HEI Fixed Income Market Commentary

- The U.S. stock markets, specifically the NYSE, and S&P 500 rose after meeting minutes from the US Federal Reserve showed that policymakers believed slower interest rate cuts could be more plausible going forward.

- The Namibian Stock Exchange (NSX), closed in positive territory with the overall bourse sitting at 1.42% before the release of the Fed minutes last night at 21h00. This resulted in a decline in bond yields because, when stock markets rally, the bond market drops

- In South Africa, the JSE bourse closed shy of 1% supported by the ICT and resource counters.

- Yesterday, the weaker US dollar and expectations of aggressive interest rate hikes by the South African Reserve Bank (SARB) boosted the rand, which traded at R16.98/US$ at 21h30. The expectations did come to light as the SARB hiked their repo rate, causing the rand to trade as R17.03/US$.

- Thus, causing bond yields to follow a similar trend then Namibia’s.

Table 1. Namibia Government Bonds

| Bonds | Coupon | Maturity | YTM (%) | YTM (%) | YTM (%) | DTDΔ | Prices |

| 02-Nov-22 | 22-Nov-22 | 23-Nov-22 | (bps) | 23-Nov-22 | |||

| GC23 | 8.85 | 15-Oct-23 | 8.71 | 8.76 | 8.79 | 2.91 | 100.03 |

| GC24 | 10.5 | 15-Oct-24 | 8.39 | 8.05 | 8.05 | -0.10 | 104.20 |

| GC25 | 8.5 | 15-Apr-25 | 8.74 | 8.80 | 8.79 | -0.50 | 99.37 |

| GC26 | 8.5 | 15-Apr-26 | 8.74 | 9.19 | 9.15 | -3.82 | 98.12 |

| GC27 | 8 | 15-Jan-27 | 9.55 | 9.28 | 9.28 | -0.50 | 95.68 |

| GC28 | 8.5 | 15-Oct-28 | 11.20 | 10.84 | 10.74 | -9.81 | 90.38 |

| GC30 | 8 | 15-Jan-30 | 11.58 | 11.17 | 11.12 | -5.40 | 84.88 |

| GC32 | 9 | 15-Apr-32 | 11.94 | 11.55 | 11.68 | 13.24 | 84.94 |

| GC35 | 9.5 | 15-Jul-35 | 13.04 | 12.98 | 12.82 | -16.43 | 79.45 |

| GC37 | 9.5 | 15-Jul-37 | 13.18 | 13.25 | 13.04 | -20.38 | 77.07 |

| GC40 | 9.8 | 15-Oct-40 | 13.29 | 13.00 | 12.97 | -2.63 | 78.10 |

| GC43 | 10 | 15-Jul-43 | 14.27 | 14.29 | 14.10 | -18.61 | 72.62 |

| GC45 | 9.85 | 15-Jul-45 | 14.30 | 16.88 | 14.39 | -248.75 | 69.77 |

| GC48 | 10 | 15-Oct-48 | 14.68 | 14.75 | 14.57 | -17.14 | 69.88 |

| GC50 | 10.25 | 15-Jul-50 | 14.87 | 14.82 | 14.71 | -11.33 | 70.25 |

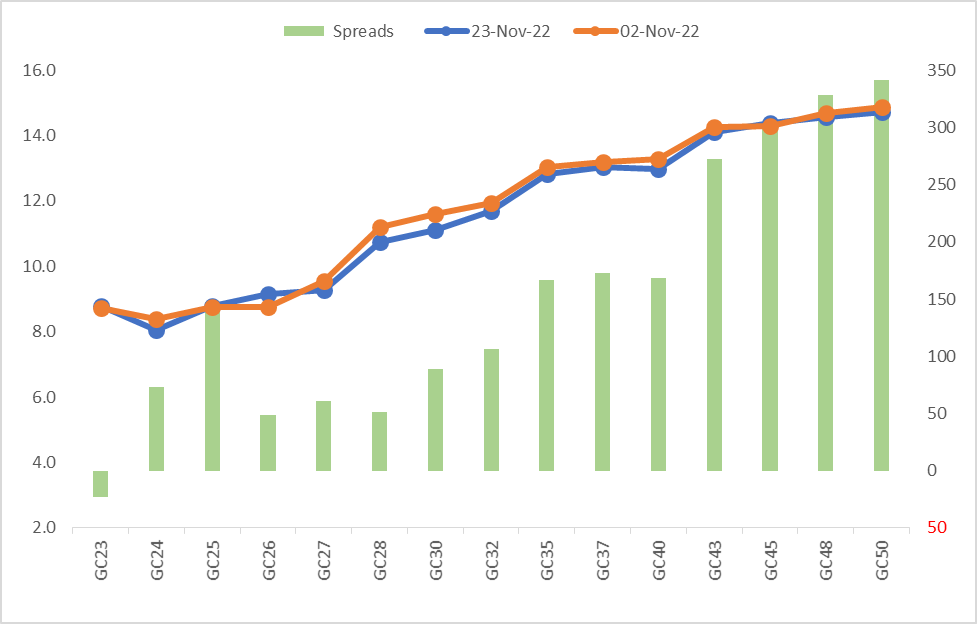

Figure 1. Namibia Bond Yield: 02-Nov-2022 vs. 23-Nov-2022

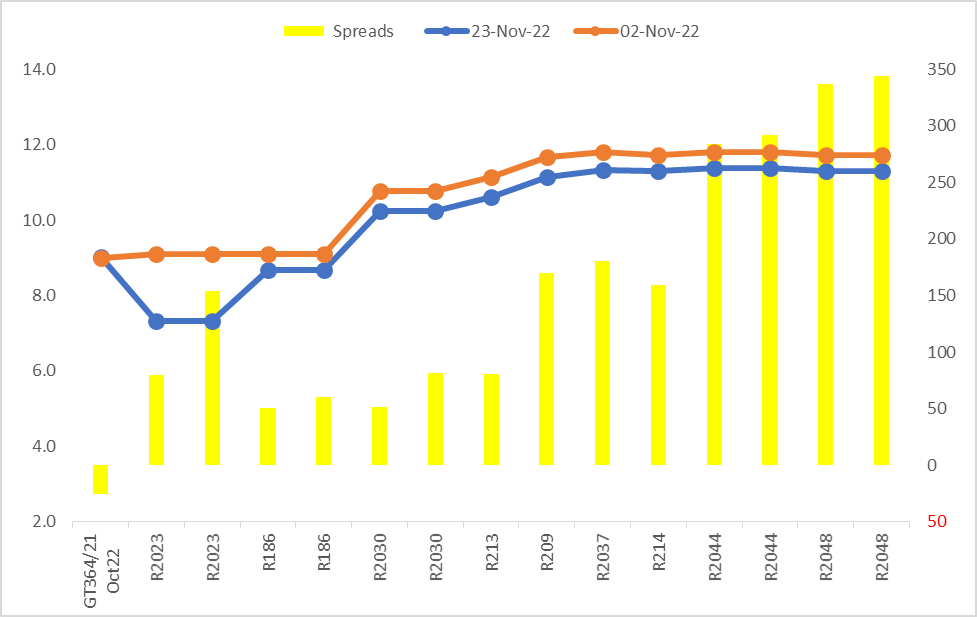

Figure 1. South African Bond Yields: 02-Nov-2022 vs. 23-Nov-2022