Executive summary

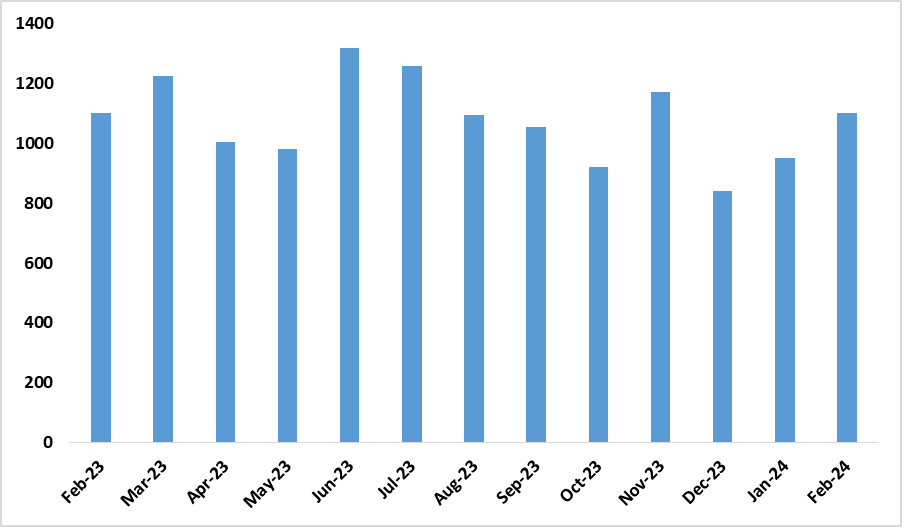

- New vehicle sales increased to 1102 vehicles in February 2024, up from 950 vehicles sold in January2024. This represented a monthly increase of 16%. (Figure 1)

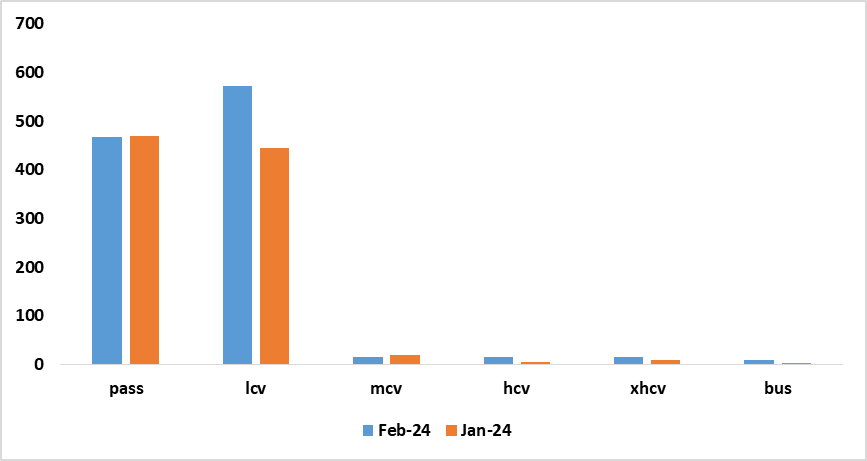

- Sales of light commercial, Heavy commercial and extra heavy commercial increased by 29%, 200%, and 267% month on month respectively.

- Passenger, medium commercial and bus vehicle sales decreased by 1%, 25% and 100% respectively in February 2024 compared to January 2024.

- In the first two months of 2024, 2052 vehicles were sold, compared to 1901 vehicles sold during the same period last year.

- Out of the 2052 vehicles sold for 2024 so far, 937 were passenger vehicles, 1016 were Light commercial vehicles, 35 were medium commercial vehicles, 20 were heavy commercial, 42 were extra heavy vehicles and 2 were buses.

Analysis

- The 1102 vehicles sold in February 2024, sets the year-to-date record of highest number of vehicles

- The monthly increase in vehicle sales in February from January 2024 was mainly driven by the increased sales of light, heavy and extra heavy commercial vehicles. This could be ascribed to increased demand because of no changes in the interest rates in the last MPC meetings, additionally, higher sales of commercial vehicles could be attributed to increasing commercial activities hence a growing demand for commercial transportation services.

- On an annual basis, new vehicle sales remain unchanged%. 1102 sold in February 2024 vs 1103 sold in February 2023. This implies a plateau in consumer confidence.

- Passenger vehicle sales slowed from 470 vehicles sold in january to 467 in February 2024, although its slow down its not alarming as real differences only 3 vehicles. This could be attributed to an a no change in interest rates and the continued incentives offered by car dealerships at the beginning of the year.

- Commercial vehicle sales increased from 635 in January 2024 to 478 that was recorded in February 2024. This could have been influenced by increasing commercial sector performance.

Table 1: Monthly vehicle sales by type

| Market | Feb 2024 | Jan 2024 | Monthly unit change | Monthly % change |

| Passenger vehicles | 467 | 470 | -3 | -1 |

| Light commercial vehicles | 572 | 444 | 128 | 29 |

| Medium commercial vehicles sales | 15 | 20 | -5 | -25 |

| Heavy commercial vehicle sales | 15 | 5 | 10 | 200 |

| Extra heavy commercial vehicle sales | 33 | 9 | 24 | 267 |

| Bus | 0 | 2 | -2 | -100 |

Figure 1: Monthly Vehicle Sales (February 2023 – February 2024)

Source: Lightstone Auto & HEI RESEARCH

Figure 2: month on month, Vehicle Sales Growth (February 2025 vs January 2024)

Source: Lightstone (Pty) Ltd & HEI RESEARCH

Outlook

Despite the prevailing high-interest rates, the demand for new vehicles has demonstrated resilience. As inflation gradually subsides, we anticipate that interest rates will be lowered, subsequently resulting into a boost of vehicle sales in the short to medium term. The expectation stems from the understanding that lower interest rates make financing more affordable, thereby incentivizing consumers to make vehicle purchases.