The Bank of Namibia Monetary Policy Committee (MPC) is set to make its last announcement for 2023 regarding the interest rate decision on the 6th of December 2023. The MPC decided to keep rates unchanged at their last meeting in October 2023. That was their second unchanged MPC meeting. The repo rate currently stands at 7.75%, the highest it has ever been in the past 14 years.

Additionally, inflation in Namibia currently stands at 6.0%, up from 5.4% recorded in August 2023. Inflation pressures remain elevated, driven by food and non-alcoholic beverages, and transport. Other countries in the CMA continue to lag behind South Africa's repo rate of 8.25% and a real interest rate of 2.35%. The South Africa Reserve Bank kept its repo rate unchanged at 8.25% in its last meeting held in November 2023. This results in a spread of 50 basis points between Namibia and South Africa's repo rates (Figure 1).

Core inflation in South Africa fell to 4.4% from 4.5%, and Namibia’s core inflation remains unchanged at 4.9%, after months of raising prices in core components. This indicates subdued overall price pressures, providing a rationale for central banks to keep interest rates unchanged as a measure to stimulate spending and investment, supporting economic growth.

Our outlook is that the Bank of Namibia’s MPC will keep the repo rate unchanged at 7.75% to continue protecting the currency peg and to control inflation for price stability. We expect the interest rate pause to persist in the short term with possible cuts in the late first half of 2024

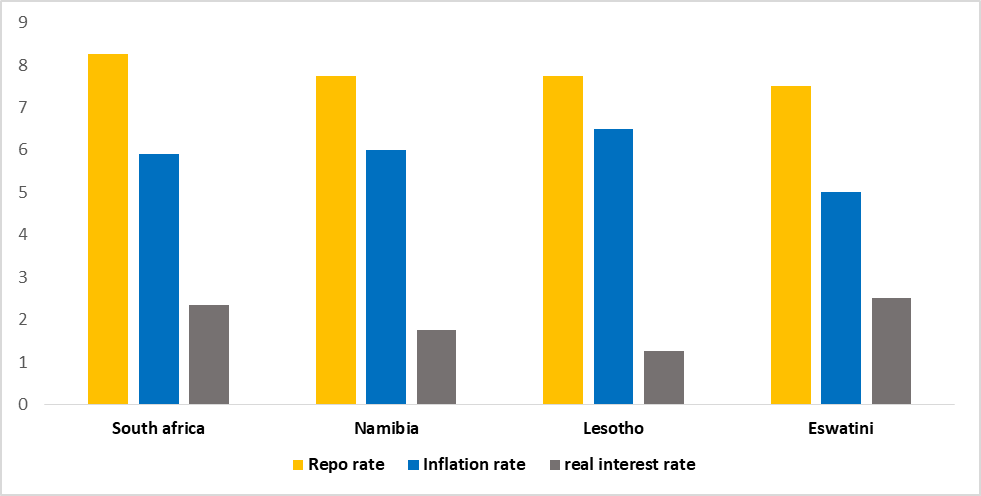

Figure 1: Repo and Interest Rates, CMA countries October 2023

Source: Respective Central Banks, Respective Statistics Agencies & HEI Research

The Bank of Namibia Monetary Policy Committee (MPC) is set to make its fifth announcement for 2023 regarding the interest rate decision tomorrow the 25th of October 2023. The MPC decided to keep rates unchanged at their last meeting in August 2023. That was their second unchanged MPC meeting. The repo rate currently stands at 7.75%, the highest it’s ever been in the past 14 years.

Additionally, inflation in Namibian currently stands at 5.4% from 4.7% recorded in August 2023. Inflation pressures remain elevated, driven by food and non-alcoholic beverages, and transport. Other countries in the CMA continue to lag behind South Africa's repo rate of 8.25% and a real interest rate of 2.85%. The South Africa Reserve Bank kept its repo rate unchanged at 8.25% in its last meeting held in September 2023. This results in a spread of 50 basis points between Namibia and South Africa's repo rates (Figure 1).

Core inflation in South Africa fell to 4.5% from 4.8% and Namibia remains unchanged at 4.9%, after months of raising prices in core components. This indicates subdued overall price pressures, providing a rationale for central banks to keep interest rates unchanged as a measure to stimulate spending and investment, supporting economic growth.

Figure 1: Repo and Interest Rates, CMA countries October 2023, (Eswatini inflation rate August 2023)

Source: Respective Central Banks, Respective Statistics Agencies & HEI Research

Our outlook is that the Bank of Namibia’s MPC will keep the repo rate unchanged at 7.75% to continue protecting the currency peg and to control inflation for price stability. We expect the interest rate pause to persist in the short term with possible cuts in the late first half of 2024.

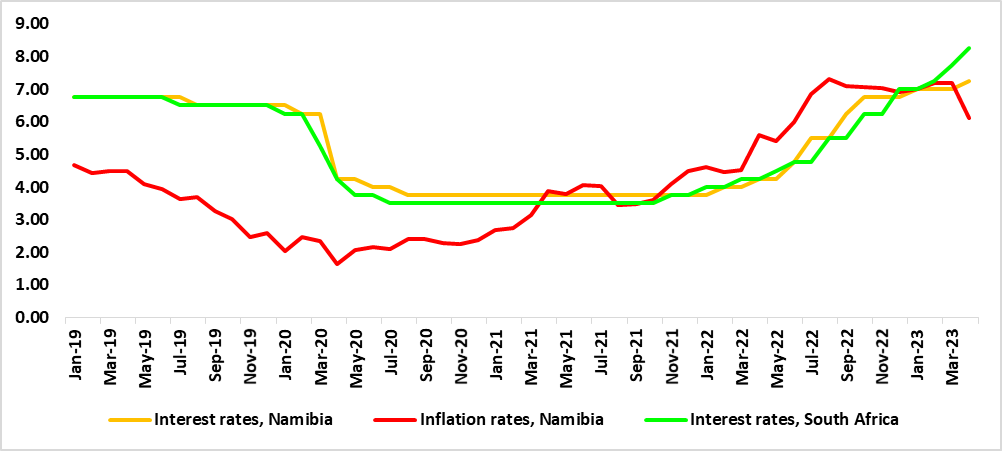

The Bank of Namibia Monetary Policy Committee (MPC) is set to make its third announcement for 2023 on the interest rate decision today the 14th of June 2023. The MPC increased the repo rate by 25 basis points during their second meeting on the 13th of April 2023, bringing the repo rate to 7.25%. Additionally, the South Africa Reserve Bank increased its repo rate by 50 basis points in its last meeting held in March 2023 bringing the repo rate to 8.25%. This translated into a spread of 100 basis points between Namibia and South Africa’s repo rates. (Figure 1)

Our outlook is that the Bank of Namibia’s MPC could increase the repo rate by 25 basis points to continue protecting the currency peg and to control inflation for price stability. We expect the interest rate hike cycle to persist in the short term. This is augmented by the lingering upside inflation risks in South Africa as food price inflation continues to be elevated, as the risk of drier weather conditions in coming months has increased. Load-shedding may additionally have broader price effects on the cost of doing business and the cost of living. Non-performing loans at the banks will rise as a result of the ongoing increase in interest rates. As such banks will start to take the variation in the rise in non-performing loans and the returns on interest rates into account.

Figure 1: Repo and Interest Rates, Namibia vs. South Africa (January 2019- April 2023)

Source: BoN & HEI Research

The South African bank’s monetary policy committee opted to increasing the repurchase rate by 0.25% to 7.25%. This decision was strongly motivated by finding the balance between inflation risks and the potential economic slowdown climate. The revised repurchase rate remains supportive of credit demand in the near term while raising rates to levels more consistent with the current view of inflation and its risks to it. The SARB’s MPC aims to anchor inflation expectations more firmly around the midpoint of the target band (3% -6%) which currently stands at 7.2%. The Governor of the Reserve Bank is of the view that this decision is aimed at maintaining the inflation target sustainably over time. Guiding inflation back towards the mid-point of the target band can reduce the economic costs of high inflation and enable lower interest rates in the future according to SARB. Economic and financial conditions are expected to remain more on the upside of risk for the foreseeable future.

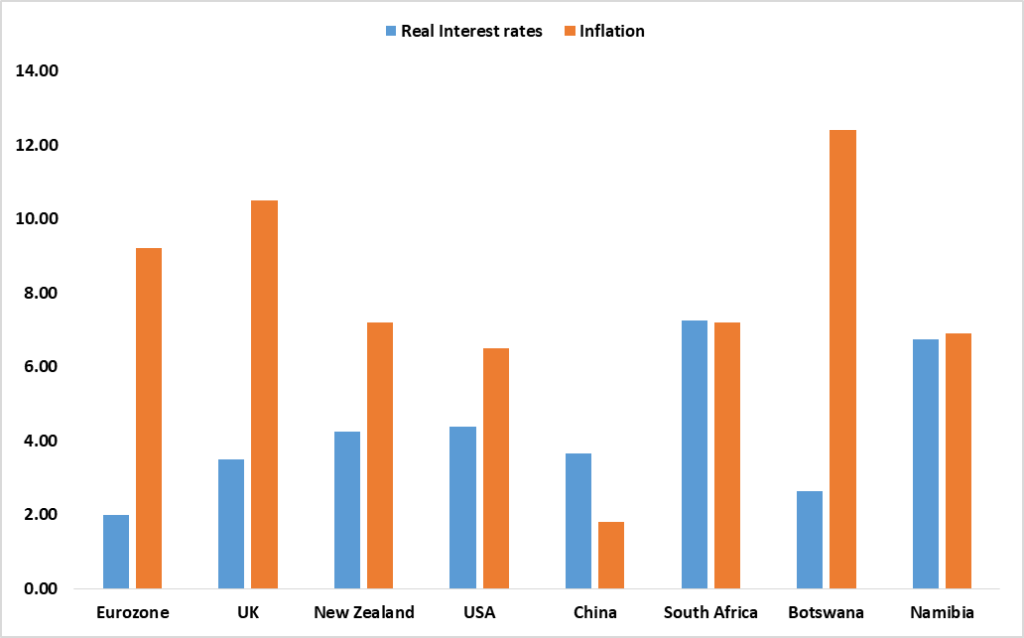

Figure 1: Global real interest rates vs. Inflation as at 27 January 2023

Source: COUNTRY’S STATISTICS AGENCY, CENTRAL BANKS & HEI RESEARCH

The Bank of Namibia Monetary Policy Committee (MPC) is scheduled to make its last announcement for 2022 on the interest rate decision tomorrow, the 30th of November 2022.

The committee increased the repo rate by 75 basis points to 6.25% in their last meeting held in October 2022. The MPC was of the view that the rate will continue safeguarding the peg arrangement and thus anchoring inflation expectations while meeting the country’s international financial obligations. South Africa’s reserve bank increased its repo rate by 75 basis points in their last meeting held last week, on the 24th of November 2022.

The Bank of Namibia MPC increased the repo rate by 250 basis points year to date while the South African Reserve Bank increased by 300 basis points

The repo rate currently stands at 6.25%. The Bank of Namibia’s MPC indicated that the repo rate remained supportive of credit demand in the near term, and they were of the view that hiking the rate will be more consistent with the current view of inflation risks.

Although inflation has shown signs of slowing down over the past 3 months ever since peaking at 7.3% in August 2022, the current inflation levels still remain significantly too high, with average annual inflation for 2022(January to October) standing at 5.9% compared to 3.6% recorded during the period in 2021.

Our outlook is that the MPC could increase the repo rate by 75 basis points following South Africa’s path. The decision will continue to contain the elevated global and domestic inflationary pressures, and the fragile economic recovery and maintain the need to safeguard the currency peg while meeting the country’s international financial obligations.

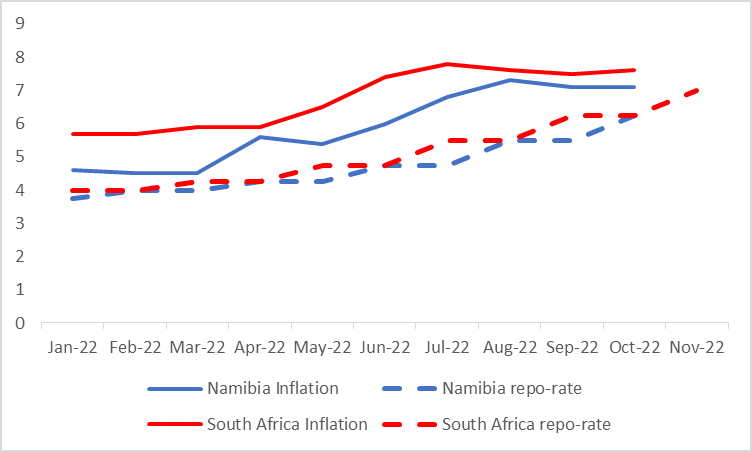

Figure 1: Repo Rates and Inflation Rates, Namibia vs. South Africa (January - November 2022)