Key Highlights

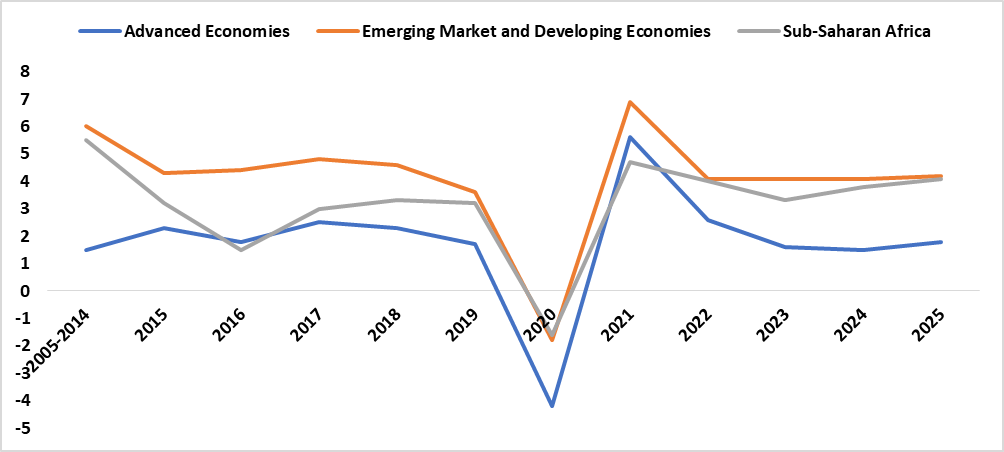

- Global growth is projected at 3.1% in 2024 and 3.2% in 2025, a 0.2% higher than the October 2023 forecast.

- The forecast for 2024-25 is below the historical average of 3.8% due to elevated central bank policy rates to fight inflation, high debt, and low underlying productivity growth.

- Advanced Economies: Growth is projected to decline slightly from 1.6% in 2023 to 1.5% in 2024, before rising to 1.8% in 2025. This includes an upward revision of 0.1 percentage point for 2024 due to stronger-than-expected US growth, offset by weaker growth in the euro area.

- United States: Growth is projected to fall from 2.5% in 2023 to 2.1% in 2024 and 1.7% in 2025. This is due to the lagged effects of monetary policy tightening, gradual fiscal tightening, and a softening in labor markets.

- Euro Area: Growth is projected to recover from 0.5% in 2023 to 0.9% in 2024 and 1.7% in 2025. This recovery is expected to be driven by stronger household consumption as the effects of the shock to energy prices subside and inflation falls.

- United Kingdom: Growth is projected to rise modestly from 0.5% in 2023 to 0.6% in 2024, then to 1.6% in 2025. This is due to the waning effects of high energy prices and an easing in financial conditions.

- Japan: Growth is projected to decelerate from 1.9% in 2023 to 0.9% in 2024 and 0.8% in 2025, reflecting the fading of one-off factors that supported activity in 2023.

- Emerging Market and Developing Economies: Growth is expected to remain at 4.1% in 2024 and rise to 4.2% in 2025. This includes an upward revision of 0.1% for 2024 due to upgrades for several regions.

- Sub-Saharan Africa, growth is projected to rise from an estimated 3.3 percent in 2023 to 3.8 percent in 2024 and 4.1 percent in 2025, as the negative effects of earlier weather shocks subside and supply issues gradually improve. The downward revision for 2024 of 0.2 percentage points from October 2023 mainly reflects a weaker projection for South Africa on account of increasing logistical constraints, including those in the transportation sector, on economic activity.

- Global headline inflation is expected to fall to 5.8% in 2024 and 4.4% in 2025.

- Risks to global growth are broadly balanced with potential upside from faster disinflation and downside from new commodity price spikes and supply disruptions.

Figure 1: Global Real GDP growth rates, Annual % Changes (2005-2025)

Source: IMF, January 2024

- World trade growth is projected at 3.3% in 2024 and 3.6% in 2025, below its historical average growth rate of 4.9%.

- These forecasts are based on assumptions that fuel and nonfuel commodity prices will decline in 2024 and 2025 and that interest rates will decline in major economies.

- Policymakers’ challenge is to manage the final descent of inflation to target, calibrate monetary policy, and adjust to a less restrictive stance.

- A renewed focus on fiscal consolidation is needed to deal with future shocks, raise revenue for new spending priorities, and curb the rise of public debt.

- More efficient multilateral coordination is needed for debt resolution, to avoid debt distress and create space for necessary investments, as well as to mitigate the effects of climate change.

Forces Shaping the Outlook

- The global economic recovery from the COVID-19 pandemic, Russia’s invasion of Ukraine, and the cost-of-living crisis is proving surprisingly resilient.

- Inflation is falling faster than expected from its 2022 peak, reflecting favorable supply-side developments and tightening by central banks.

- High-interest rates aimed at fighting inflation and a withdrawal of fiscal support amid high debt are expected to weigh on growth in 2024.

Growth Resilient in Major Economies

- Economic growth is estimated to have been stronger than expected in the second half of 2023 in the United States, and several major emerging market and developing economies.

- Inflation is subsiding faster than expected, reflecting favorable global supply developments.

- High borrowing costs are cooling demand, resulting in high mortgage costs, challenges for firms refinancing their debt, tighter credit availability, and weaker business and residential investment.

Fiscal Policy Amplifying Economic Divergences

- Governments in advanced economies eased fiscal policy in 2023.

- In emerging markets and developing economies, the fiscal stance is estimated to have been neutral.

- The fiscal policy stance is expected to tighten in several advanced and emerging markets and developing economies to rebuild budgetary room for maneuvering and curb the rising path of debt.

Risks to the Outlook

- Upside risks include faster disinflation, slower-than-assumed withdrawal of fiscal support, faster economic recovery in China, and artificial intelligence and supply-side reforms.

- Downside risks include commodity price spikes amid geopolitical and weather shocks, persistence of core inflation, faltering of growth in China, and disruptive turn to fiscal consolidation.

Policy Priorities

- As inflation declines toward target levels across regions, the near-term priority for central banks is to deliver a smooth landing.

- With fiscal deficits above prepandemic levels and higher debt-service costs, fiscal consolidation based on credible medium-term plans is warranted to restore room for budgetary maneuver.

- Intensifying supply-enhancing reforms would facilitate both inflation and debt reduction and enable a durable rise in living standards.

- Strengthening resilience through multilateral cooperation is vital for mitigating the costs of the separation of the world economy into blocs