Background

The Bank of Namibia Monetary Policy Committee (MPC) is set to announce an interest rate decision on the 19 August 2020. The MPC decided to cut the repo rate by 250 basis points since the beginning of the year in an attempt to cushion an ailing economy and as a response to devastating impact of Covid-19,while maintaining the one-to-one link between the Namibian dollar and the South African rand.

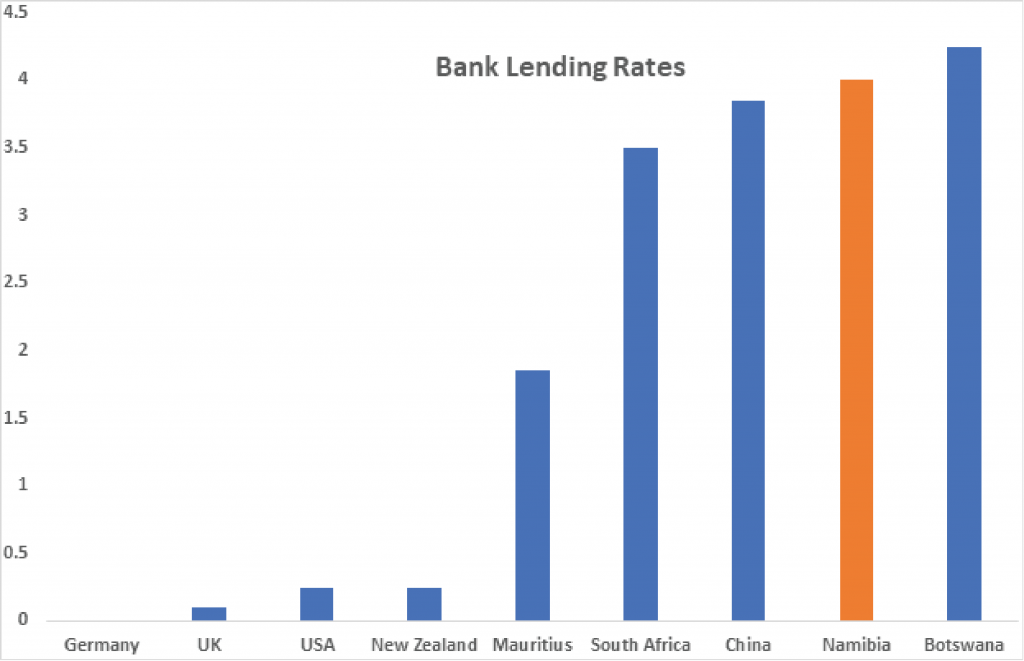

Namibia’s repo rate is now at 4.00 percent ,50 basis points higher than that of South Africa, which is at 3.50 percent. The Bank of Namibia has provided relief to commercial banks by undertaking regulatory and policy measures to assist business and households during this time. Central banks around the world have taken decisive measures to intervene in the real economy and increase Government expenditure to fight the pandemic.

Outlook

Our prediction is that there will be no interest rate cut at the next MPC meeting. This is supported by the fact that interest rate cuts are a blunt tool in the face of the current global pandemic. We believe that expansionary fiscal stimulus is required for monetary policy to be effective at this stage of the cycle.

Figure 1: Global Bank Lending Rates