- Background

According to the World Bank Global Economic Prospectus of June 2023, the global economy is set to moderate to 2.1% in 2023 from a growth of 3.1% recorded in 2022, before a slight upturn of 2.4% in 2024. The global economy remains in a precarious state amid the protracted effects of the overlapping negative shocks of the pandemic, the Russian and Ukraine conflict, and the sharp tightening of monetary policy to contain high inflation. Inflation pressures persist, and tight monetary policy is expected to weigh substantially on activity in 2023. Recent banking sector stress in advanced economies will also likely dampen activity through more restrictive credit conditions. More widespread bank turmoil and tighter monetary policy could lead to even weaker global growth.

Growth in Sub-Saharan Africa is projected to slow to 3.2% in 2023, a 0.4% downward revision from January forecasts as external headwinds, persistent inflation, higher borrowing costs, and increased insecurity weigh on activity. Recoveries from the pandemic remain incomplete in many Sub-Saharan African countries, with elevated costs of living tempering the growth of consumption. Over half of the 2023 downgrade is attributable to an abrupt slowdown in South Africa. Growth in South Africa decelerated sharply in early 2023, reflecting policy tightening and the impact of an intensifying energy crisis.

South Africa

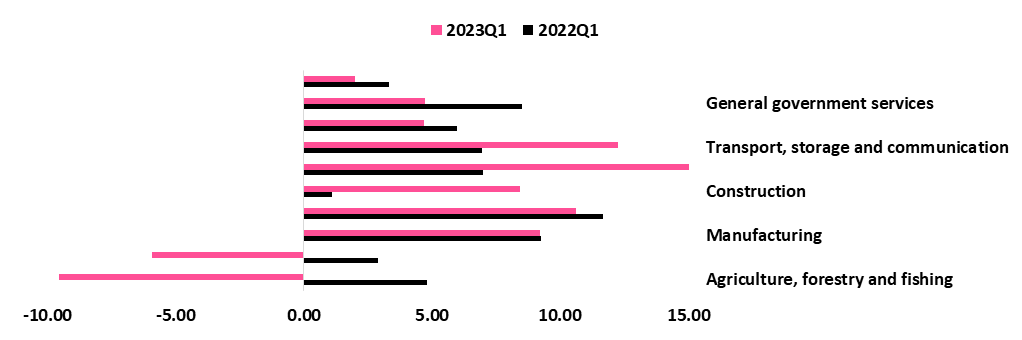

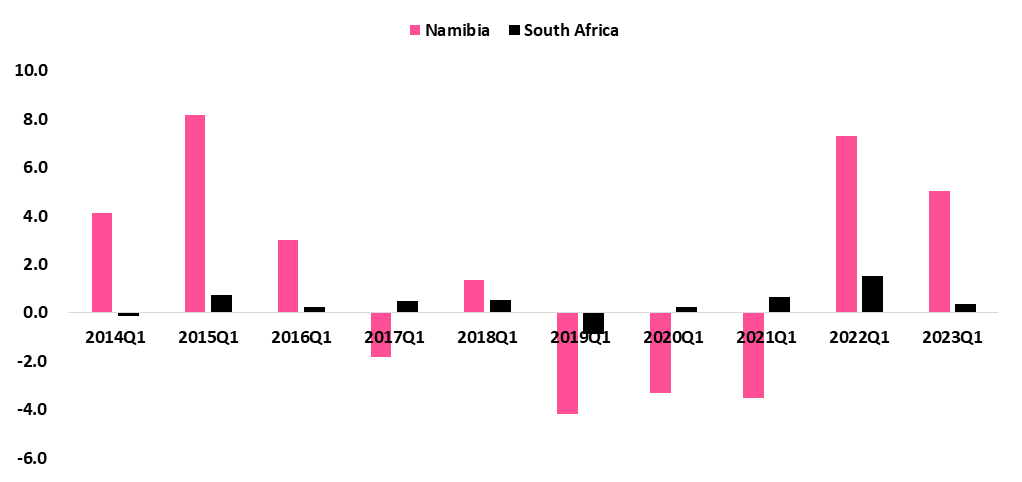

Despite concerns over load shedding and the potential impact on inflation and economic growth, the South African economy managed to avoid a technical recession. The South African economy recorded a rebound of 0.4% in economic activity during quarter 1 of 2023. Stats SA report indicated that the manufacturing and finance industries were the main drivers for economic growth during the period under review. The manufacturing sector demonstrated a modest growth rate of 1.5%, followed by the construction and the transport, storage, and communication sector, both experiencing growth rates of 1.1% respectively.

However, certain sectors faced challenges despite the overall economic recovery. Load shedding, in particular, hindered growth, leading to a significant decline of 12.3% in the agriculture, forestry, and fishing sector. Further to this, the excessive rainfall received at the beginning of the season resulted in difficult conditions for field crops, causing disruptions and delays in planting, with some areas experiencing delays of over a month. Additionally, the livestock sector continues to face challenges stemming from foot and mouth disease, leading to a decrease in slaughtering activity. Another significant sector that recorded a decline was the electricity, gas, and water sector. This decline was attributed to Eskom’s current inability to generate sufficient electricity to meet demand. (Figures 1 & 3).

Namibia

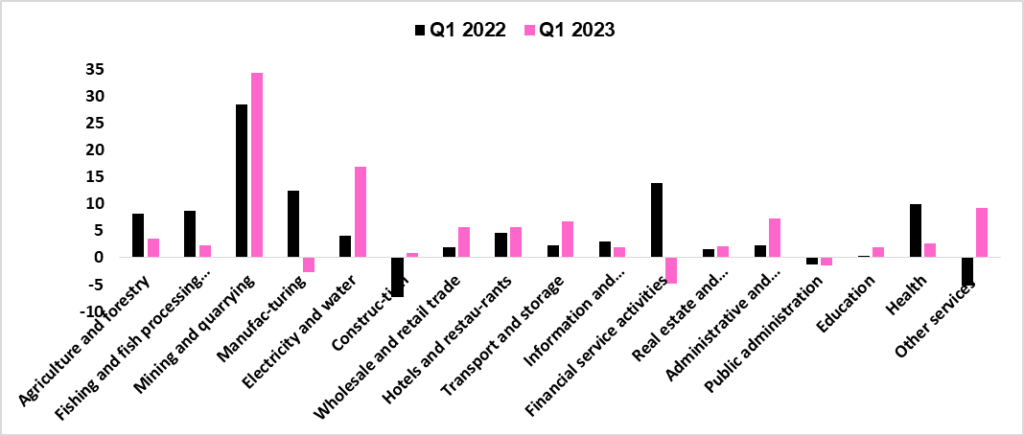

The Namibian economy recorded a growth of 5.0% in the first quarter of 2023, a slower growth when compared to the 7.3% growth rate that was recorded in the corresponding quarter of 2022. The quarter-on-quarter decline in economic performance was largely attributed to contractions in the financial services which declined by 4.9%. Poor performance in the sector was attributed to both banking services and the insurance services subsectors as a result of the deterioration in the stock of net claims on central government and the decline in the real total deposits and claims. Additionally, the manufacturing sector also recorded the second notable decline of 2.7% during the period under review. The decline in the manufacturing sector activities was a result of the reduction in real value added in subsectors of grain mill, beverages, and dairy products which came as a result of low volume sales of grain mill products as well as the volume produced in the beverages sub-sectors.

Furthermore, the ‘agriculture and forestry, health sectors also experienced significant declines of 3.6 %, 2.6% respectively. Low growth in the agriculture and forestry sector was attributed to low growth in the crop farming subsector as a result of the adverse impact of inadequate, delayed, and erratic rainfall in the country. Poor performance in health could be attributed to a deceleration in real compensation for employees.

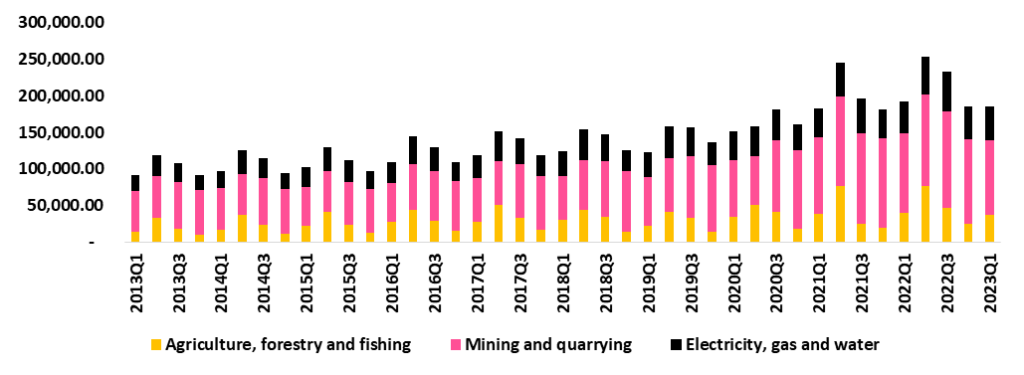

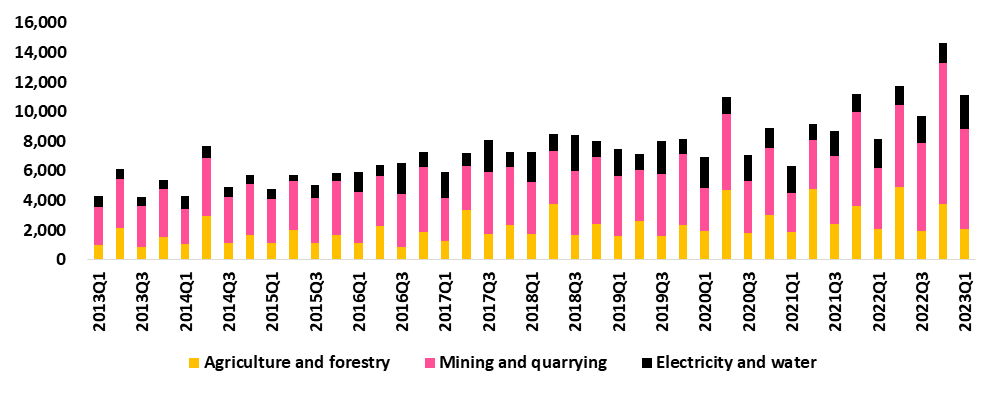

Additionally, sectors such as mining and quarrying and ‘electricity and water’ posted growths. The sectors contributed 3.7% and 0.5% to GDP during the period under review. Furthermore, activities also picked up in the sectors of administrative and support services, transport and storage, wholesale and retail trade, and hotels and restaurants (Figures 2 & 3).

Undoubtedly, Namibia’s economic structure bears a striking resemblance to that of South Africa, particularly in terms of the sectors that make significant contributions to both countries’ Gross Domestic Product (GDP). Namibia and South Africa exhibit similarities in their economic structures, particularly in the significance of the mining and quarrying sectors, which contribute substantially to their exports and employment. Both countries possess abundant mineral resources like diamonds, gold, and uranium. Furthermore, agriculture holds importance for both economies, though South Africa has a more prominent agricultural industry due to a larger share of cultivable land. Additionally, Namibia’s coastal location enables a strong focus on the fishing sector, contributing significantly to its GDP and export revenue. Namibia has also experienced double-digit growth in the manufacturing sector and hence, diversifying its economy away from the dependence on raw materials from the primary sector. In contrast, South Africa’s economy is more diversified, with a well-developed industrial sector and a prominent financial and services industry. Overall, these similarities and differences shape the economic landscapes of Namibia and South Africa (Figures 4&5).

Figure 1: South Africa’s Key Industry growth rates- Q1 2023 compared with Q1 2022

Source: StatsSA & HEI Research

Figure 2: Namibia’s GDP, Quarter 1 2022 Vs. Quarter 1 2023

Source: NSA & HEI Research

Figure 3: South Africa’s Q1 GDP Vs Namibia’s Q1 GDP % change quarter-on-quarter

Source: StatsSA, NSA & HEI Research

Figure 4: South Africa’s historic quarterly GDP for the top 3 sectors at current prices (millions R)

Source: StatsSA & HEI Research

Figure 5: Namibia’s Historic quarterly GDP for the top 3 sectors at current prices (millions N$)

Source: NSA & HEI Research

Outlook

In anticipation of the potential recovery of the South African economy, several factors support this outlook. Firstly, the strengthening of the rand is contributing to positive sentiment, partially attributed to the reduction of power outages during the winter season, which aligns with historical production trends of the state-owned power utility, Eskom. Moreover, measures implemented by the government, such as load curtailment, expanding the diesel rebate to the food value chain, and the introduction of the Agro-Energy Fund; the fund is targeting to assist about 836 farmers with R2.5 billion. These initiatives are expected to facilitate the recovery of the agricultural sector in South Africa. Additionally, the decrease in the frequency of power outages is seen as encouraging news for the overall economy.

However, the South African economy faces risks that could impede growth in the second quarter and throughout 2023. These risks include insufficient and unreliable electricity supply, potential sharp increases in government debt interest rates, remaining on the Financial Action Task Force (FATF) greylist for an extended period, slow and unequal domestic growth, and the potential impact of the tightening of monetary policy to address high inflation. Moreover, the sluggish global economic outlook affecting Namibia’s commodity demand and export revenue, uncertainties surrounding the Chinese economy and its effect on the demand for metal commodities, currency volatility leading to higher costs of key imports, concerns about being greylisted by the Financial Action Task Force (FATF), water supply interruptions impacting coastal mines, and below-average rainfall across the country paint are factors that could hinder growth for the Namibian economy in 2023, putting pressure on Namibian consumers and producers.