Analysis

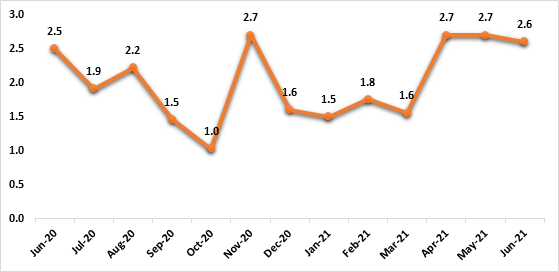

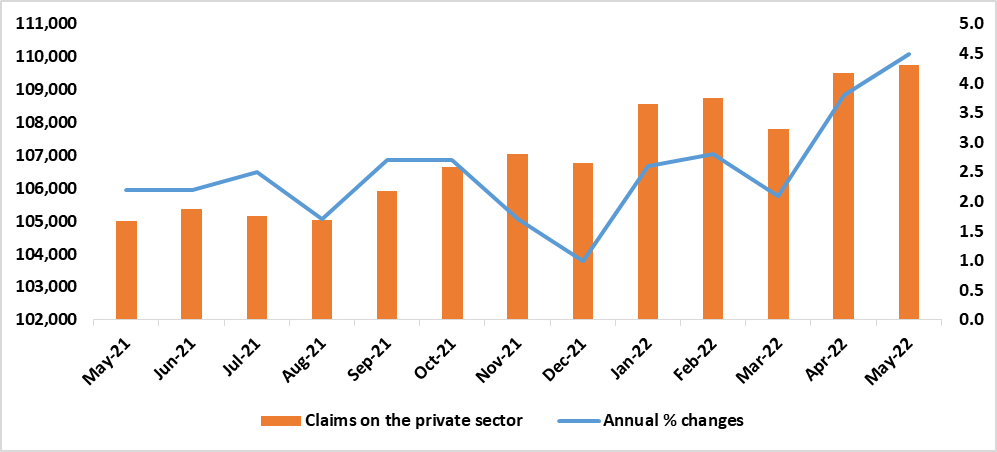

The total credit extended to the private sector (households and businesses) amounted to N$109.7 million in May 2022, with businesses and households taking up to N$46,889 million and 62,596 million respectively. (See figure 1 below). Total credit extended to the private sector recorded growth of 4.5% in May 2022 from 3.8% recorded in April 2022. This was driven by credit uptake for mortgages and other loan advances for households and growth recorded in the commercial and retail services sector as well as commercial rental property space for businesses. (BON, May 2022).

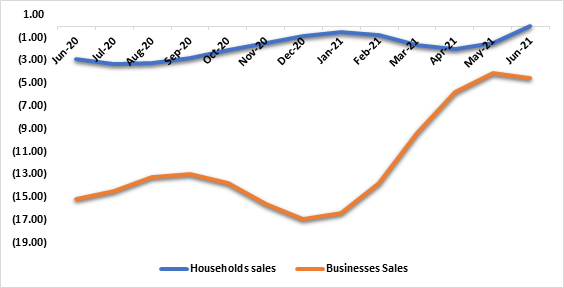

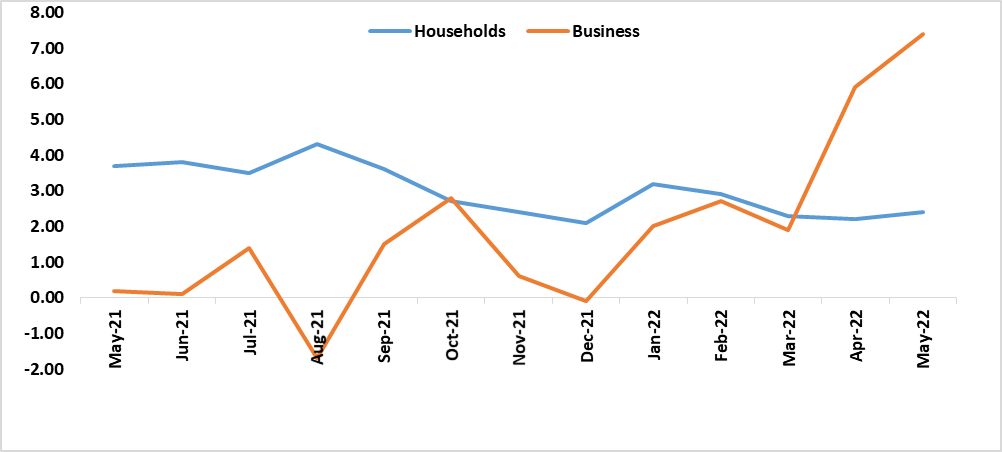

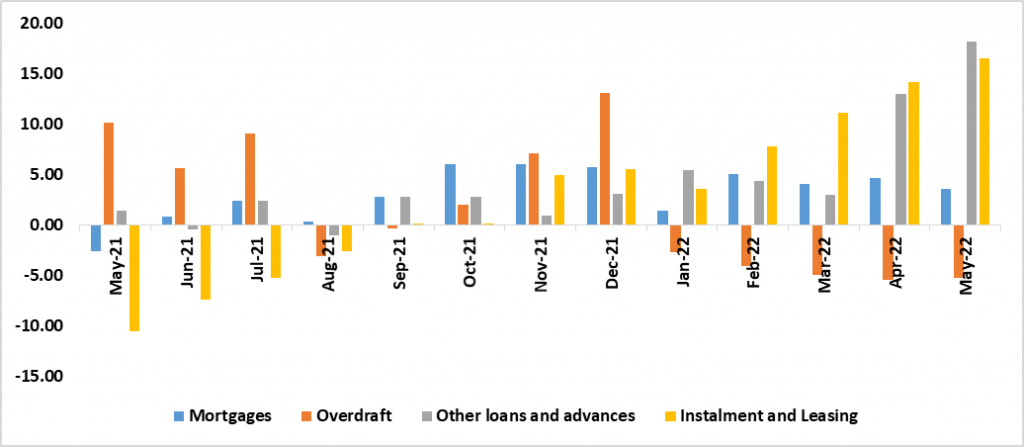

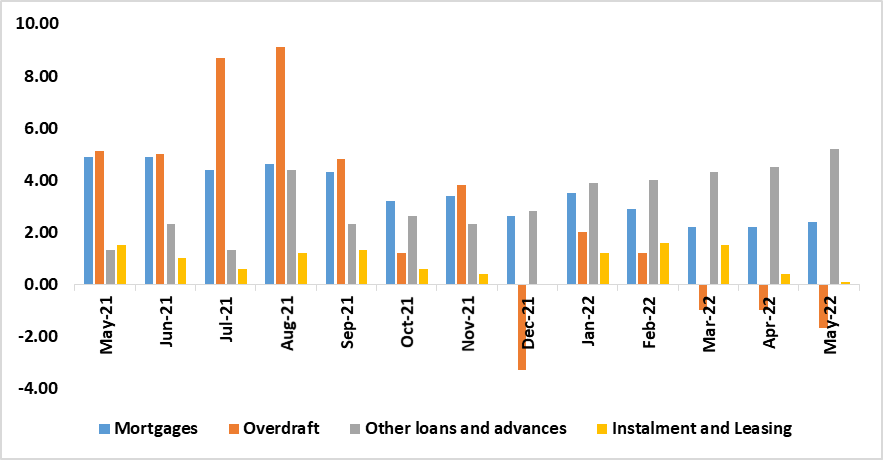

On an annual basis, Total credit extended to businesses recorded a growth of 7.4% from 0.2% that was recorded during the same period last year. The growth was mainly driven by the demand for credit for installment leasing and other loans and advances. (See Figures 2 & 3). Total credit uptake for households declined from 3.7% recorded in May 2021 to 2.4% for May 2022. The decline was driven by low demand for overdrafts and mortgages and installment and leasing. (See figure 2 &4) This could be influenced by the rise in interest rates and inflation that suppressed the demand for credit by households.

Figure 1: Total Credit Extended to the Private Sector vs. Annual % growth rates, (May 2021-May 2022)

Figure 2: Annual % changes on credit extended to by businesses and households, (May 2021-May 2022)

Figure 3: Credit extended to Businesses, Annual % changes (May 2021-May 2022)

Figure 4: Credit Extended to Household Annual % changes (May 2021-May 2022)

Outlook

Given the scope of the current economic climate, with rising interest rates and high levels of inflation the private sector credit extension will remain subdued in the short to medium term.