Analysis

Credit extended to households and businesses in the private sector marginally increased by N$59 million between July and August 2023. In monetary terms, total credit extended to the private sector grew from N$119,229.8 million in July 2023 to N$119,288.8 million in August 2023, due to the slight increase in demand for mortgages for households by 3.1% as well as installments and leasing credit by businesses by 17.7%.

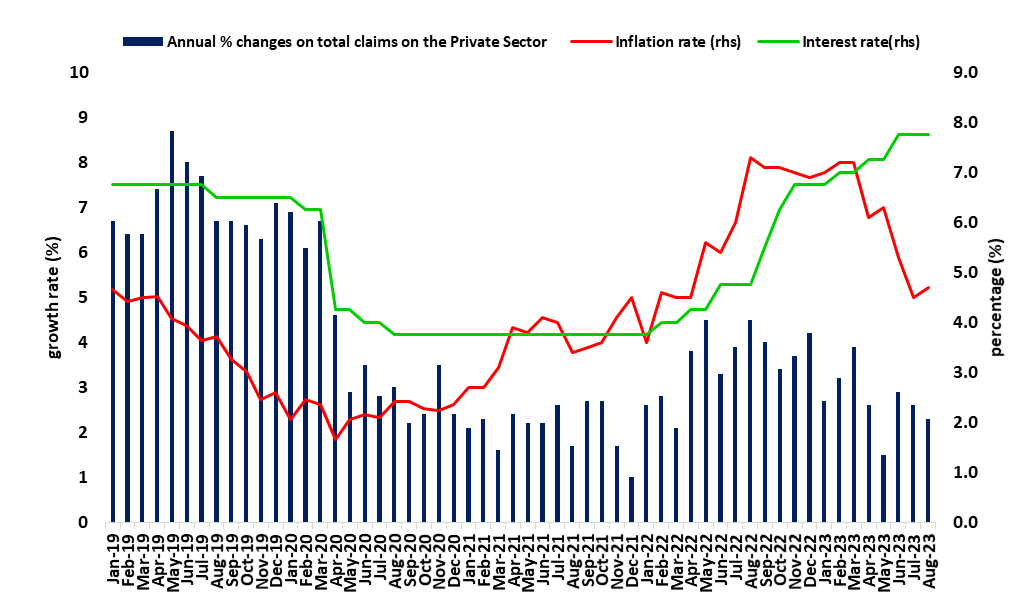

On an annual basis, the Private Sector Credit Extension (PSCE) decelerated at 2.7%, from a 3.9% growth rate recorded at the end of July 2023 as debt obligations hinder consumers from taking up more credit facilities. (Figure 1). Furthermore, business credit contracted by 2.0% y/y, while household credit stood at 5.4% y/y.

Figure 1: Annual % PSCE vs. Repo Rate & Interest Rate, (January 2019- August 2023)

Source: BON, NSA & HEI RESEARCH

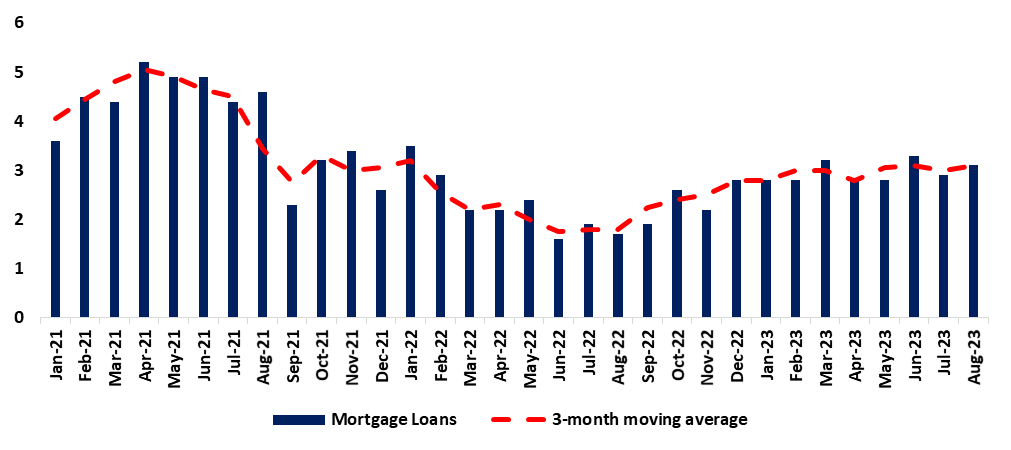

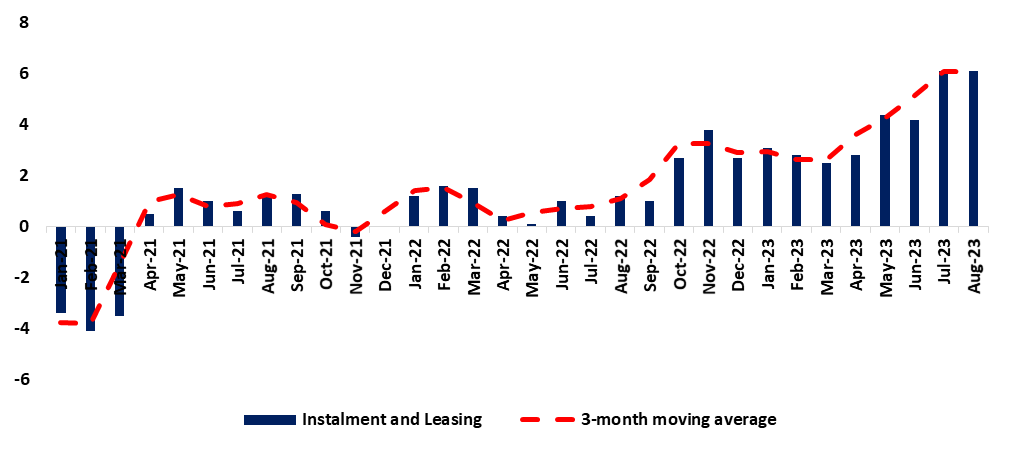

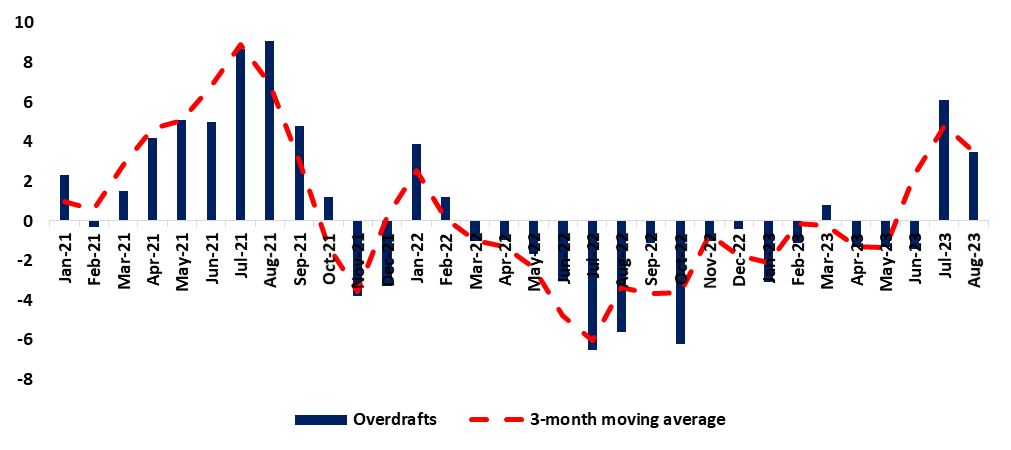

Credit to Households

The subdued growth in credit extended to households was driven by the sub-categories of; mortgage loans (from -2.9% to 3.1% m/m), while installment and leasing remained unchanged at 6.1% m/m (Figures 2&3). Additionally, there were declines in most credit facilities available to households, leading to minor overall growth. This was primarily attributed to a decrease in the uptake of weak overdraft credit, falling from 6.1% to 3.5%, and a decline in other loans and advances from 15.9% to 14.9% during the specified period (Refer to Figures 4 and 5)

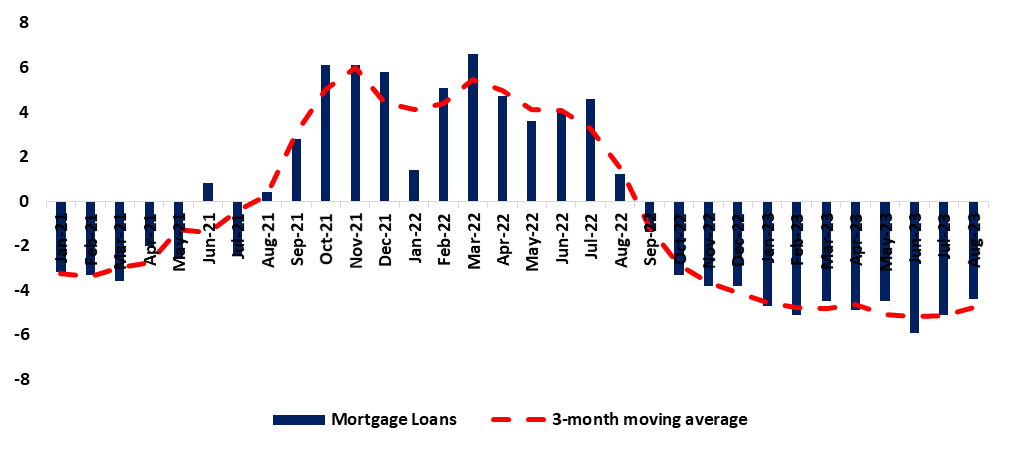

Figure 2: Mortgage, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

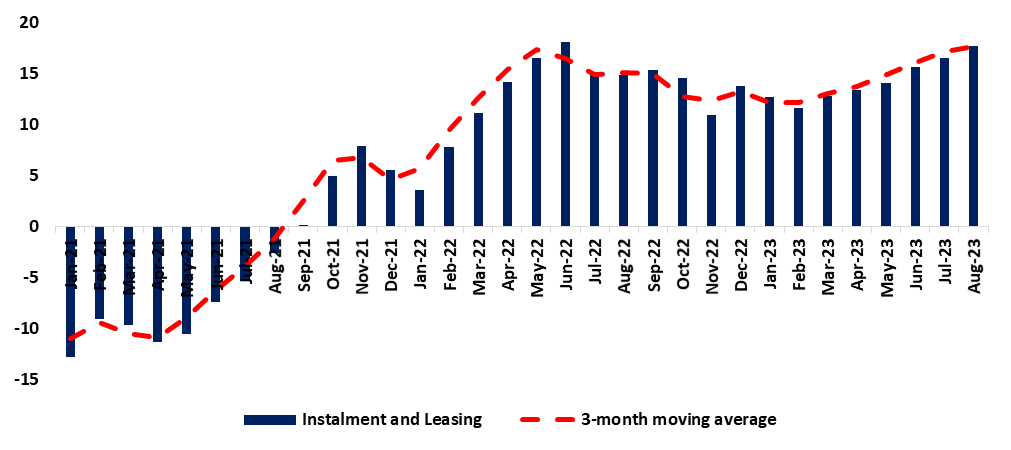

Figure 3: Instalments and Leasing, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

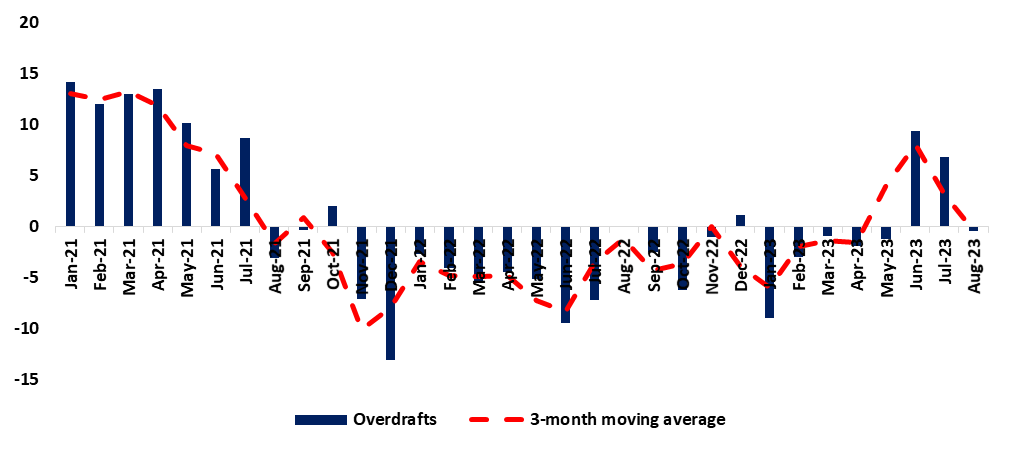

Figure 4:, Overdrafts (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

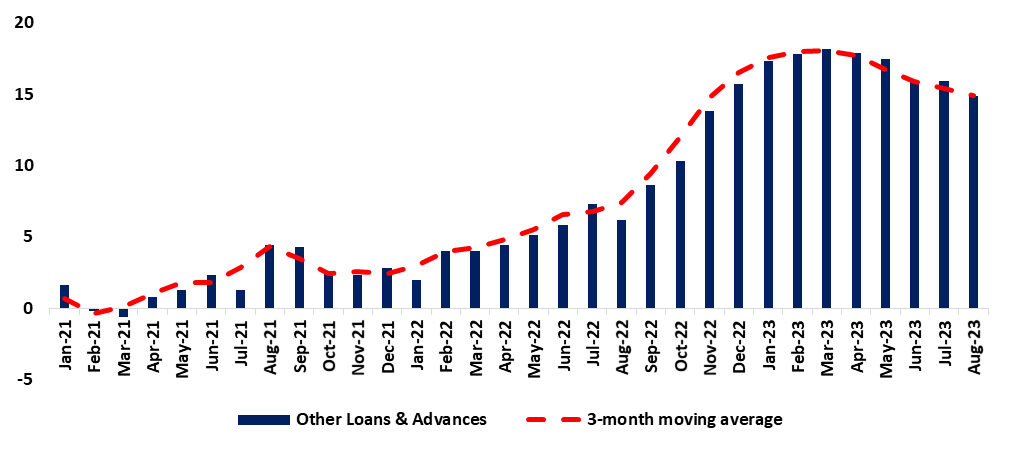

Figure 5: Other loans and advances, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

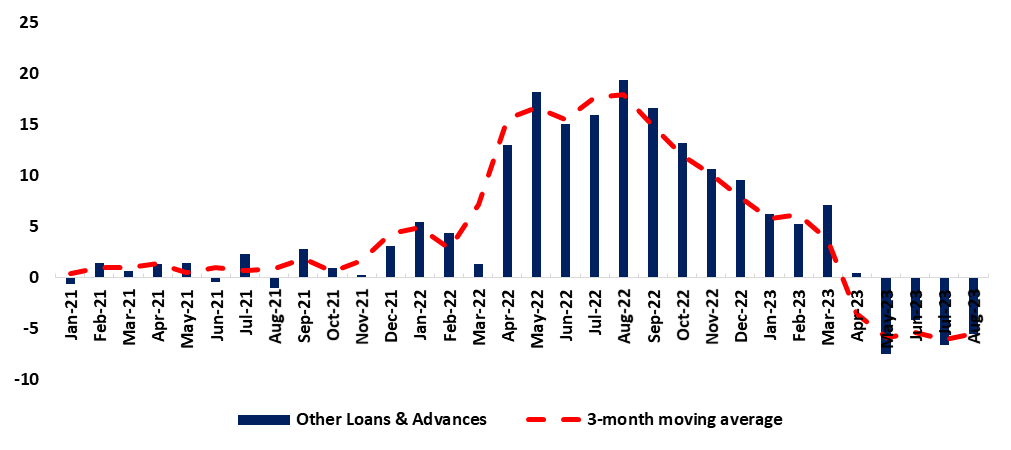

Credit to Businesses

The tightening in credit extended to businesses was driven by debt by businesses specifically in the services, wholesale and retail, commercial real estate, fishing as well as the transport sectors in the form of overdraft credit (from 6.8% to -0.4%), other loans and advances (from –6.6% to -5.5% m/m), and mortgage credit (from -5.1 to -4.4m/m) as illustrated in figure 5, 6 and 7. Furthermore, the demand for installments and leasing slightly improved from 16.6% to 17.7% m/m (Figure 8).

Figure 5: Overdrafts, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Figure 6: Other loans and advances, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Figure 7: Mortgage, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Figure 8: Instalments and Leasing, (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Commercial Bank Liquidity Position

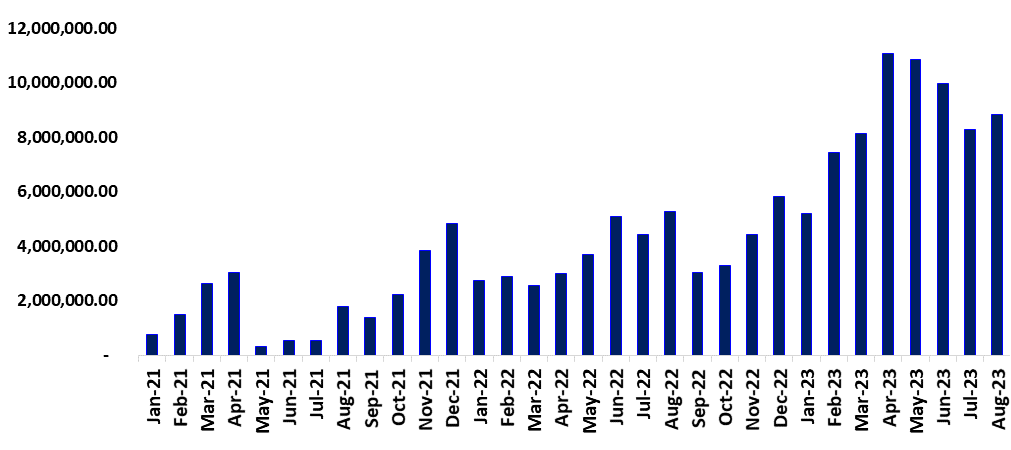

The overall liquidity position of the banking industry averaged N$8.9 billion in August 2023, depicting a month-on-month increase of N$26.1 million when compared to July 2023 (Figure 9). According to the Bank of Namibia (BoN), the increase was due to the rise in government payments as well as diamond sale proceeds.

Figure 9: Banking Liquidity (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

Foreign Reserves & Money Supply

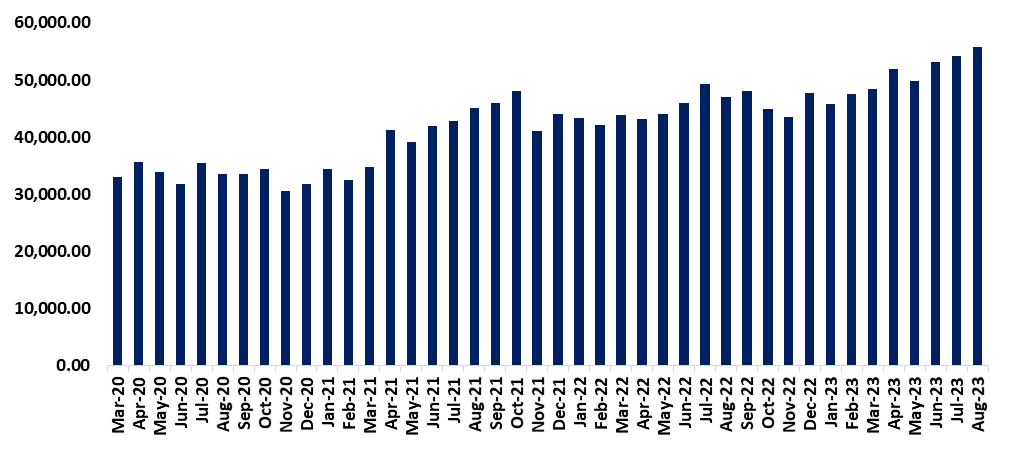

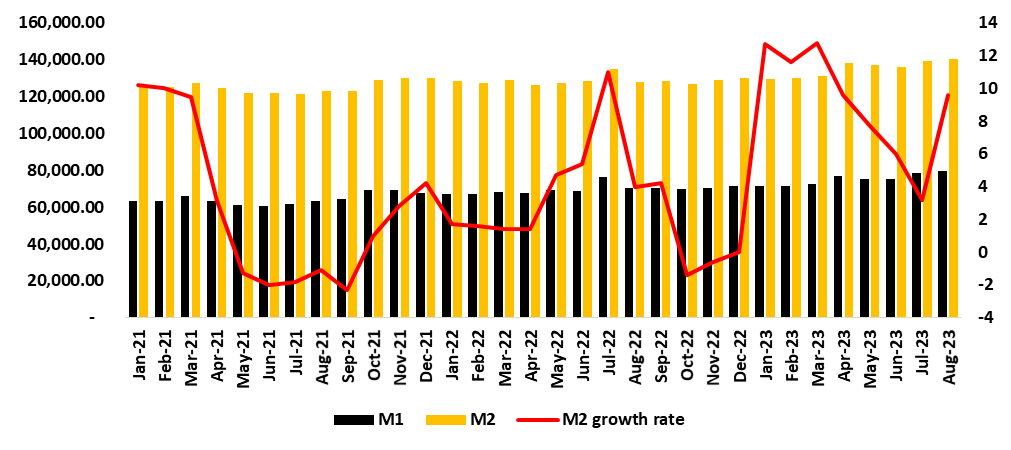

The Bank of Namibia’s stock of international reserves increased to N$55.6 billion in August 2023 from N$54.2 billion recorded in July 2023. The growth was attributed to the increase in commercial bank inflows, placements of Customer Foreign Currency (CFC), and gains from revaluation (Figure 10). Subsequently, growth in broad money supply significantly increased to 9.6 % in August 2023, from the 3.2% experienced in July 2023 (Figure 11).

Figure 10: Foreign Reserves (March 2020- August 2023)

Source: BON, NSA & HEI RESEARCH

Figure 11: Broad Money Supply Growth % (January 2021- August 2023)

Source: BON, NSA & HEI RESEARCH

HEI Sentiments and Outlook

The persistent weak demand for credit, particularly in business sectors such as overdrafts, mortgages, and other loans and advances, could suggest hesitancy among businesses to pursue credit due to a perceived lack of profitable investment opportunities. This hesitancy stems from a lack of confidence in their ability to generate future cash flows that would justify borrowing.

Conversely, the increasing trend in installments and leasing indicates a different scenario. Businesses opting for these financing options might be displaying greater confidence in their future revenue streams, indicating a willingness to invest in assets. This uptick reflects a belief in the profitability of such investments.

Similarly, the positive trend in credit demand from households, specifically in the mortgages and installment and leasing categories, mirrors consumer confidence in their financial future. The readiness of households to commit to long-term debt obligations underscores their positive outlook on income stability.

Considering these factors, we anticipate the Private Sector Credit Extension, particularly in the business category, to remain weak in the short to medium term. This projection is grounded in the cautious approach exhibited by both businesses and households, emphasizing the importance of economic stability and confidence in shaping credit market dynamics.