Analysis

In July 2023, there was a modest increase in credit extended to households and businesses in the private sector, amounting to N$42.2 million. This growth pushed the total credit extended to the private sector from N$119,187.6 million in June 2023 to N$119,229.8 million in July 2023. The uptick in credit demand was primarily attributed to a 10.1% increase in installment sales and leasing credit, along with a 6.1% rise in overdraft credit, coming from both business and household segments. The surge in credit demand was primarily driven by the car rental sector’s substantial vehicle purchases in July. The increase in vehicle procurement by the car rental industry could be a direct response to the upswing in tourism-related activities and significant shifts in household expenditure patterns.

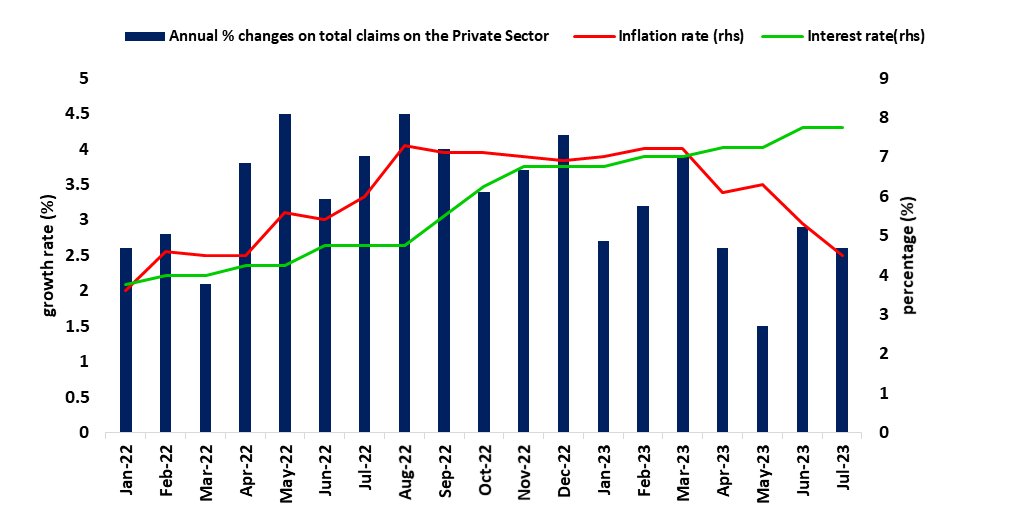

On an annual basis, the Private Sector Credit Extension (PSCE) has decelerated to 2.6% from the 3.9% growth rate recorded in July 2022. This slowdown could be a result of households and businesses factoring in the delayed effects of monetary policy changes aimed at controlling inflation. Additionally, business credit has declined by 1.2% year-on-year, while household credit has increased by 5.5% year-on-year. Figure 1.

Figure 1: Annual % PSCE vs. Repo Rate & Interest Rate, (January 2022- July 2023)

Source: BON, NSA & HEI RESEARCH

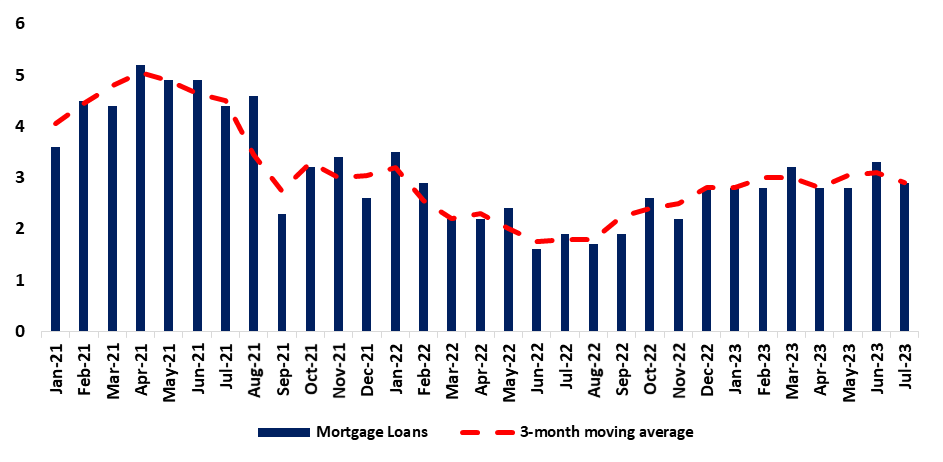

Credit to Households

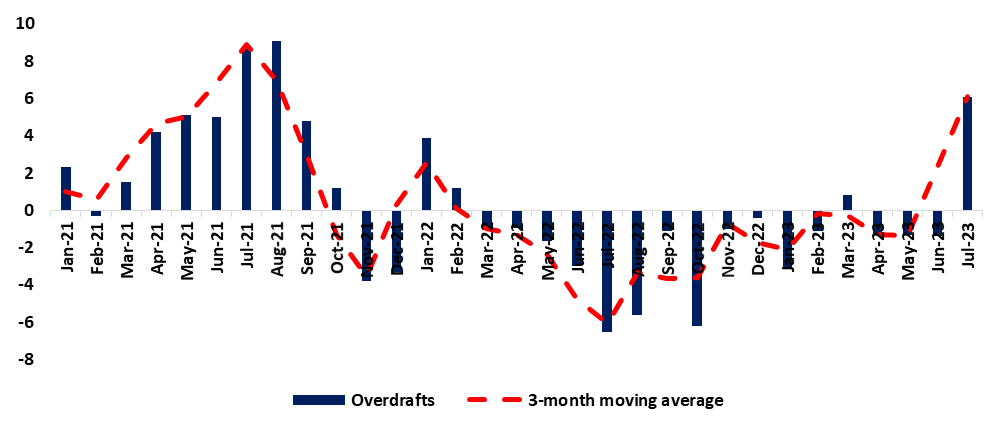

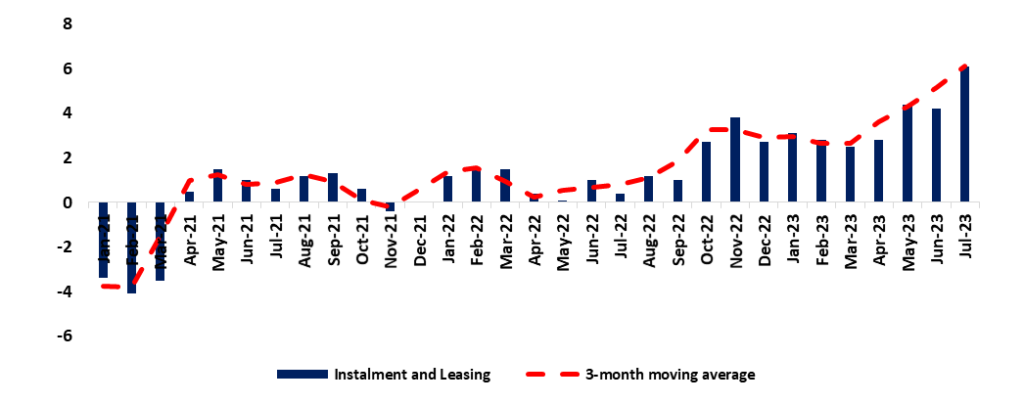

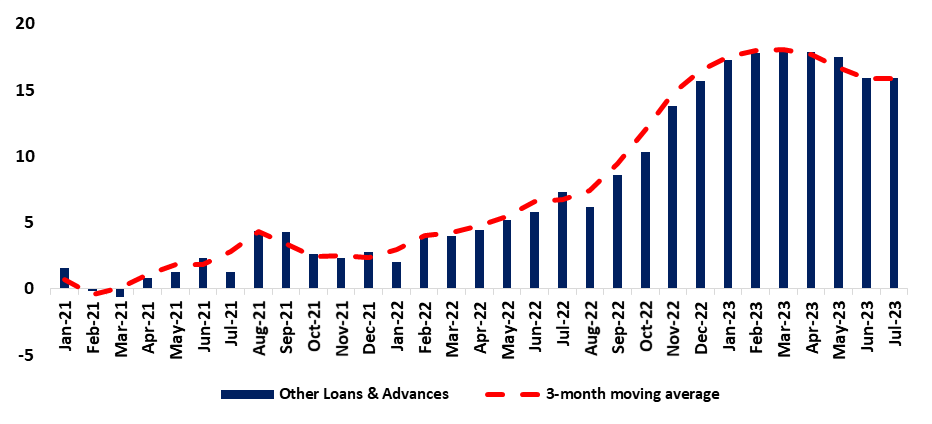

The annual sluggish growth in credit extension was primarily influenced by household sub-categories. Overdrafts, for instance, showed a significant shift from -1.4% to 6.1% month-on-month, and installments and leasing, increased from 4.2% to 6.1% month-on-month (See Figures 2 and 3). Additionally, the category for other loans and advances increased by 15.9%, while mortgage credit experienced a slight decline, dropping from 3.3% to 2.9% during the period under review (See Figures 4 and 5).

Figure 2: Overdraft, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 3: Instalments and Leasing, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 4: Other loans and advances, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 5: Mortgage, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

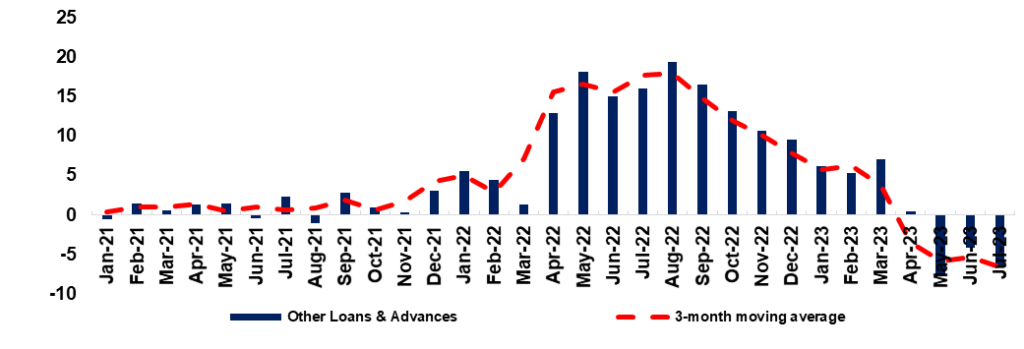

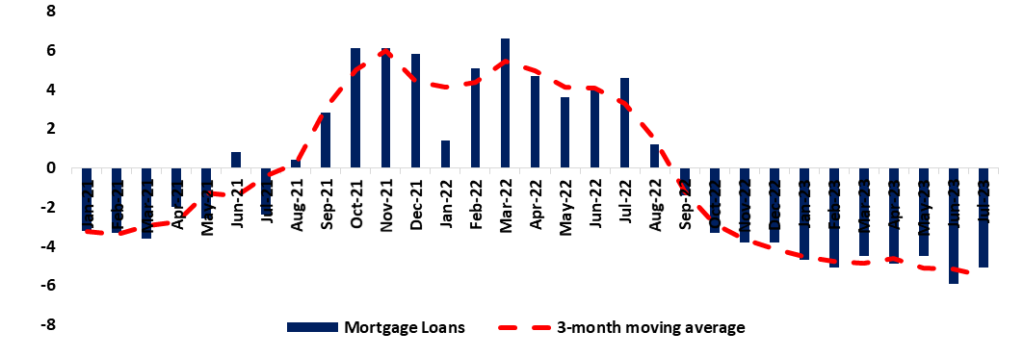

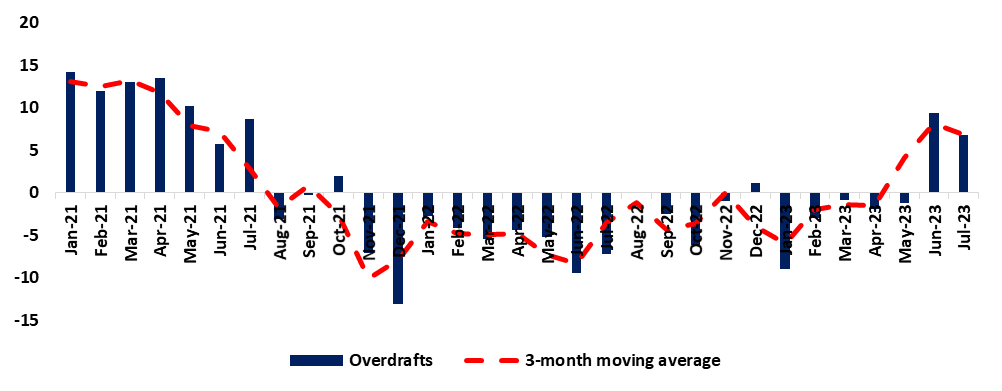

Credit to Businesses

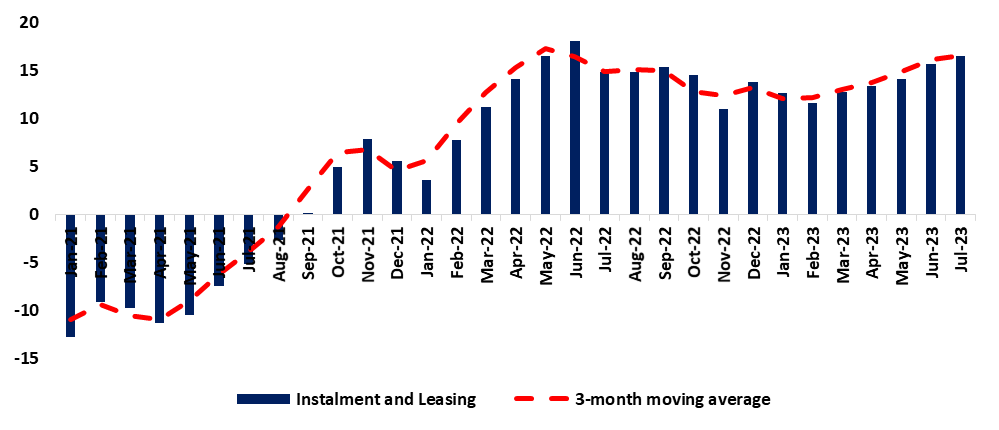

The contraction in credit extended to businesses was driven by repayments from the mining, wholesale and retail, fishing, and financial services made in the form of other loans and advances (from -4.2% to -6.6% m/m) and mortgage credit (from -5.9% to -5.1% m/m) as illustrated in figure 6 and 7. Uptake in overdraft facilities from businesses declined from 9.4% to 6.8% m/m (Figure 8), however, it is worth noting that there was an upsurge in installments and leasing facilities from 15.7% to 16.6% m/m (Figure 9).

Figure 6: Other loans and advances, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 7: Mortgage, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 8: Overdrafts, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 9: Instalments and Leasing, (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Commercial Bank Liquidity Position

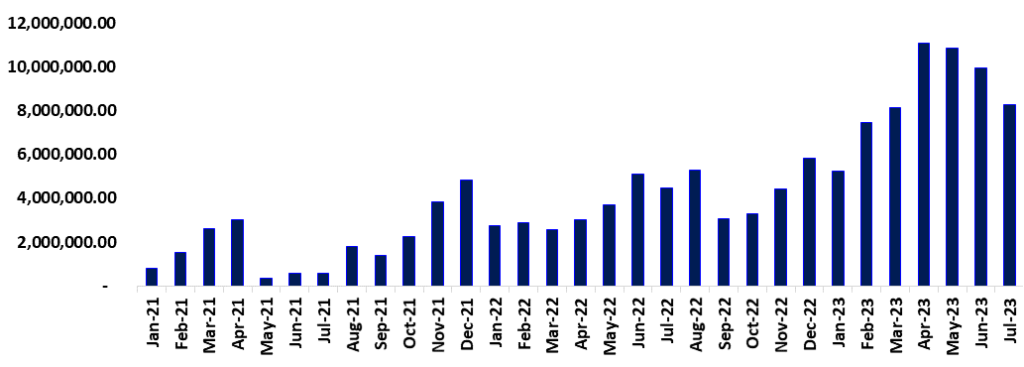

The overall liquidity position of the banking industry averaged N$8.6 billion in July 2023, depicting a month-on-month decrease of N$1.3 billion (Figure 10). According to the Bank of Namibia (BoN), the decline was due to corporate tax payments.

Figure 10: Banking Liquidity (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Foreign Reserves & Money Supply

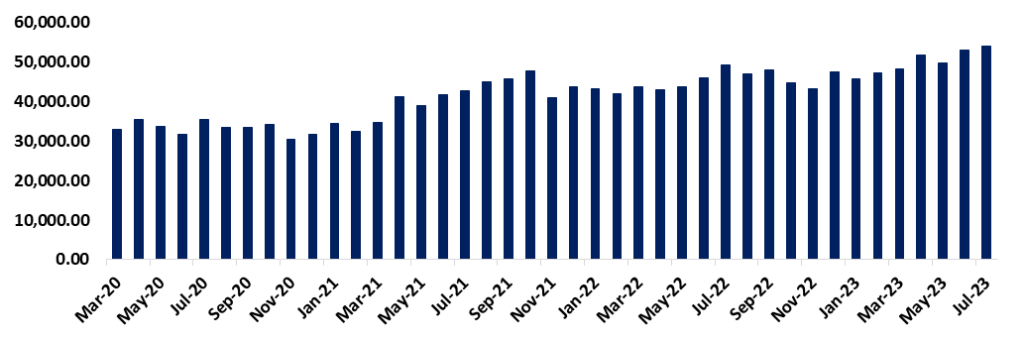

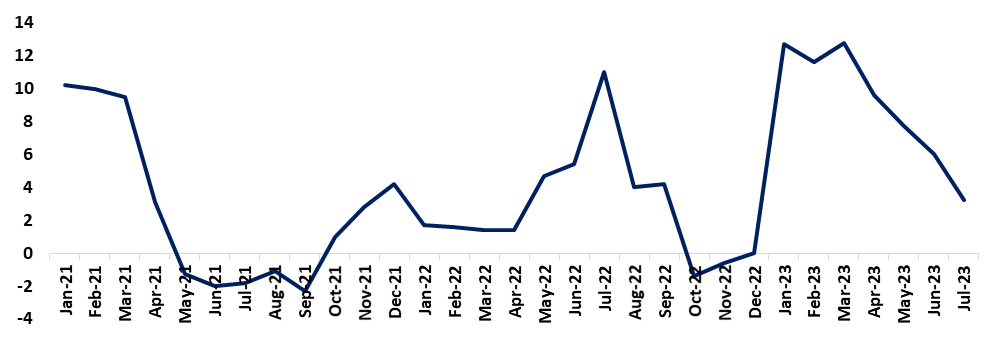

The Bank of Namibia’s stock of international reserves increased from about N$52.9 billion in June to around N$54.1 billion in July 2023 as SACU inflows, diamond sales, and Customer Foreign Currency (CFC) placements were the main drivers for growth (Figure 11). However, the growth in money supply stood at 3.2% in July 2023, from the 6.0% experienced in June 2023. The monthly low growth in the money supply could be attributed to a tightening of monetary conditions, characterized by the Bank of Namibia’s decision to raise the interest rate by 50 basis points. This measure was taken to combat inflation effectively and uphold the stability of the currency peg (Figure 12).

Figure 11: Foreign Reserves (March 2020- July 2023)

Source: BON, NSA & HEI RESEARCH

Figure 12: Broad Money Supply Growth % (January 2021- July 2023)

Source: BON, NSA & HEI RESEARCH

Outlook

Given the current economic climate, we expect the growth trajectory of Private Sector Credit Extension to persist, albeit at a more gradual pace in the short to medium term. This cautious outlook aligns with the need to navigate the evolving financial landscape prudently.