Key Highlights

- Global growth is projected at 3.1% in 2024 and 3.2% in 2025, a 0.2% higher than the October 2023 forecast.

- The forecast for 2024-25 is below the historical average of 3.8% due to elevated central bank policy rates to fight inflation, high debt, and low underlying productivity growth.

- Advanced Economies: Growth is projected to decline slightly from 1.6% in 2023 to 1.5% in 2024, before rising to 1.8% in 2025. This includes an upward revision of 0.1 percentage point for 2024 due to stronger-than-expected US growth, offset by weaker growth in the euro area.

- United States: Growth is projected to fall from 2.5% in 2023 to 2.1% in 2024 and 1.7% in 2025. This is due to the lagged effects of monetary policy tightening, gradual fiscal tightening, and a softening in labor markets.

- Euro Area: Growth is projected to recover from 0.5% in 2023 to 0.9% in 2024 and 1.7% in 2025. This recovery is expected to be driven by stronger household consumption as the effects of the shock to energy prices subside and inflation falls.

- United Kingdom: Growth is projected to rise modestly from 0.5% in 2023 to 0.6% in 2024, then to 1.6% in 2025. This is due to the waning effects of high energy prices and an easing in financial conditions.

- Japan: Growth is projected to decelerate from 1.9% in 2023 to 0.9% in 2024 and 0.8% in 2025, reflecting the fading of one-off factors that supported activity in 2023.

- Emerging Market and Developing Economies: Growth is expected to remain at 4.1% in 2024 and rise to 4.2% in 2025. This includes an upward revision of 0.1% for 2024 due to upgrades for several regions.

- Sub-Saharan Africa, growth is projected to rise from an estimated 3.3 percent in 2023 to 3.8 percent in 2024 and 4.1 percent in 2025, as the negative effects of earlier weather shocks subside and supply issues gradually improve. The downward revision for 2024 of 0.2 percentage points from October 2023 mainly reflects a weaker projection for South Africa on account of increasing logistical constraints, including those in the transportation sector, on economic activity.

- Global headline inflation is expected to fall to 5.8% in 2024 and 4.4% in 2025.

- Risks to global growth are broadly balanced with potential upside from faster disinflation and downside from new commodity price spikes and supply disruptions.

Figure 1: Global Real GDP growth rates, Annual % Changes (2005-2025)

Source: IMF, January 2024

- World trade growth is projected at 3.3% in 2024 and 3.6% in 2025, below its historical average growth rate of 4.9%.

- These forecasts are based on assumptions that fuel and nonfuel commodity prices will decline in 2024 and 2025 and that interest rates will decline in major economies.

- Policymakers' challenge is to manage the final descent of inflation to target, calibrate monetary policy, and adjust to a less restrictive stance.

- A renewed focus on fiscal consolidation is needed to deal with future shocks, raise revenue for new spending priorities, and curb the rise of public debt.

- More efficient multilateral coordination is needed for debt resolution, to avoid debt distress and create space for necessary investments, as well as to mitigate the effects of climate change.

Forces Shaping the Outlook

- The global economic recovery from the COVID-19 pandemic, Russia’s invasion of Ukraine, and the cost-of-living crisis is proving surprisingly resilient.

- Inflation is falling faster than expected from its 2022 peak, reflecting favorable supply-side developments and tightening by central banks.

- High-interest rates aimed at fighting inflation and a withdrawal of fiscal support amid high debt are expected to weigh on growth in 2024.

Growth Resilient in Major Economies

- Economic growth is estimated to have been stronger than expected in the second half of 2023 in the United States, and several major emerging market and developing economies.

- Inflation is subsiding faster than expected, reflecting favorable global supply developments.

- High borrowing costs are cooling demand, resulting in high mortgage costs, challenges for firms refinancing their debt, tighter credit availability, and weaker business and residential investment.

Fiscal Policy Amplifying Economic Divergences

- Governments in advanced economies eased fiscal policy in 2023.

- In emerging markets and developing economies, the fiscal stance is estimated to have been neutral.

- The fiscal policy stance is expected to tighten in several advanced and emerging markets and developing economies to rebuild budgetary room for maneuvering and curb the rising path of debt.

Risks to the Outlook

- Upside risks include faster disinflation, slower-than-assumed withdrawal of fiscal support, faster economic recovery in China, and artificial intelligence and supply-side reforms.

- Downside risks include commodity price spikes amid geopolitical and weather shocks, persistence of core inflation, faltering of growth in China, and disruptive turn to fiscal consolidation.

Policy Priorities

- As inflation declines toward target levels across regions, the near-term priority for central banks is to deliver a smooth landing.

- With fiscal deficits above prepandemic levels and higher debt-service costs, fiscal consolidation based on credible medium-term plans is warranted to restore room for budgetary maneuver.

- Intensifying supply-enhancing reforms would facilitate both inflation and debt reduction and enable a durable rise in living standards.

- Strengthening resilience through multilateral cooperation is vital for mitigating the costs of the separation of the world economy into blocs

Executive summary

Namibia’s economic performance in the third quarter of 2023 exhibited a resilient upward trend in economic activities, with notable increases in mining and quarrying, agriculture and forestry, and transport and storage. However, certain sectors faced challenges despite the overall economic recovery. South Africa’s economic landscape in the third quarter of 2023 deteriorated, with notable declines in five key sectors. After two consecutive quarters of growth, South Africa's Gross Domestic Product (GDP) contracted with the poor performance evenly spread between industries on the production side of the economy.

Analysis

Namibia

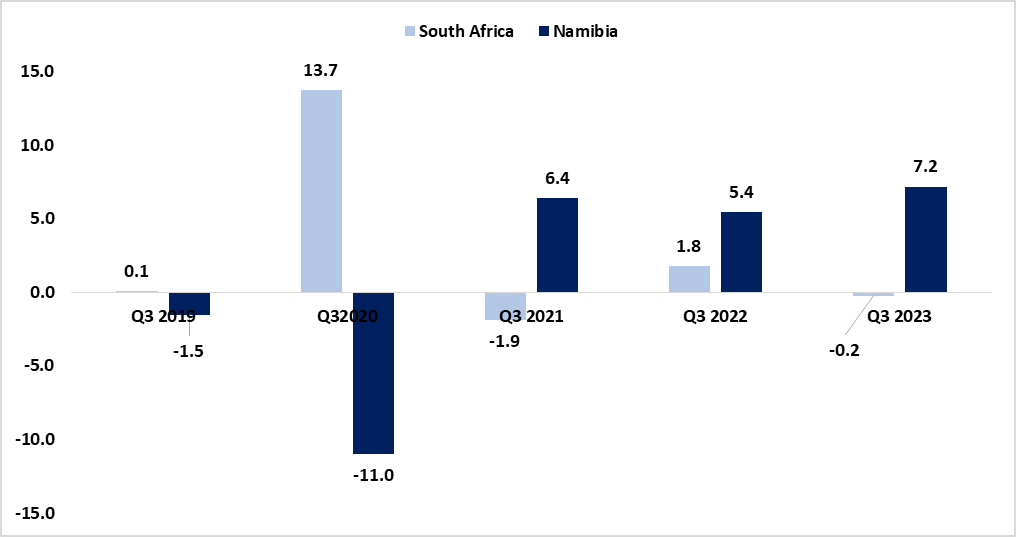

During the third quarter of 2023, the Namibian economy recorded a growth rate of 7.2% when compared to the 5.4% recorded in the corresponding quarter of 2022 (Figure 1). This quarter-on-quarter increase in economic performance was primarily driven by expansions in the following sectors.

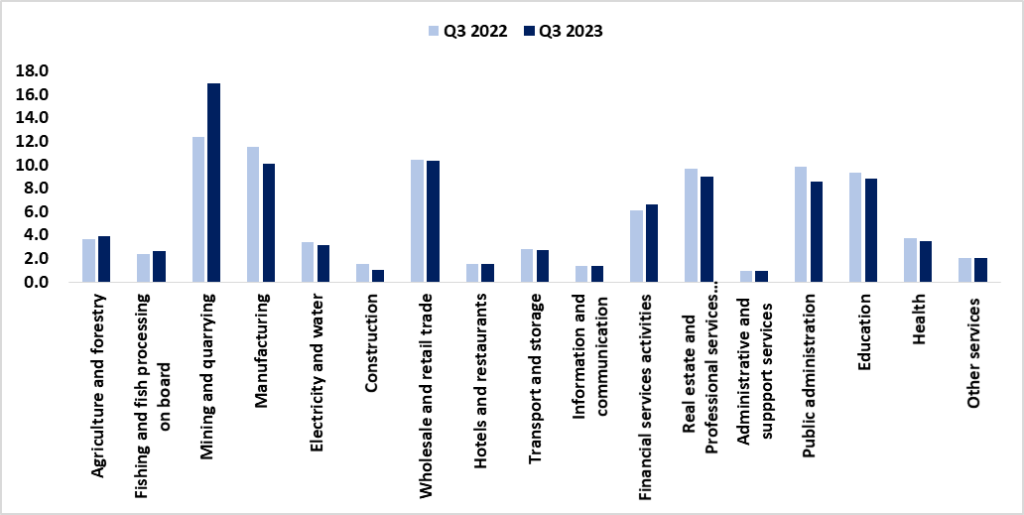

- Mining and Quarrying: The mining and quarrying sector recorded robust growth, marking 51.7% surpassing the 30.6% growth recorded during the same period in 2022. This growth is primarily attributed to activities in the mining of metal ores, uranium mining, and sustained investments in mineral exploration as oil and gas exploration activities pick up pace.

- Agriculture and Forestry: The agriculture and forestry sector registered an increase of 19.9%. The upsurge was primarily attributed to the livestock farming subsector, which experienced a growth of 25.6%. The increase was associated with improved livestock marketing during the period under review.

- Transport and Storage: The transport and storage sector posted a growth of 8.8% during the quarter under review, compared to a decline of 5.0% that was recorded in the corresponding quarter of 2022. The strong performance in transport was attributed to an increase in passenger and aircraft movement due to improved activities related to tourism.

On the downside, certain sectors recorded declines:

- Construction Activities: The construction sector registered a significant decline, with real value-added contracting by 30.6%. This poor performance was particularly evident in government expenditure on construction, which posted a contraction of 51.8%. The decrease was mainly due to the reduction in government spending on construction related to transportation infrastructure projects

- Manufacturing: The manufacturing sector exhibited a notable decline of 8.7%, which marked a significant downturn from the 11.2% growth recorded in the second quarter of 2022. The performance in the sector was mainly driven by the basic non-ferrous metals subsector which registered a decline of 74.4%, due to the maintenance shutdown experienced

- Health: The health and social work sector witnessed a 4.0% decline in contrast to the 8.5% decrease noted in the corresponding quarter of 2022. This performance was attributed to a reduction in employee compensation, stemming from fewer employees coupled with a decline in spending on goods and services

South Africa

During the third quarter of 2023, South Africa’s real GDP exhibited a decline of 0.2%, marking a notable deterioration compared to the robust 1.8% growth recorded in the corresponding quarter of 2022 (Figure 1). This quarter-on-quarter decline in economic performance was primarily driven by contractions in the following sectors.

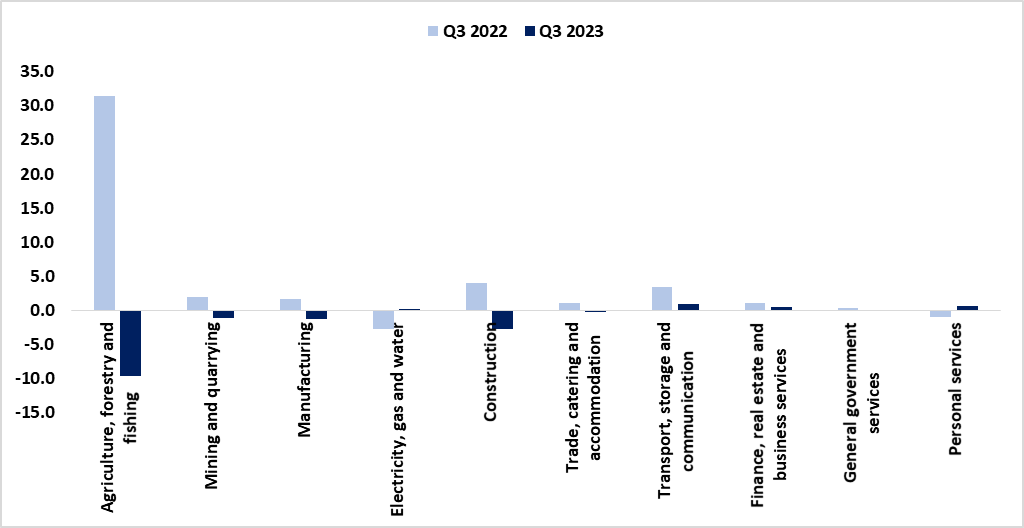

- Agriculture: The sector experienced a decline of 9.6% from a significant robust growth of 31.4% observed in the same quarter of 2022, negatively impacting GDP growth by -0.3%. This was primarily due to decreased economic activities reported for field crops, animal products, and horticulture products

- Manufacturing: The manufacturing sector exhibited a notable decline of 1.3%, which marked a significant downturn from the 1.6% growth recorded in the second quarter of 2022, contributing 0.1% to the overall GDP growth, with the food, beverages, and tobacco division making the largest contribution to the decrease in the third quarter

- Construction: During the second quarter of 2023, the industry saw a decline of 2,8% mainly due to decreases in residential buildings, non-residential buildings, and construction works

However, certain sectors recorded growth:

- The transport, storage, and communication: The industry recorded a growth rate of 0.9%, which, while positive, marked a deceleration compared to the 3.4% growth recorded in the corresponding quarter of 2022. The growth stemmed from increased economic activities that were reported for land transport, air transport, transport support services, and communications

- The personal services: Personal services increased by 0.6%, primarily due to improved economic activities in the education and health sector, contributing 0.1% to overall GDP growth

- The finance, real estate, and business services: The sector increased by 0,5% in the third quarter of 2023, contributing 0,1% to overall GDP growth. The growth was underpinned by increased economic activities in financial intermediation, real estate activities, and other business services

Figure 1: Namibia vs. South Africa GDP Growth rates (Q3 2019-Q3 2023)

Source: NSA, STATSSA & HEI RESEARCH

Figure 2: Namibia GDP by activity % change Quarter 3 2022 vs Quarter 3 2023

Source: NSA & HEI Research

Figure 3: South Africa GDP by activity % change Quarter 3 2022 vs Quarter 3 2023

Source: STATS SA & HEI Research

Outlook

Namibia

Namibia's economy has shown strong growth, especially in mining and agriculture, despite challenges in construction and financial services. The mining sector, fueled by diamond and oil and gas exploration, has been a major contributor. Agriculture has proven resilient, benefiting from increased livestock marketing. The construction sector faced setbacks, mainly due to reduced government spending on transportation infrastructure. However, positive developments like green hydrogen projects and infrastructure loans suggest a potential improvement in 2024. Risks remain, including uncertainties in the investment environment, slow progress in power generation, growing debt, global developments, high living costs, expensive imports, water supply interruptions affecting mining, and the persistent threat of drought. Despite these challenges, the outlook for 2024 seems promising due to strategic initiatives, financial commitments, and positive performance in key sectors, contributing to Namibia's overall economic resilience and growth potential.

South Africa

South Africa’s economy is facing mounting economic and social challenges. While South Africa’s electricity load-shedding has declined, domestic growth in the near term is likely to remain muted.

The longer-term economic outlook is, however, clouded by persistent risks to the inflation trajectory, the negative effects of climate change, outbreak of avian flu, unprecedented energy, and logistical constraints. Although domestic economic activity weakened the trajectory of GDP growth (and potential growth) going forward will be determined largely by the pace at which structural reforms in the energy and logistics sectors materialize. The SA Reserve Bank has forecasted South Africa’s GDP to grow to 1.2% and 1.3% in 2024 and 2025, respectively, due to an expected decrease in load-shedding.