HEI Fixed Income Market Commentary

- Most markets performed poorly after the hawkish commentary by the U.S Federal Reserve (Feds) last week. The Feds uttered; “the policy rate is not yet in a zone that may be considered sufficiently restrictive” and suggested the “proper zone for the fed funds rate could be in the 5% to 7% range”, which is higher than the current market pricing and Fed’s forecast

- In the domestic market, the NSX bourse declined by 2.10% at the close of business last week. Bond yields continue to decline, showing a similar trend as the U.S 30-year bond. To many investors, a decline in bond yields signals a recession. Analysts at Goldman Sachs stated that there are some “wild cards that haven’t been resolved”, henceforth the future remains unpredictable

- In South Africa, the bond yields gradually declined, following last week’s commentary of the Feds’. However, a positive rating on foreign and local debt by S&P Global for South Africa could result in positive yields in the short to medium term.

Table 1. Namibia Government Bonds

| Bonds | Coupon | Maturity | YTM (%) | YTM (%) | YTM (%) | DTDΔ | Prices |

| 01-Nov-22 | 17-Nov-22 | 18-Nov-22 | (bps) | 18-Nov-22 | |||

| GC23 | 8.85 | 15-Oct-23 | 8.7 | 8.796 | 8.7827 | -1.34431 | 100.04315 |

| GC24 | 10.5 | 15-Oct-24 | 8.4 | 8.133 | 8.1210 | -1.20498 | 104.10999 |

| GC25 | 8.5 | 15-Apr-25 | 8.8 | 8.872 | 8.8599 | -1.20505 | 99.22099 |

| GC26 | 8.5 | 15-Apr-26 | 8.8 | 9.271 | 9.2549 | -1.59581 | 97.82181 |

| GC27 | 8 | 15-Jan-27 | 9.6 | 9.357 | 9.3448 | -1.20076 | 95.43625 |

| GC28 | 8.5 | 15-Oct-28 | 11.0 | 10.925 | 10.9009 | -2.38864 | 89.72404 |

| GC30 | 8 | 15-Jan-30 | 11.6 | 11.227 | 11.2089 | -1.80037 | 84.46777 |

| GC32 | 9 | 15-Apr-32 | 12.0 | 11.589 | 11.5649 | -2.45243 | 85.50501 |

| GC35 | 9.5 | 15-Jul-35 | 13.0 | 12.983 | 12.9628 | -1.99545 | 78.70496 |

| GC37 | 9.5 | 15-Jul-37 | 13.2 | 13.250 | 13.2286 | -2.09726 | 76.09424 |

| GC40 | 9.8 | 15-Oct-40 | 13.3 | 13.000 | 12.9738 | -2.59972 | 78.08958 |

| GC43 | 10 | 15-Jul-43 | 14.3 | 14.375 | 14.3212 | -5.364 | 71.52298 |

| GC45 | 9.85 | 15-Jul-45 | 14.3 | 14.435 | 14.4024 | -3.2493 | 69.70813 |

| GC48 | 10 | 15-Oct-48 | 14.735193 | 14.7936 | 14.7624 | -3.11946 | 68.98088 |

| GC50 | 10.25 | 15-Jul-50 | 14.94886 | 14.8695 | 14.8382 | -3.12909 | 69.62946 |

Source: BoN & HEI Research

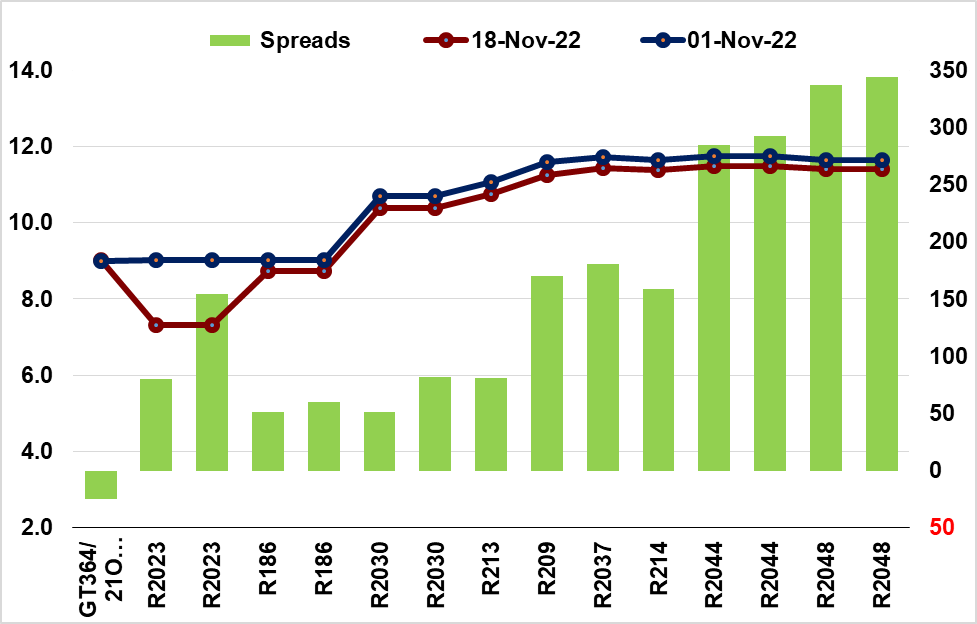

Figure 1. Namibia Bond Yield: 01-Nov-2022 vs. 18-Nov-2022

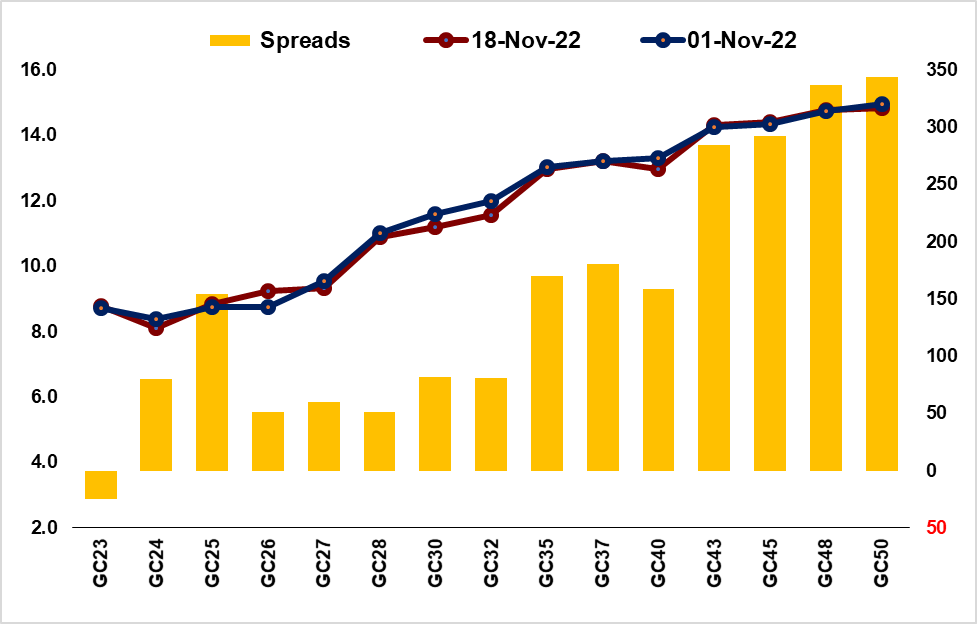

Figure 1. South African Bond Yields: 01-Nov-2022 vs. 18-Nov-2022