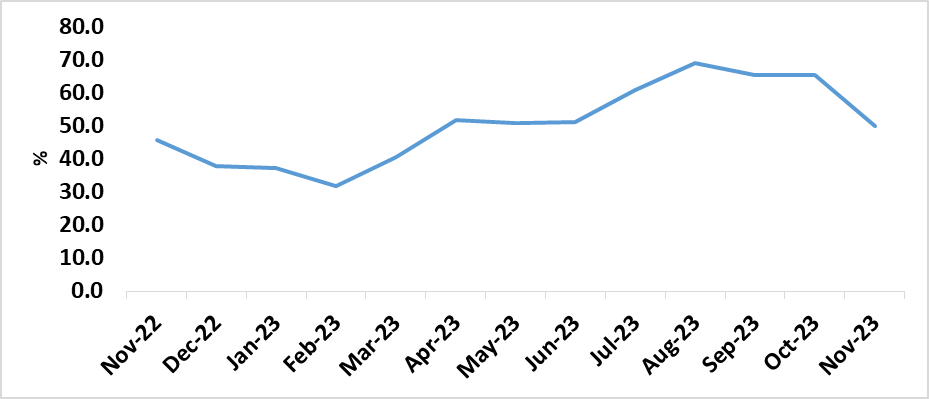

In November 2023, Namibia experienced a decline in national occupancy rates, dropping from 65% in October to 49%. This report provides an analysis of the regional variations in occupancy rates, highlights the year-on-year improvements, and discusses the impact of the COVID-19 pandemic on the tourism industry. Additionally, it explores the primary drivers of tourism activities, the contribution of the domestic market, and the role of international tourists.

Regional Analysis: Northern Region: The northern region recorded the highest occupancy rate in November 2023, reaching 51.4%, Coastal Region: The coastal region closely followed with an occupancy rate of 50.1%, Southern Region: The southern region had the lowest occupancy rate at 41.4%.

Yearly Improvements: The national occupancy rates for the 11 months averaged 52.2%, showcasing significant improvement compared to the average of 40.4% for the same period last year. This improvement can be attributed to the influx of investors visiting Namibia for green hydrogen pilot projects, particularly in coastal towns.

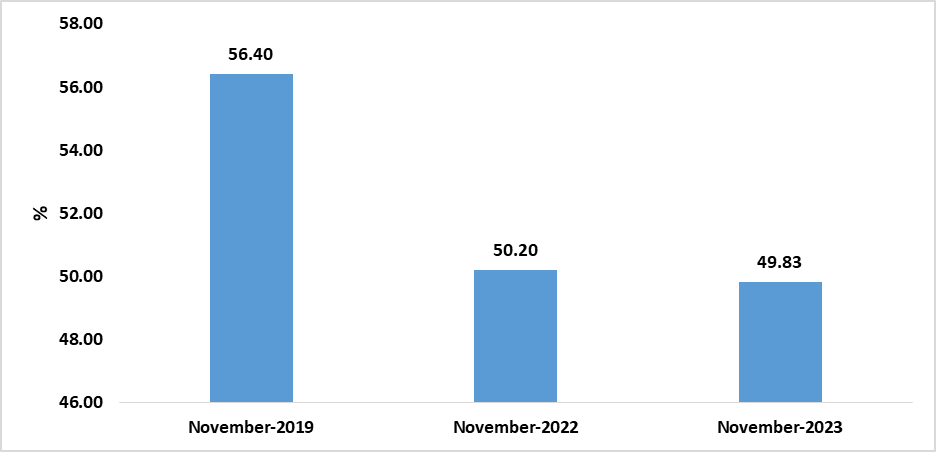

Comparison with Previous Years: November 2023 vs. November 2022: The national occupancy rate experienced a minimal decrease of 1% from 50.2% in November 2022, November 2023 vs. November 2019: The national occupancy rate saw a 7% decline from pre-pandemic levels, standing at 56.4%. This highlights that the tourism industry is still recovering from the impact of the COVID-19 pandemic.

Leisure Tourism vs. Business Travel: Leisure-related occupancy rates constituted a significant 98.9% in November 2023, showcasing a notable increase of 9.3% from October. On the other hand, the business travel segment accounted for only 1.0%, experiencing a decline from 9.9% in October.

Domestic Market Contribution: The domestic market contributed 15.8% to the national occupancy rates in November 2023, indicating a slight increase from October. However, this suggests subdued domestic tourism activities, emphasizing the need for incentives and initiatives to encourage domestic demand. Special travel packages, discounts, and promotional deals could enhance the appeal and affordability of domestic travel for residents.

Role of International Tourists: Key countries such as Germany, Switzerland, and Australia contributed to 48.4% of the total international occupancy demand in November 2023, showing a substantial increase from October. This highlights the growing dependence of Namibia's tourism sector on international arrivals, with a sustained positive trajectory throughout the year.

Outlook: Looking ahead, Namibia Wildlife Resorts (NWR) plans to kick off its Black Friday Specials from November 24 to November 30, 2023. These exclusive vouchers offer affordable opportunities for avid travelers to explore the country's diverse attractions. With these enticing specials, NWR aims to extend accessible options. We anticipate that the tourism sector will maintain its favorable trajectory for December 2023 as it is a festive season.

Conclusion: While November 2023 saw a decline in national occupancy rates, the overall trend indicates an improvement compared to the previous year. The report emphasizes the significance of international tourists, the need for domestic market incentives, and the upcoming Black Friday Specials as potential drivers for the tourism sector. As Namibia continues to fully recover from the impact of the COVID-19 pandemic on tourism, strategic measures should be implemented to ensure sustainable growth in tourism activities.

Figure 1: National Occupancy Rates, Namibia (November 2022- November 2023)

Source: H.A.N & HEI RESEARCH

Figure 2: National Occupancy Rates (%), Namibia (November 2019, November 2022 vs November 2023)

Source: H.A.N & HEI RESEARCH