2020 Economic Overview

Executive summary

The Namibian economy was

hard hit during 2020 due to the negative impact of COVID-19 pandemic. The domestic

economy contracted by 8.5% during 2020 from a contraction of 0.9% recorded in

2019. Real Gross Domestic Product (RGDP) declined to N$ 132.5 billion from N$ 144.8 billion

recorded for 2019. This was the deepest economic contraction since

independence.

The main contributors to the economy’s contraction were the

manufacturing sector, taxes on products, mining and quarrying, wholesale and

retail trade and the financial services activities sectors. Out of a total of

18 sectors of the economy only 6 sectors registered growth for the year 2020

and the rest of the 12 sectors recorded a decline with the hotels and

restaurants sector leading the pack followed by the transport sector (See

figure 1). The secondary industries recorded the greatest decline with 13.0%

followed by the tertiary industries with a decline of 5.7% and primary

industries contribution to GDP declined by 5.9%.

Namibia’s GDP is driven by the tertiary sector which was the main

contributor to the country’s economic growth. In a skills-constrained economy

like Namibia, the bias towards skills-intensive employment driven by

technological advancement has the unintended consequence of raising wage

premiums, which further entrenches inequality and contributes to rising

unemployment (See figure 2).

Analysis

The Hotels and the restaurants sector recorded the highest contraction

of 31.2% this was due to a lack of demand for accommodation services which

resulted from the lockdown restrictions imposed to contain the spread of

Covid-19 for the year 2020. The taxes on products sector recorded the second

highest contraction of 27.5%, this was due to reduced disposable income as a

result of retrenchments and job losses.

The transport sector recorded the third

highest contraction of 23.1%, this was due to the low demand for air transport

services as a result of local and international travel restrictions. The

manufacturing sector recorded the fourth largest contraction of 18.3%, this was

due to low production reported for processed zinc as a result of the closure of

the mine, low production of beverages as a result of the restriction on alcohol

sales and also a low production of meat (See figure 1).

The water and electricity sector recorded the highest growth of 19.5%,

this was driven by the growth in the electricity subsector due to good rainfall

received in the catchment areas. The information and communication sector

recorded the second highest growth of 17.4%, this was due to a high demand for

communication services. The agriculture forestry and fishing sector recorded

the third highest growth of 6.1%, this was driven by the growth in the crop

farming subsector as a result of good rainfall which resulted in good harvests

of cereal crops.

The health sector recorded the fourth largest growth of 4.5%,

this was driven by a high demand of health services due to Covid-19 (See figure

1 below). For the year 2020, the secondary industries recorded a decline of

13.0% from a growth of 2.2% recorded in 2019, this was driven by low growths

recorded in the manufacturing sector. The primary industries

recorded a decline of 5.9% from a decline of 6.9% recorded in 2019, the slight

growth was driven by the growth recorded

for the agriculture, forestry and fishing sector. Lastly the tertiary sector recorded a decline of 5.7%

from a growth of 1.1% recorded in 2019, this was driven by low growth recorded

in the transport sector, wholesale and retail sector and in the administrative

and support services (See figure 2 below).

Figure 1: GDP Growth per sector (2020)

Figure 2: Industries contribution to GDP (2019 & 2020)

Outlook

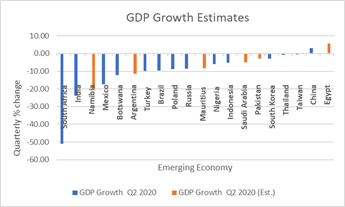

Economic prospects continue to diverge across countries and vaccine access has emerged as the principal fault line along which the global recovery deviates. The recovery, however, is not assured even in countries where infections are currently very low so long as the virus circulates elsewhere.

Economic policy has become health policy and the efficient roll-out of Covid-19 vaccines will continue to help flatten the curve. Additionally, the relaxed Covid-19 protocols gives an opportunity for the economy to open up. However, an active demand of policies that caters towards the rebuilding of the economy is highly advised.

Concerted, well-directed structural reforms can make the difference between a future of sustainable recovery for the Namibian economy or one with widening fault line, as many struggle with the health crisis while a handful see conditions normalize, albeit with the constant threat of renewed flare-ups but to pre-covid19 levels.