- Background

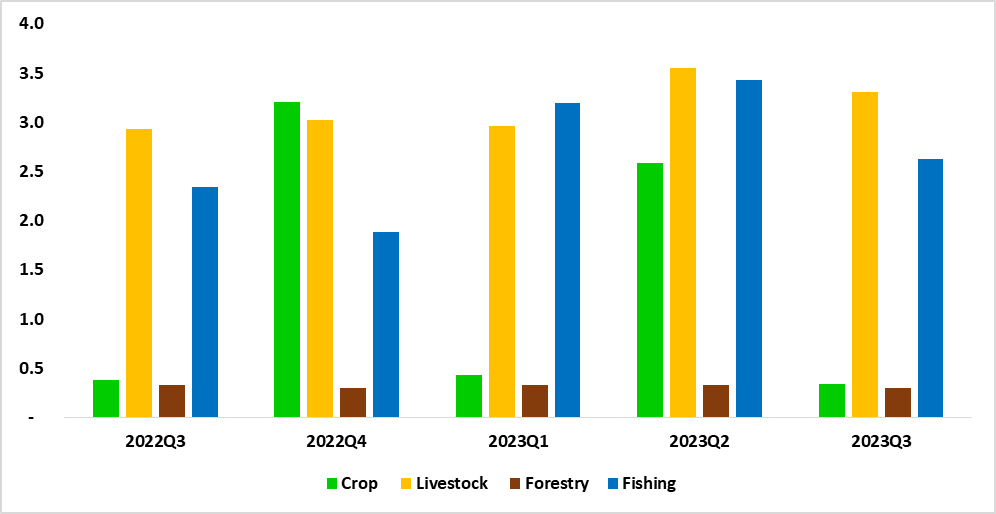

Despite facing significant challenges such as high input costs and limited rainfall, the agricultural sector demonstrated resilience in 2023, particularly with a robust performance observed during the third quarter. The agriculture, forestry, and fishing sector share of GDP for Q3 of 2023 increased to 6.6% from 6.0% recorded in Q3 of 2022. Livestock accounted for 3.3% of GDP, followed by the fishing subsector (2.6%), while the crop and forestry subsector were the least contributor recording 0.3%, respectively (See figure 1).

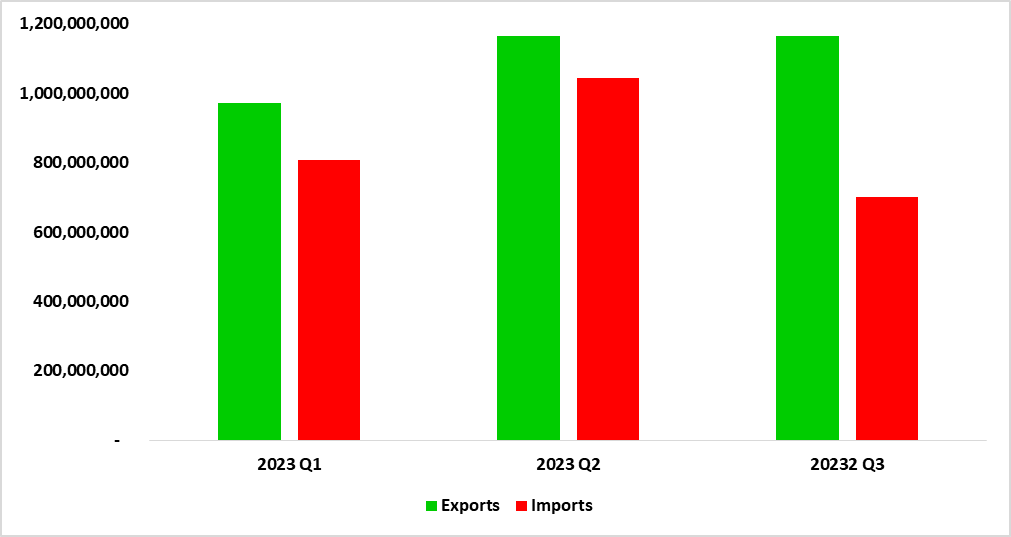

The country’s export earnings from commodities in the agriculture, forestry, and fishing sectors amounted to N$ 1.2 billion whereas the import bill stood at N$ 701 million (See figure 3). Export earnings from fish products reached N$3.4 billion, marking an uptick from the N$2.8 billion recorded in the third quarter of 2022. Conversely, the import expenditure for fish products during the same period decreased to N$130.5 million, down from N$439.6 million in the third quarter of 2022.

- Analysis

- Fisheries Products

While the landings of most fish species decreased, hake exhibited the highest landings at 46,442 metric tons, followed by horse mackerel with 27,135 metric tons, and tuna in third place with 1,952 metric tons during the period under review. Namibia’s export of fish and crustaceans, molluscs and other aquatic invertebrates reached N$3.4 billion, showing an increase from N$2.8 billion recorded in the same quarter of 2022. The majority of these exports, about 37.9%, went to Spain, mainly consisting of frozen fillets of hake followed by Zambia representing 20.7%, and the primary product exported was horse mackerel. South Africa ranked third, making up 8.8% of the total exports, with frozen fillets of hake.

In terms of import, the value of fish and crustaceans, molluscs, and other aquatic invertebrates was N$130.5 million, a decrease from the N$439.6 million recorded in the third quarter of 2022. The main source of these imports, constituting 36.0%, was South Africa, primarily involving hake followed by Spain contributing 18.3% to the imports, with the primary imported products being cuttlefish and squid.

2.2. Livestock Auction

The total number of livestock auctioned in the third quarter of 2023 rose by 15.2% to 92,881 livestock, compared to 80,626 livestock auctioned in the same quarter of 2022. Cattle auctions reached 72,339 heads, while goat and sheep auctions accounted for 14,988 heads and 5,554 heads, respectively.

Top of Form

Prices across all types of livestock depicted declines during the quarter under review. Goats, at N$29.88 per kg, experienced a 21.0% reduction. Cattle posted N$27.55 per kg, reflecting a 15.5% decrease, while sheep recorded N$30.14 per kg, reflecting a reduction of 15.3%.

2.3 Trade of Selected Horticultural Products

Namibia exported horticultural products valued at N$241.7 million, marking an increase from N$188.5 million in the same quarter of 2022. The leading exports were onions (N$91.4 million), tomatoes (N$85.1 million), dates (N$24.0 million), pumpkins, squash, and gourds (N$13.1 million), and broad beans and horse beans with an export value of N$7.9 million. The main destinations for horticultural products in Q3 2023 were South Africa (77.0%), Angola (12.6%), and the United Kingdom (3.6%).

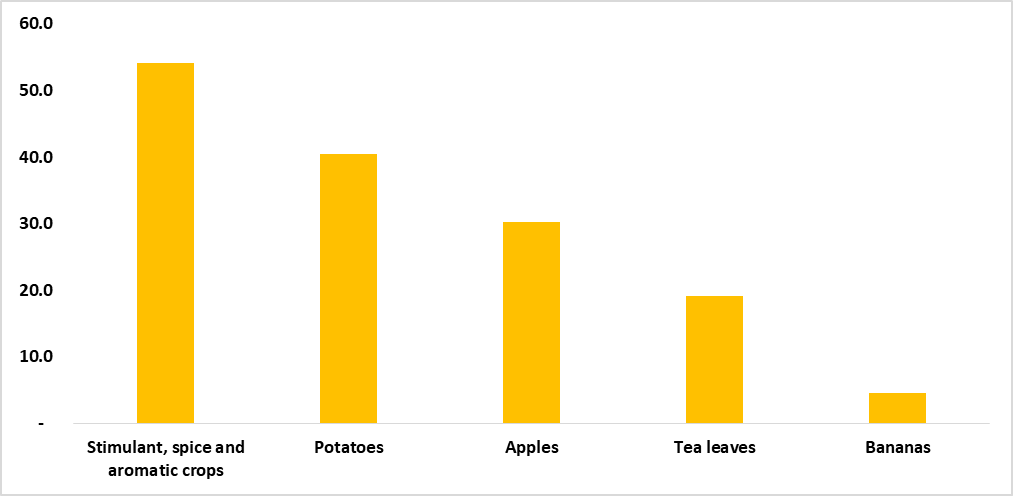

The import bill for horticulture products was N$256.3 million, an increase from N$220.5 million in the same quarter of 2022. The leading imported product was stimulant, spice, and aromatic crops totaling N$54.1 million. Additionally, potatoes (N$40.4 million), apples (N$30.3 million), tea leaves (N$19.2 million), and bananas valued at N$12.2 million were among the top five imported products for the period under review (See figure 2).

Looking ahead to 2024, the sector is expected to sustain its resilience, benefiting from improved rainfall for crop cultivation and enhanced rangeland conditions for livestock farmers. However, it is advisable for farmers to persist in diversifying their agricultural activities to mitigate potential impacts from climatic, sectoral, or economic fluctuations on both production and sales. Ensuring stability in growth is achievable by providing early support during droughts and implementing measures that are resilient to climate variations, emphasizing the importance of diversification.

Figure 1: Agriculture, forestry, and fishing sector % share to GDP, (2022Q3 – 2023Q3)

Figure 2: Top 5 imported horticultural products in million N$ for the hird quarter of 2023

Source: NSA & HEI Research

Figure 3: Trade Statistics on Agriculture, Forestry, and Fishing Sector (N$), Q1 – Q3 2023

Source: NSA & HEI Research