Analysis

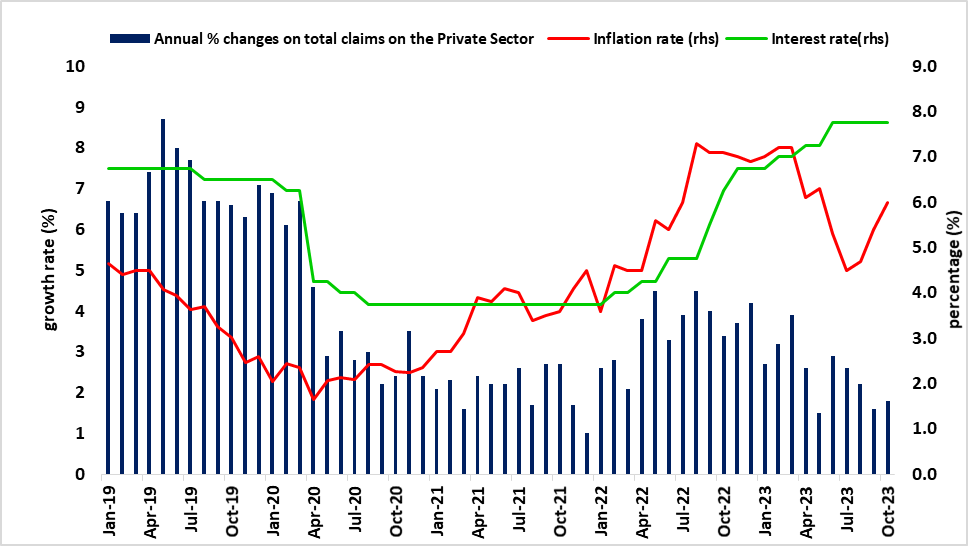

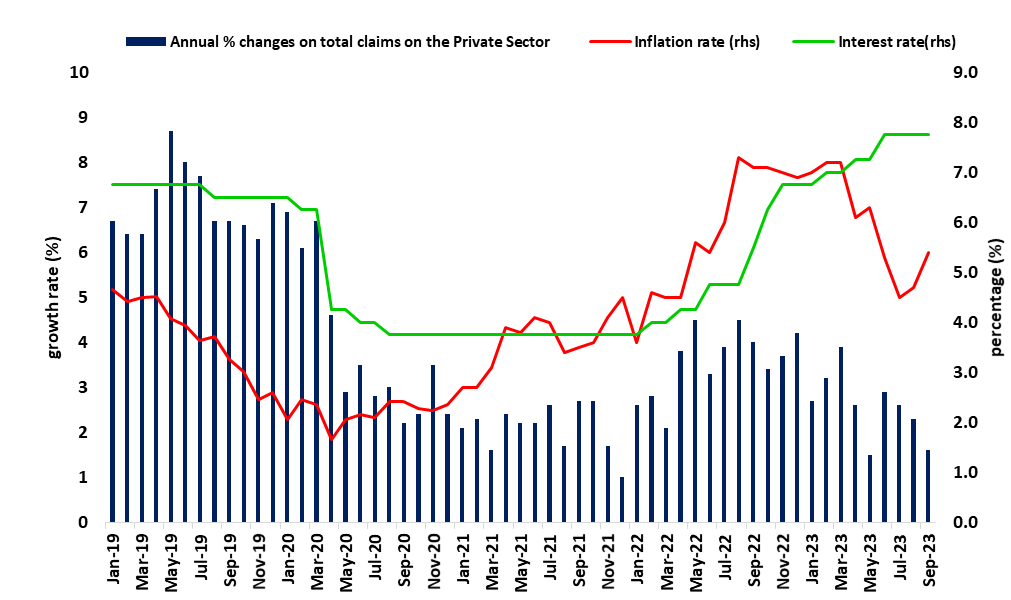

Total credit extended to the private sector (households and businesses) increased to N$ 119,320.3 million for October 2023 from N$118,943.7 million recorded in September 2023. This translated into a 0.3% monthly increase. The monthly increase was influenced by an increase in credit extended to households as a result of an increased demand for loans and loans and advances mainly the overdrafts. However, monthly declines were observed across almost all credit subcategories for the business category except for the other loans and advances installment and leasing credit, which exhibited a monthly increase of 1.0%. Figure 1

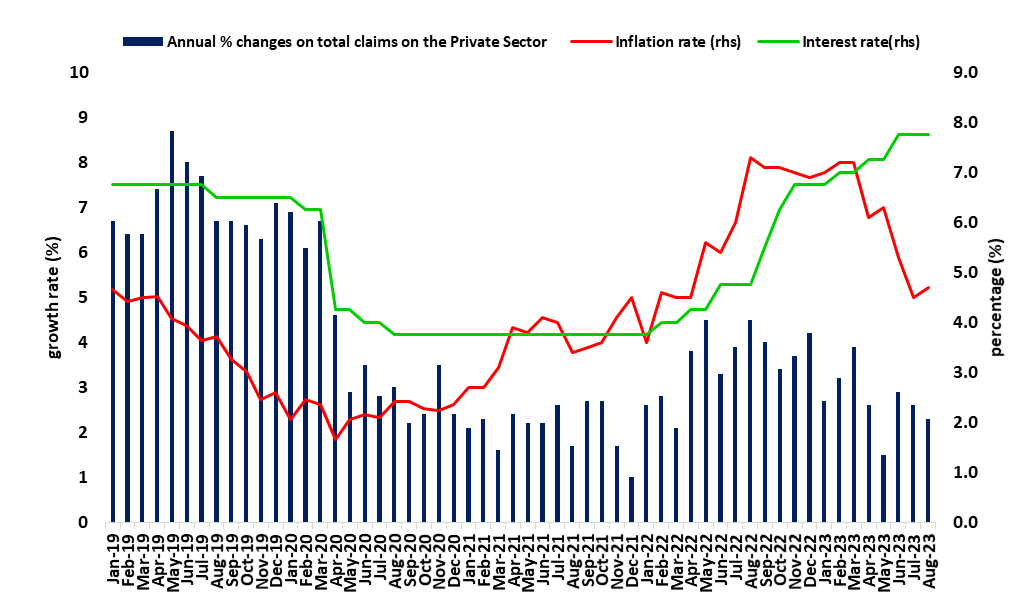

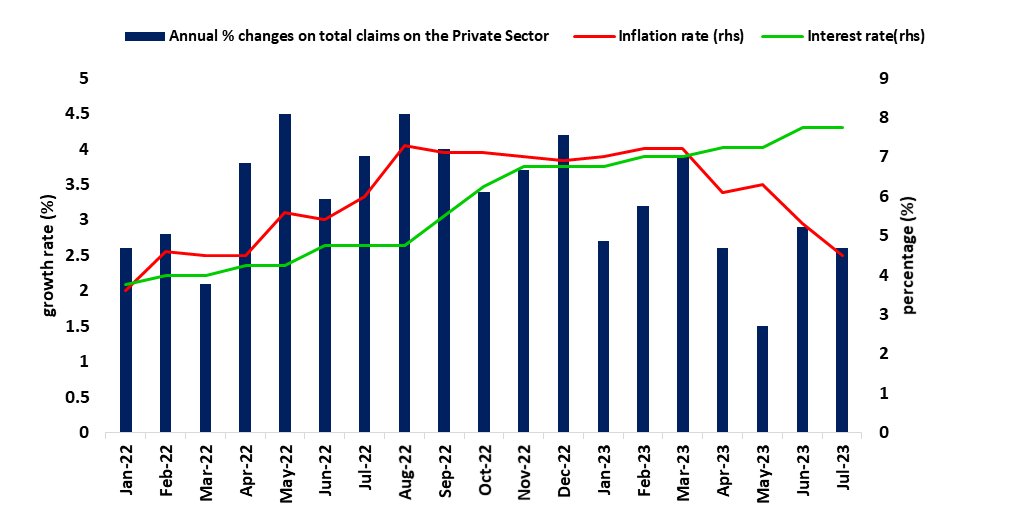

On an annual basis, the Private Sector Credit Extension (PSCE) recorded a growth rate of 1.8%, down from the 1.6% growth rate recorded at the end of September 2023. The slight increase in the growth of PSCE emanated from an increase in overdraft credit mainly by the household sector during the review period. In contrast, total credit extended to the business sector continued to decline during the period under review. Figure 2

Figure 1: Annual % PSCE vs. Repo Rate & Interest Rate, (January 2019- October 2023)

Source: BON, NSA & HEI RESEARCH

Credit to Households

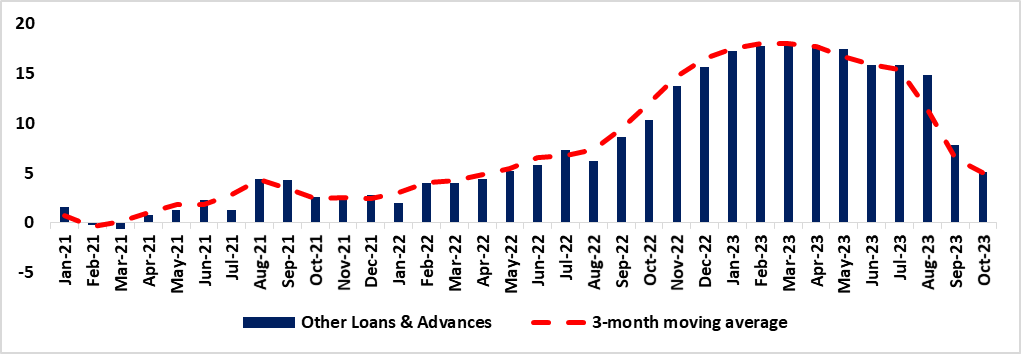

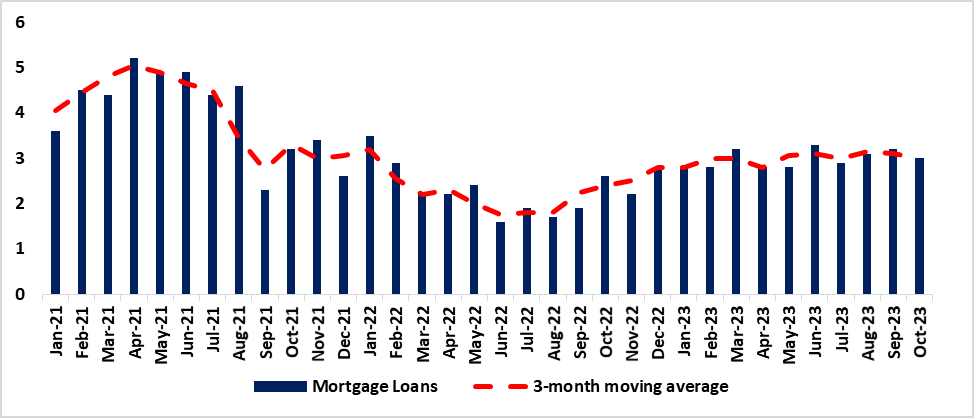

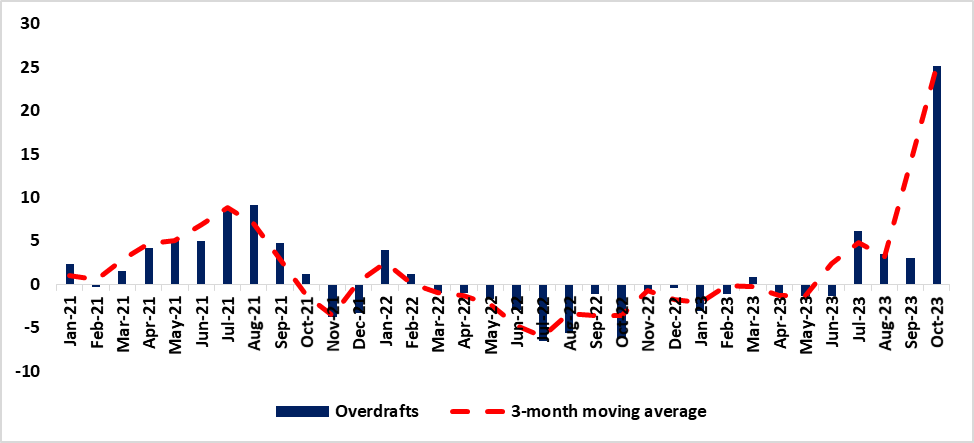

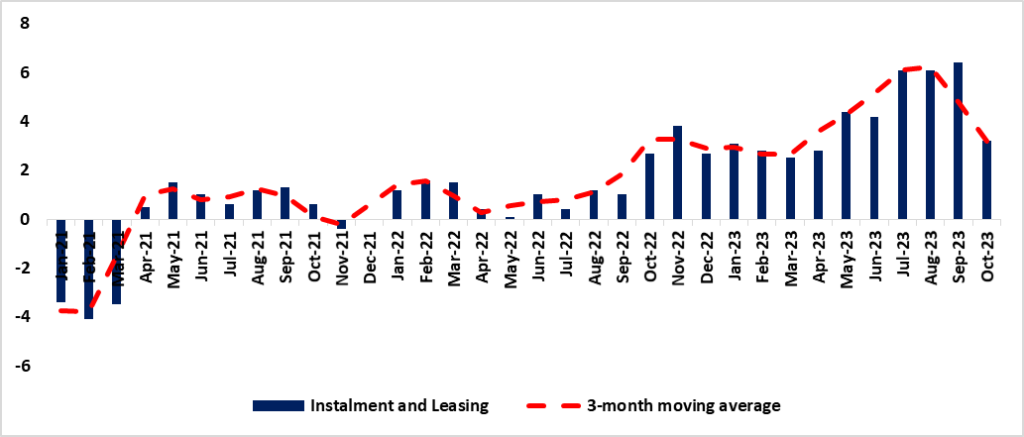

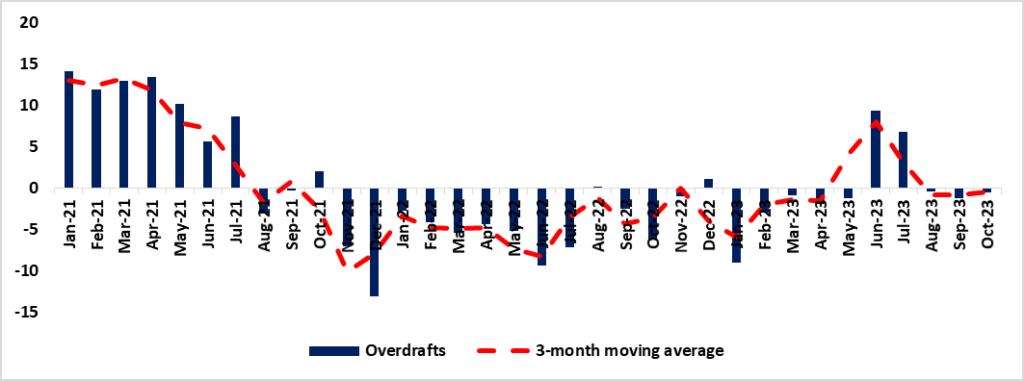

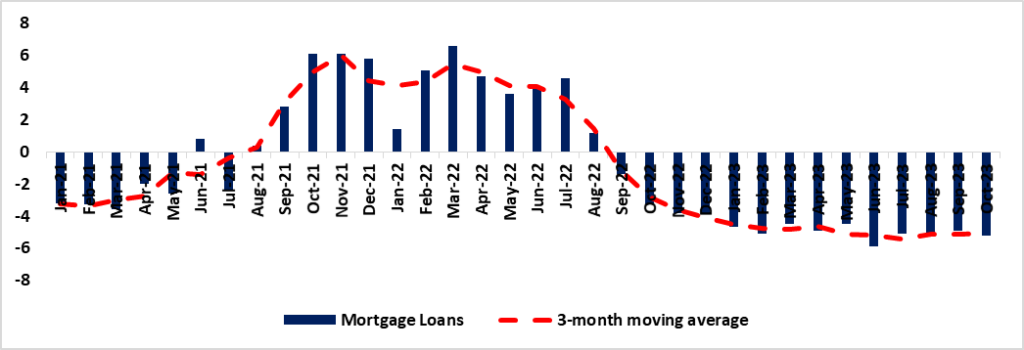

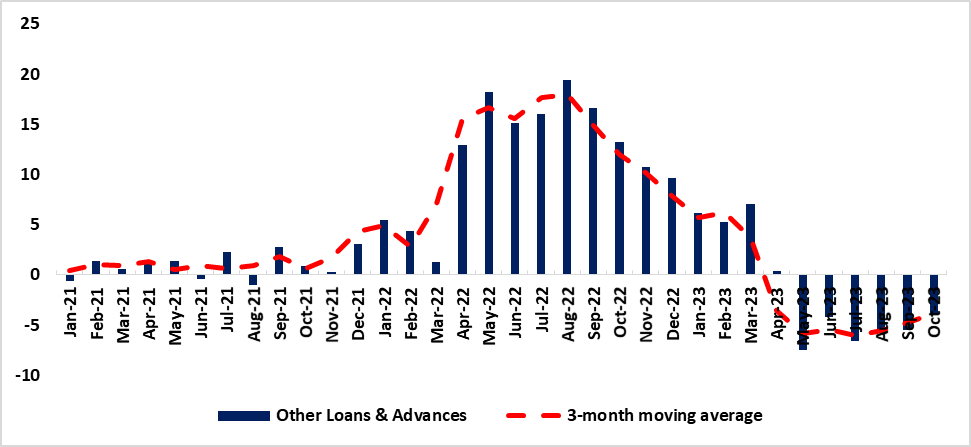

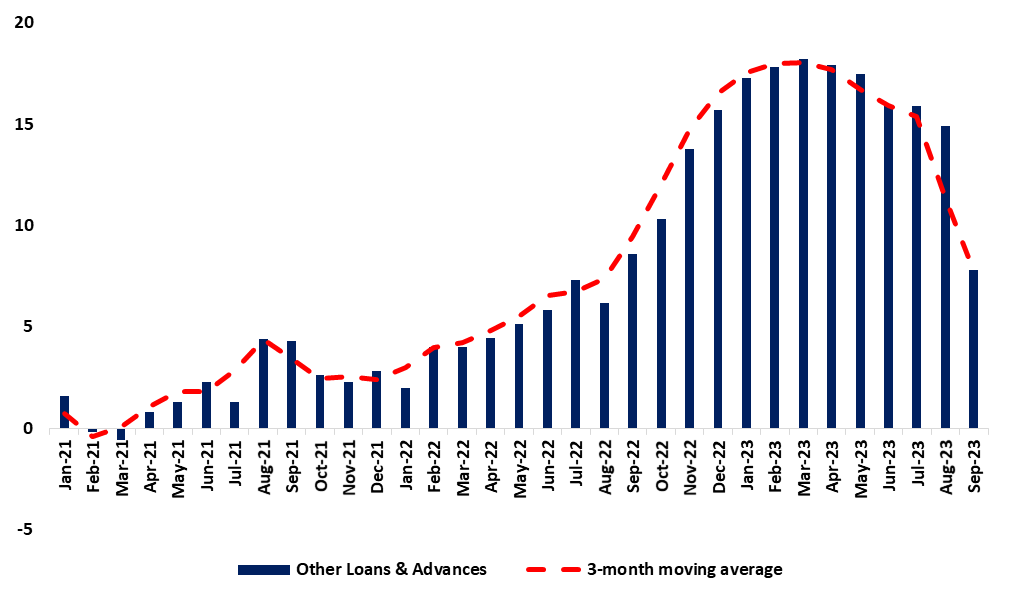

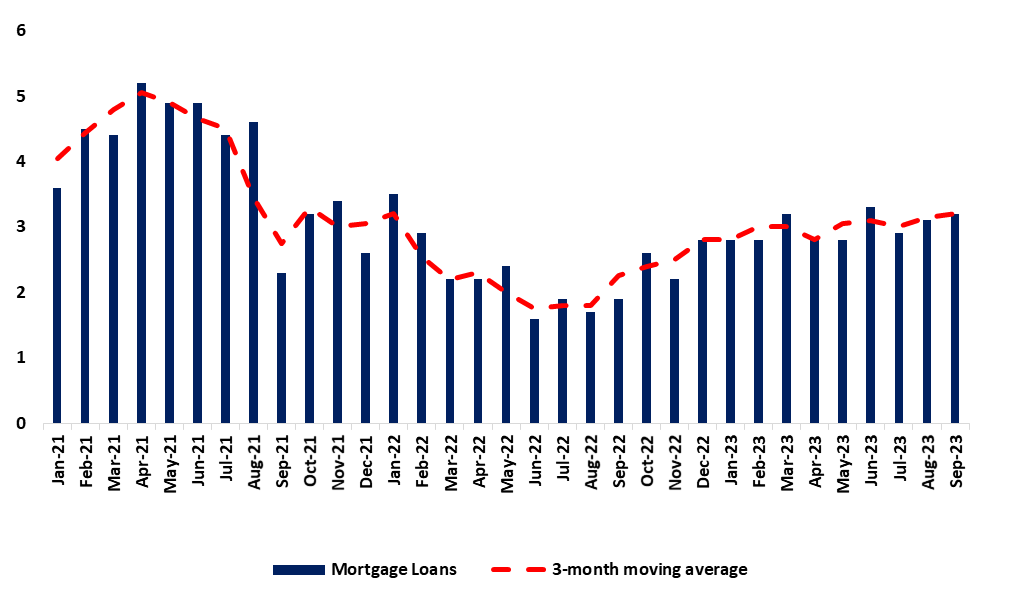

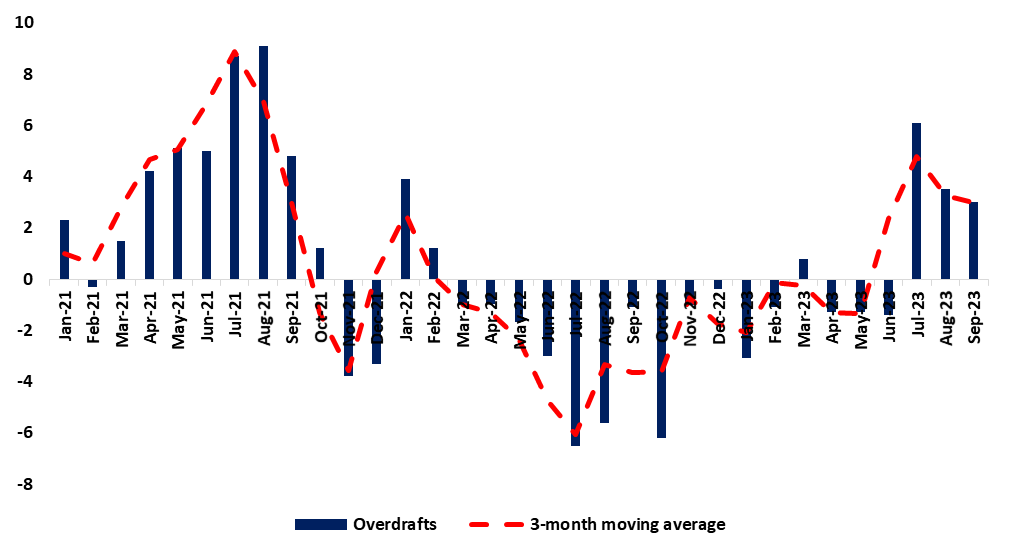

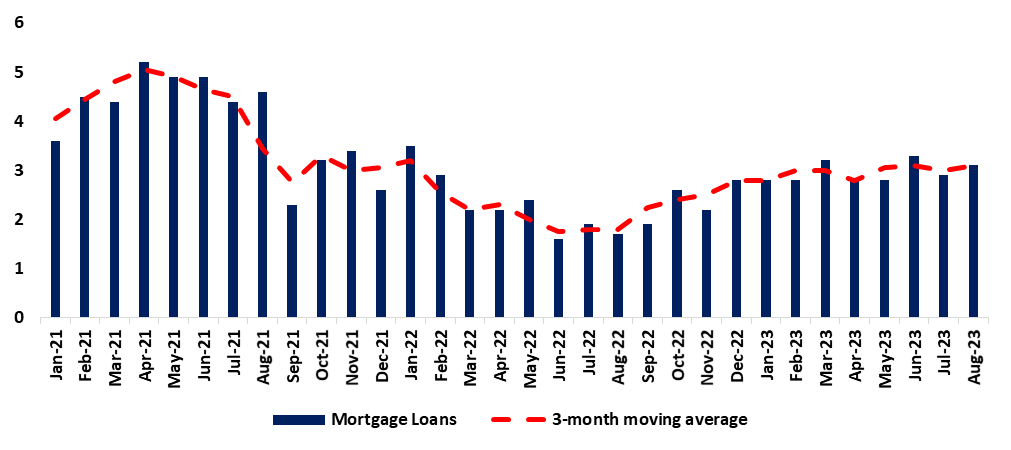

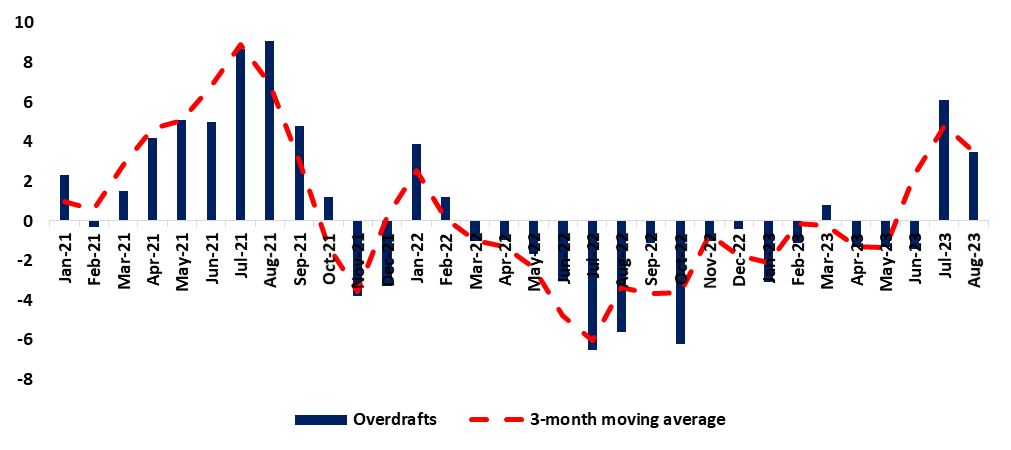

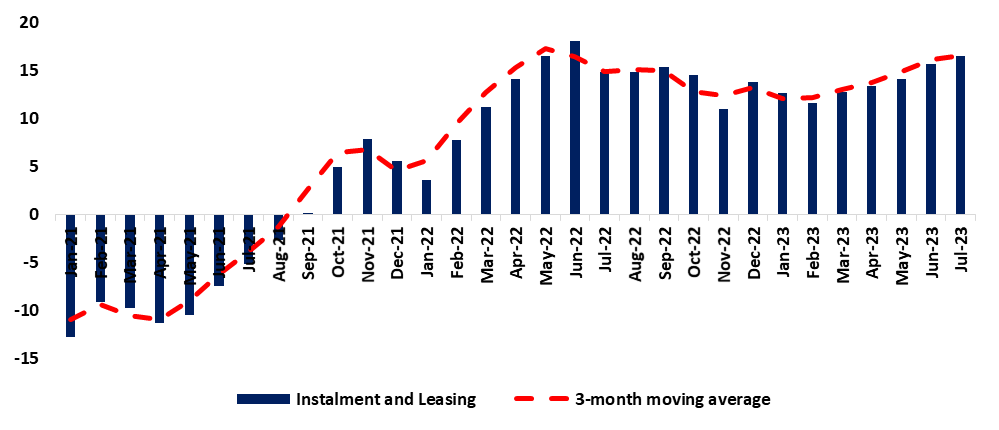

In October 2023, the credit extended to households reached N$ 66,427.1 million, indicating a growth compared to the N$ 65,967.9 million recorded in September 2023, reflecting a monthly increase of 0.7%. The upswing was predominantly propelled by a 1.0% expansion in the loans and advances category. The surge in this category was attributed to notable increases in sub-categories such as overdraft, which escalated from 3.0% to 25.1%, while other loans and advances experienced a decline from 7.8% to 5.1%. Concurrently, mortgage loans observed a decrease from 3.2% to 3.0% (refer to Figures 2, 3, and 4). Furthermore, the installment and leasing category witnessed a decline from 6.4% to 3.4% (Figure 5)

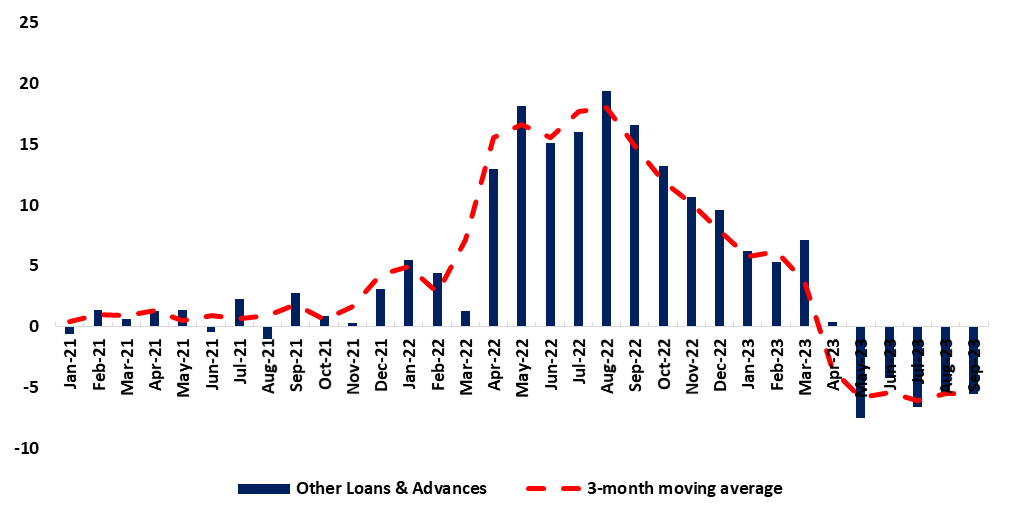

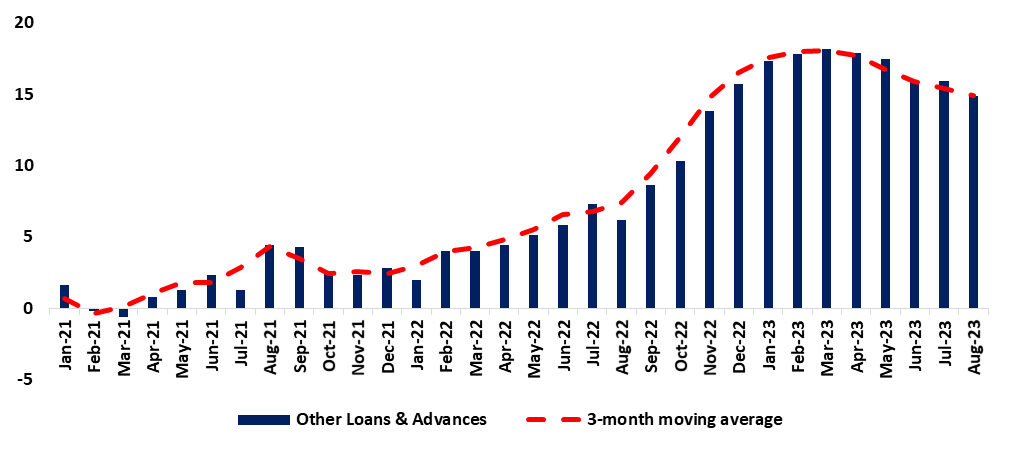

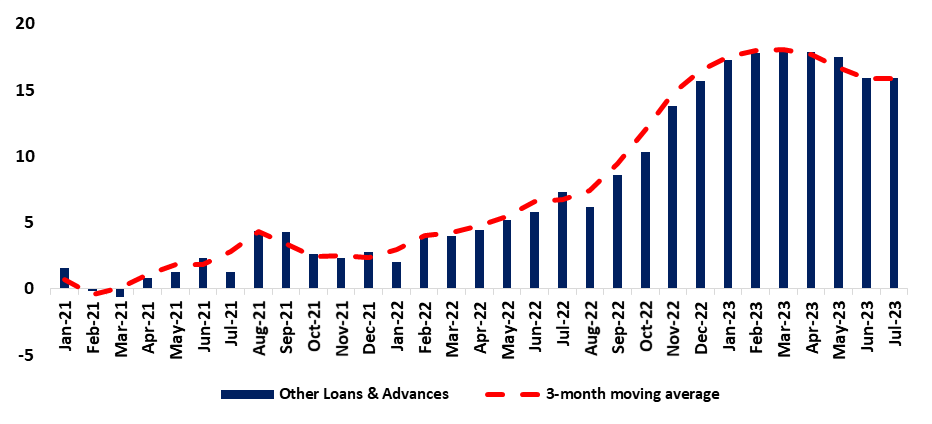

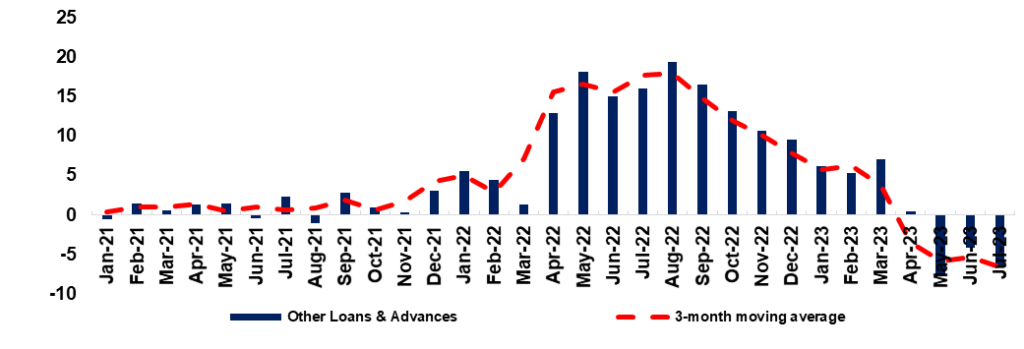

Figure 2: Other loans and advances, (January 2021- October 2023)

Source: BON & HEI RESEARCH

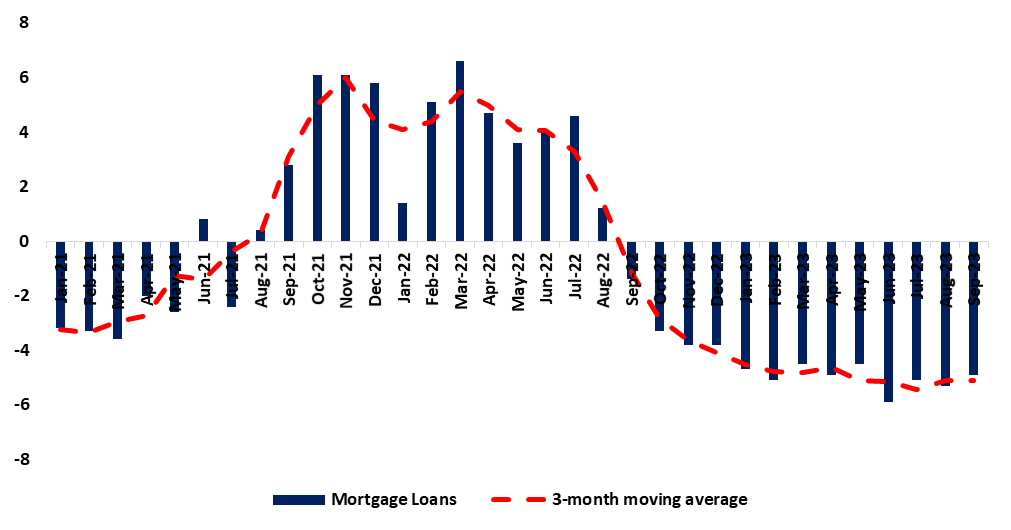

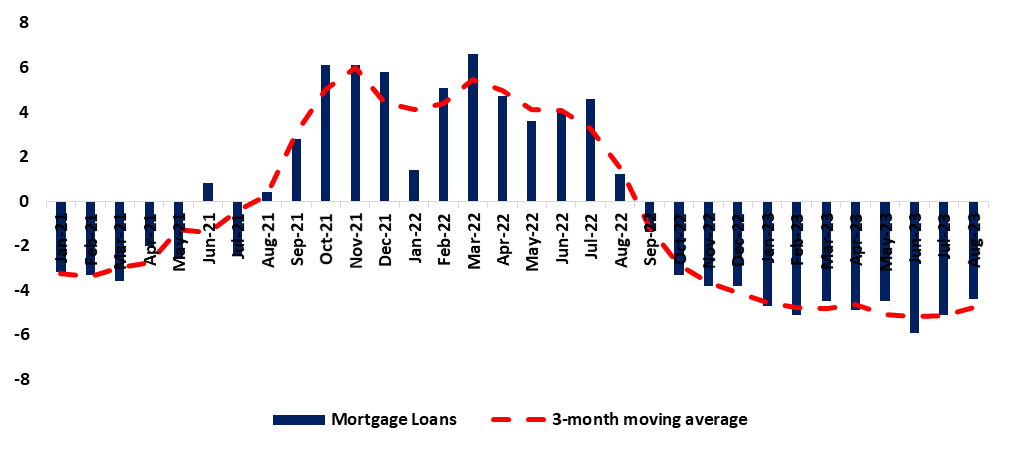

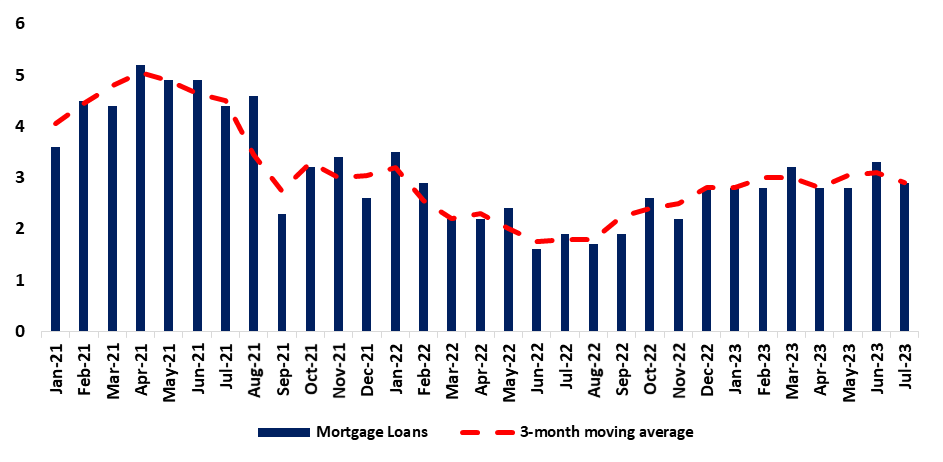

Figure 3: Mortgage, (January 2021- October 2023)

Source: BON & HEI RESEARCH

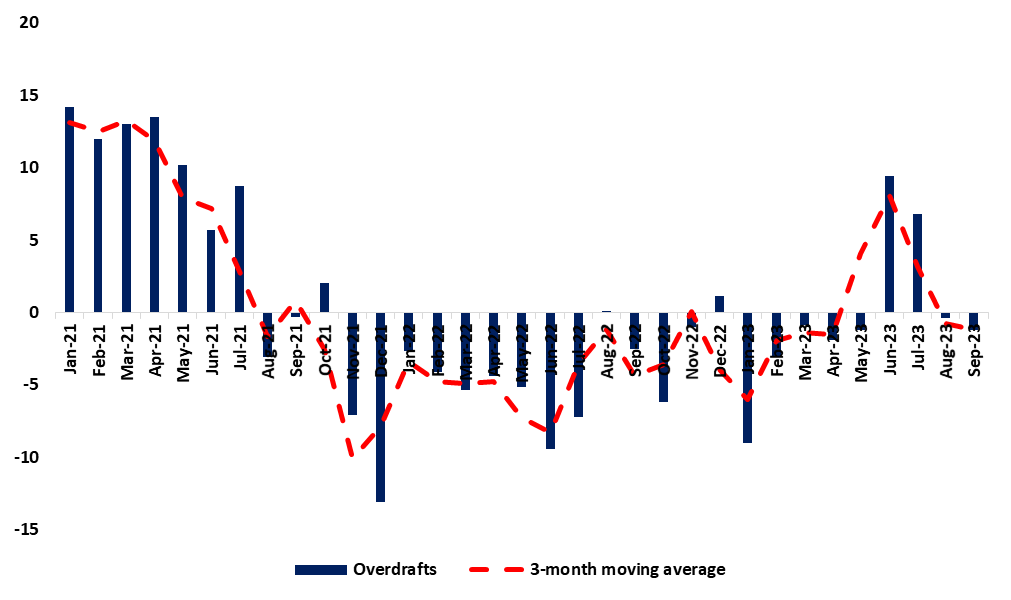

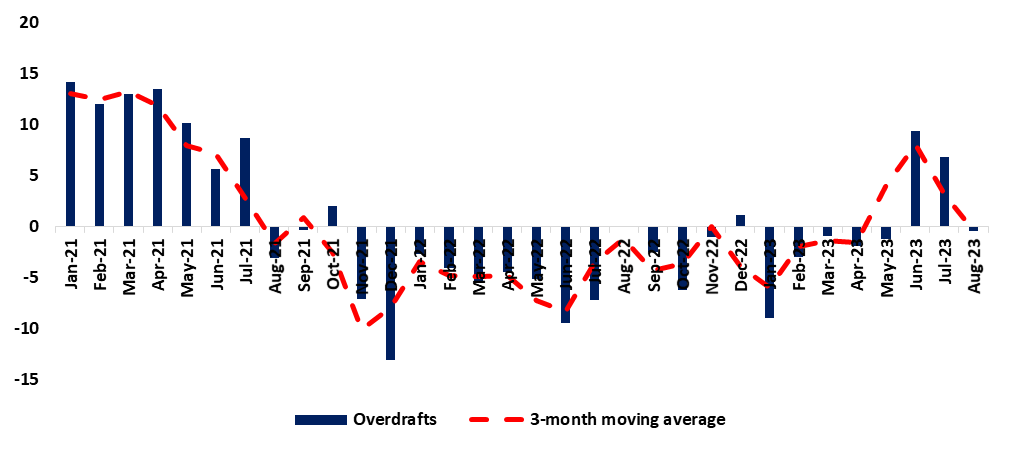

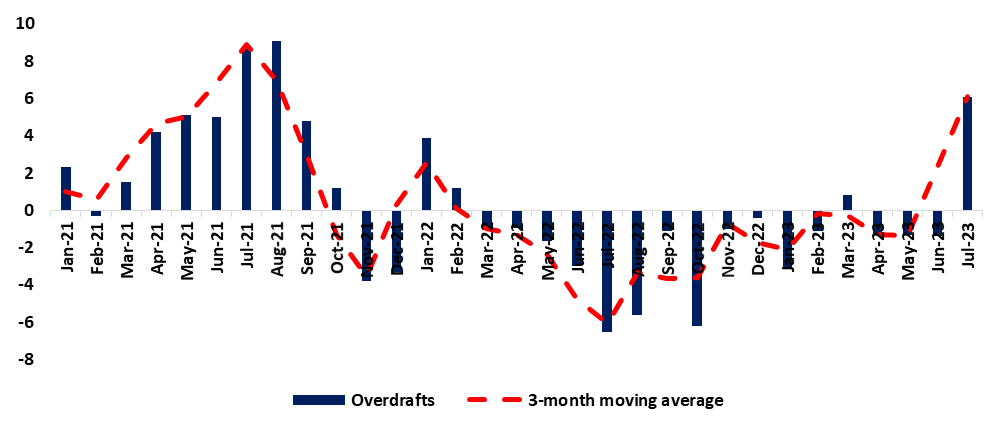

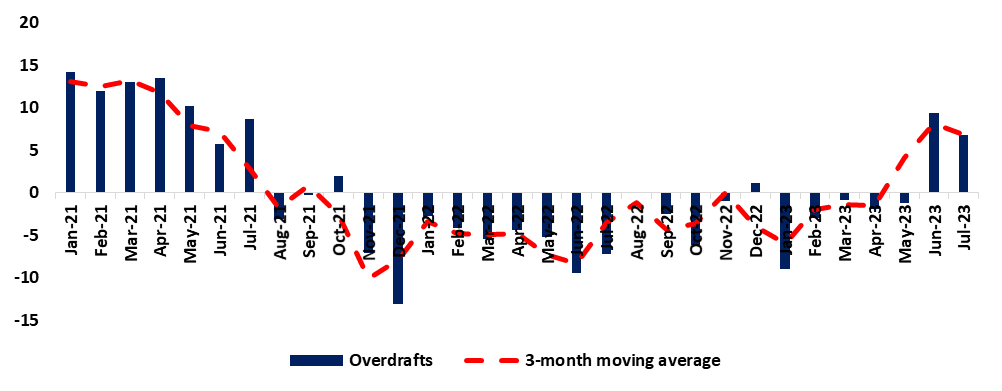

Figure 4: Overdrafts (January 2021- October 2023)

Source: BON & HEI RESEARCH

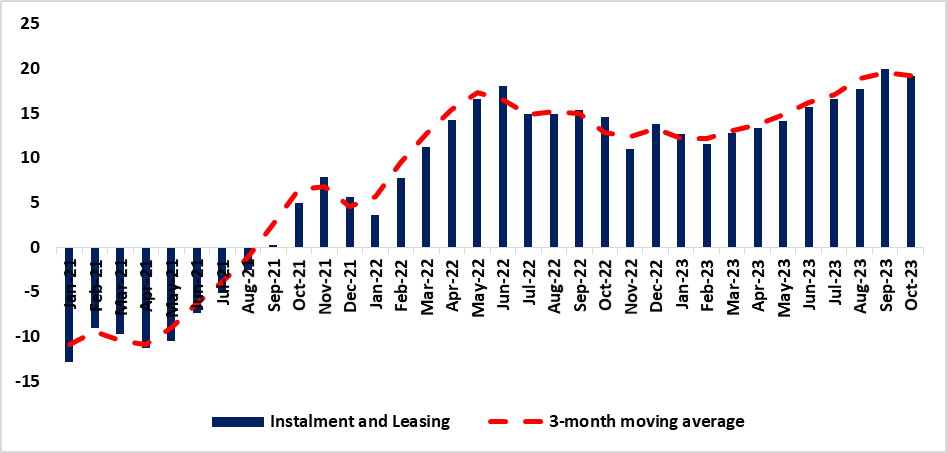

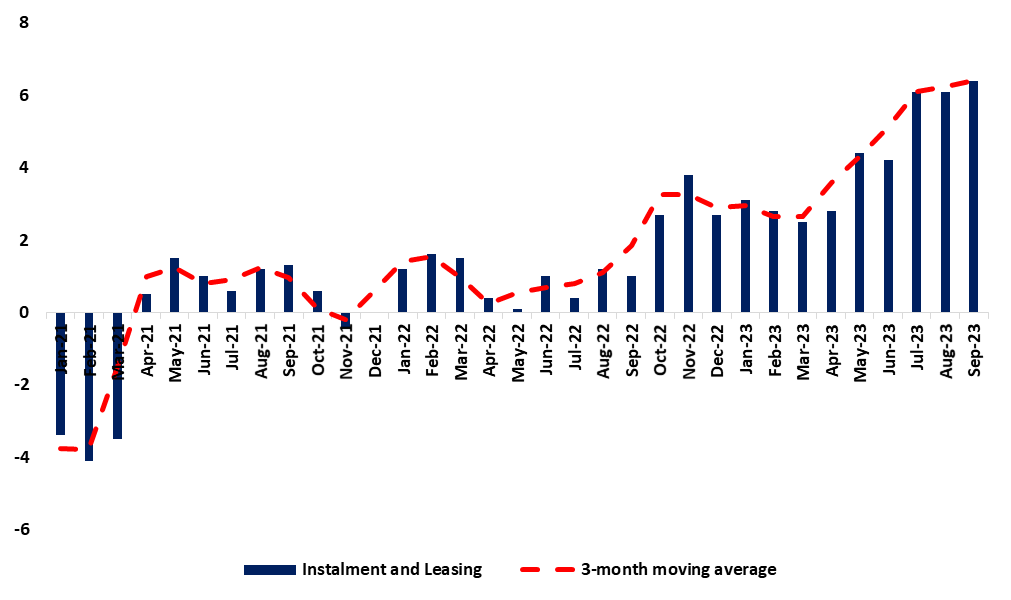

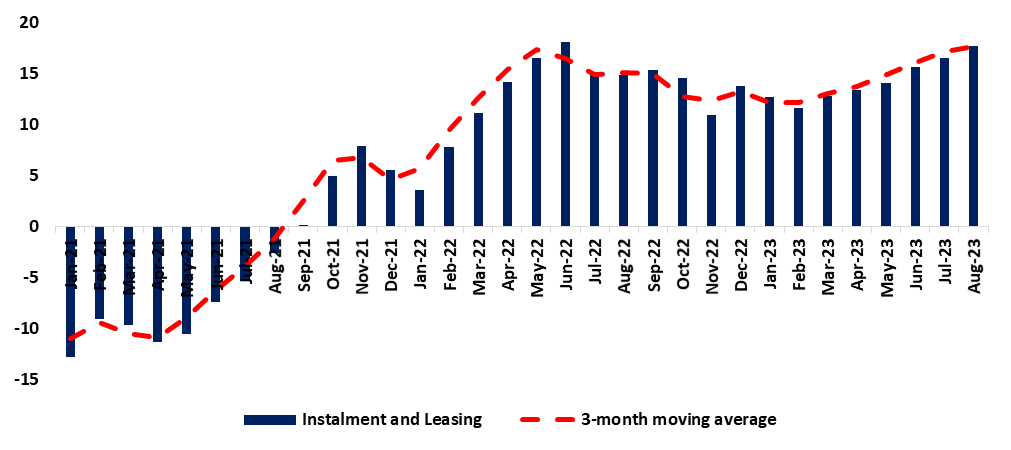

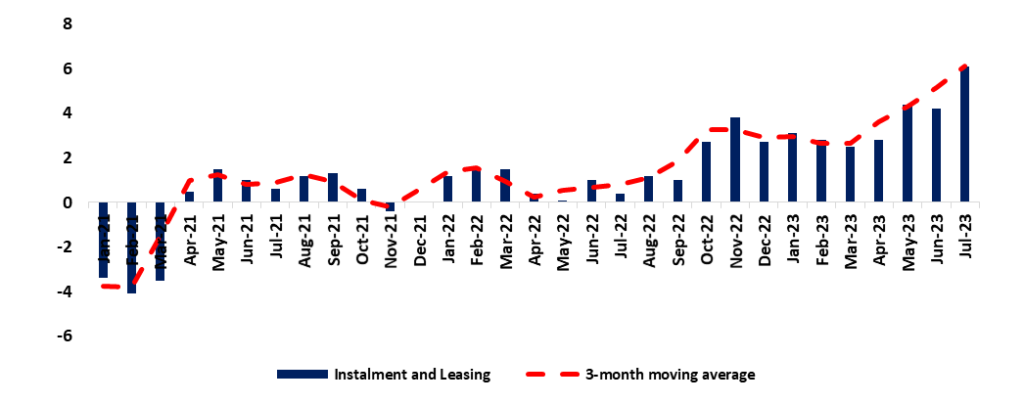

Figure 5: Instalments and Leasing, (January 2021- October 2023)

Source: BON & HEI RESEARCH

Credit to Businesses

During the month of October 2023, a 1.4% contraction in credit extended to businesses, representing a milder decline compared to the 2.1 percent recorded in September 2023. This marks the seventh consecutive month of negative growth in credit to businesses. In actual numbers total credit extended to businesses amounted to N$ 45,182.5 million, reflecting a slight decrease from the previous month's figure of N$ 45,281.7 million. This reduction primarily stemmed from declines in both the loans and advances category (from 4.9% to 5.2% month-on-month) and the installment and leasing category (from 20.0% to 19.2% month-on-month), primarily influenced by reduced demand for credit in those categories, additionally corporate entities in the financial sector contributed to the negative growth through net repayments in mortgage and overdraft credit

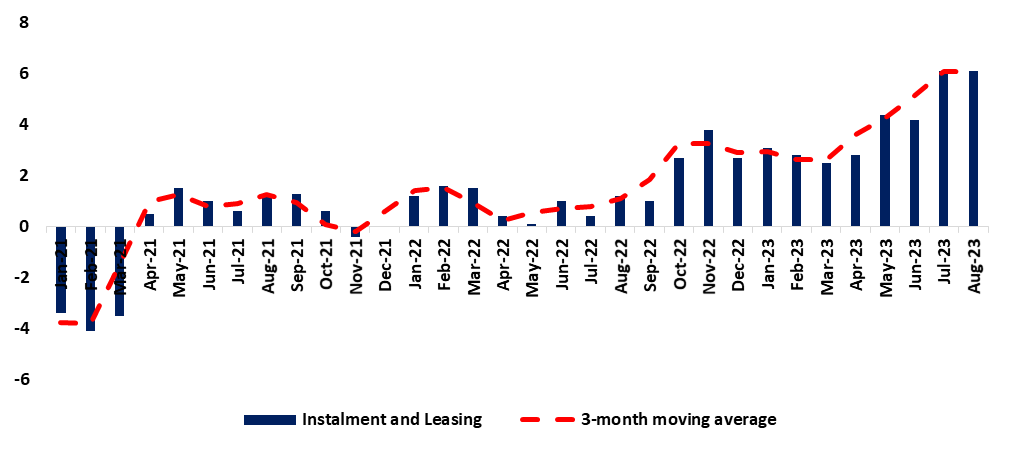

Specifically, within the loans and advances category, there was a notable decrease of 1.7% in other loans and advances, while the sub-category of overdrafts experienced a modest increase of 0.8% month-on-month. (Refer to Figures 5, 6, 7& 8).

Figure 5: Overdrafts, (January 2021- October 2023)

Source: BON & HEI RESEARCH

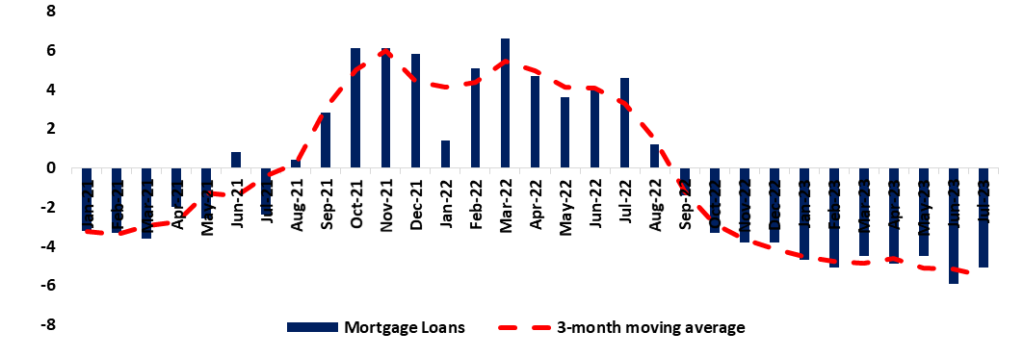

Figure 6: Mortgage, (January 2021- October 2023)

Source: BON & HEI RESEARCH

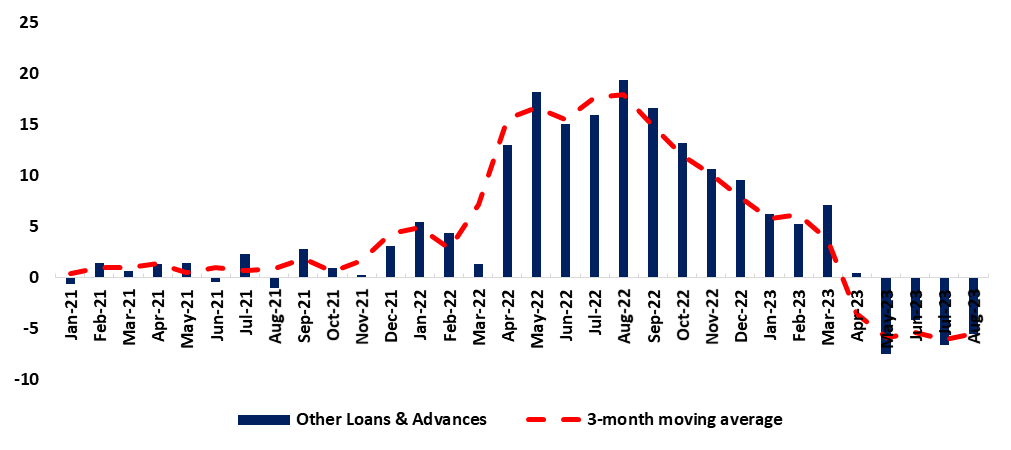

Figure 7: Other loans and advances, (January 2021- October 2023)

Source: BON & HEI RESEARCH

Figure 8: Instalments and Leasing, (January 2021- October 2023)

Source: BON & HEI RESEARCH

Banking Liquidity position

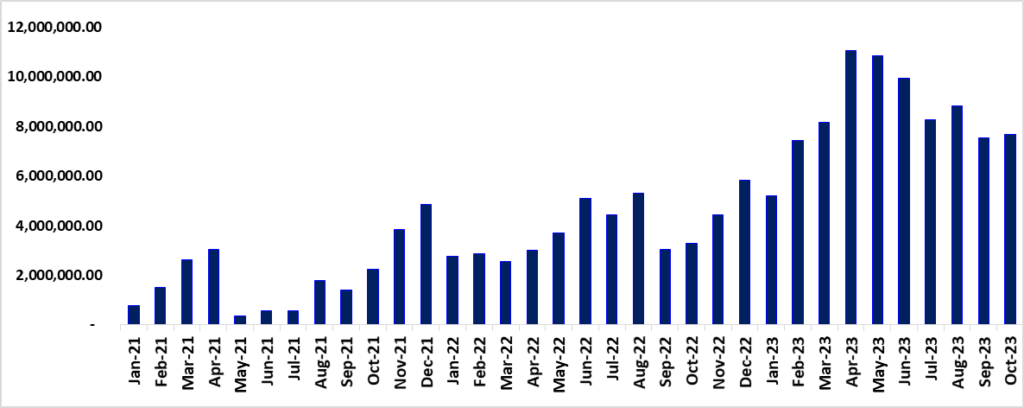

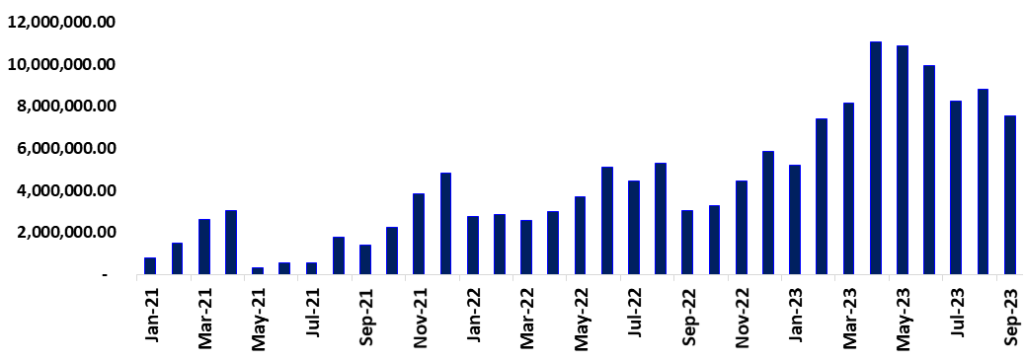

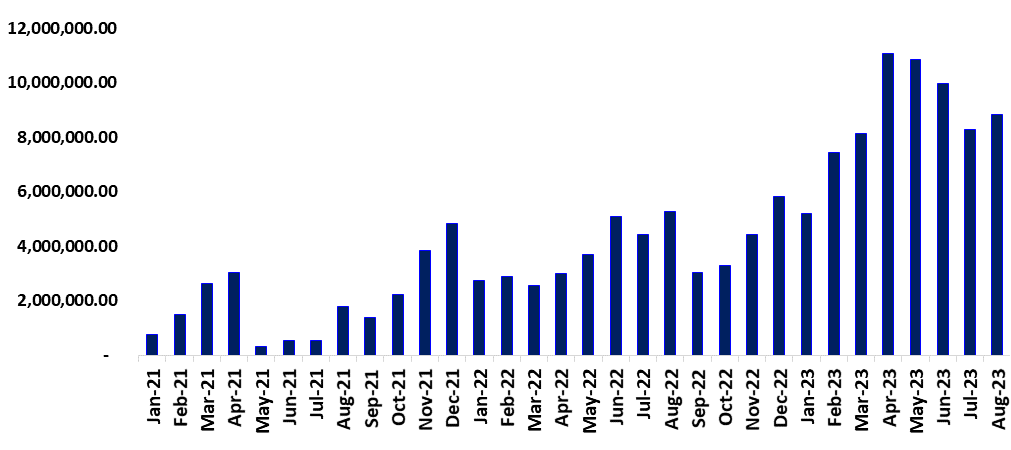

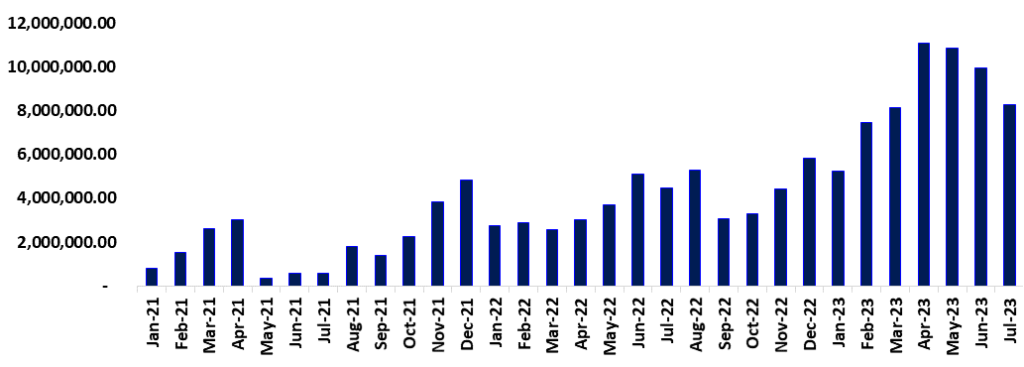

As of October 2023, there was a rise in the overall liquidity of the banking industry. Cash balances within the industry increased from N$7.4 billion in September 2023 to N$7.5 billion by the end of October 2023. This upward trend, reflecting a month-on-month growth of N$174.6 million, can be attributed to government bond payments during the specified period. Figure 9.

Figure 9: Banking Liquidity (January 2021- October 2023)

Source: BON & HEI RESEARCH

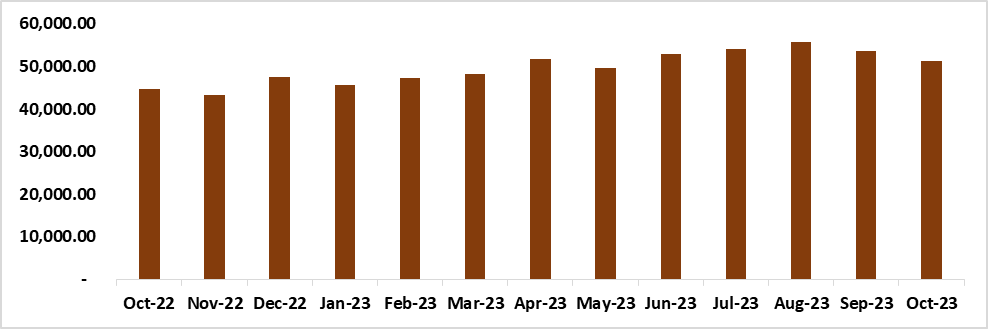

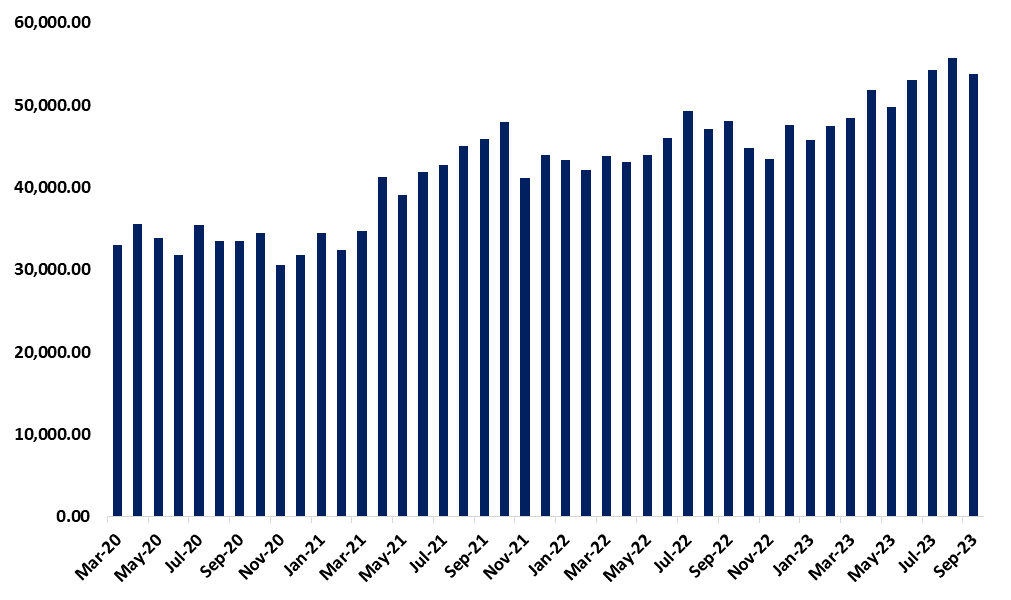

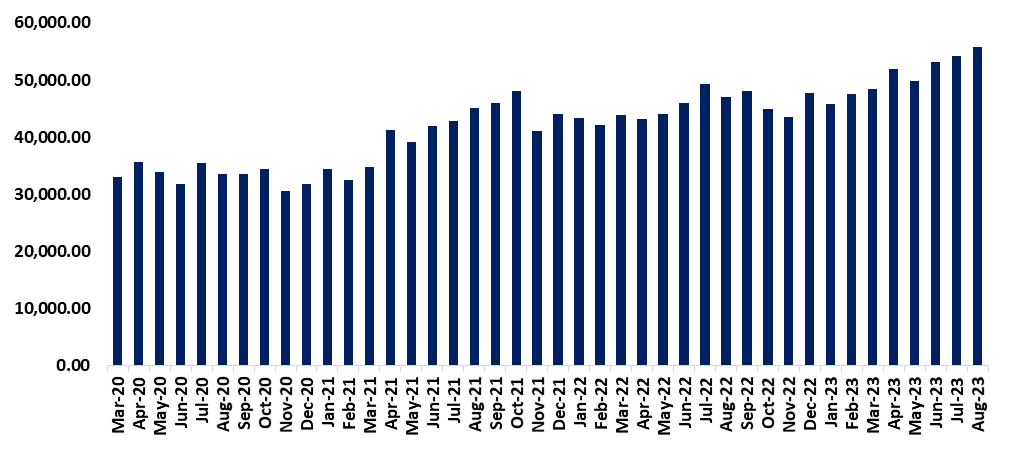

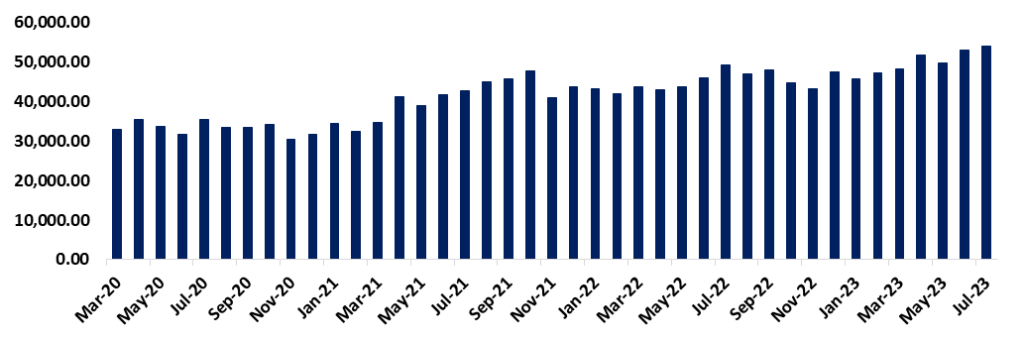

Foreign Reserves & Money Supply

The Bank of Namibia experienced a decrease in its international reserves, witnessing a decline from N$53.7 billion in September 2023 to N$51.3 billion in October 2023. This reduction is primarily linked to heightened outflows from commercial banks, driven by increased import expenses. However, on an annual basis, foreign reserves demonstrated a notable 20% increase, a positive trend attributed to enhanced foreign earnings from exports. Figure 10.

Figure 10: Foreign Reserves (October 2022- October 2023)

Source: BON & HEI RESEARCH

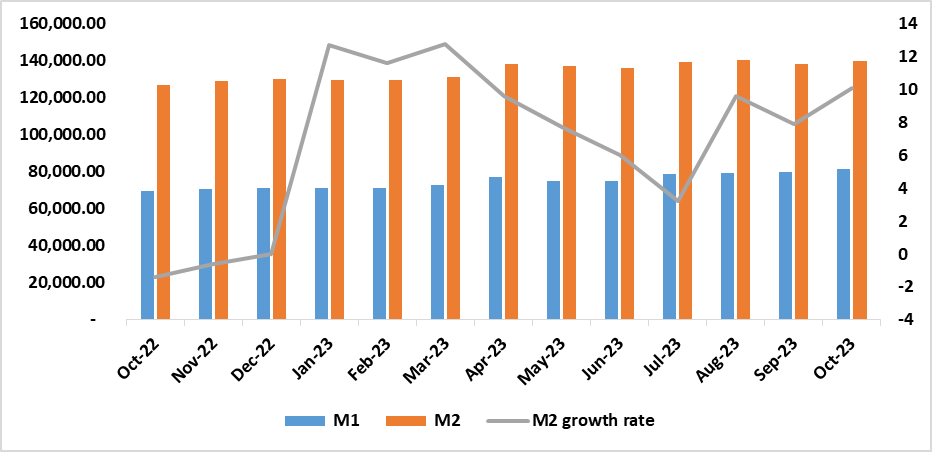

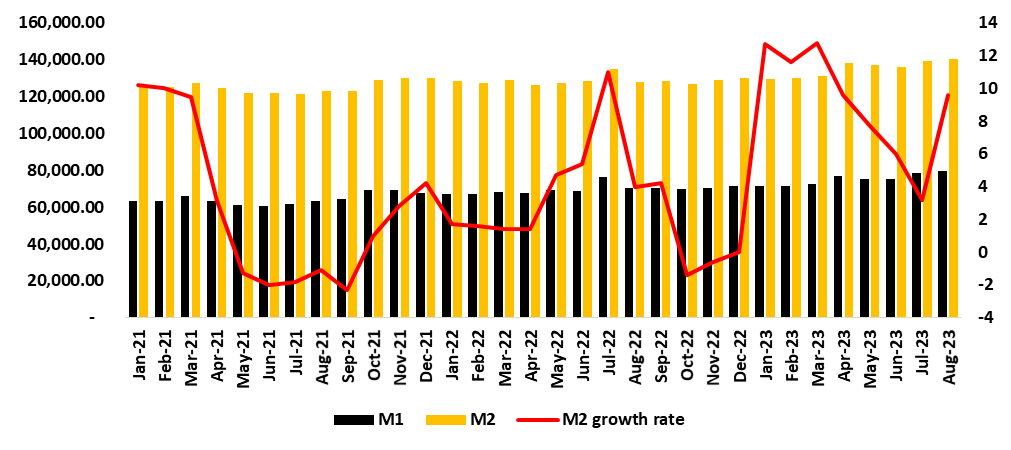

Figure 11: Broad Money Supply Growth % (October 2022- October 2023)

Source: BON, NSA & HEI RESEARCH

Outlook

Namibia experienced subdued growth in Private Sector Credit Extension (PSCE) during the month of October 2023. The annual growth rate persisted at modest levels, reflecting a trend where businesses remained focused and hesitant in taking more loans to reduce their debt burdens. This implies that corporations are showing a reluctance to borrow amid the existing economic conditions characterized by high interest rates and weakened consumer confidence.

Despite the prevailing economic challenges, credit extension to individuals has demonstrated notable resilience. Looking ahead to 2024, we anticipate a gradual and sustained upward trend in credit extension for individuals. This expectation is grounded in the forthcoming improvements in tax brackets in 2024, which are set to enhance credit scores and subsequently stimulate increased demand for credit. As these positive adjustments in tax policies take effect, we foresee a positive impact on individuals' financial profiles, fostering a climate conducive to higher credit utilization. However, despite these favorable developments, our perspective maintains that the overall growth in Private Sector Credit Extension (PSCE) will persist in a subdued state, primarily influenced by the business category in the short term.

Analysis

Between August and September 2023, credit extended to households and businesses in the private sector decreased by N$345.1 million. In real terms, total credit extended to the private sector decreased from N$119,288.8 million in August 2023 to N$118,943.7 million in September 2023. This decline was observed across all credit categories except for installment sales and leasing credit, which exhibited a modest increase of 11.6% during the period under review.

On an annual basis, the Private Sector Credit Extension (PSCE) recorded a growth rate of 1.6% a decline from the 2.2% growth rate recorded at the end of August 2023. This decline could be attributed to low demand for credit and the net repayment of credit by businesses, particularly in the services, wholesale, retail trade, commercial real estate, mining, manufacturing, and fishing sectors, as reported by the Bank of Namibia (see Figure 1). Moreover, business credit contracted by 2.1% year-on-year, while household credit experienced a decline of 4.3% year-on-year.

Figure 1: Annual % PSCE vs. Repo Rate & Interest Rate, (January 2019- September 2023)

Source: BON, NSA & HEI RESEARCH

Credit to Households

The credit extended to households stood at N$65,967.9 million in September 2023 from N$66,433 million in August 2023. This signified a weakening trend, primarily driven by sub-categories such as other loans and advances, which decreased from 14.9% to 7.8% month-on-month. In comparison, mortgage credit remained subdued at 3.2% month-on-month (refer to Figures 2 and 3). Consequently, most credit facilities available to households experienced declines, including overdraft credit, which decreased from 3.5% to 3.0%. However, there was a slight increase in installments and leasing credit, albeit modest, rising from 6.1% to 6.4% during the specified period (refer to Figures 4 and 5).

Figure 2: Other loans and advances, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Figure 3: Mortgage, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Figure 4: Overdrafts (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

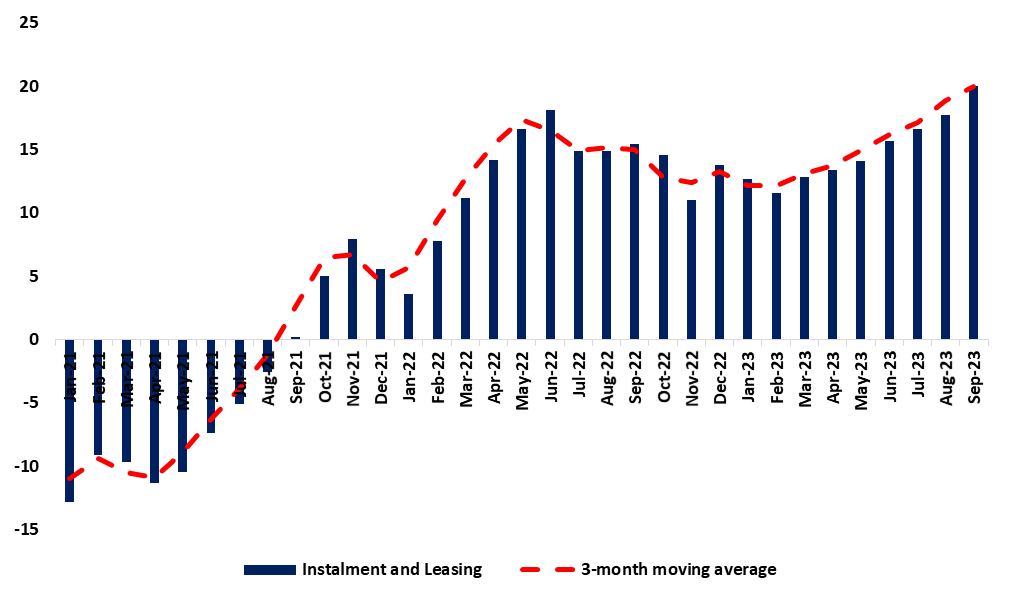

Figure 5: Instalments and Leasing, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Credit to Businesses

During the month under review (September 2023), total credit extended to businesses amounted to N$ 45,281 million, reflecting a marginal improvement from the August figure of N$ 45,188 million. This slight uptick was primarily driven by a surge in demand for installment and leasing credit, which increased from 17.8% to 20.0% month-on-month. This growth was spurred by heightened demand in the car rental industry, supported by activities within the tourism sector. On the other hand, overdraft credit experienced a decline, decreasing from 0.4% to -1.2% month-on-month, along with a contraction in mortgage loans, dropping from 5.3% to -4.9% month-on-month. Meanwhile, other loans and advances remained stable at -5.5%, as illustrated in Figures 6, 7, and 8 (refer to Figure 9).

Figure 6: Overdrafts, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Figure 7: Mortgage, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Figure 8: Other loans and advances, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Figure 9: Instalments and Leasing, (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Commercial Bank Liquidity Position

The aggregate liquidity status of the banking industry saw a decline to N$7.3 billion in September 2023, in comparison to the N$8.8 billion reported in August 2023, marking a month-on-month reduction of N$1.5 billion (see Figure 10). The Bank of Namibia (BoN) attributed this decline to factors such as reduced government expenditure, decreased diamond sales, and an increase in funds placed in the BoN Bill.

Figure 10: Banking Liquidity (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Foreign Reserves & Money Supply

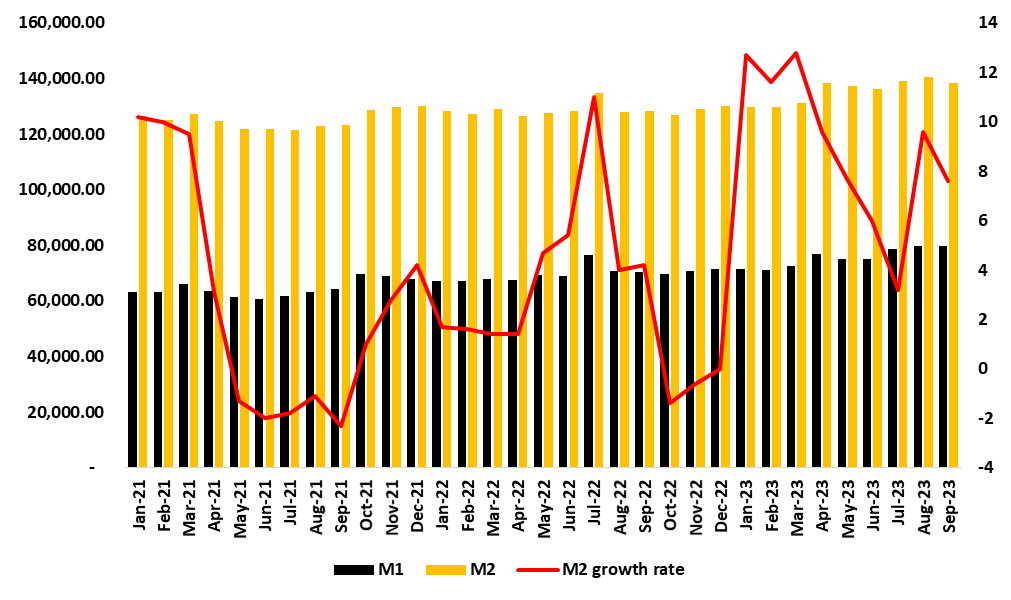

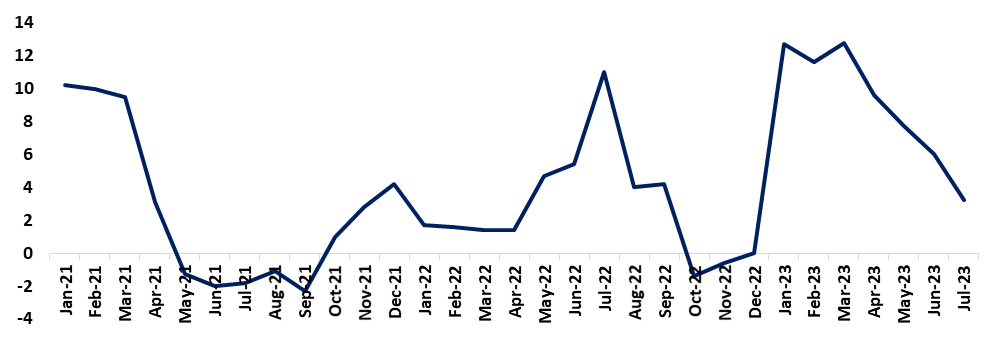

The Bank of Namibia saw a reduction in its stock of international reserves, which decreased from N$55.6 billion in August 2023 to N$53.8 billion in September 2023. This decline could be attributed to outflows from commercial banks and government payments, as illustrated in Figure 11. Due to these developments, the growth rate in broad money supply experienced a notable decrease, falling from 9.6% in August 2023 to 7.9% in September 2023, as shown in Figure 12.

Figure 11: Foreign Reserves (March 2020- September 2023)

Source: BON, NSA & HEI RESEARCH

Figure 12: Broad Money Supply Growth % (January 2021- September 2023)

Source: BON, NSA & HEI RESEARCH

Outlook

The prevalence of homeownership facilitated by mortgages among households, along with the adoption of Installment and Leasing credit options by both households and businesses, often serves as an indicator of economic confidence and individual financial stability. Within Namibia's credit landscape, a subdued trend is distinct, evident in the restrained growth of various credit options such as overdrafts and other loans and advances available to households and businesses, coupled with constraints in liquidity.

Our analysis suggests that the trajectory of credit allocation to households and businesses is likely to face continued limitations in the near-to-intermediate future. Additionally, there is evidence of evolving preferences among households and businesses regarding the types of credit facilities they prefer, with a growing inclination towards installment and leasing options. It's worth noting that, with the central bank keeping the interest rates unchanged, consumers might experience some relief, particularly as they adjust to the effects of previous interest rate hikes.

Analysis

Credit extended to households and businesses in the private sector marginally increased by N$59 million between July and August 2023. In monetary terms, total credit extended to the private sector grew from N$119,229.8 million in July 2023 to N$119,288.8 million in August 2023, due to the slight increase in demand for mortgages for households by 3.1% as well as installments and leasing credit by businesses by 17.7%.

On an annual basis, the Private Sector Credit Extension (PSCE) decelerated at 2.7%, from a 3.9% growth rate recorded at the end of July 2023 as debt obligations hinder consumers from taking up more credit facilities. (Figure 1). Furthermore, business credit contracted by 2.0% y/y, while household credit stood at 5.4% y/y.

Figure 1: Annual % PSCE vs. Repo Rate & Interest Rate, (January 2019- August 2023)

Source: BON, NSA & HEI RESEARCH

Credit to Households

The subdued growth in credit extended to households was driven by the sub-categories of; mortgage loans (from -2.9% to 3.1% m/m), while installment and leasing remained unchanged at 6.1% m/m (Figures 2&3). Additionally, there were declines in most credit facilities available to households, leading to minor overall growth. This was primarily attributed to a decrease in the uptake of weak overdraft credit, falling from 6.1% to 3.5%, and a decline in other loans and advances from 15.9% to 14.9% during the specified period (Refer to Figures 4 and 5)

Figure 2: Mortgage, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Figure 3: Instalments and Leasing, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Figure 4:, Overdrafts (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Figure 5: Other loans and advances, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Credit to Businesses

The tightening in credit extended to businesses was driven by debt by businesses specifically in the services, wholesale and retail, commercial real estate, fishing as well as the transport sectors in the form of overdraft credit (from 6.8% to -0.4%), other loans and advances (from –6.6% to -5.5% m/m), and mortgage credit (from -5.1 to -4.4m/m) as illustrated in figure 5, 6 and 7. Furthermore, the demand for installments and leasing slightly improved from 16.6% to 17.7% m/m (Figure 8).

Figure 5: Overdrafts, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Figure 6: Other loans and advances, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Figure 7: Mortgage, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Figure 8: Instalments and Leasing, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Commercial Bank Liquidity Position

The overall liquidity position of the banking industry averaged N$8.9 billion in August 2023, depicting a month-on-month increase of N$26.1 million when compared to July 2023 (Figure 9). According to the Bank of Namibia (BoN), the increase was due to the rise in government payments as well as diamond sale proceeds.

Figure 9: Banking Liquidity (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Foreign Reserves & Money Supply

The Bank of Namibia’s stock of international reserves increased to N$55.6 billion in August 2023 from N$54.2 billion recorded in July 2023. The growth was attributed to the increase in commercial bank inflows, placements of Customer Foreign Currency (CFC), and gains from revaluation (Figure 10). Subsequently, growth in broad money supply significantly increased to 9.6 % in August 2023, from the 3.2% experienced in July 2023 (Figure 11).

Figure 10: Foreign Reserves (March 2020- August 2023)

Source: BON, NSA & HEI RESEARCH

Figure 11: Broad Money Supply Growth % (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

HEI Sentiments and Outlook

The persistent weak demand for credit, particularly in business sectors such as overdrafts, mortgages, and other loans and advances, could suggest hesitancy among businesses to pursue credit due to a perceived lack of profitable investment opportunities. This hesitancy stems from a lack of confidence in their ability to generate future cash flows that would justify borrowing.

Conversely, the increasing trend in installments and leasing indicates a different scenario. Businesses opting for these financing options might be displaying greater confidence in their future revenue streams, indicating a willingness to invest in assets. This uptick reflects a belief in the profitability of such investments.

Similarly, the positive trend in credit demand from households, specifically in the mortgages and installment and leasing categories, mirrors consumer confidence in their financial future. The readiness of households to commit to long-term debt obligations underscores their positive outlook on income stability.

Considering these factors, we anticipate the Private Sector Credit Extension, particularly in the business category, to remain weak in the short to medium term. This projection is grounded in the cautious approach exhibited by both businesses and households, emphasizing the importance of economic stability and confidence in shaping credit market dynamics.

Analysis

In July 2023, there was a modest increase in credit extended to households and businesses in the private sector, amounting to N$42.2 million. This growth pushed the total credit extended to the private sector from N$119,187.6 million in June 2023 to N$119,229.8 million in July 2023. The uptick in credit demand was primarily attributed to a 10.1% increase in installment sales and leasing credit, along with a 6.1% rise in overdraft credit, coming from both business and household segments. The surge in credit demand was primarily driven by the car rental sector's substantial vehicle purchases in July. The increase in vehicle procurement by the car rental industry could be a direct response to the upswing in tourism-related activities and significant shifts in household expenditure patterns.

On an annual basis, the Private Sector Credit Extension (PSCE) has decelerated to 2.6% from the 3.9% growth rate recorded in July 2022. This slowdown could be a result of households and businesses factoring in the delayed effects of monetary policy changes aimed at controlling inflation. Additionally, business credit has declined by 1.2% year-on-year, while household credit has increased by 5.5% year-on-year. Figure 1.

Figure 1: Annual % PSCE vs. Repo Rate & Interest Rate, (January 2022- July 2023)

Source: BON, NSA & HEI RESEARCH

Credit to Households

The annual sluggish growth in credit extension was primarily influenced by household sub-categories. Overdrafts, for instance, showed a significant shift from -1.4% to 6.1% month-on-month, and installments and leasing, increased from 4.2% to 6.1% month-on-month (See Figures 2 and 3). Additionally, the category for other loans and advances increased by 15.9%, while mortgage credit experienced a slight decline, dropping from 3.3% to 2.9% during the period under review (See Figures 4 and 5).

Figure 2: Overdraft, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 3: Instalments and Leasing, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 4: Other loans and advances, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 5: Mortgage, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Credit to Businesses

The contraction in credit extended to businesses was driven by repayments from the mining, wholesale and retail, fishing, and financial services made in the form of other loans and advances (from -4.2% to -6.6% m/m) and mortgage credit (from -5.9% to -5.1% m/m) as illustrated in figure 6 and 7. Uptake in overdraft facilities from businesses declined from 9.4% to 6.8% m/m (Figure 8), however, it is worth noting that there was an upsurge in installments and leasing facilities from 15.7% to 16.6% m/m (Figure 9).

Figure 6: Other loans and advances, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 7: Mortgage, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 8: Overdrafts, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 9: Instalments and Leasing, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Commercial Bank Liquidity Position

The overall liquidity position of the banking industry averaged N$8.6 billion in July 2023, depicting a month-on-month decrease of N$1.3 billion (Figure 10). According to the Bank of Namibia (BoN), the decline was due to corporate tax payments.

Figure 10: Banking Liquidity (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Foreign Reserves & Money Supply

The Bank of Namibia’s stock of international reserves increased from about N$52.9 billion in June to around N$54.1 billion in July 2023 as SACU inflows, diamond sales, and Customer Foreign Currency (CFC) placements were the main drivers for growth (Figure 11). However, the growth in money supply stood at 3.2% in July 2023, from the 6.0% experienced in June 2023. The monthly low growth in the money supply could be attributed to a tightening of monetary conditions, characterized by the Bank of Namibia's decision to raise the interest rate by 50 basis points. This measure was taken to combat inflation effectively and uphold the stability of the currency peg (Figure 12).

Figure 11: Foreign Reserves (March 2020- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 12: Broad Money Supply Growth % (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Outlook

Given the current economic climate, we expect the growth trajectory of Private Sector Credit Extension to persist, albeit at a more gradual pace in the short to medium term. This cautious outlook aligns with the need to navigate the evolving financial landscape prudently.