HEI Fixed Income Market Commentary

- The New York Stock Exchange (NYSE) and the NASDAQ stock markets in the U.S. were closed for the Thanksgiving holiday, thus resulting in lower Treasury yields and a softer US dollar.

- The overall bourse of the Namibian Stock Exchange (NSX), closed in negative territory at -0.07% on the backdrop of real estate and financial sectors, which dropped by 0.26% and 0.90%, respectively.

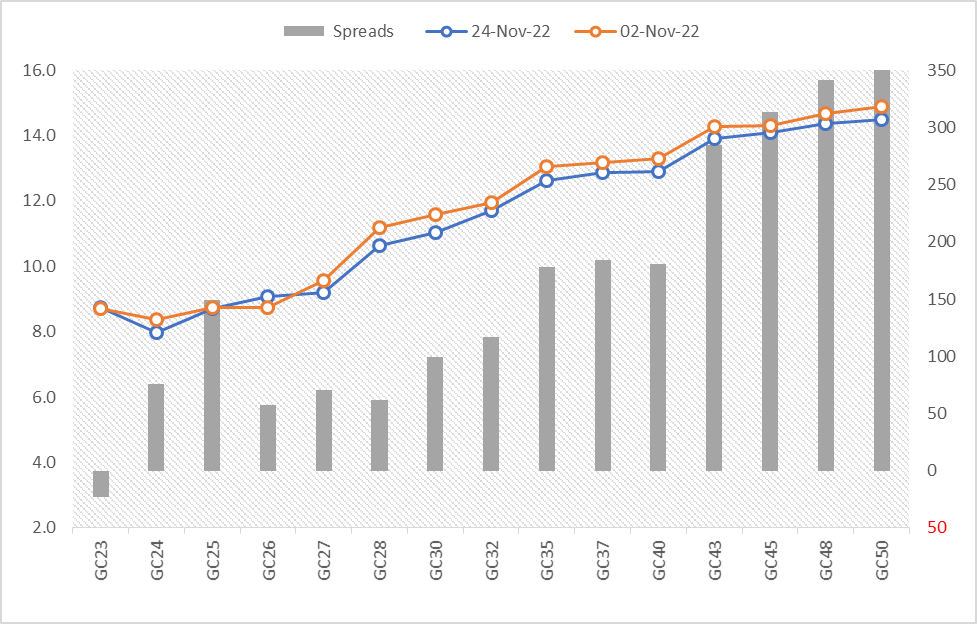

- Bond yields in Namibia are continuously on a downward trajectory, as SARBs increased the repo rate to 7.00% yesterday, however, Namibia still remains behind the curve, and most economists anticipate an increase in repo rate on 7 December 2022 at the next Bank of Namibia’s upcoming meeting.

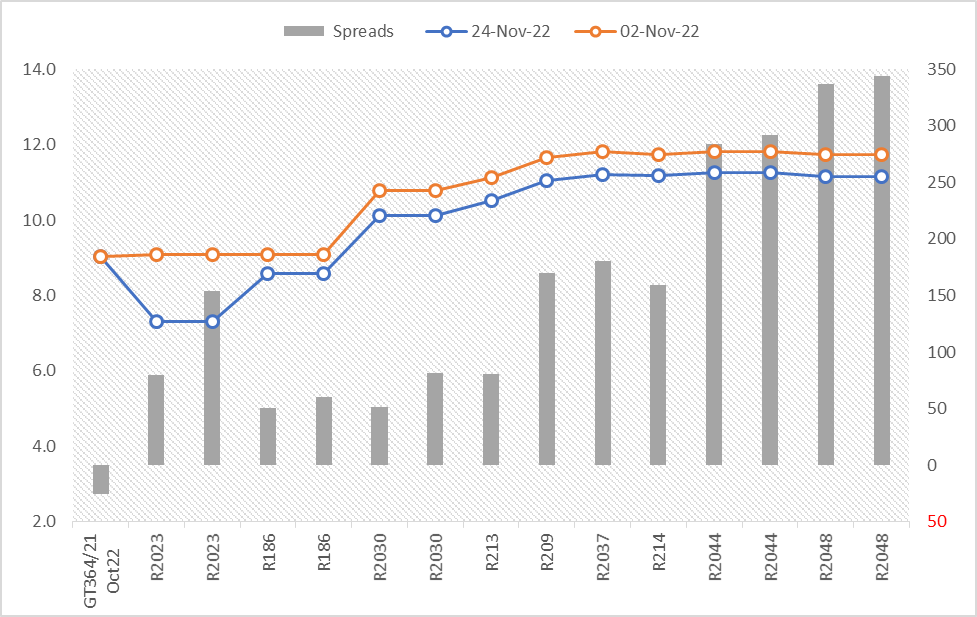

- Despite the JSE bourse closing at 0.32%, in South Africa, the bond yields are following the same trend as the Namibian bond yields

Table 1. Namibia Government Bonds

| Bonds | Coupon | Maturity | YTM (%) | YTM (%) | YTM (%) | DTDΔ | Prices |

| 02-Nov-22 | 23-Nov-22 | 24-Nov-22 | (bps) | 24-Nov-22 | |||

| GC23 | 8.85 | 15-Oct-23 | 8.71 | 8.79 | 8.75 | -4.37 | 100.07 |

| GC24 | 10.5 | 15-Oct-24 | 8.39 | 8.05 | 7.98 | -7.20 | 104.32 |

| GC25 | 8.5 | 15-Apr-25 | 8.74 | 8.79 | 8.72 | -7.00 | 99.52 |

| GC26 | 8.5 | 15-Apr-26 | 8.74 | 9.15 | 9.06 | -8.68 | 98.37 |

| GC27 | 8 | 15-Jan-27 | 9.55 | 9.28 | 9.21 | -7.00 | 95.91 |

| GC28 | 8.5 | 15-Oct-28 | 11.20 | 10.74 | 10.64 | -10.35 | 90.80 |

| GC30 | 8 | 15-Jan-30 | 11.58 | 11.12 | 11.04 | -7.85 | 85.22 |

| GC32 | 9 | 15-Apr-32 | 11.94 | 11.68 | 11.69 | 1.19 | 84.89 |

| GC35 | 9.5 | 15-Jul-35 | 13.04 | 12.82 | 12.61 | -20.61 | 80.54 |

| GC37 | 9.5 | 15-Jul-37 | 13.18 | 13.04 | 12.87 | -17.20 | 77.99 |

| GC40 | 9.8 | 15-Oct-40 | 13.29 | 12.97 | 12.89 | -8.25 | 78.56 |

| GC43 | 10 | 15-Jul-43 | 14.27 | 14.10 | 13.92 | -18.25 | 73.56 |

| GC45 | 9.85 | 15-Jul-45 | 14.30 | 14.24 | 14.09 | -14.81 | 71.25 |

| GC48 | 10 | 15-Oct-48 | 14.68 | 14.57 | 14.37 | -20.17 | 70.86 |

| GC50 | 10.25 | 15-Jul-50 | 14.87 | 14.71 | 14.48 | -22.33 | 71.34 |

Figure 1. Namibia Bond Yield: 02-Nov-2022 vs. 24-Nov-2022

Figure 1. South African Bond Yields: 02-Nov-2022 vs. 24-Nov-2022