- Background

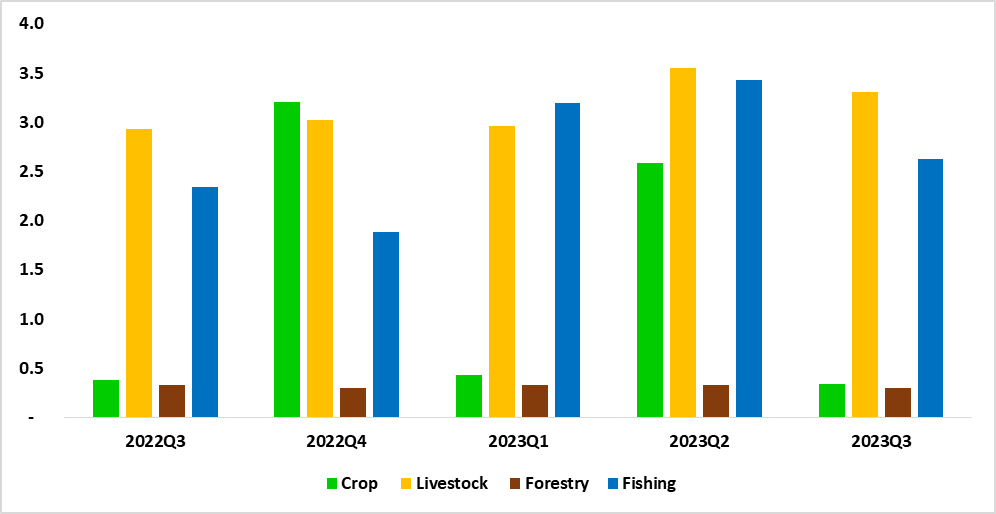

Despite facing significant challenges such as high input costs and limited rainfall, the agricultural sector demonstrated resilience in 2023, particularly with a robust performance observed during the third quarter. The agriculture, forestry, and fishing sector share of GDP for Q3 of 2023 increased to 6.6% from 6.0% recorded in Q3 of 2022. Livestock accounted for 3.3% of GDP, followed by the fishing subsector (2.6%), while the crop and forestry subsector were the least contributor recording 0.3%, respectively (See figure 1).

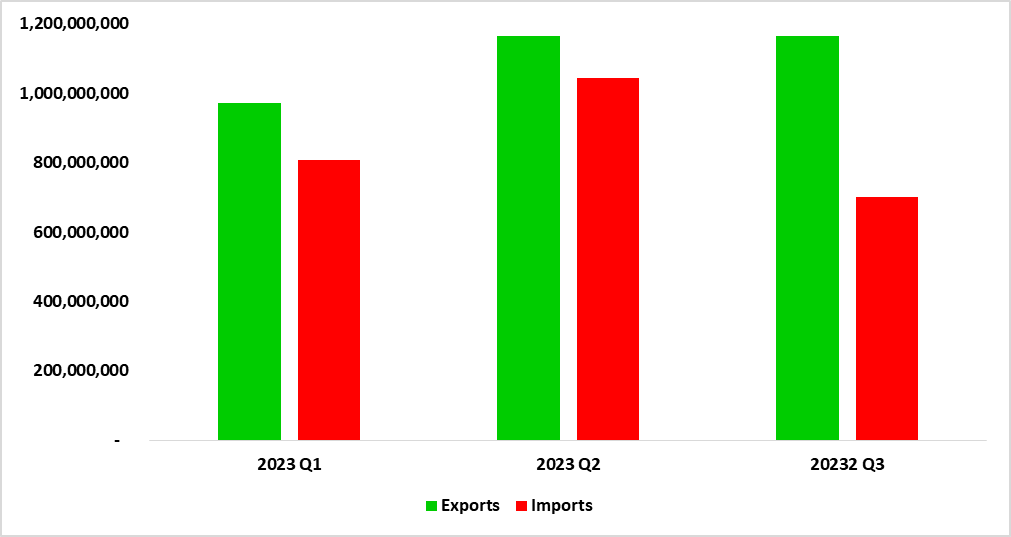

The country’s export earnings from commodities in the agriculture, forestry, and fishing sectors amounted to N$ 1.2 billion whereas the import bill stood at N$ 701 million (See figure 3). Export earnings from fish products reached N$3.4 billion, marking an uptick from the N$2.8 billion recorded in the third quarter of 2022. Conversely, the import expenditure for fish products during the same period decreased to N$130.5 million, down from N$439.6 million in the third quarter of 2022.

- Analysis

- Fisheries Products

While the landings of most fish species decreased, hake exhibited the highest landings at 46,442 metric tons, followed by horse mackerel with 27,135 metric tons, and tuna in third place with 1,952 metric tons during the period under review. Namibia's export of fish and crustaceans, molluscs and other aquatic invertebrates reached N$3.4 billion, showing an increase from N$2.8 billion recorded in the same quarter of 2022. The majority of these exports, about 37.9%, went to Spain, mainly consisting of frozen fillets of hake followed by Zambia representing 20.7%, and the primary product exported was horse mackerel. South Africa ranked third, making up 8.8% of the total exports, with frozen fillets of hake.

In terms of import, the value of fish and crustaceans, molluscs, and other aquatic invertebrates was N$130.5 million, a decrease from the N$439.6 million recorded in the third quarter of 2022. The main source of these imports, constituting 36.0%, was South Africa, primarily involving hake followed by Spain contributing 18.3% to the imports, with the primary imported products being cuttlefish and squid.

2.2. Livestock Auction

The total number of livestock auctioned in the third quarter of 2023 rose by 15.2% to 92,881 livestock, compared to 80,626 livestock auctioned in the same quarter of 2022. Cattle auctions reached 72,339 heads, while goat and sheep auctions accounted for 14,988 heads and 5,554 heads, respectively.

Top of Form

Prices across all types of livestock depicted declines during the quarter under review. Goats, at N$29.88 per kg, experienced a 21.0% reduction. Cattle posted N$27.55 per kg, reflecting a 15.5% decrease, while sheep recorded N$30.14 per kg, reflecting a reduction of 15.3%.

2.3 Trade of Selected Horticultural Products

Namibia exported horticultural products valued at N$241.7 million, marking an increase from N$188.5 million in the same quarter of 2022. The leading exports were onions (N$91.4 million), tomatoes (N$85.1 million), dates (N$24.0 million), pumpkins, squash, and gourds (N$13.1 million), and broad beans and horse beans with an export value of N$7.9 million. The main destinations for horticultural products in Q3 2023 were South Africa (77.0%), Angola (12.6%), and the United Kingdom (3.6%).

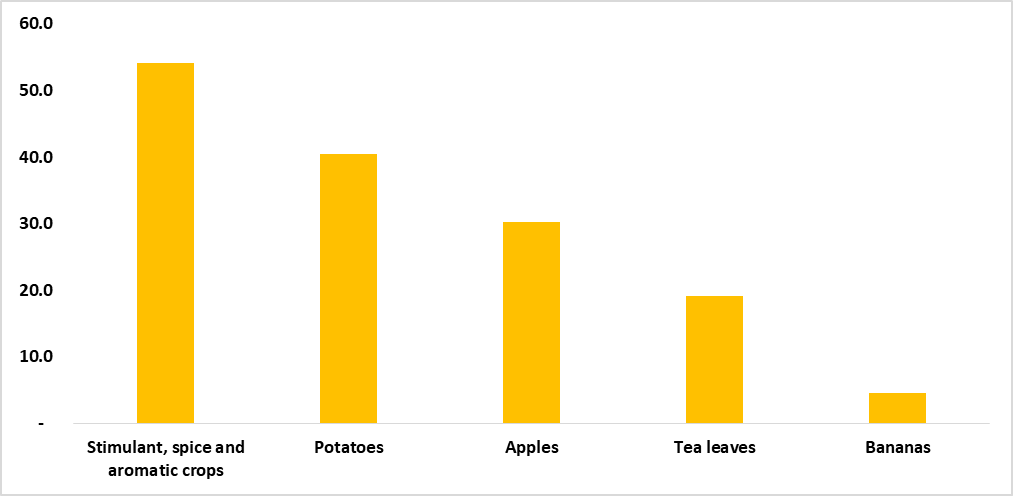

The import bill for horticulture products was N$256.3 million, an increase from N$220.5 million in the same quarter of 2022. The leading imported product was stimulant, spice, and aromatic crops totaling N$54.1 million. Additionally, potatoes (N$40.4 million), apples (N$30.3 million), tea leaves (N$19.2 million), and bananas valued at N$12.2 million were among the top five imported products for the period under review (See figure 2).

Looking ahead to 2024, the sector is expected to sustain its resilience, benefiting from improved rainfall for crop cultivation and enhanced rangeland conditions for livestock farmers. However, it is advisable for farmers to persist in diversifying their agricultural activities to mitigate potential impacts from climatic, sectoral, or economic fluctuations on both production and sales. Ensuring stability in growth is achievable by providing early support during droughts and implementing measures that are resilient to climate variations, emphasizing the importance of diversification.

Figure 1: Agriculture, forestry, and fishing sector % share to GDP, (2022Q3 – 2023Q3)

Figure 2: Top 5 imported horticultural products in million N$ for the hird quarter of 2023

Source: NSA & HEI Research

Figure 3: Trade Statistics on Agriculture, Forestry, and Fishing Sector (N$), Q1 - Q3 2023

Source: NSA & HEI Research

Background

The agriculture, fishing, and forestry sector in Namibia remains crucial for reducing poverty, creating jobs, and making sure there is enough food. In 2022, real value added for ‘agriculture, fishing, and forestry’ recorded a growth of 2.6% when compared to a growth of 1.3% noted in the previous year. Livestock farming and ‘fishing and fish processing on board’ were the main drivers in the sector with improved growth rates of 1.2% and 2.3% during 2022 compared to a negative growth of 3.6% and a positive growth of 1.9% registered in the preceding year, respectively.

Analysis

The country’s export earnings from commodities in the agriculture, forestry, and fishing sectors amounted to N$ 6.2 billion whereas the import bill stood at N$ 3.4 billion. Fish products brought in N$4.1 billion in Q2 2023, up from N$3.2 billion in Q2 2022. However, the cost of importing fish products in the same period decreased to N$173.3 million from N$274.1 million in 2022. This translated into a 36.8 monthly decline.

Fisheries Products

During the period under review, horse mackerel was the most commonly caught fish, with 44,548 metric tons landed. Hake came second with 33,816 metric tons, and Monk was third with 1,825 metric tons. In Q2 2023, N$4.1 billion worth of fish and aquatic creatures were exported, compared to N$3.2 billion in Q2 2022. Spain was the top destination for these products, accounting for 36.6% of exports (mostly frozen hake fillets), followed by the Democratic Republic of Congo at 15.4% (mostly frozen mackerel), and Zambia at 14.3% (mostly horse mackerel).

Imports of fish and aquatic creatures were valued at N$173.3 million in Q2 2023, down from N$274.1 million in Q2 2022. These products mainly came from the Falkland Islands (mostly frozen cuttlefish and squid) at 65.8%, South Africa (mostly hake) at 20.2%, and Spain (mostly sardines) at 4.5%.

Livestock Auction

The total number of animals auctioned increased by 2.3% to 79,113 in Q2 2023 compared to 77,338 in the same quarter of 2022. Goats and cattle saw growth of 18.4% (18,933 more animals) and 6.1% (50,794 more animals), respectively. Sheep, on the other hand, declined from 13,482 in Q2 2022 to 9,386 in the current quarter. Prices for all types of livestock decreased during this period compared to the same quarter in 2022. Cattle prices dropped by 20.0% (N$25.96), while goat and sheep prices decreased by 17.4% (N$30.69) and 14.6% (N$28.70), respectively.

Trade of Selected Horticultural Products

In Q2 2023, dates were the top earners in horticultural product exports, bringing in N$25.8 million. Tomatoes and vegetable seeds followed with N$3.3 million and N$1.4 million, respectively. For imports, potatoes were the most significant, costing N$17.2 million in Q2 2023. Apples and onions came second and third, with import costs of N$8.7 million and N$7.0 million, respectively.

Figure 1: Agriculture, forestry, and fishing sector % share to GDP, (2022Q2 – 2023Q2)

Figure 2: Top 5 Imported horticultural products in million N$ for the second quarter of 2023

Source: NSA & HEI Research

Figure 3: Number of livestock auctioned, (2022Q2 – 2023Q2)

Source: NSA & HEI Research

Background

Agriculture, fishing, and forestry play a significant role in terms of employment creation, contribution to GDP, foreign earnings, and food security. Real value added in the industry increased by 2.6% in 2022, and between 2010 and 2022 the sector contributed around 7.9% to GDP on average.

Analysis

Namibia’s export earnings from agriculture, forestry, and fishing commodities amounted to N$ 971 million for Q1 of 2023 whereas the import bill stood at N$ 806 million when compared to the export earnings of N$ 4.0 billion and import bill of N$ 1.1 billion in Q1 of 2022. Fish products during the quarter under review attracted export earnings of N$ 4.0 billion relative to N$3.1 billion recorded in Q1 of 2022 while the import bill amounted to N$ 167.9 million down from N$194.6 million recorded in Q1 of 2022.

Fisheries Products

During the period under review, horse mackerel recorded the highest landings of 43 346 metric tons, followed by Hake and Monk with 41 155 and 1 672 metric tons, respectively. Fish and crustaceans, mollusks, and other aquatic invertebrates worth N$ 4.0 billion were exported during the period under review, relative to N$3.1 billion recorded for the first quarter of 2022. The main export market for fish was Spain accounting for 32.9%, followed by Zambia at 16.2%, and lastly the Democratic Republic of Congo with a share of 12% of the total fish export.

In terms of imports, the country demanded fish valued at N$ 167.9 million during the first quarter of 2023. Fish products were mainly imported from Morocco (19.4%), Chile (17.6%), and the United States of America (14.1%).

Livestock

From a decline of 30.7% in the comparable quarter of 2022, the number of livestock marketed increased by 7.8% in the first quarter of 2023. Namibia marketed a total of 74 289 heads of animals during the period under review. Goats posted the highest growth of 26.4% (15 898 heads), followed by sheep which saw an increase of 18.1% (11 897 heads). During the period under review, the country marketed a total of 46 494 cattle an increase from 46 271 cattle marketed in the corresponding quarter of 2022.

In terms of auction prices, prices across all types of livestock recorded declines during the quarter under review. Cattle posted N$ 31.82 per KG which is a 13.2% reduction, followed by goats which posted a decline of 6.2%. Goats and sheep recorded average prices of N$31.34 per KG and N$32.19 per KG, respectively during the first quarter of 2023. This was ascribed mainly to an increase in the supply of weaners from Botswana to South Africa, resulting in an oversupply of livestock in the South African market, and eventually contributing to a decline in weaner prices in Namibia.

Trade of selected horticultural products

During the quarter under review, grapes were the top exported product recording foreign earnings of N$ 79.9 million. The export of date and tomatoes were also significant posting values of N$ 58.2 million and N$ 19.8 million, respectively. In terms of horticulture imports, apples ranked first with a value of N$ 24.8 million, followed by vegetable seeds with a value of N$ 20.8 million and onions with a value of N$ 13.4 million. The top traded goods in both exports and imports were onions and tomatoes.

Figure 1: Agriculture, forestry, and fishing sector % share to GDP, (2022Q1 – 2023Q1)

Source: NSA & HEI Research

Figure 2: Top ten imported horticultural products in million N$ for the first quarter of 2023

Source: NSA & HEI Research

Background

The agriculture, forestry, and fishing sector continued to face challenges, especially from the pressure of market distortions resulting from the higher prices of general goods. The disruptions have exacerbated the vulnerability of the sector, especially in terms of input price volatility for agricultural, forestry, and fishing commodities. Furthermore, the price fluctuations have exposed the sector to value chain disruptions particularly influenced by high input costs.

Namibia’s export earnings from commodities of agriculture, forestry, and fishing sector amounted to N$4.4 billion for Q4 of 2022 whereas the import bill stood at N$1.2 billion. Although the fisheries products and agriculture commodities accounted for the highest foreign earnings with N$2.4 billion and N$1.6 billion, respectively for Q4 of 2022 the values declined relative to Q3 of 2022. Fisheries products earnings for Q3 of 2022 were N$ 2.7 billion while agriculture commodities were valued at N$ 606 million.

Analysis

Fisheries Products

During the period under review, hake was the top exported product valued at N$ 1.1 billion for 15 869 metric tons, followed by horse mackerel valued at N$ 849 million total horse mackerel exported weighted 30 984 metric tons. The main export market for hake was Spain accounting for 56.5%, while for horse mackerel was Zambia accounting for 50%.

Horse Mackerel topped the list of imports, with a value of N$57.8 million and a weight of 2 745 metric tons followed by Sardine with a bill of N$41.3 million for 2 035 metric tons, and Tilapia with a bill of N$22 million for 1 185 metric tons.

Agriculture Commodities

Namibia exported 63 275 tons of agricultural commodities valued at N$1.6 billion and imported 71 935 tons of commodities valued at N$ 700 million. The export of fresh grapes stood at 42 156 tons valued at N$1.1 billion and fresh watermelons were 1 464 tons valued at N$17.5 million. During the quarter under review, a total of 58 306 tons of horticultural products were exported when compared to 51 696 tons exported during the same quarter last year.

The total number of livestock marketed for Q4 of 2022 stood at 214 802 when compared to 176 820 recorded in the same period of 2021. This translated into an increase of 21%. During the quarter under review, there were no imports of both cattle and small stock (goats and sheep) as a result of an import restriction due to the foot and mouth disease.

Namibia exported 35 346 cattle on hoof, valued at N$276.3 million. This is an increase of 10% when compared to 32 129 cattle that were exported at a value of N$255.1 million in Q4 of 2021. The number of small stocks marketed (goats and sheep) during the period under review stood at 147 007 compared to 111 302 small stocks marketed in the corresponding quarter of 2021.

Figure 1: Agriculture, forestry, and fishing sector % share to GDP, (2021Q4 – 2022Q4)

Figure 2: Export of fish and crustaceans in (N$) million, (2021Q4 – 2022Q4)

Agriculture is one of the country's most significant productive sectors, however, the sector faces greater risks compared to other productive sectors of the economy. The risks include lack of access to finance and low-rainfall seasons that often leads to droughts. The risks have made both crop and livestock farming challenging, leading to high instability in agricultural production. During times of drought, communal farmers are the most affected when it comes to any shocks in the production or value chain systems. The agricultural sector percentage share to Gross Domestic Product (GDP) for the years 2015, 2016, and 2019 recorded declines of 3.8%, 3.6%, and 4.2% respectively (See figure 1). The below-normal rainfall since 2013 is consistent with a declining trend in agricultural productivity and the debt level which has heightened fears of food insecurity. The funding of agriculture is a major bottleneck in expanding agricultural production. Although Agribank’s loan disbursements over the years have increased, additional investment in agriculture is needed to fully unlock private sector investment and domestic productive capacity (See figures 2 & 3).

Domestic agricultural debt has significantly increased over the years. During the period under review, the accumulative figure extended to agriculture in credit by the Agribank and commercial banks stood at about N$ 22 billion and was recorded in 2019 owing to a decline in primary agricultural production as a result of droughts that led to the massive loss of livestock (See figure 4). The productivity and revenue of farmers that use agricultural loans increase depending on their timely and sufficient use of inputs. Namibian farmers’ ability to repay loans is negatively affected by fewer herd sizes to market coupled with recurring drought and long-term debt as they rebuild their herds.

According to Agribank of Namibia (2022), the agriculture sector is expected to remain resilient in 2023, owing to better rainfall for crops and improved rangeland conditions for livestock farmers. Farmers are encouraged to continue diversifying their farming operations to minimize the risk of climatic, sectoral, or economic shocks on production output and sales. Investments in the agriculture sector are essential to boost productivity, precisely focusing on technological change and climate-resilient production techniques.

Figure 1: Agriculture sector % share to GDP, (2013-2021)

Figure 2: Commercial vs Agribank loans, N$ billion (2010-2021)

Figure 3: Agribank’s Historical Advances vs Non-performing loans, N$ billion (2010-2021)

Figure 4: Cumulative domestic agriculture debt and %YOY Growth, N$ billion (2011-2021)

Background

The agriculture, forestry, and fishing sector were not spared from the pressure of the market distortions that resulted from price volatility and value chain disruptions particularly caused by the transportation component. High energy demands that have been causing fuel, oil, and energy prices to increase have negatively affected the agriculture sector. The agriculture, forestry, and fishing sector share of GDP for Q3 of 2022 declined to 6.4% from 12.9% recorded in Q2 of 2022. Livestock accounted for 3.4% of GDP, followed by the fishing subsector (2.3%), and crop subsector (0.4%). The forestry subsector was the least contributor recording 0.3%. Export earnings for agriculture, forestry, and fishing products amounted to N$ 3.7 billion for Q3 of 2022 while the import bill stood at N$ 1.3 billion. Fisheries products continue to account for the highest foreign earnings at N$ 2.7 billion followed by agriculture commodities valued at N$ 606 million.

Analysis

Fisheries Products

The fishing sub-sector is one of the important sectors in the economy as it is an important source of foreign earnings for the country. During the period under review, hake was the top exported product with earnings valued at N$1.2 billion, followed by tilapia (N$ 1.6 million), and salmon (N$ 0.5 million). The top three export markets were Spain (52.1%), France (12.7%), and Italy (9.6%). In terms of import, tilapia was the main imported product valued to the tune of N$1.5 million. South Africa accounted for 38% of fish fillets and other fish meat imports.

Agriculture Commodities

The trade of vegetables dominated the trade flow of agricultural commodities. During the quarter under review, the value of exported vegetables increased from N$ 101.1 million in Q3 of 2021 to N$ 151.5 million for Q3 of 2022. Tomatoes and onions were the most exported vegetable types, recording values of N$ 71.3 million and N$ 37.6 million, respectively. South Africa claimed the highest share of 76.2%, followed by Angola (20.3 %) in terms of the export market.

Live Animals

International demand for Namibian live animals stood at N$ 400.2 million in Q3 of 2022, a decline when compared to N$ 440.3 million recorded in Q3 of 2021. The decrease in exports came as a result of the border closure for livestock exports to South Africa. Cattle, sheep, and goats contributed the most value of export of live animals in Q3 of 2022, recording N$ 258.0 million, N$ 100.4 million, and N$ 28.5, respectively. The relatively lower cost of farming encourages the export of Namibian live animals to feedlots in South Africa.

Figure 1: Agriculture, forestry, and fishing sector % share to GDP, (2021Q3 – 2022Q3)

Figure 2: Top export of live animals in (N$) million, (2021Q3 – 2022Q3)